Recent Work by ITEP

Mortgage Interest Deduction Wiped Out for 7 in 10 Current Claimants Under House Tax Plan

November 5, 2017 • By Carl Davis, Steve Wamhoff

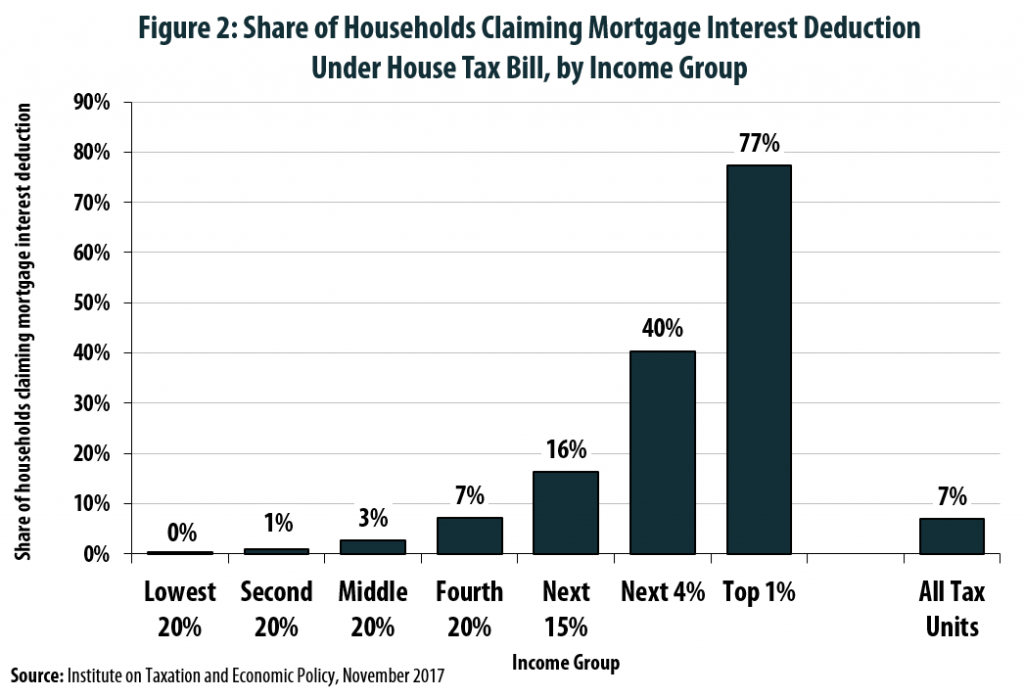

Throughout the ongoing federal tax debate, President Trump and Congressional leadership have insisted that while many tax deductions and credits would be wiped out, the mortgage interest deduction would be spared from the chopping block. But while the proposal recently unveiled by House leaders retains the mortgage interest deduction on paper, the actual substance of this policy would be nearly unrecognizable to today’s homeowners.

House Plan Slashes SALT Deductions by 88%, Even with $10,000 Property Tax Deduction

