New Jersey

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…

State Rundown 12/19: Time to Rest and Recharge for Big Year Ahead

December 19, 2018 • By ITEP Staff

With many people enjoying time off over the next couple weeks, and the longest nights of the year coming over the weekend, now is a good time to get plenty of rest and relaxation in advance of what is likely to be a very busy 2019 for state fiscal policy and other debates. Among those debates, Kentucky lawmakers will be returning to topics they could not resolve in a brief special session held this week, New Jersey and New York will both be deciding how to legalize and tax cannabis, and gas tax updates will be on the agenda in…

NorthJersey.com: Democrats Taking Another Run at SALT Restoration

November 24, 2018

While it remains to be seen whether bipartisan support for a full or partial SALT restoration is feasible or even affordable in the new Congress, the fight – or at least the conversation – is one well worth having. Indeed, homeowners, particularly in the northern part of New Jersey, are going to be hit hard […]

State Rundown 11/16: Election Results Clarify Agendas as Real Work Begins

November 16, 2018 • By ITEP Staff

State policymakers, voters, and observers have been reflecting on this year’s campaigns and looking ahead to how the policy opportunities in their states have shifted as a result. For example, Arkansas’s governor sees a fresh chance to slash income taxes on the state’s wealthiest residents, while the governor-elect of Illinois will be doing just the opposite, launching into a promised effort to shore up the state’s budget by asking the wealthy to pay more. New York and Virginia residents may end up with buyers’ remorse after Amazon accepted their combined $2 billion tax subsidy offers for its HQ2 project. And…

The cap on federal tax deductions for state and local taxes (SALT) that is in effect now under the Tax Cuts and Jobs Act (TCJA) is a flawed provision but repealing it outright would be costly and provide a windfall to the rich. Congress should consider replacing the SALT cap with a different type of limit on deductions that would avoid both of these outcomes. Using the ITEP microsimulation tax model, this report provides revenue estimates and distributional estimates for several such options, assuming they would be in effect in 2019.

Today Amazon announced major expansions in New York and Virginia, where it intends to hire up to 50,000 full-time employees. The announcement marks the culmination of a highly publicized search that lasted more than a year and involved aggressive courting of the company by cities across the nation. The following are three tax-related observations on the announcement.

NJ Spotlight: GOP Leaders Call on NJ Democrats to Reconsider Middle-class Tax Cuts

October 29, 2018

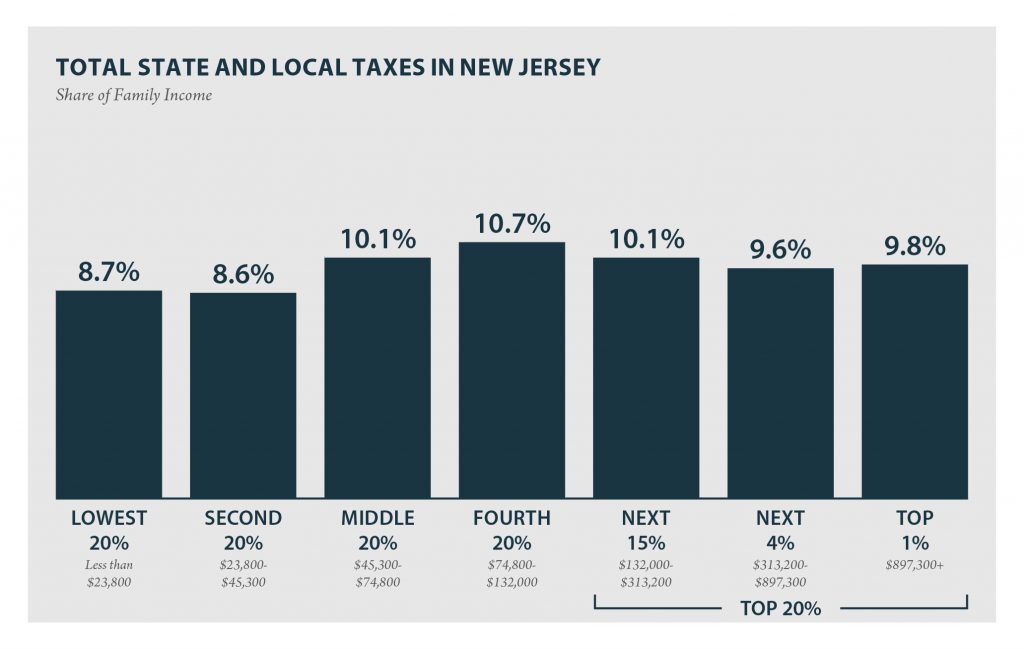

The related tax-cut bills — and another that would shield most retirement-savings contributions from state income taxes — were introduced at the start of the year but have not been posted for votes by the Democratic leaders who control the Assembly’s agenda. Bucco suggested a report released earlier this month by the left-leaning Institute on Taxation and Economic Policy that found middle-income taxpayers in New Jersey pay a higher effective tax rate than any other group — including the top 1 percent of earners — as a reason to begin prioritizing adoption of the GOP bills.

