Summary

The Missouri House of Representatives recently passed a bill, HB 798, making a variety of changes to Missouri tax law. The bill reduces personal and corporate income tax rates, fully eliminates taxes on capital gains income from sale of assets, and eliminates the state’s modest Earned Income Tax Credit that assists many working people in lower-paid jobs.

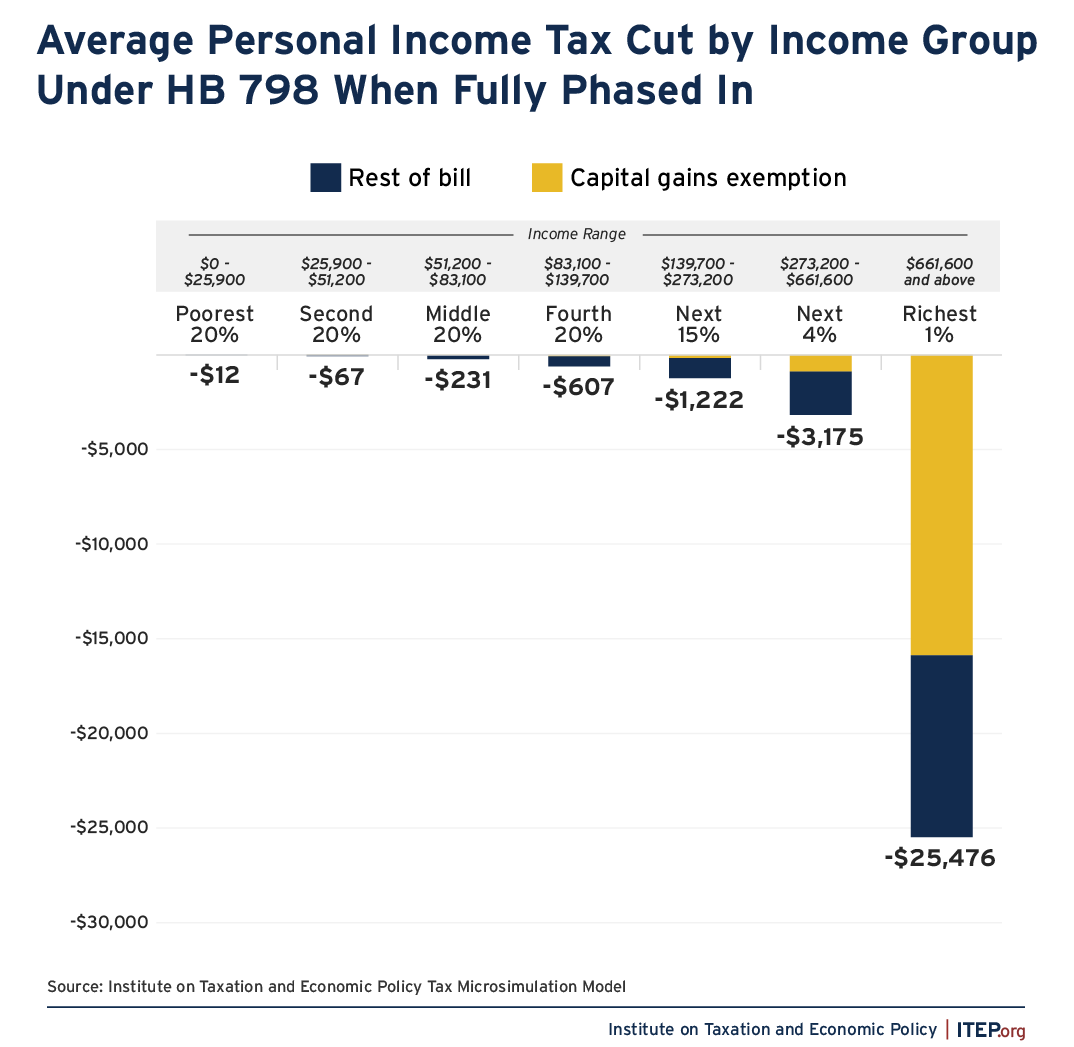

HB 798 would radically transform Missouri’s income tax code into a system that privileges income from wealth over income from work, leaving many middle-income families to pay a higher income tax rate than wealthy people living off their investments. Once fully phased in, HB 798 would cut the income tax liability of the state’s top 1 percent of households by an average of $25,476, compared to average tax cuts of $231 for middle-income earners and $12 for low-income families.

