Recent Work by ITEP

New Jersey’s new governor, Phil Murphy campaigned on a promise to raise state income taxes on millionaires, a proposal that is supported by 70 percent of the state and was, until recently, backed by New Jersey’s Senate President, Steve Sweeney. In recent months, Sweeney changed his position on the proposed millionaires tax and called for an increase in New Jersey’s corporate tax instead. The idea of hiking taxes on corporations is not a bad one, particularly since corporations received a windfall from the Tax Cuts and Jobs Act. But Sweeney’s new opposition to an income tax hike for the state’s…

State Rundown 5/17: Don’t Bet on Legal Sports Betting Solving State Budget Woes

May 17, 2018 • By ITEP Staff

This week the U.S. Supreme Court opened the door to legal sports gambling in the states (see our What We're Reading section), which will surely be a hot topic in state legislative chambers, but most states currently have more pressing matters before them. The teacher pay crisis made news in North Carolina, Alabama, and nationally. Louisiana, Oregon, and Vermont lawmakers are headed for special sessions over tax and budget issues. And several other states have recently reached or are very near the end of their legislative sessions.

Why Proponents of the Trump-GOP Tax Law Can’t Get their Story Straight

May 16, 2018 • By Steve Wamhoff

If you listened closely to today’s House Ways and Means Committee hearing on the Tax Cuts and Jobs Act (TCJA), you could sense that the witnesses speaking in favor of the new tax law were not 100 percent on the same page. This has been apparent ever since the law was enacted at the end of last year. The economists who speak in favor of the law (including Douglas Holtz-Eakin at today’s hearing) tend to focus on other indicators of its success. They know that the talk of bonuses and raises is nothing more than a desperate corporate PR campaign…

There Is No Evidence That the New Tax Law Is Growing Our Economy or Creating Jobs

May 15, 2018 • By Steve Wamhoff

The House Ways and Means Committee will hold a hearing on the Tax Cuts and Jobs Act (TCJA) Wednesday. Proponents of the law likely will use the occasion to tout its alleged economic benefits and argue that its temporary provisions should be made permanent. The title of the hearing is “Growing Our Economy and Creating Jobs,” but there is little evidence that the law does either of these things.

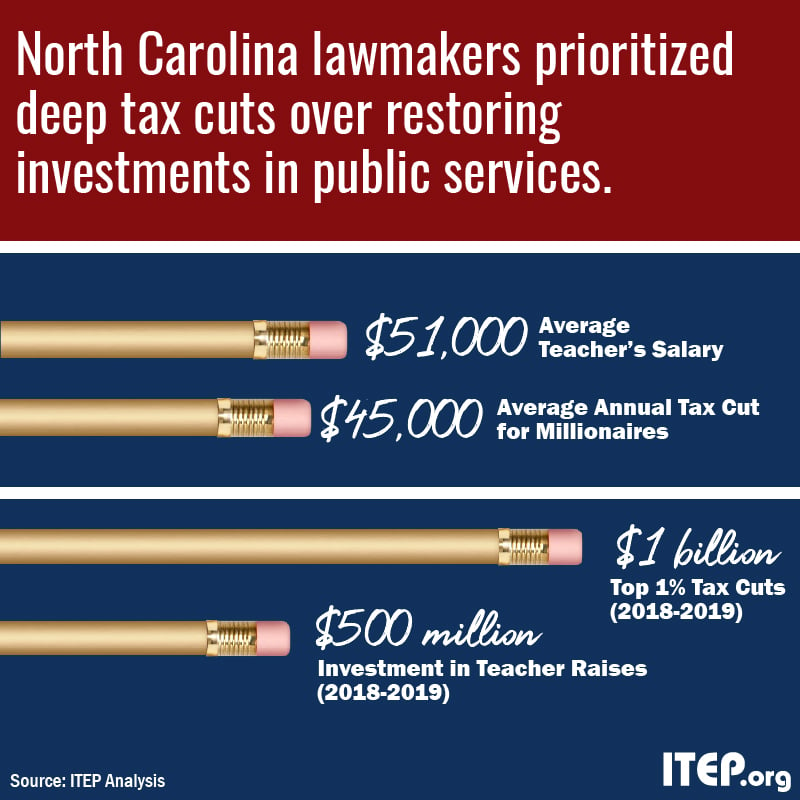

NC Teachers’ March on Raleigh and the Tax Cuts that Led Them There

May 15, 2018 • By Aidan Davis

Once again, public school teachers are taking a stand for education and against irresponsible, top-heavy tax cuts that deprive states of the revenue they need to sufficiently fund public services, including education.

No Work Requirements for the Richest 1 Percent — Most of Their Tax Cuts Are for Unearned Income

May 10, 2018 • By Steve Wamhoff

The Trump Administration is pushing to add or strengthen work requirements for programs that benefit low- and middle-income people but holds a different view when it comes to the wealthy. Most tax cuts enjoyed by the richest 1 percent of households under the recently enacted Tax Cuts and Job Act (TCJA) are tax cuts for unearned income.

State Rundown 5/9: Iowa Digs a New Hole as Other States Try to Avoid or Climb Out of Theirs

May 9, 2018 • By ITEP Staff

This week we have news of a destructive tax cut plan finally approved in Iowa just as one was narrowly avoided in Kansas. Tax debates in Minnesota and Missouri will go down to the wire. And residents of Arizona and Colorado are considering progressive revenue solutions to their states' education funding crises.

New Tax Subsidy for Private K-12 Tuition in Massachusetts Creates a Host of Problems

May 9, 2018 • By Carl Davis

Last year’s federal tax cut bill changed 529 college savings accounts in a major way, expanding them so that they can be used as tax shelters by higher-income families who choose to send their children to private K-12 schools. This controversial change was added in the Senate by the slimmest of margins—requiring a tie-breaking vote […]

In the Face of the Trump Administration’s Anti-Immigrant Agenda, We Must Rely on Evidence to Highlight the Contributions of and Dispel Myths About Dreamers

May 4, 2018 • By Misha Hill

Immigrants face tremendous uncertainty and little hope under the Trump Administration. The administration’s actions—banning travel from residents of primarily Muslim countries, the deportation of Christian Iraqi asylum seekers, and the rescission of DACA, the program that provides temporary reprieve to young immigrants; public statements on the value of immigrants from countries like Norway; and leaked […]

Tax Wars: 3 Lessons about Tax Policy from the Star Wars Universe

May 4, 2018 • By Richard Phillips

Even in the universe of Jedi, Death Stars and Ewoks, tax policy plays a surprisingly important role in driving the events of the day. In celebration of Star Wars Day, we just wanted to share some of the little-known tax policy lessons from the Star Wars universe.