Oregon

Oregon Center for Public Policy: Tax Cuts for the Rich, Higher Taxes for Everyone Else: The Net Effect of Trump’s Tax Policies

March 5, 2026

ITEP analyzed the combined impact of the Trump administration’s three biggest changes in tax policy so far. The net effect of these policies is tax cuts for the rich and higher taxes for everyone else. Read more.

National Sausage Month isn’t until October, but now is the time of year when state lawmakers are really diving into their sausage-making processes, as separate legislative houses and oftentimes political parties send competing bills, budgets, and visions back and forth to grind out their differences.

State Rundown 2/19: Necktie (NCTI) Offers a Way Out of a Knotty Situation

February 19, 2026 • By ITEP Staff

State lawmakers are grappling with a range of challenges as their fiscal outlooks deteriorate, federal tax enforcement wanes (after the Trump administration cut the IRS workforce by 25 percent), and a rewritten federal tax code sends states scrambling to decide what changes they might want to make in their own codes.

State Rundown 2/11: This Valentine’s Day, Conscious Decoupling Is Our Love Language

February 11, 2026 • By ITEP Staff

While some may be excited for a romantic Valentine’s Day this weekend, many state lawmakers are breaking up and decoupling from recent federal tax changes that are poised to leave states with revenue shortfalls – much like a bad date who forgets their wallet and asks you to pick up the tab.

Despite wintry conditions across much of the country, that hasn’t stopped state lawmakers from debating major tax policy changes.

State Tax Watch 2026

February 2, 2026 • By ITEP Staff

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

As state legislative sessions ramp up across the country, property taxes are one of many issues dominating tax policy conversations in statehouses.

State Rundown 1/14: New Year Brings New Resolutions for Funding Key Priorities

January 14, 2026 • By ITEP Staff

State governors are beginning to lay out their top priorities as legislatures reconvene in statehouses around the country.

State Rundown 1/7: New Year, New Opportunities for Progressive Revenue

January 7, 2026 • By ITEP Staff

As we kick off a new year, several states are facing revenue shortfalls. Some lawmakers are approaching the challenge with sustainable and equitable solutions.

State Rundown 12/17: Tax Policy ‘Naughty or Nice’ List Has Late Entrants

December 17, 2025 • By ITEP Staff

With a little over a week left, some states are solidifying their spots on the tax policy “naughty or nice” list.

Linking to Tipped and Overtime Income Deductions Would Worsen State Shortfalls, Do Little to Help Workers

December 8, 2025 • By Neva Butkus, Galen Hendricks

State deductions for tips and overtime are not only ineffective at supporting working-class people, it will come at a substantial cost to state budgets.

States are increasingly facing difficult choices as revenues stagnate and deficits come clearer into focus.

State Rundown 11/24: States Say ‘No Thank You’ to Federal Tax Cuts Reducing State Revenue

November 24, 2025 • By ITEP Staff

Lawmakers in two more states have wisely said “no thank you” to federal tax cuts that would have flowed through to their state tax codes and undermined funding for their priorities

Re-Examining 529 Plans: Stopping State Subsidies to Private Schools After New Trump Tax Law

November 20, 2025 • By Miles Trinidad, Nick Johnson

The 2025 federal tax law risks making 529 plans more costly for states by increasing tax avoidance and allowing wealthy families to use these funds for private and religious K-12 schools.

State Rundown 11/13: States Tackle Impending Deficits, Pennsylvania Secures an EITC

November 13, 2025 • By ITEP Staff

Revenue forecasts look increasingly grim as states anticipate shortfalls due to the slowing economy and impacts of the new federal tax law.

Despite being an off-year election, voters made a call for shared public investments at the polls.

Audio: ITEP’s Spandan Marasini on Corporate Tax Avoidance and What To Do About It

October 16, 2025

ITEP Data Analyst Spandan Marasini appeared on the Oregon Center for Public Policy’s “Policy for the People” podcast, discussing how corporations hide their profits and insights on what can be done to stop it. Listen here.

