The tax plan outlined by President Trump would strip away

the U.S. tax system’s moderate progressivity by lowering the effective tax rate for the wealthiest 1 percent of Americans by 7.5 percentage points and shifting more of the nation’s tax bill to every other income group, a new analysis released today by the Institute on Taxation and Economic Policy reveals.

progressivity by lowering the effective tax rate for the wealthiest 1 percent of Americans by 7.5 percentage points and shifting more of the nation’s tax bill to every other income group, a new analysis released today by the Institute on Taxation and Economic Policy reveals.

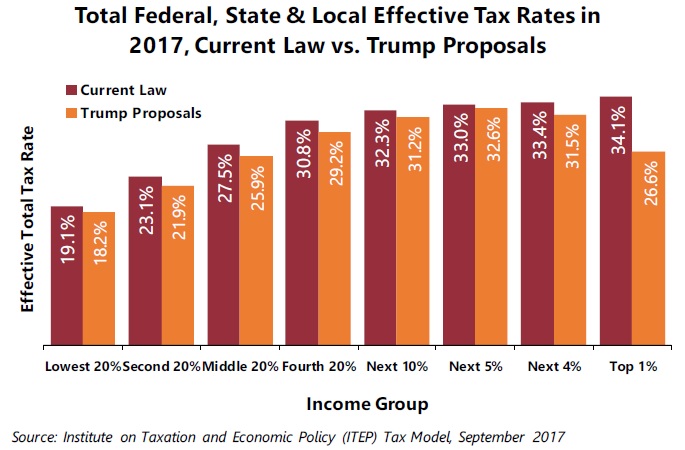

The analysis examines effective total (combined federal, state and local) tax rates paid by each income group under current tax policy and compares them to taxes people would pay under the president’s tax proposals. Under the plan Trump outlined in April, effective tax rates for the bottom 99 percent of taxpayers would decrease by 1.9 percentage points or less for each income group. In sharp contrast, the effective tax rate for the wealthiest top 1 percent of taxpayers would dramatically drop from 34.1 percent to 26.6 percent if the president’s current proposals become law.

“GOP leaders and the White House continue to tell the public that tax reform will benefit the middle class, but these promises are merely rhetoric,” said Alan Essig, the executive director of ITEP. “Vague promises can’t conceal the hard facts: if anything resembling President Trump’s current proposal becomes law, the outcome would be a redistribution of wealth to the already wealthy on a scale we have not seen before.”

Currently, our federal, state and local tax system is moderately progressive, with the top 1 percent paying an effective tax rate that is nearly 6 percentage points higher than the middle 20 percent of taxpayers. But under the White House’s proposed tax changes, the top 1 percent would pay a tax rate on par with what the middle class pays. To put this into broader perspective, the middle 20 percent of taxpayers have an average income of $50,500, and the richest 1 percent of taxpayers have an average income of $1.83 million, and they would pay about the same effective federal, state, and local combined tax rate, effectively stripping away the system’s progressivity.

“It’s hardly a ‘benefit’ to the middle class to pay the same tax rate as the very richest Americans,” Essig said.

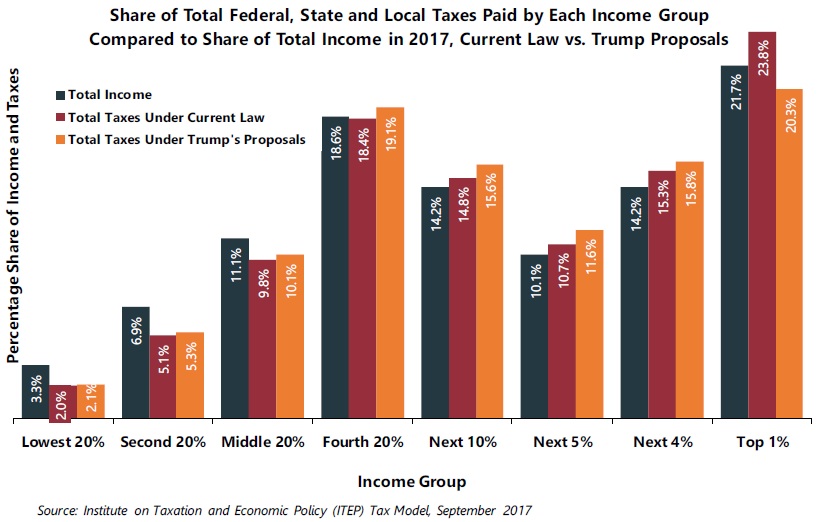

The report also examines each income group’s share of total income and compares it to the share of total taxes that each group pays. This is an important distinction because there is widespread misperception that the rich pay all the taxes. In truth, each income group’s share of total taxes (again, this report collectively examines federal, state and local taxes) is nearly proportional to their total share of income.

For example, under the current system, middle-income taxpayers will earn 11.1 percent of the nation’s income this year, and their share of total taxes will be 9.8 percent. The top 1 percent will capture 21.7 percent of all income in 2017 and pay about 23.8 percent of all taxes. Trump’s tax proposals, however, would effectively make middle-income people and every other income group–except the top 1 percent–shoulder a greater share of the nation’s tax bill. The share of total taxes that the top 1 percent pays would drop by 3.5 percentage points under Trump’s proposals while increasing for every other group.

capture 21.7 percent of all income in 2017 and pay about 23.8 percent of all taxes. Trump’s tax proposals, however, would effectively make middle-income people and every other income group–except the top 1 percent–shoulder a greater share of the nation’s tax bill. The share of total taxes that the top 1 percent pays would drop by 3.5 percentage points under Trump’s proposals while increasing for every other group.

“Poverty and income data released Tuesday reveals that median household income has finally recovered after either being stagnant or declining for most of the last 20 years,” Essig said. “Our nation’s public policies should consider how to improve on this recent success.”