Recent Work

2162 items

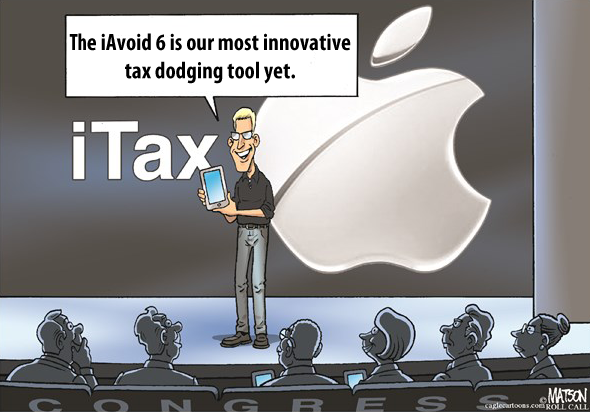

Tim Cook’s Disingenuous Argument to Justify Apple’s $215 Billion Offshore Cash Hoard

August 9, 2016 • By Jenice Robinson

Tim Cook is a persuasive CEO. In a wide-ranging interview published earlier this week in the Washington Post, he discussed his vision for the company, thoughts about leadership succession, and humbly admitted he has made mistakes. So it would be very easy to view as reasonable his declaration that Apple will not repatriate its offshore […]

Achieving Sustainable Infrastructure Revenue with Gas Tax Reform

August 8, 2016 • By Carl Davis

This brief outlines the causes of Louisiana's infrastructure revenue shortfall and offers recommendations for how the state can achieve "sufficient increased levels of recurring funding to address the transportation backlog in highway and bridge maintenance needs in Louisiana," as per the Task Force's mandate.

The sharp decline in oil prices since summer 2014 has allowed consumers to save hundreds of dollars annually at the pump, but it also has left some energy producing states clamoring to come up with policy ideas to make up for lost revenue.

Read this Policy Brief in PDF here. General sales taxes are an important revenue source for state governments, accounting for close to one-third of state tax collections nationwide. But most state sales taxes have a damaging structural flaw: they typically apply to most sales of goods, such as books and computers, but exempt most services […]

Read this report in PDF. This month, Alaska legislators regroup in yet another special session where they will consider legislation to address a yawning budget gap created by declining oil tax and royalty revenues. Through the use of his veto pen, Gov. Bill Walker has partially addressed the gap with cuts to state spending and […]

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 11, 2016 • By Meg Wiehe

This brief was updated July 2018 Read this Policy Brief in PDF here. Sales taxes are an important revenue source, composing close to half of all state tax revenues.[1] But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and services subject to the […]

Ryan Tax Plan Reserves Most Tax Cuts for Top 1 percent, Costs $4 Trillion Over 10 Years

June 29, 2016 • By ITEP Staff

A new distributional analysis of Republican Speaker of the House Paul Ryan’s “A Better Way” policies finds that the plan would: • Add $4 trillion to the national debt over a decade. • Overwhelmingly benefit the top 1 percent of tax payers while resulting in a net loss for the bottom 95 percent of taxpayers. • Slash corporate […]

Few state tax trends are as striking as the rapid decline of state corporate income tax revenues. As recently as 1986, state corporate income taxes equaled 0.5 percent of nationwide Gross State Product (GSP) (a measure of statewide economic activity). But in fiscal year 2013 (the last year for which data are available), state and local corporate income taxes were just 0.33 percent of nationwide GSP--representing a decline of over 30 percent.

An updated version of this report has been published with data through July 1, 2017. Read this Policy Brief in PDF form Many states’ transportation budgets are in disarray, in part because they are trying to cover the rising cost of asphalt, machinery, and other construction materials with a gasoline tax rate that is rarely […]

The New Jersey Legislature is considering a proposal to increase the state’s gas tax but at the same time some lawmakers are insisting that that tax increase be paired with tax cuts for the wealthiest New Jerseyans. Perhaps most bizarre is that the state is considering providing a tax cut for retirement and pension income (a move that would benefit the best-off state residents) while also weighing cuts to the revenue that funds state pensions.

Read this Policy Brief in PDF Form Map of State Treatment of Itemized Deductions Thirty-one states and the District of Columbia allow a group of income tax breaks known as “itemized deductions.” [1] Itemized deductions are designed to help defray a wide variety of personal expenditures that affect a taxpayer’s ability to pay taxes, including charitable […]

A new study released today provides the best evidence yet that progressive state income taxes are not leading to any meaningful amount of “tax flight” among top earners.

Distributional Analyses of Revenue Options for Alaska

April 13, 2016 • By Aidan Davis, Carl Davis

Alaskans are faced with a stark fiscal reality. Following the discovery of oil in the 1960s and 1970s, state lawmakers repealed their personal income tax and began funding government primarily through oil tax and royalty revenues. For decades, oil revenues filled roughly 90 percent of the state's general fund.

Higher Education Income Tax Deductions and Credits in the States

March 22, 2016 • By Carl Davis

Read full report in PDF Download detailed appendix with state-by-state information on deductions and credits (Excel) Every state levying a personal income tax offers at least one deduction or credit designed to defray the cost of higher education. In theory, these policies help families cope with rising tuition prices by incentivizing college savings or partially […]

Undocumented Immigrants’ State & Local Tax Contributions (2016)

February 24, 2016 • By Lisa Christensen Gee, Meg Wiehe

This report was updated in March 2017 Read as a PDF. (Includes Full Appendix of State-by-State Data) Report Landing Page Public debates over federal immigration reform often suffer from insufficient and inaccurate information about the tax contributions of undocumented immigrants particularly at the state level. The truth is that undocumented immigrants living in the United […]