November 3, 2017 • By Carl Davis, Steve Wamhoff

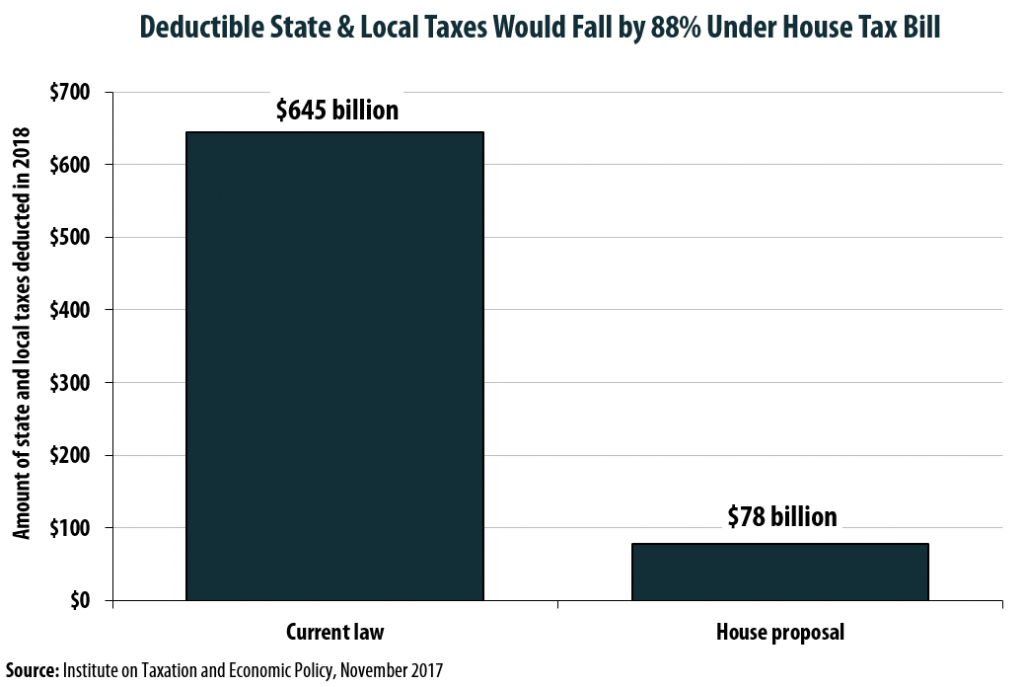

One of the most contentious issues in the current federal tax debate is over what to do with the deduction for state and local taxes paid (the SALT deduction). Since the deduction’s benefits vary by state, the House proposal to drastically scale it back has led to an outcry among lawmakers from states such as New York, New Jersey, and California whose constituents would be impacted most dramatically by the change. In an attempt to address those concerns, House leadership agreed to partially retain the deduction for real estate property taxes paid (up to $10,000 per year) while still repealing…

A Chart Book on the U.S. Tax System

House Tax Plan Will Keep 39.6% Top Rate, But That Won’t Matter for Most Types of Income Going to the Rich

