Recent Work by ITEP

In last night’s address to Congress, President Trump spent more time insulting Americans, lying, and bragging than he did talking about taxes. But regardless of what President Trump and Elon Musk talk about most loudly and angrily, there is one clear policy that they and the corporations and billionaires that support them will try hardest […]

A Well Targeted Federal Renter Credit Could Help Reduce Wealth Gaps

March 3, 2025 • By Brakeyshia Samms

While lawmakers often speak about income inequality, less attention is paid to wealth inequality. Wealth is distributed even more unequally than income in the U.S. in ways that reinforce racial divides, leave some households with too little to handle unexpected expenses, and enable some households to pass down enormous intergenerational wealth. A renter tax credit is one tool lawmakers can use to reduce wealth inequalities both within racial and ethnic groups and between these groups. As we show in our new analysis, Black and Hispanic households are more likely to be renters and hold less wealth than white households.

High-Rent, Low-Wealth: Addressing the Racial Wealth Gap through a Federal Renter Credit

March 3, 2025 • By Brakeyshia Samms, Emma Sifre, Joe Hughes

While the federal tax code has some policies focused on raising income of low earners, it contains fewer provisions designed specifically to address wealth inequality. A renter tax credit offers a simple, administratively practical means of reaching low-wealth populations through the federal tax code without requiring a comprehensive measurement of every household’s wealth.

Below is a list of tax expenditure reports published in the states.

Mississippi Considers Deep Tax Cuts Amidst Budget and Economic Uncertainty

February 26, 2025 • By Neva Butkus

At a time when states across the country are forecasting deficits or anticipating slowing revenue growth, Mississippi lawmakers are debating deeply regressive and expensive tax cuts that would overwhelmingly benefit their state’s richest residents.

State Rundown 2/26: House Budget Plan Could Further Strain State Budgets

February 26, 2025 • By ITEP Staff

States would be wise to keep a close eye on happenings in Washington, D.C. Republicans in the House of Representatives recently passed their budget resolution, which could spell trouble for state budgets. The plan tees up major cuts to Medicaid, SNAP, and college tuition assistance—all likely to allow for tax cuts that will overwhelmingly benefit the wealthy. If approved, trillions of dollars would be cut from programs supported by federal dollars and states and localities could bear the brunt of those shifting costs. Many states are already facing delicate fiscal outlooks and those considering cutting taxes further should seriously reconsider.…

The budget resolution passed by House Republicans will enrich the richest, blow up the deficit, and decimate vital public services. The budget resolution allows Congress to pass reconciliation legislation with $4.5 trillion in tax cuts that would mostly flow to the wealthiest families in the country. Congressional Republicans have no way to pay for the massive tax cuts promised by President Trump during his campaign other than to dismantle fundamental parts of the government and increase the federal budget deficit.

Learn from Prop 13 History to Avoid Repeating Past Mistakes

February 26, 2025 • By Rita Jefferson

Worries about housing costs and property tax bills are leading people to check the history books for solutions, but there’s a danger that they’ll repeat past mistakes. If anti-tax lawmakers carelessly weaken property taxes as they did in the 1970s, as they did with California’s Proposition 13, they will undercut public finances, making municipalities, school districts, and other special districts worse off.

Revenue Effect of Mandatory Worldwide Combined Reporting by State

February 21, 2025 • By ITEP Staff

Universal adoption of mandatory worldwide combined reporting (WWCR) in states with corporate income taxes would boost state tax revenue by $18.7 billion per year. The revenue effects of mandatory WWCR would vary across states. We estimate that 38 states and the District of Columbia would experience revenue increases totaling $19.1 billion. The top 10 states […]

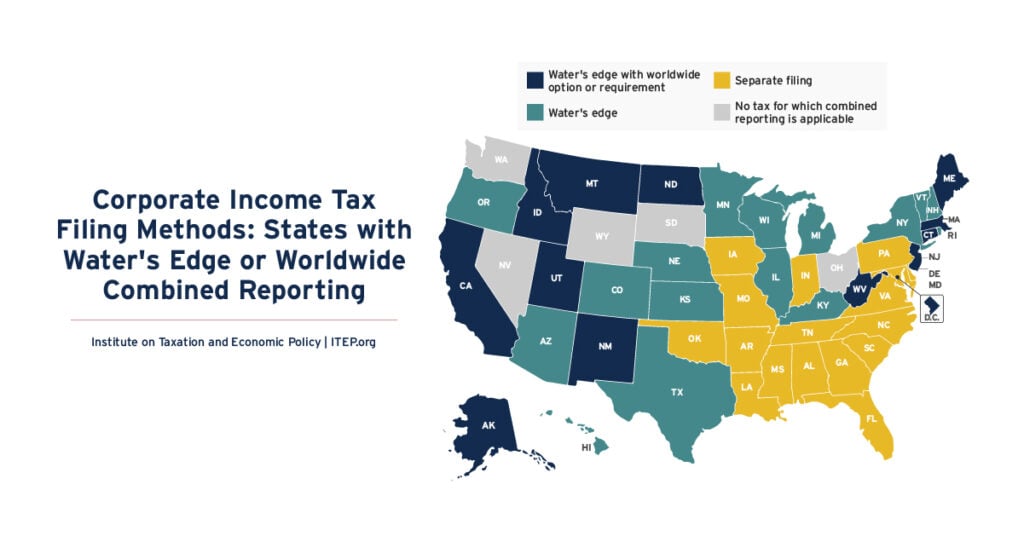

Corporate Income Tax Filing Methods: States with Water’s Edge or Worldwide Combined Reporting

February 21, 2025 • By ITEP Staff

The purpose of state corporate income taxes is to tax the profit, or net income, an incorporated business earns in each state. Ascertaining the state where profits are earned is, however, complicated for companies that conduct business in multiple jurisdictions. Twenty-eight states plus D.C. now require a limited version of combined reporting called “water’s edge” […]