Recent Work by ITEP

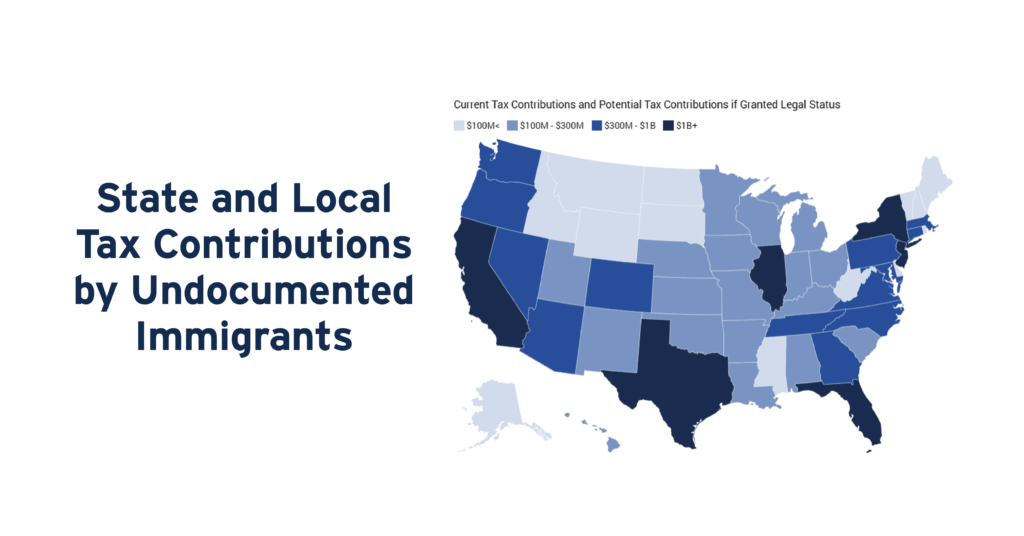

Undocumented immigrants pay taxes that help fund public infrastructure, institutions, and services in every U.S. state. Nearly 39 percent of the total tax dollars paid by undocumented immigrants in 2022 ($37.3 billion) went to state and local governments.

Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Providing access to work authorization for undocumented immigrants would increase their tax contributions both because their wages would rise and because their rates of tax compliance would increase.

Four states expanded or boosted refundable tax credits for children and families, and the District of Columbia is poised to create a new Child Tax Credit. These actions — in Colorado, Illinois, New York, Utah, and D.C. — continue the recent trend of improving the well-being of children and families with refundable tax credits.

State Rundown 7/25: Summertime Hits Different in Different States

July 25, 2024 • By ITEP Staff

State lawmakers will have a lot to discuss when they compare notes on how they spent their summer vacations this year...

Major tax cuts were largely rejected this year, but states continue to chip away at income taxes. And while property tax cuts were a hot topic across the country, many states failed to deliver effective solutions to affordability issues.

Improving Refundable Tax Credits by Making Them Immigrant-Inclusive

July 17, 2024 • By Emma Sifre, Marco Guzman

Undocumented immigrants who work and pay taxes but don't have a valid Social Security number for either themselves or their children are excluded from federal EITC and CTC benefits. Fortunately, several states have stepped in to ensure undocumented immigrants are not left behind by the gaps in the federal EITC and CTC. State lawmakers should continue to ensure that immigrants who are otherwise eligible for these tax credits receive them.

Corporate Tax Breaks Contribute to Income and Racial Inequality and Shift Resources to Foreign Investors

July 16, 2024 • By Emma Sifre, Steve Wamhoff

Corporate tax cuts and corporate tax avoidance worsen income and racial inequality in our country. Most of the benefits flow to foreign investors and the richest 20% of Americans.

While Massachusetts legislators recently dropped a real estate transfer tax from their major housing bill, the District of Columbia council sent a budget to the mayor that includes a mansion tax that would increase the tax rate on properties valued over $2.5 million. Meanwhile, lawmakers in New Jersey and South Carolina continue to, respectively, raise and reduce needed revenues.

Tax the Wealthy and Reject Austerity for a More Just and Thriving Democracy

July 1, 2024 • By Amy Hanauer

Two of the last five presidents won office over the objection of the majority of the people; California, with 65 times more people, has the same voting power in the U.S Senate as Wyoming; and the U.S. Supreme Court just permitted South Carolina lawmakers to dilute Black votes in drawing districts. These obvious flaws undermine our claim to be a strong democracy. One less appreciated but similarly undemocratic trend is our extreme inequality that supercharges the power and wealth of corporations and the uber-rich, weakens what the public sector can deliver, and often feeds on itself.

Reality Interrupts the Fever Dream of Income Tax Elimination in Kentucky

June 27, 2024 • By Eli Byerly-Duke

Keeping the Kentucky income tax on a march to zero would mean tax hikes for working families or widespread cuts to education, health care, and other public services. Reversing course is certainly the wiser course of action.