Recent Work by ITEP

As states prepare for the revenue loss and disruption resulting from the federal tax bill, tax policy is being considered in legislatures across the country.

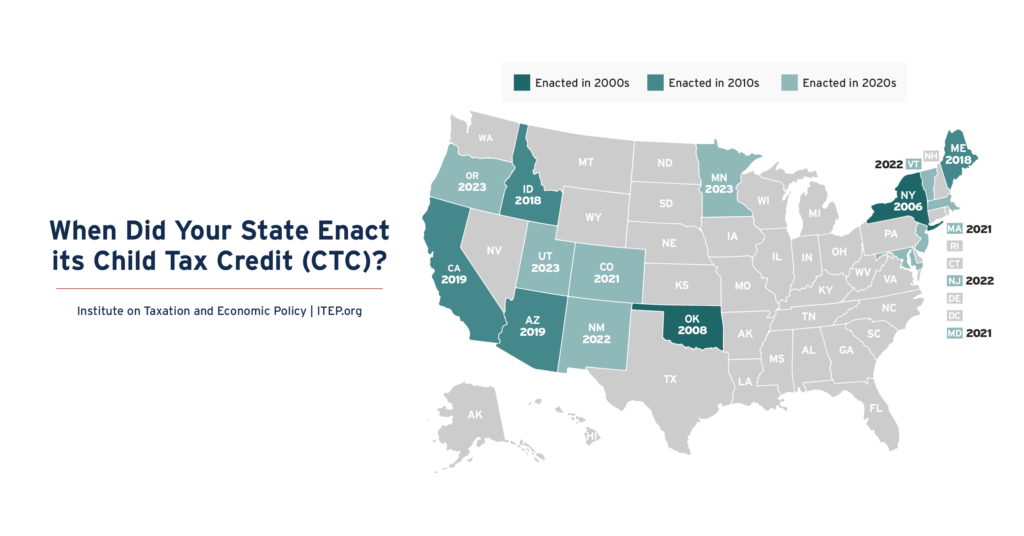

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also make tax systems less regressive. As of 2020, only six states had CTCs. Today, 15 states have CTCs, with many credits exceeding $1,000 per qualifying child.

Excessive CEO Pay Makes Inequality Worse. Shareholders and the Public Deserve to Know About Compensation Disparities

July 30, 2025 • By Matthew Gardner

Huge executive pay packages are a prime driver of income inequality. Shareholders and the public deserve to know about how CEOs are compensated, but new SEC leadership seems to think otherwise.

State Tax Action in 2025: Amid Uncertainty, Tax Cuts and New Revenue

July 28, 2025 • By Aidan Davis, Neva Butkus, Marco Guzman

Federal policy choices on tariffs, taxes, and spending cuts will be deeply felt by all states, which will have less money available to fund key priorities. This year some states raised revenue to ensure that their coffers were well-funded, some proceeded with warranted caution, and many others passed large regressive tax cuts that pile on to the massive tax cuts the wealthiest just received under the federal megabill.

Refundable tax credits were a big part of state tax policy conversations this year. In 2025, nine states improved or created Child Tax Credits or Earned Income Tax Credits.

State Rundown 7/24: States Begin Preparing for Federal Megabill Fallout

July 24, 2025 • By ITEP Staff

All eyes in statehouses in recent weeks have been on federal budget negotiations, and now that the “megabill” has passed, they are focused in on their own budgets in search of ways to cope with the enormous consequences coming their way. All states will see fewer federal dollars flowing through their coffers, higher needs due […]

Americans Want to Know Which Corporations Aren’t Paying Taxes, but House Republicans Want to Keep this Information Secret

July 23, 2025 • By Matthew Gardner

The appropriations plan released by House Republicans this weekend threatens to withhold funding for an obscure but vital financial oversight board because that board now requires corporations to disclose basic information about their income tax payments (or lack thereof).

How Will the Trump Megabill Change Americans’ Taxes in 2026?

July 22, 2025 • By Steve Wamhoff, Michael Ettlinger, Carl Davis, Jon Whiten

The megabill will raise taxes on the poorest 40 percent of Americans, barely cut them for the middle 20 percent, and cut them tremendously for the wealthiest Americans next year.

Sales Tax Holidays Miss the Mark When it Comes to Effective Sales Tax Reform

July 17, 2025 • By Miles Trinidad

Sales tax holidays are often marketed as relief for everyday families, but they do little to address the deeper inequities of regressive sales taxes. In 2025, 18 states offer these holidays at a collective cost of $1.3 billion.

States Should Move Quickly to Chart Their Own Course on SALT Deductions

July 17, 2025 • By Dylan Grundman O'Neill, Nick Johnson

While a federal SALT cap is hotly debated, capping deductibility at $10,000 was an unambiguously good idea at the state level. States would be smart to stick with the current cap or, better yet, go even farther and repeal SALT deductions outright. Going along with a higher federal SALT cap would double down on a regressive tax cut that will mostly benefit a small number of relatively wealthy state residents and cost states significant revenue.