NorthJersey.com: 2018 Elections: Candidates Taking Wait-and-See Approach to SALT Deductions

October 22, 2018

A study by the Institute on Taxation and Economic Policy, a non-partisan think tank, found that a majority of New Jersey taxpayers in every income group will pay less taxes next year than they did in 2017 as a result of last year’s federal tax-code overhaul. The cap is expected to affect those in high-income brackets the most. Thousands of New Jersey homeowners rushed to prepay their 2018 taxes in December to take advantage of bigger deductions on their 2017 returns before the cap took effect.

NJ Spotlight: New Jersey’s Tax System Ranked Among Fairest in the Country

October 18, 2018

A report on the fairness of state and local tax policy that was released yesterday by the Washington, D.C.-based Institute on Taxation and Economic Policy ranked New Jersey among the U.S. states with the most equitable tax systems. Read more

NJ BIZ: Report: NJ’s Top Earners Pay Lower Tax Share Than Middle-Income Families

October 17, 2018

New Jersey’s top earners enjoy vastly more wealth than the majority of New Jersey residents but pay a much lower percentage of taxes than middle-income families in the state. That’s according to a nationwide analysis released Wednesday by New Jersey Policy Perspective and the Institution of Taxation and Economic Policy.

Insider NJ: New Analysis: Middle Class Taxpayers in New Jersey Still Paying More Than Tax Rate Paid by Richest 1 Percent of New Jerseyans

October 17, 2018

A new study released today by the Institute on Taxation and Economic Policy (ITEP) and New Jersey Policy Perspective (NJPP) finds that New Jersey’s middle class families pay more in taxes as a percent of their income compared to the state’s wealthiest residents.

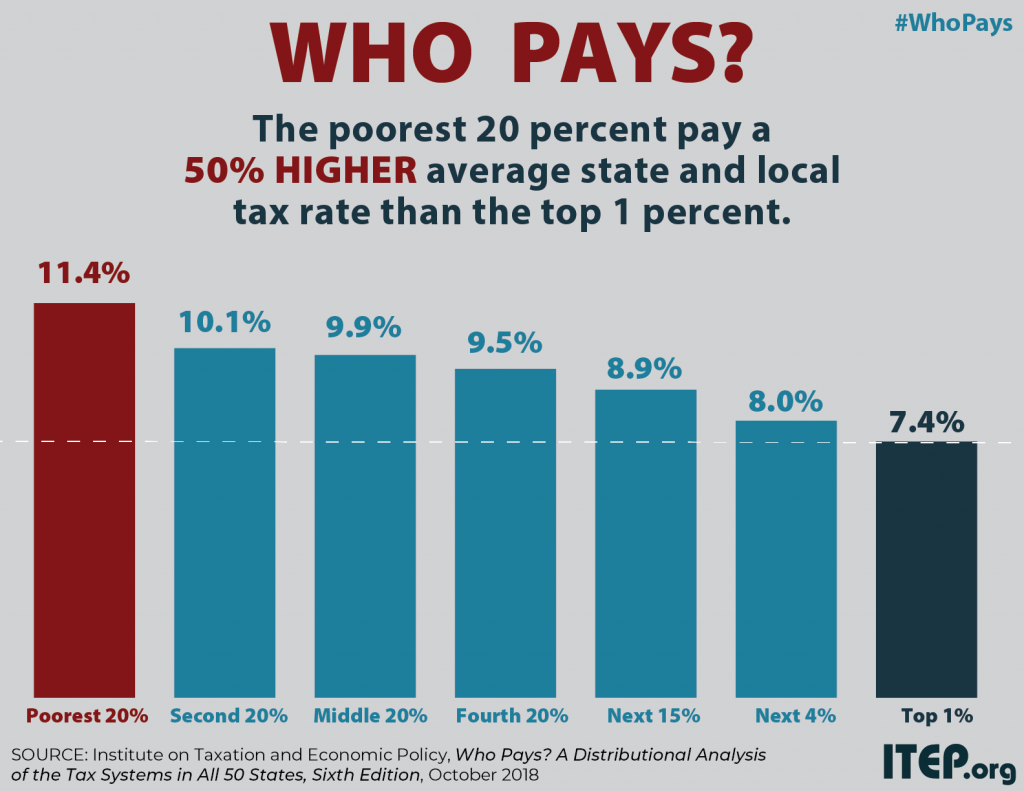

New Report Finds that Upside-down State and Local Tax Systems Persist, Contributing to Inequality in Most States

October 17, 2018 • By Aidan Davis

State and local tax systems in 45 states worsen income inequality by making incomes more unequal after taxes. The worst among these are identified in ITEP’s Terrible 10. Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming hold the dubious honor of having the most regressive state and local tax systems in the nation. These states ask far more of their lower- and middle-income residents than of their wealthiest taxpayers.

