Recent Work by ITEP

Rigging the System and Poor Shaming (Rightly) Are Incompatible Political Strategies

June 27, 2018 • By Jenice Robinson

The absurdity of blaming poor and moderate-income people for their circumstances is close to running its course as an effective political tool, particularly as some elected officials more boldly assert their intent to cater to the whims of the wealthy. Take last year’s GOP-led drive to eliminate the Affordable Care Act (ACA), for example. House […]

The Other SALT Cap Workaround: Accountants Steer Clients Toward Private K-12 Voucher Tax Credits

June 27, 2018 • By Carl Davis

On May 23, 2018, the IRS and Treasury Department announced that they “intend to propose regulations addressing the federal income tax treatment of certain payments made by taxpayers for which taxpayers receive a credit against their state and local taxes.” They made the announcement in response to new “workaround tax credits” enacted in New York […]

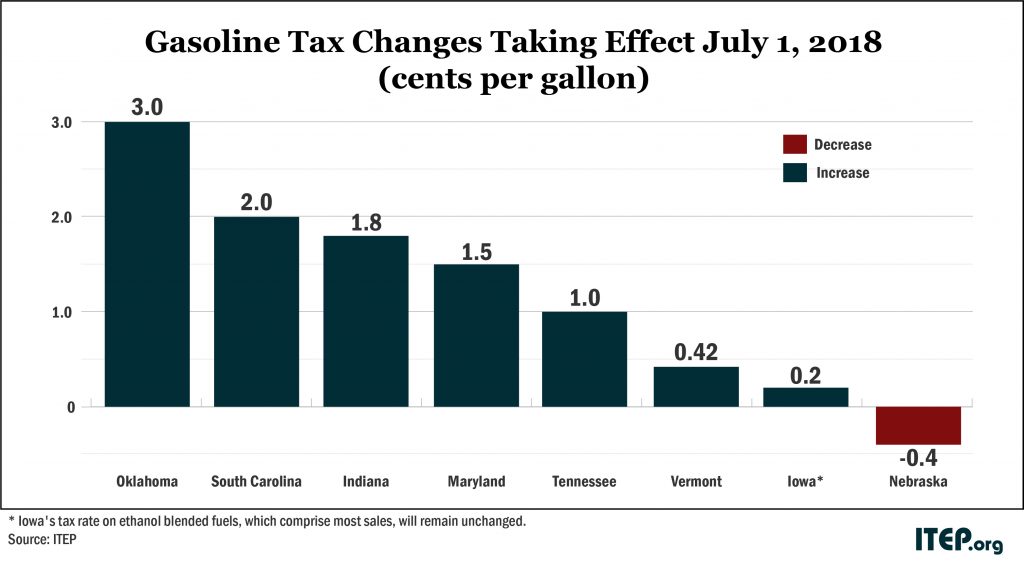

Gas Taxes Rise in Seven States, Including an Historic Increase in Oklahoma

June 26, 2018 • By Carl Davis

A rare sight is coming to Oklahoma. The last time the Sooner State raised its gas tax rate, the Berlin Wall was still standing, and Congress was debating whether to ban smoking on flights shorter than two hours. Fast forward 31 years, and Oklahoma is finally at it again. On Sunday, the state’s gas tax rate will rise by 3 cents and its diesel tax rate by 6 cents. Both taxes will now stand at 19 cents per gallon—still among the lowest in the country. But Oklahoma isn’t the only state where gas taxes will soon rise.

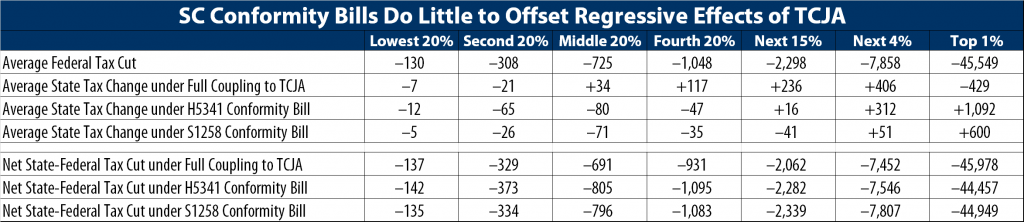

What’s at Stake in South Carolina’s Upcoming Tax Conformity Debate

June 22, 2018 • By Dylan Grundman O'Neill

South Carolina legislators will return next week to try to finalize a few issues before the end of their session and fiscal year on June 30th, including the question of how to respond to the federal Tax Cuts and Jobs Act (TCJA). That's a short timeframe with some important questions at stake, and some misinformation has been spread, so here's a quick guide to the facts, issues, and options.

The U.S. Supreme Court made big news this morning by allowing states to collect taxes due on internet purchases, which will help put main-street and online retailers on an even playing field while also improving state and local revenues and the long-term viability of the sales tax as a revenue source. Many states remain focused on more local issues, however, as Louisiana's third special session of the year kicked off, Massachusetts won a living wage battle while losing an opportunity to put a popular millionaires tax proposal before voters, and major fiscal debates continue in Maine, New Jersey, and Vermont.

Supreme Court Decision in Wayfair Is a Leap Forward for Sales Tax Modernization

June 21, 2018 • By Carl Davis

For years, state and local governments have been dealing with a tax enforcement nightmare as out-of-state Internet retailers have refused to collect sales tax. That non-collection was facilitated by a Supreme Court precedent that tax collection can only be required when a retailer has a “physical presence” inside of a state. In today’s ruling in […]

State Rundown 6/13: Budget Crunch Time Sets in as State Fiscal Years Come to Close

June 13, 2018 • By ITEP Staff

With many state fiscal years ending June 30th, budget negotiations were completed recently in California, Illinois, Michigan, and North Carolina. New Jersey remains a state to watch as a government shutdown looms but leaders continue to disagree about a proposed millionaires tax, corporate taxes, and school funding. In other states looking to wealthy individuals and large corporations for needed revenues, Arizona's teacher pay crisis could be solved with a tax on its highest-income residents and a similar proposal in Massachusetts is polling well, but Seattle's new "head tax" could be on the chopping block.

All Bets are Off: State-Sponsored Sports Betting Isn’t Worth the Risk

June 13, 2018 • By Misha Hill

Many state legislators and regulators are considering expanding state-sponsored gambling by allowing betting on major league sports games. But the revenue states could bring in isn’t worth the risk.

Lottery, Casino and other Gambling Revenue: A Fiscal Game of Chance

June 12, 2018 • By ITEP Staff

Cash-strapped, tax-averse state lawmakers continue to seek unconventional revenue-raising alternatives to the income, sales, and property taxes that form the backbone of most state tax systems. However, gambling revenues are rarely as lucrative, or as long-lasting, as supporters claim.

New Legislation Would Close Significant Offshore Loopholes in the Tax Cuts and Jobs Act

June 6, 2018 • By Richard Phillips

One simple rule should drive the nation’s international tax policies: tax the offshore profits of American companies the same way their domestic profits are taxed. The latest legislation to approach that ideal is the Per-Country Minimum Act (H.R. 6015), from Rep. Peter DeFazio (D-OR). The DeFazio bill closes the loophole that allows corporations to use foreign tax credits to shelter profits in tax havens from U.S. taxes. No other bill addresses this.