In addition, by reducing what the most affluent people and businesses pay, the bill would require lawmakers to cut or reduce the quality of schools, health care, infrastructure, and other public goods in Missouri or result in higher reliance, over time, on revenue sources that ask more of middle- and low-income families.

Bill Summary

Missouri House Bill 798 of the 103rd General Assembly would make the following changes to state tax law:

- Replace the graduated personal income tax rate structure with a flat tax. Current rates ranging from 0 to 4.7 percent would be replaced by a single, 4.7 percent flat rate. The flat tax rate would eventually be cut to 3.7 percent on a schedule determined by future revenue collections.

- Reduce the corporate income tax rate from 4 to 3.75 percent and the financial institutions tax rate from 4.48 to 4.2 percent.

- Fully exempt capital gains (that is, income derived from asset sales) from tax.

- Increase the standard deduction by $4,000.

- Repeal the Earned Income Tax Credit (EITC), which is currently nonrefundable and set at 20 percent of the federal EITC amount.

- Increase tax credits for contributions to maternity homes and pregnancy resource centers from 70 percent to 100 percent of the amount contributed, and for diaper banks from 50 to 100 percent of the contribution.

Bill Analysis

These tax cuts would come at a significant cost to the state’s budget. While the state’s Joint Committee on Legislative Research forecasts an annual cost of nearly $1.3 billion upon full implementation, there is good reason to expect that the true cost would be significantly higher.[1]