November 1, 2017 • By Carl Davis

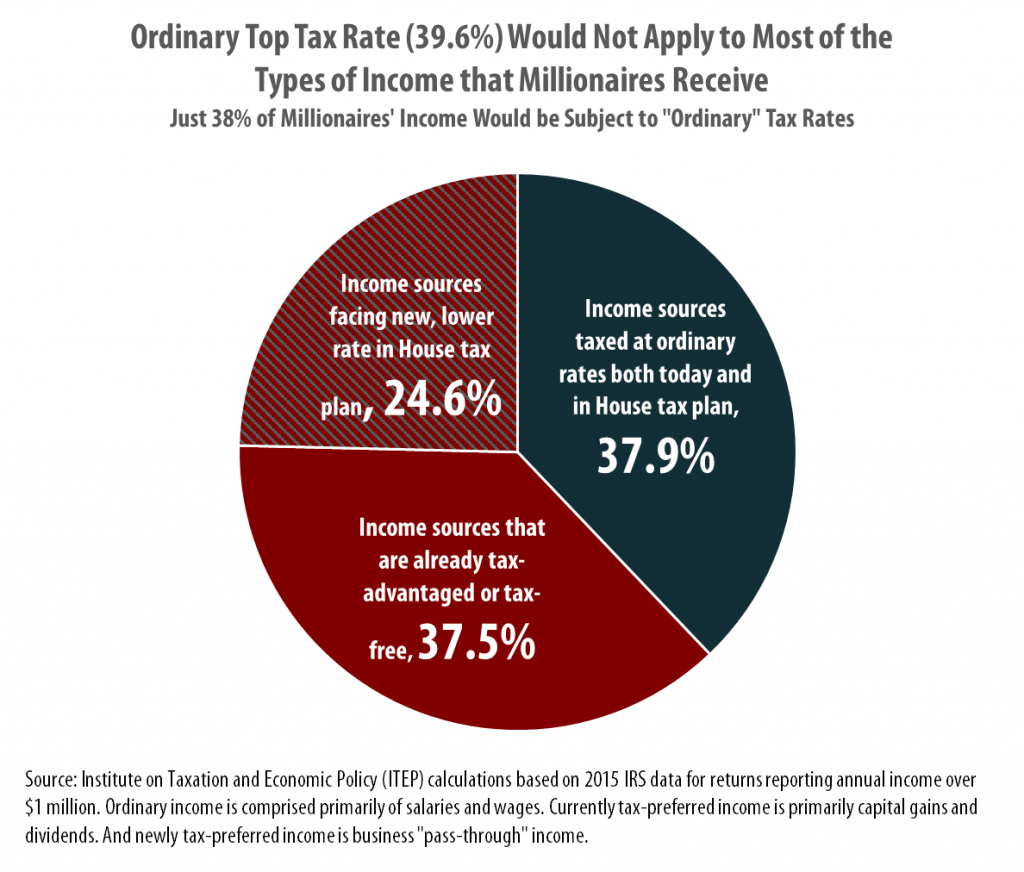

In recent days, news that House tax writers will not seek to cut the top personal income tax rate below 39.6 percent on taxable income above $1 million has led some to question whether the newest iteration of the Trump-GOP tax plan will provide a major windfall to the wealthy—a fact that has so far been widely understood. Unfortunately, this second-guessing is unnecessary.

State Rundown 11/1: Connecticut Balances Budget, Leaves Tax Code Out of Whack

November 1, 2017 • By ITEP Staff

This week a "historic" but highly problematic budget agreement was finally reached in Connecticut, Michigan lawmakers banned localities from taxing any food or beverages, and Nebraska and North Dakota both got unpleasant news about future revenues. Also see our "what we're reading" section for news on 11 states that have run up long-term fiscal deficits since 2002 and the impacts of flooding on local tax bases.

Trump Administration Might Propose a Long-Overdue Gas Tax Increase

October 31, 2017 • By Carl Davis

The Trump Administration is reportedly considering backing a 7-cent increase in the federal gas tax next year to pay for improvements in the nation's infrastructure. While most of the tax policy ideas coming from the administration in recent weeks would undermine the nation's ability to fund core public services, this one is a notable exception.

The Manufacturing Deduction Is a Case Study in Tax Policy Gone Wrong

October 30, 2017 • By Richard Phillips

When you think of manufacturing, what comes to mind? According to the U.S. Congress, manufacturing may include things like the production of wrestling-rated films, assembling bouquets of flowers and even slicing cheesecake. These unusual definitions of manufacturing come from the domestic production activities deduction (better known as the manufacturing deduction), a tax break Congress created to encourage manufacturing in the United States.

The Domestic Production Activities Deduction: Costly, Complex and Ineffective

October 26, 2017 • By Richard Phillips

When the Domestic Production Activities Deduction (DPAD) became law in 2004, proponents described it as a way to help American companies manufacture in the United States and export products abroad. In recent years, the DPAD has grown into one of the largest corporate tax expenditures, with an estimated cost of more than $15 billion in 2016 and $174 billion over the next 10 years.

Trickle-Down Dries Up: States without personal income taxes lag behind states with the highest top tax rates

October 26, 2017 • By Carl Davis, Nick Buffie

Lawmakers who support reducing or eliminating state personal income taxes typically claim that doing so will spur economic growth. Often, this claim is accompanied by the assertion that states without income taxes are booming, and that their success could be replicated by any state that abandons its income tax. To help evaluate these arguments, this study compares the economic performance of the nine states without broad-based personal income taxes to their mirror opposites—the nine states levying the highest top marginal personal income tax rates throughout the last decade.

State Rundown 10/25: Marijuana Taxes a Bright Spot amid Underperforming State Revenues

October 25, 2017 • By ITEP Staff

This week in state tax news saw Alaska begin yet another special session, Louisiana lawmakers holding meetings to begin preparing for the state’s looming (self-imposed) fiscal cliff, and Alabama policymakers beginning a study of school finance (in)adequacy and (in)equity. Meanwhile, state revenue performance is poor well into 2017 in many states, though Montana, Nevada, and Oregon are all enjoying modest but welcome revenue bumps from legalized marijuana.