Recent Work by ITEP

State and Local Policymakers Can Resist Austerity Even Amid Historic Federal Retreat

November 6, 2025 • By Kamolika Das

The progressivity of the federal tax code has been waning. State and local policymakers should respond by protecting their revenue bases, promoting equity, and safeguarding vulnerable communities from harmful budget cuts.

In 2025, Voters Said Yes to Public Resources and Community Investments

November 6, 2025 • By Rita Jefferson

Important tax measures were on the ballot this week, and the outcomes are clear: many voters support new state and local spending to support critical services in their communities.

States Begin Decoupling from Flawed ‘QSBS’ Tax Break

November 6, 2025 • By Nick Johnson, Sarah Austin

A costly tax break for wealthy venture capitalists is drawing some critical attention from state policymakers.

The move was expected, given heavy lobbying from tax prep companies like Intuit and H&R Block to put a halt to the IRS’s popular Direct File program.

Despite being an off-year election, voters made a call for shared public investments at the polls.

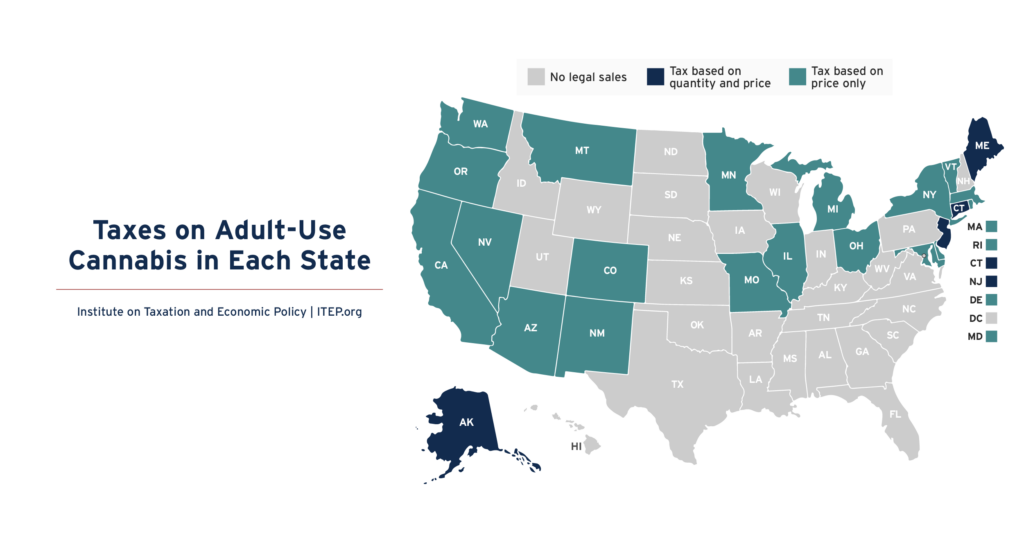

Twenty-three states have legalized the sale of cannabis for general adult use. Every state allowing legal sales applies an excise tax to cannabis based on the product’s quantity, its price, or both. Quantity taxes can be based on either overall product weight or the amount of THC sold. ITEP research indicates that taxes based on […]

Biden Tax Reforms Take a $16 Billion Bite Out of Trump’s Big Tax Giveaway to Meta

October 30, 2025 • By Matthew Gardner

Meta’s earnings setback is entirely attributable to an important tax reform championed by the Biden administration in 2022.

Oil and Gas Companies Are Paying Less Tax to the U.S. than to Foreign Governments

October 30, 2025 • By Matthew Gardner

Since 2017, these companies paid $135 billion in income taxes to foreign governments, but just $29 billion to the U.S.

The Wealth Proceeds Tax: A Simple Way for States to Tax the Wealthy

October 30, 2025 • By Sarah Austin, Carl Davis

Taxing the proceeds generated by wealth through a new Wealth Proceeds Tax is a simple way for states to raise billions in new revenue and improve the fairness of their tax systems.

States across the nation are debating how best to respond to costly new federal tax cuts.