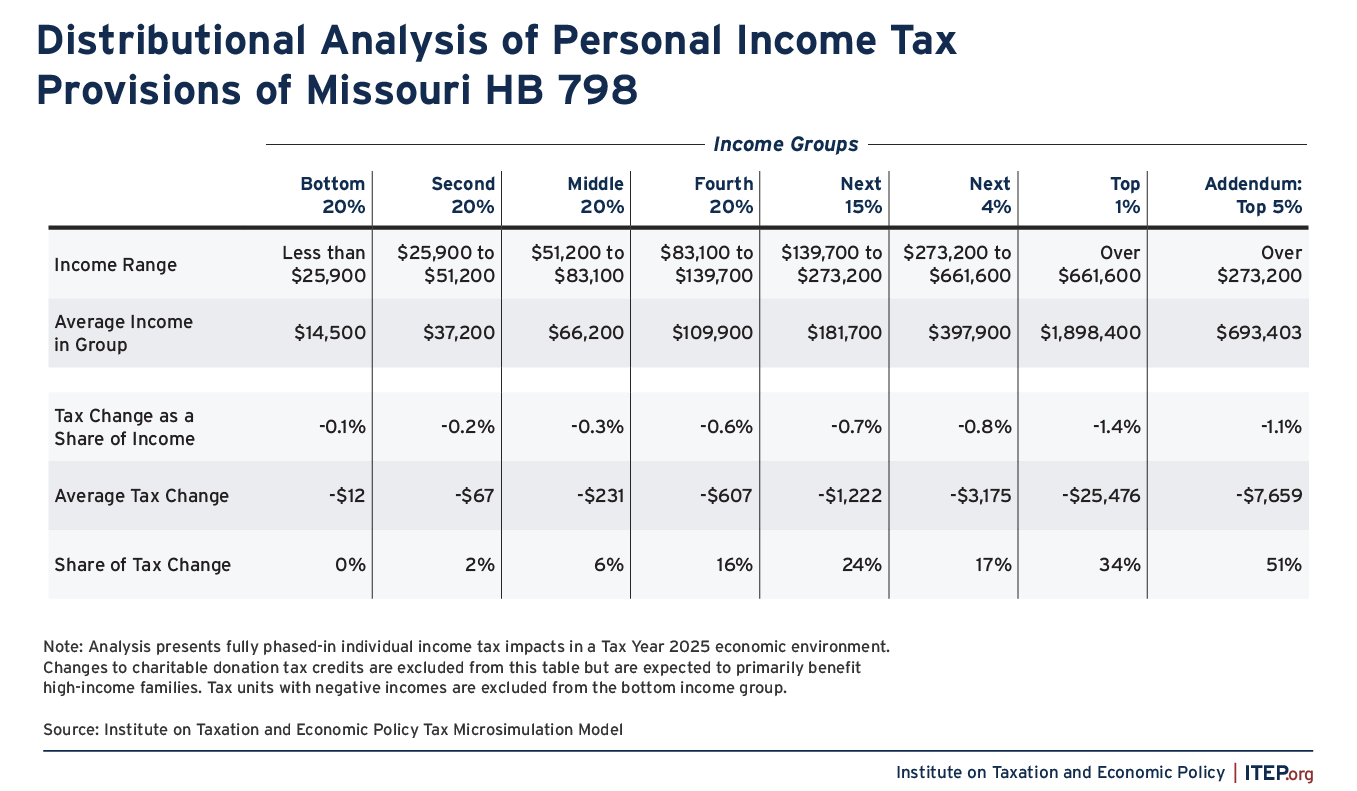

Most of those tax cuts would be directed to high-income people. Nearly all the components of HB 798 would be regressive in their effect, meaning they would impact middle- and low-income earners less favorably than high-income families. If HB 798 were in full effect this year, the overall result would be an average personal income tax cut of $25,476 for the state’s top 1 percent of families—a group comprised exclusively of people with incomes above $660,000. More than half of the tax cuts would flow to Missourians with incomes above $273,000 per year. Figure 1 presents the average tax cut provided by HB 798 at every income level and Appendix Table A provides additional detail.

FIGURE 1

At the top of the income scale, most of the tax cuts would come from removing capital gains income from the tax base. Specifically, 62 percent of the tax cuts provided to the top 1 percent of households, by income, would come through the capital gains tax exemption. When fully implemented, HB 798 would cut the top tax rate on wage income from work by 1 percentage point (from 4.7 to 3.7 percent) and would cut the top tax rate on capital gains income derived from wealth by 4.7 percentage points (from 4.7 to 0 percent).

