Recent Work by ITEP

State Rundown 1/30: Flip-Flops and Steady Marches in State Tax Debates

January 30, 2020 • By ITEP Staff

State tax and budget debates can turn on a dime sometimes, as in Utah this past week, where lawmakers unanimously repealed a tax package they had just approved in a special session last month. Delaware lawmakers are hoping to avoid the similarly abrupt end to their last effort to improve their Earned Income Tax Credit (EITC) by crafting a bill that Gov. John Carney will have no reason to unexpectedly veto as he did two years ago. But at other times, these debates just can’t change fast enough, as in New Hampshire and Virginia, where leaders are searching for revenue to address long-standing transportation needs, and in Hawaii, Nebraska, and North Carolina, where education funding issues remain painfully unresolved.

A new IRS proposal could once again allow wealthy business owners to use state charitable tax credits–including tax credits for donating to support private and religious K-12 schools–to dodge the federal government’s $10,000 cap on state and local tax (SALT) deductions.

ITEP Comments and Recommendations on REG-107431-19

January 29, 2020 • By Carl Davis

Comments regarding the possibility that owners of passthrough businesses may be able to circumvent the $10,000 SALT deduction cap of section 164(b)(6) by recharacterizing the nondeductible portion of their state and local income tax payments as deductible expenses associated with carrying on a trade or business.

GOP Legacy on IRS Administration: Auditing Mississippi, not Microsoft

January 24, 2020 • By Matthew Gardner

Money doesn’t buy happiness—but it can buy immunity from the reach of Uncle Sam. The IRS is outgunned in cases against corporate giants because that’s how Republican leaders want it to be. They have systematically assaulted the agency’s enforcement capacity through decades of funding cuts. Instead of saving money, these cuts have cost billions: each dollar spent on the IRS results in several dollars of tax revenue collected.

This week as Americans celebrate Martin Luther King Jr.’s messages of resisting oppression and fighting for progress, state policymakers can look to some bright spots where tax and budget debates are bending toward justice. Among those highlights, Hawaii leaders are considering improvements to minimum wage policy, early childhood education, and affordable housing; Kansas Gov. Laura Kelly is seeking to reduce sales taxes applied to food and restore the state’s grocery tax credit; and advocates in Connecticut and Maryland are pushing for meaningful progressive tax reforms.

After years of watching tax policy increasingly leave communities behind, at ITEP I’ll have the chance to work with local, state and national partners on policy solutions. I’m prepared to push for a tax system that can better deliver economic, climate and racial justice; for a public sector that can prepare our kids and our grid for 2020 and beyond; and for an America that works for all of us, whether we were born in Nebraska or Hawaii, Detroit or Miami.

State tax and budget debates have arrived in a big way, with proposals from every part of the country and everywhere on the spectrum from good to bad tax policy. Just look to ARIZONA for a microcosm of nationwide debates, where education advocates have a plan to raise progressive taxes for school needs, Gov. Doug […]

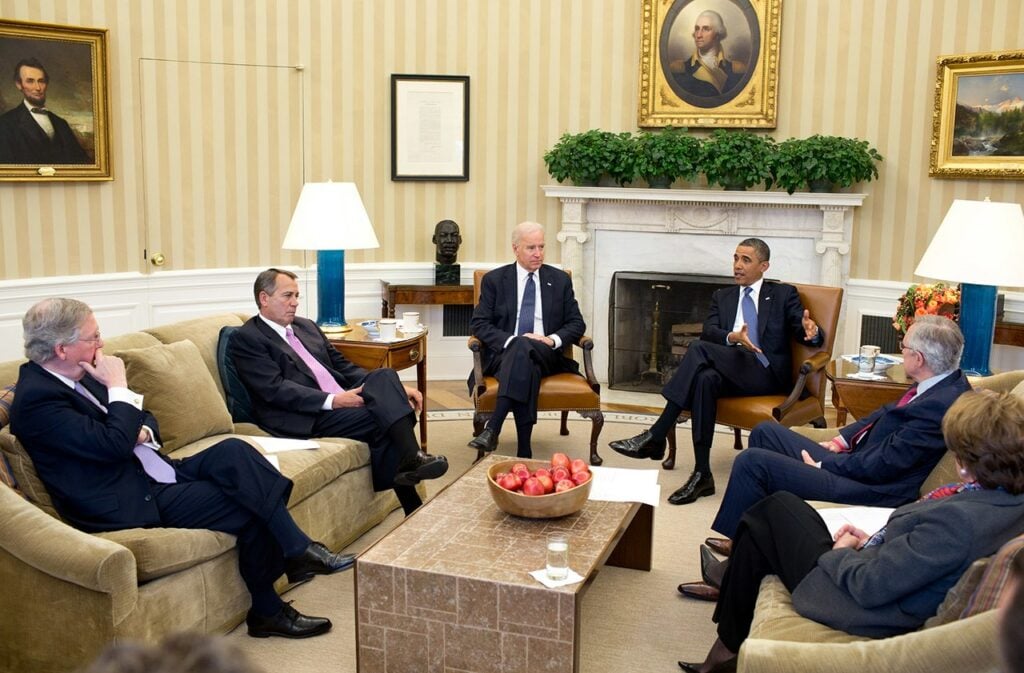

The 2013 Biden-McConnell “Fiscal Cliff” Deal Shows Why the Next President Needs a New Approach to Taxes

January 15, 2020 • By Steve Wamhoff

Americans have long wanted more progressive tax policies and have told pollsters for years that they want wealthy individuals and big corporations to pay more, not less, in taxes. The only way forward is for lawmakers and the next president to take a dramatically different approach to tax policy.

White House Council of Economic Advisers Crows about Lowest-Income Americans Being Infinitesimally “Wealthier”

January 14, 2020 • By Matthew Gardner

When the White House Council of Economic Advisors last week tweeted that the poorest 50 percent of Americans’ wealth is growing 3 times faster than the wealth of the top 1 percent, we were skeptical. As it turns out, the CEA’s tweet is a reminder that the poorest 50 percent wealth grew twice as fast during Barack Obama’s second term than it has under Trump, but to this day remains far below its pre-recession share and significantly less than what it was 30 years ago.

A basic understanding and idea of fairness is a trait we share with intelligent primates, which is precisely why more than two years ago as Congress was debating the Tax Cuts and Jobs Act, the American public disapproved of the tax bill.