Recent Work

2144 items

State Child Tax Credits Boosted Financial Security for Families and Children in 2024

September 12, 2024 • By Neva Butkus

Fifteen states plus the District of Columbia provide Child Tax Credits to reduce poverty, boost economic security, and invest in children. This year alone, lawmakers in three states – Colorado, New York, and Utah – expanded their Child Tax Credits while lawmakers in the District of Columbia created a new credit that will take effect in 2025.

Expanded Child Tax Credit is Key to Reducing Child Poverty, New Census Data Illustrate

September 10, 2024 • By Jon Whiten

From 2021-2023, child poverty has more than doubled from 5.2 to 13.7 percent. The latest Census data make clear that lawmakers have the tools to help millions of children and their families – and it’s beyond time they take action.

After the dust settles on this year’s election, one of the most pressing issues confronting the next Congress and President will be how to deal with the expiration of the 2017 Trump tax cuts and, more specifically, who will pay for the cost of extending some or all of those cuts. Among the more widely accepted ideas circulating on the right is to raise income taxes on single parents, more than four in five of whom are women and a disproportionate share of whom are people of color.

State Rundown 9/5: Property Tax Policy Continues to Make Headlines

September 5, 2024 • By ITEP Staff

Property tax bills are undeniably a concern for many low- and moderate-income households across the nation...

The IRS has opened its free tax filing service called Direct File to every state for the 2025 tax filing season. Direct File was made possible by President Biden’s Inflation Reduction Act, which provided new resources for the IRS to improve customer service and ensure taxpayers claim the benefits and deductions for which they are […]

The no tax on tips idea isn't a new one, but it's always been abandoned because it's practically impossible to do without creating new avenues for tax avoidance. Despite its embrace by the candidates from both major parties, this policy idea would do little to help the roughly 4 million people who work in tipped occupations while creating a host of problems.

Many cities, counties, and townships across the country are in a difficult, or at least unstable, budgetary position. Localities are responding to these financial pressures in a variety of ways with some charging ahead with enacting innovative reforms like short-term rental and vacancy taxes, and others setting up local tax commissions to study the problem.

State Rundown 8/8: States Laying the Groundwork for Future Tax Battles

August 8, 2024 • By ITEP Staff

Whether they’re in a special session, gearing up for one, or prepping for 2025, states around the country are focusing on important tax fights...

Minnesota stands apart from the rest of the country with a moderately progressive tax system that asks slightly more of the rich than of low- and middle-income families. Recent reforms signed by Gov. Tim Walz have contributed to this reality.

Sales Tax Holidays Miss the Mark When it Comes to Effective Sales Tax Reform

August 6, 2024 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2024. These suspensions combined will cost states and localities over $1.3 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system.

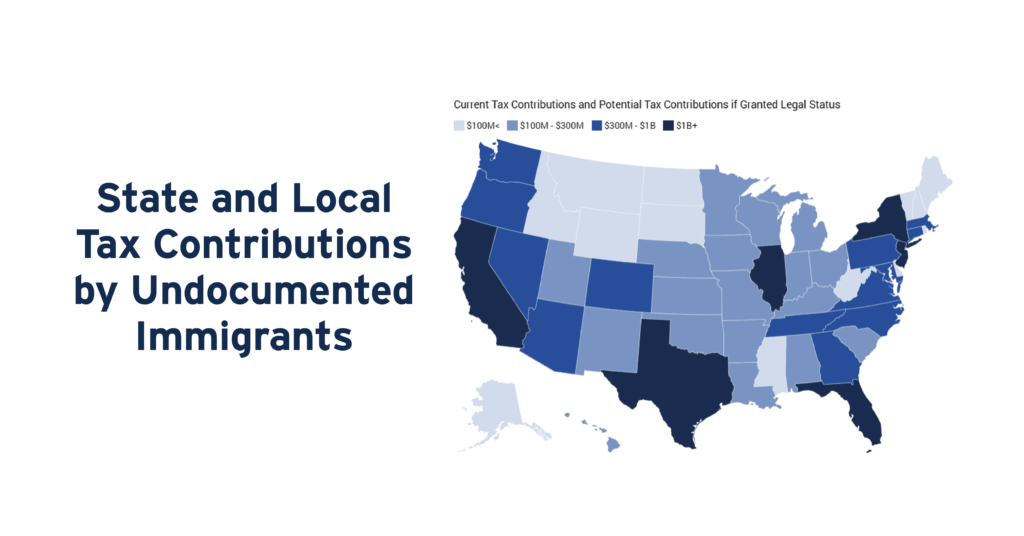

Undocumented immigrants pay taxes that help fund public infrastructure, institutions, and services in every U.S. state. Nearly 39 percent of the total tax dollars paid by undocumented immigrants in 2022 ($37.3 billion) went to state and local governments.

Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Providing access to work authorization for undocumented immigrants would increase their tax contributions both because their wages would rise and because their rates of tax compliance would increase.

Four states expanded or boosted refundable tax credits for children and families, and the District of Columbia is poised to create a new Child Tax Credit. These actions — in Colorado, Illinois, New York, Utah, and D.C. — continue the recent trend of improving the well-being of children and families with refundable tax credits.

State Rundown 7/25: Summertime Hits Different in Different States

July 25, 2024 • By ITEP Staff

State lawmakers will have a lot to discuss when they compare notes on how they spent their summer vacations this year...

Major tax cuts were largely rejected this year, but states continue to chip away at income taxes. And while property tax cuts were a hot topic across the country, many states failed to deliver effective solutions to affordability issues.