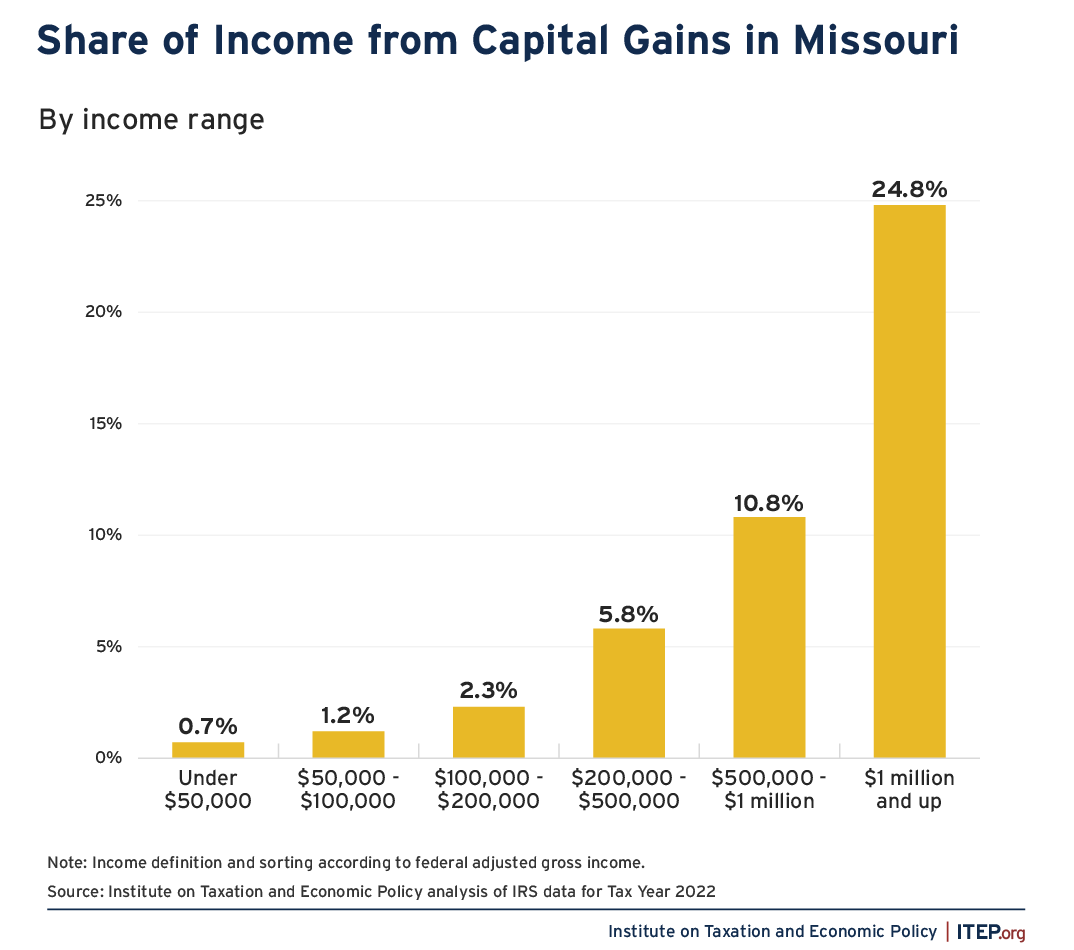

As seen in Figure 2, removing capital gains income from the tax base would tend to benefit high-income families because a larger share of their income comes from such gains. Missouri families with incomes over $1 million, for instance, derived nearly a quarter of their income from capital gains in 2022. Middle-income families, by contrast, saw 3 percent or less of their income from capital gains.

