Recent Work by ITEP

What the Wall Street Journal Editorial Board Got Wrong About Tesla’s Tax Avoidance

April 4, 2025 • By Matthew Gardner

Tesla’s income tax avoidance is still in the news, and that’s a good thing.

Senate Republicans Rig Congressional Rules to Make Their Tax Cuts Appear Cost-Free

April 4, 2025 • By Steve Wamhoff

This week, members of Congress are arguing about whether extending Trump’s 2017 tax cuts would cost trillions of dollars over a decade or cost nothing.

State Rundown 4/3: Amidst Tariff Uncertainty, State Lawmakers Talk Taxes

April 3, 2025 • By ITEP Staff

While all eyes are on the Trump administration’s tariffs on foreign imports, state lawmakers are moving forward with a mix of deep, regressive tax cuts and progressive revenue raisers.

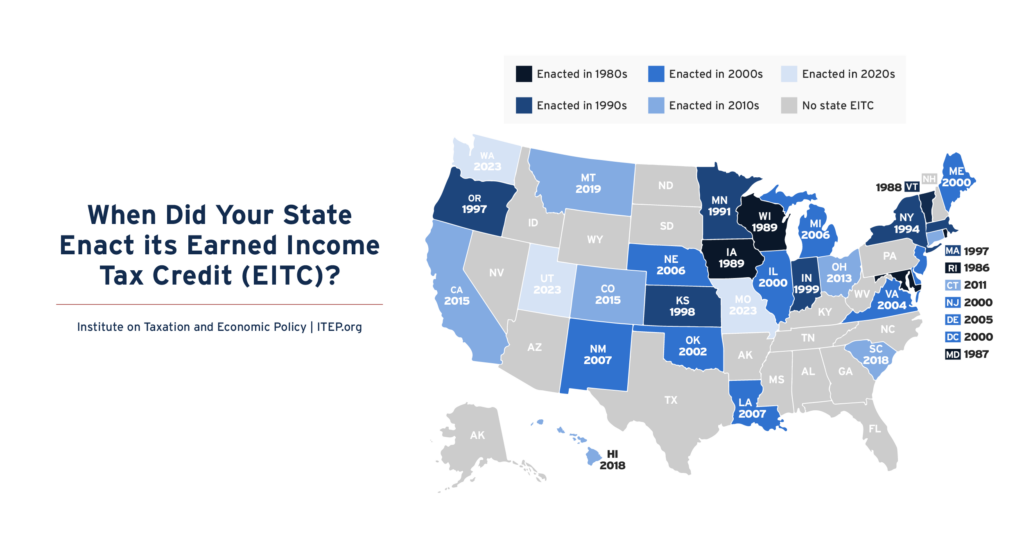

The Earned Income Tax Credit (EITC) supports millions of workers and families and continues to grow in states and localities across the country. Today, 31 states plus the District of Columbia and Puerto Rico offer EITCs. Local EITCs can also now be found in Montgomery County, Maryland, New York City, and San Francisco, where they benefited 700,000 households in 2023.

This week, we celebrate 50 years of the federal Earned Income Tax Credit (EITC) and the impact it's had on millions of workers and families. In 2023 alone, the latest year of available data, the federal EITC alongside the refundable portion of the Child Tax Credit lifted 6.4 million people and 3.4 million children out of poverty.

Advantaging Affluence: A Distributional Analysis of Missouri HB 798’s Uneven Tax Cuts for Wealth and Work

March 28, 2025 • By Aidan Davis, Carl Davis, Dylan Grundman O'Neill, Eli Byerly-Duke, Matthew Gardner

Missouri House Bill 798 would reduce personal and corporate income tax rates, fully eliminate taxes on capital gains income from sale of assets, and eliminates the state’s modest Earned Income Tax Credit that assists many working people in lower-paid jobs. HB 798 would radically transform Missouri’s income tax code into a system that privileges income from wealth over income from work, leaving many middle-income families to pay a higher income tax rate than wealthy people living off their investments.

State Rundown 3/26: Lawmakers Navigate Shortfalls, Potholes, and Pitfalls

March 26, 2025 • By ITEP Staff

State lawmakers around the country are navigating a range of potential hazards this week. Leaders in Maryland and Washington are facing budget holes but are smartly working to get out of them through progressive taxes on those with the most ability to pay. Both North Dakota and Washington state are looking to fill literal potholes […]

Why Americans Are Right to Be Unhappy About Corporate Tax Avoidance

March 26, 2025 • By Matthew Gardner

If lawmakers wanted to reduce income inequality and racial inequality, shutting down or at least limiting corporate tax breaks would be one option to achieve that goal. Unfortunately, President Trump and the current Congress show little interest in this and may even move in the opposite direction by introducing new corporate tax breaks.

Two Ways a 2025 Federal Tax Bill Could Worsen Income and Racial Inequality

March 26, 2025 • By Joe Hughes

Two parts of Trump’s 2017 tax law that are particularly expensive and beneficial to the richest individuals are the changes in income tax rates and brackets and the special deduction for “pass-through” business owners. Lawmakers should not extend these provisions for high-income households past the end of this year, when they are scheduled to expire.

The U.S. needs a tax code that is more adequate, meaning any major tax legislation should increase revenue, not reduce it. The U.S. also needs a tax code that is more progressive, meaning any significant tax legislation should require more, not less, from those most able to pay.