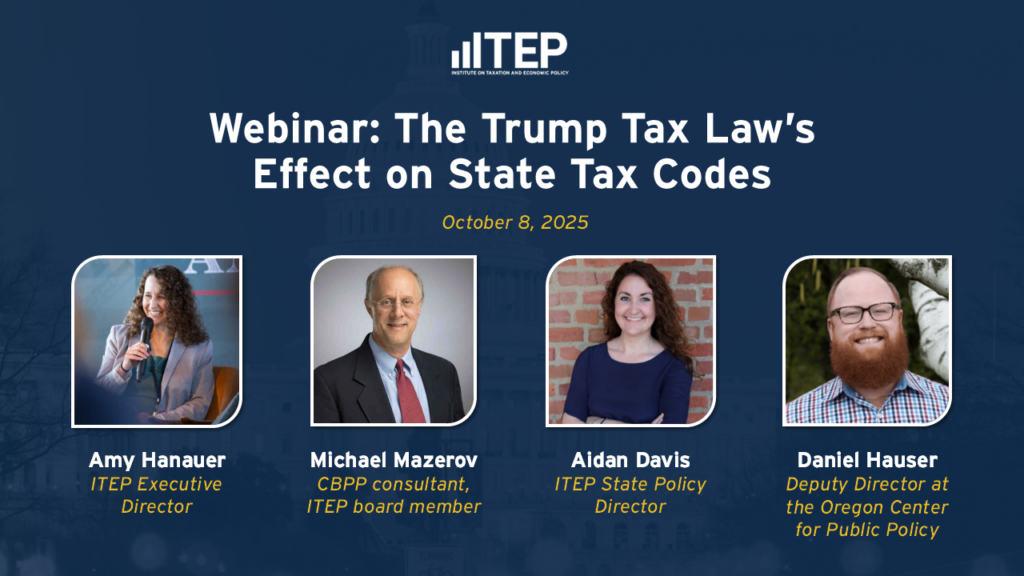

This webinar focused on the ways the new tax law could impact state revenues by changing policies that state lawmakers will soon consider mirroring in their own income tax codes.

State Rundown 10/1: State and Local Governments Doing the Opposite of Shutting Down

October 1, 2025 • By ITEP Staff

State and local officials are staying very busy by considering a dizzying amount of reversals.

Leaving Billions on the Table: Trump-Induced Brain Drain Leaves the IRS Struggling to Prevent Corporate Tax Avoidance

September 25, 2025 • By Matthew Gardner

The IRS's capacity to prevent big multinational corporations from avoiding income taxes is facing a generational crisis.

Rep. Steve Cohen: Congressmen Cohen and Beyer and Senator Wyden Introduce the Billionaire Income Tax Act

September 18, 2025

WASHINGTON – Congressmen Steve Cohen (TN-9) and Don Beyer (VA-8) and Senator Ron Wyden of Oregon today introduced bicameral Billionaire Income Tax Act bills in an effort to establish a level of fairness in federal taxation and prevent millionaires and billionaires (and one prospective trillionaire) from avoiding significant liability. The measure would tax wealth gains as […]

State Rundown 9/18: Lawmakers Confront Revenue Loss from Federal Policy Changes

September 18, 2025 • By ITEP Staff

Some states are trying to avoid revenue loss while others are welcoming it and doubling down.

State Earned Income Tax Credits Support Families and Workers in 2025

September 11, 2025 • By Neva Butkus

Nearly two-thirds of states now have an Earned Income Tax Credit (EITC). Momentum continues to build on these credits that boost low-paid workers’ incomes and offset some of the taxes they pay, helping lower-income families achieve greater economic security.

State Child Tax Credits Boosted Financial Security for Families and Children in 2025

September 11, 2025 • By Neva Butkus

Child Tax Credits (CTCs) are effective tools to bolster the economic security of low- and middle-income families and position the next generation for success.

State Rundown 9/4: Colorado Tackles Offshore Corporate Tax Avoidance, Paves Way for State Conformity Best Practices

September 4, 2025 • By ITEP Staff

Despite an increasingly bleak state revenue outlook, state lawmakers across the country continue to prioritize regressive tax cuts.