FIGURE 2

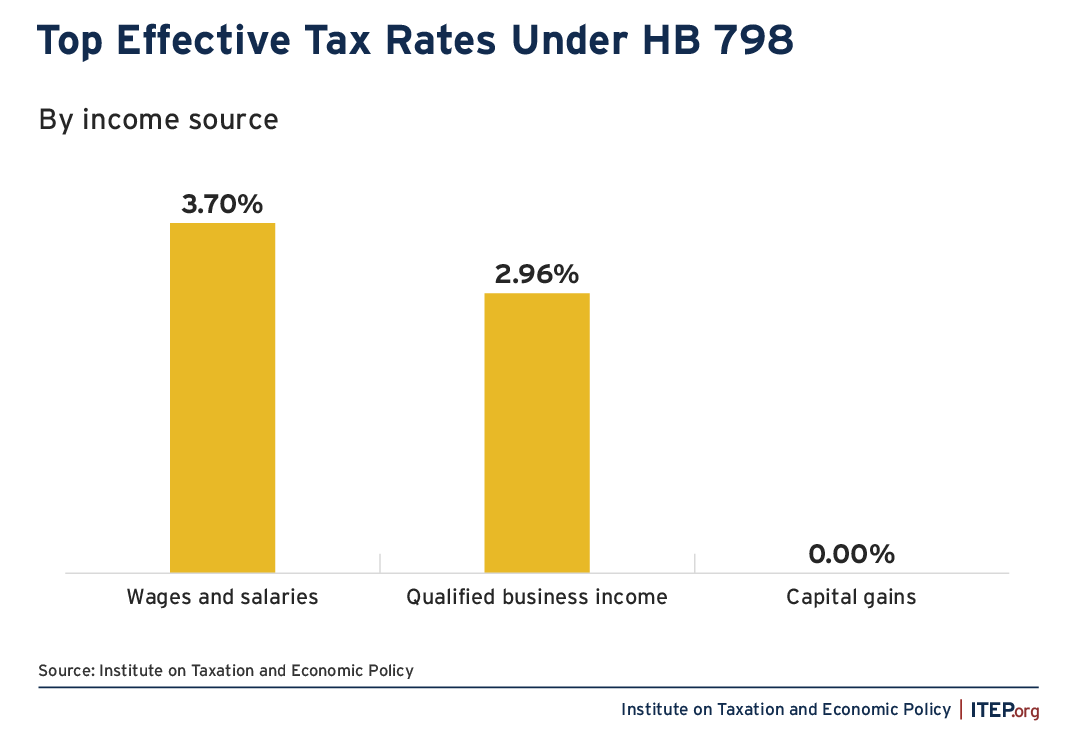

A capital gains exemption, by definition, would disproportionately benefit wealthy households because capital gains are generated by wealth holdings. As seen in Figure 3, HB 798 would shift Missouri’s income tax to a system that relies more heavily on workers and less on wealthy investors to raise revenue. The top tax rate on wages and salaries would be 3.7 percent in Missouri upon full implementation of the bill. Certain forms of business income, by contrast, would be taxed at just 2.96 percent after considering the state’s 20 percent deduction for qualified business income. Capital gains derived from wealth holdings would be treated most favorably at all, as they would be exempt from tax entirely.

