National and State-by-State Data Available for Download

By Steve Wamhoff and Meg Wiehe

Following the failure of a modified Senate GOP bill that put corporations over workers and families, the House Democrats released their own bill on Monday that was far more comprehensive and better targeted.

Tax provisions in the House Democratic bill are more significant for those who need them, including a tax rebate of $1,500 per family member, up to a total of five family members. The House bill also includes temporary expansions to the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) that will extend beyond 2020. The combined impact of the rebates, EITC and CTC provisions in the House bill would cost about $500 billion in 2020. There are many other provisions in the bill, most of which are not tax provisions, that ITEP has not modeled.

Rebates in the House Bill More Generous than GOP Version

The Democratic rebate provision is more generous than the Senate GOP bill’s tax rebate of $1,200 for each spouse and $500 per child. The House bill would provide a total of $367 billion in rebates in 2020, compared to $278 billion under the GOP bill that failed in the Senate.

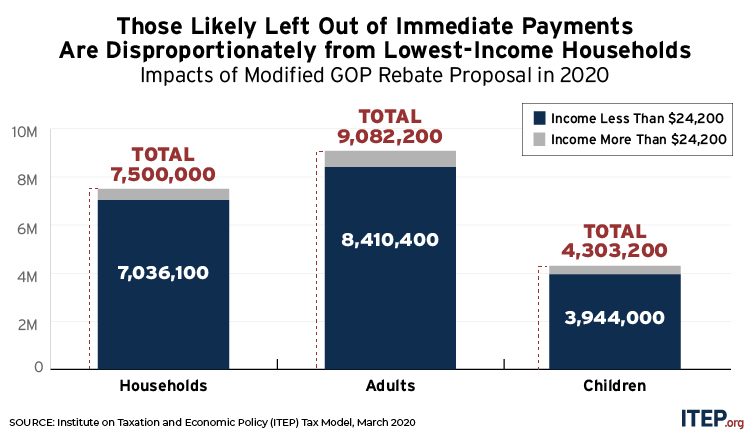

The GOP proposal limits initial payments of the tax rebate to those who have filed tax returns or have received Social Security benefits. This House Democratic bill would make payments right away to other groups, such as low-income elderly and disabled individuals who receive Supplemental Security Income (SSI) and immigrants filing with ITINs.

Both bills would limit the rebate for people above certain incomes, but the Democratic bill can be implemented more easily because it sends checks to everyone immediately. Those who exceed the income limits ($75,000 for singles and $150,000 for married couples) would pay back all or part of the rebate they received in their tax returns over the next three years. (For well-off people, the rebate is basically an interest-free loan.)

The GOP bill initially would base income eligibility on information reported in 2019 tax returns or 2018 tax returns. This is problematic because many impacted by the crisis may have vastly different incomes in 2020 than in previous years. ITEP’s analysis shows the final impact of who benefits from the rebates.

Expansions of the Earned Income Tax Credit and Child Tax Credit

The Democratic bill also includes other tax provisions to help low- and moderate-income people and families. One part of the bill includes several improvements to the Earned Income Tax Credit (EITC). It expands the EITC for childless workers, increasing the maximum for this group from $530 in 2020 to $1,490. The childless EITC, which is currently restricted to those age 25 through 64, would become available to most people age 19 through 65. A very strict limit on unearned income in current law would be removed from the EITC for all potential recipients. The EITC changes would be in place through 2021.

Another part of the bill expands the Child Tax Credit (CTC). Under current law, taxpayers are allowed a CTC of up to $2,000 per child. Limits on the refundable portion of the CTC prevent about a third of low- and moderate-income children and families from receiving the full credit. The Democratic bill would remove those limits, allowing every low-income family regardless of their earnings to receive the full credit. It would also increase the credit to $3,000 for children age 6 and older and increase it to $3,600 for children younger than 6 years old.

The House bill also expands the Child and Dependent Care Credit, which ITEP has not yet modeled.

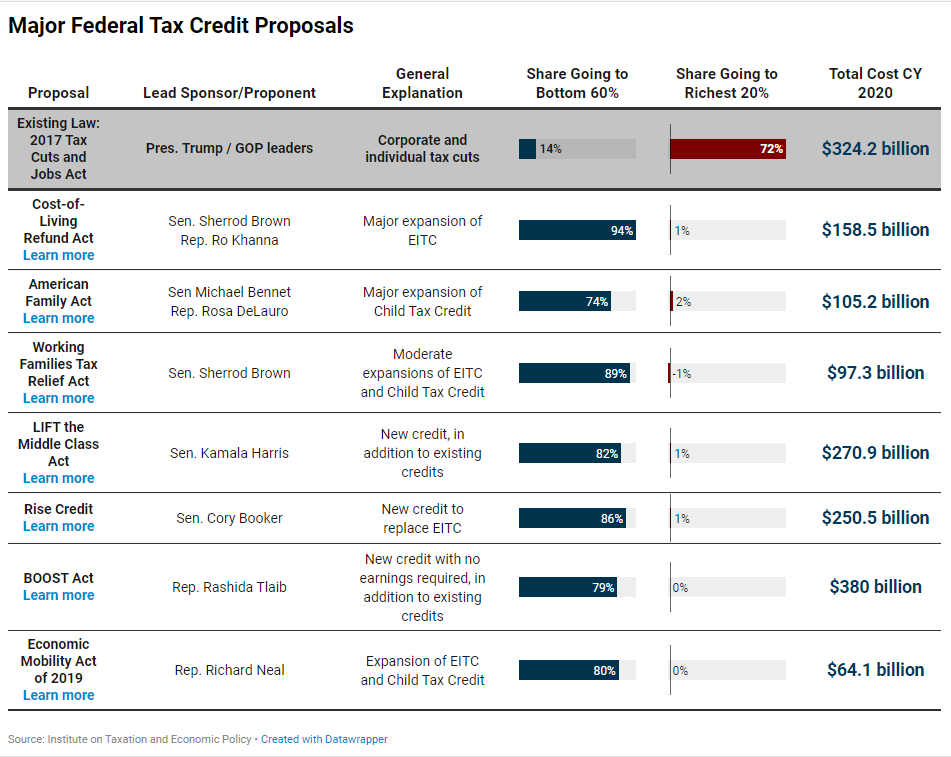

Many lawmakers have sought to expand the EITC and CTC or even replace them with much larger credits. ITEP has analyzed 10 different proposals along these lines over the past year, an indication that this has become a mainstream position for many in Congress.

Rebates and EITC, CTC Expansions Provide Workers and Families with $500 Billion This Year

The rebates and expansions of the EITC and CTC in the House bill would provide workers and families with a total of about $500 billion in 2020. The impacts are evenly shared across income groups, with 62 percent of the combined benefits from these provisions going to the bottom 60 percent of tax filers’ families.