New Jersey: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, New Jersey’s state and local tax system does not worsen income inequality and ranks 46th on the index. The large income gap between lower- and middle-income taxpayers, as compared to the wealthy, is somewhat narrower after state and local taxes than before.

South Carolina lawmakers have finally passed a federal conformity bill in response to last year’s federal tax-cut legislation. Voters in many states are hearing a lot about tax-related questions they’ll see on the ballot in November, particularly residents of Florida, Montana, and Oregon, where corporate donors and other anti-tax interests are spending major sums to alter policy in their states. And states continue to work on ensuring they can collect online sales taxes and, in some states, online sports betting taxes.

Tax Cuts 2.0 – New Jersey

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

State Rundown 9/26: States Cleaning Up from Florence, Gearing Up for November

September 26, 2018 • By ITEP Staff

Affordable housing efforts made news in Minnesota and Virginia this week, as tax breaks for homeowners and other victims of Hurricane Florence were made available in multiple states. Meanwhile, New Jersey is still looking into legalizing and taxing cannabis, and Wyoming continues to consider a corporate income tax. And gubernatorial candidates and ballot initiative efforts will give voters in many states much to consider in the November elections.

State Tax Codes Can Help Mitigate Poverty and Impact of Federal Tax Cuts on Low- and Middle-Income Families

September 20, 2018 • By Misha Hill

The national poverty rate declined by 0.4 percentage points to 12.3 percent in 2017. According to the U.S. Census, this was not a statistically significant change from the previous year. 39.7 million Americans, including 12.8 million children, lived in poverty in 2017. Median household income also increased for the third consecutive year, but this was […]

The Rundown is back after a few-week hiatus, with lots of state fiscal news and quality research to share! Maine lawmakers found agreement on a response to the federal tax-cut bill, states continue to sort out how they’ll collect online sales taxes in the wake of the Wayfair decision, and policymakers in several states have been working on summer tax studies and other preparations for 2019 legislative sessions. Meanwhile, work on ballot measures and candidate tax plans to go before voters in November has been even more active, particularly in Arizona, California, Florida, Hawaii, and Missouri. Our “What We’re Reading” section has lots of great research and reading on inequalities, cities turning…

State Tax Codes as Poverty Fighting Tools: 2018 Update on Four Key Policies in All 50 States

September 17, 2018 • By Aidan Davis, Misha Hill

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2018, and offers recommendations that every state should consider to help families rise out of poverty. States can jumpstart their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

Rewarding Work Through State Earned Income Tax Credits in 2018

September 17, 2018 • By ITEP Staff

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits. The effectiveness of the EITC as an anti-poverty policy can be increased by expanding the credit at…

New Jersey Online: Trump Administration Rejects Efforts to Save Your Property Tax Break

August 23, 2018

And in New Jersey, more than four in 10 taxpayers claimed that tax break and deducted an average deduction of $17,850 in 2015, according to the Pew Charitable Trusts. Only residents of New York, Connecticut and California deduct more from federal taxes than New Jerseyans, according the progressive Institute on Taxation and Economic Policy. Read more

State Rundown 8/16: November Ballots and 2019 Debates Coming into Focus

August 16, 2018 • By ITEP Staff

Even as the haze from western wildfires reduced visibility across the nation this week, voters got more clarity on what to expect to see on their ballots this fall, particularly in California (commercial property taxes and corporate surcharges), Colorado (income taxes for education), Missouri (gas tax update), and North Dakota (recreational cannabis). Meanwhile, although Virginia lawmakers won’t return until 2019, they got a preview of a clear-headed federal conformity plan they should strongly consider. And look to our “What We’re Reading“ section for further enlightenment from researchers on the [in]effectiveness of charitable contribution credits, the [lack of] wage growth for…

Gannette: NJ Suit Over SALT Deduction Would Help the State’s Richest 1.5 Percent the Most

August 15, 2018

That reality has led some who joined Democrats in complaining about way tax cuts were distributed to criticize efforts to overturn the SALT cap. “The Trump tax law gives away the store to the rich. Why pile on and make the situation worse?” said Steve Wamhoff of the Institute on Taxation and Economic Policy. This may be a moot […]

State Rundown 8/8: States Setting Rules for Upcoming Tax Decisions

August 8, 2018 • By ITEP Staff

August is often a season for states to define the parameters of tax debates to come, and that is true this week in several states: a tax task force in Arkansas is nearing its final recommendations; residents of Missouri, Montana, and North Carolina await results of court challenges that will decide whether tax measures will show up on their ballots this fall; and Michigan and South Dakota are taking different approaches to making sure they’re ready to collect online sales taxes next year.

Although most state legislatures are out of session during the summer, the pursuit of better fiscal policy has no "off-season." Here at ITEP, we've been revamping the State Rundown to bring you your favorite summary of state budget and tax news in the new-and-improved format you see here. Meanwhile, leaders in Massachusetts and New Jersey have been hard at work in recent weeks and are already looking ahead their next round of budget and tax debates. Lawmakers in many states are using their summer break to prepare for next year's discussions over how to implement online sales tax legislation. And…