FIGURE 3

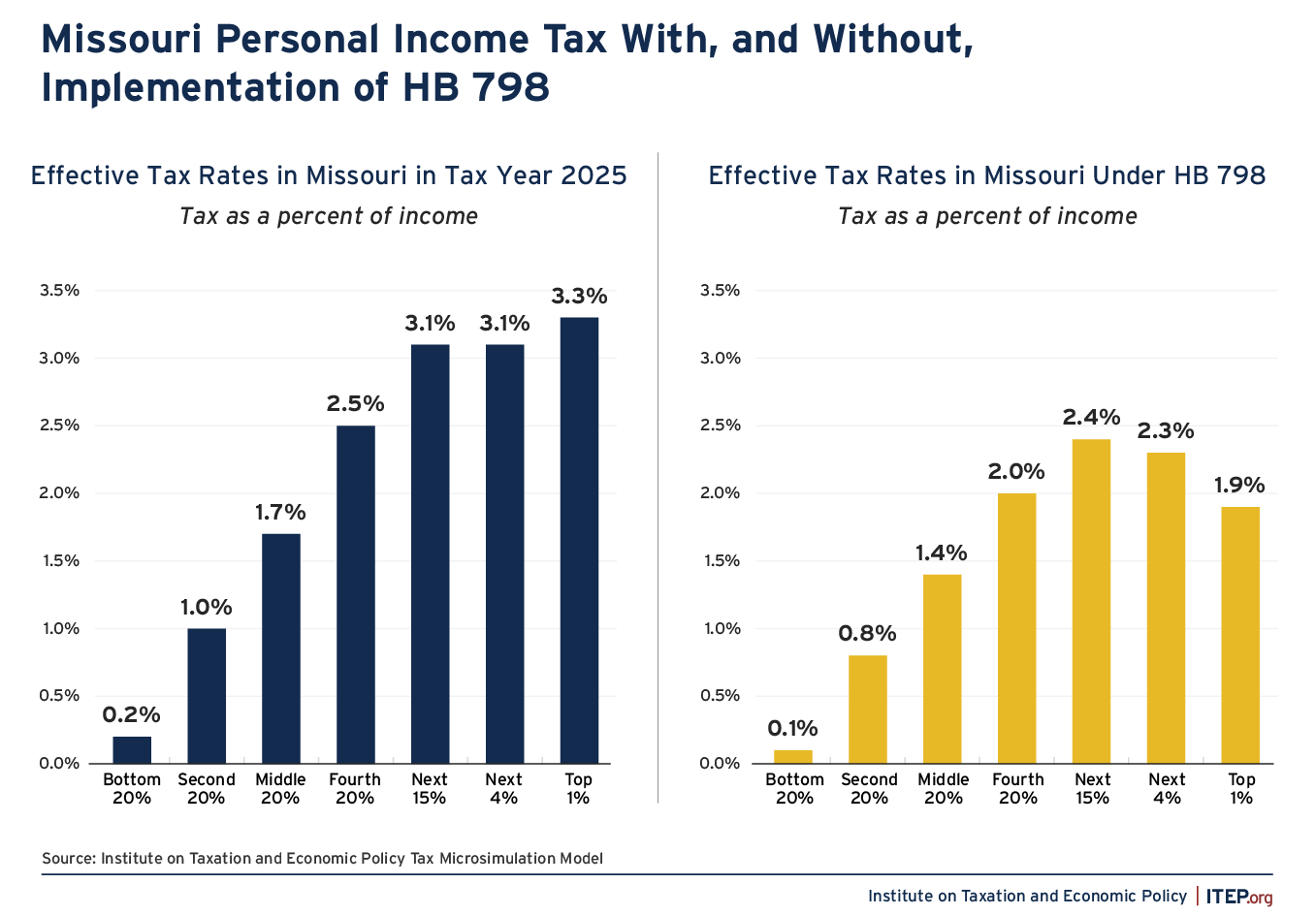

These significant disparities in tax rates across various income sources would lead to peculiar results across the income scale. As seen in the left panel of Figure 4, Missouri’s personal income tax is moderately progressive, meaning that tax rates rise as income rises. Under HB 798, Missouri would move to a hybrid system that is actually regressive, on average, for families with incomes above roughly $140,000 per year. That is, upper-middle class workers in Missouri would find themselves paying significantly higher effective tax rates than the state’s most affluent families as the latter would receive a large share of their income—specifically, capital gains—completely tax-free at the state level.

FIGURE 4

Conclusion

Missouri’s HB 798 is a regressive tax bill that would direct its largest tax cuts to high-income and wealthy people. In large part it would do this by no longer taxing a large share of income derived from wealth—capital gains. In total, more than half of the personal income tax cuts provided by this bill would flow to families with incomes over $273,000. The state’s top 1 percent of households by income would see an average tax cut of $25,476. Similar cuts would not accrue to middle and upper-middle class people. If HB 798 were enacted, Missouri would be left with an income tax code that would tax Missourians living off their wages while exempting very affluent families living off their investments. The bill would also significantly reduce state revenue available to fund schools, infrastructure, and other essential services.

Appendix

APPENDIX TABLE A

Endnotes

[1] The fiscal note accompanying HB 798 notes, for instance, that the capital gains deduction for corporations will “be larger than estimated” because the method underlying those calculations omits returns filed on paper. Moreover, in separate ITEP research we have explained that the 100 percent donation tax credits contained in the bill will cost more than predicted because the fiscal note adopts an unrealistic assumption of no change in donation levels. Finally, of particular note is the fact that the official estimates for capital gains deductions under the personal and corporate income taxes, as articulated in a fiscal note for HB Nos. 594 and 508, predict a revenue loss of between $230 million and $240 million annually. This estimate conflicts with IRS data showing that Missouri residents filing federal individual income tax returns reported more than $13.3 billion in net capital gains income in 2022. A tax deduction for $13.3 billion of income, claimed against the state’s top personal income tax rate of 4.7 percent, would seem to cost the state at least $625 million—a figure that does not account for likely growth in capital gains since 2022 or any revenue loss under the corporate income tax. We have reached out to the Joint Committee on Legislative Research to request clarification of their estimates and will update this note as new information comes to light. The relevant fiscal notes are available at the following links for HB Nos. 594 and 508 and HB No. 798.