Recent Work

2161 items

Why States Shouldn’t Go Along With OBBBA’s Corporate Tax Breaks: A Practical Guide

October 27, 2025 • By Nick Johnson, Michael Mazerov

States should immediately decouple from four costly corporate tax provisions in the new federal tax law.

The 5 Biggest State Tax Cuts for Millionaires this Year

October 16, 2025 • By Dylan Grundman O'Neill, Aidan Davis

Some states continue to hand out huge tax cuts to millionaires. The five largest tax cuts this year will cost states a total of $2.2 billion per year once fully implemented.

Well, That Was Fast: Trump Tax Law’s New Corporate Breaks are Already Worsening the Deficit

October 9, 2025 • By ITEP Staff

Corporate income taxes for the fiscal year that ended in September are $77 billion lower than in the previous year, a 15 percent drop.

Many lawmakers who were vocal supporters of this bill will see direct personal benefits while most of their constituents benefit little or will be worse off.

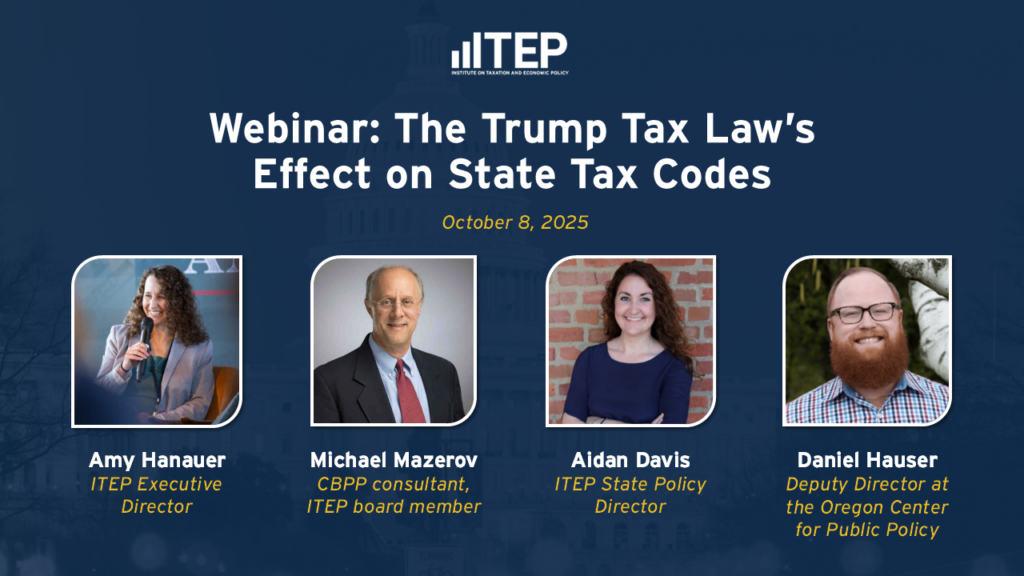

This webinar focused on the ways the new tax law could impact state revenues by changing policies that state lawmakers will soon consider mirroring in their own income tax codes.

The Potential of Local Child Tax Credits to Reduce Child Poverty

October 8, 2025 • By Kamolika Das, Aidan Davis, Galen Hendricks, Rita Jefferson

Local governments have a critical role to play in reducing child poverty. Local Child Tax Credits could provide large tax cuts to families at the bottom of the income scale, lessening the overall regressivity of state and local tax systems.

Trump Tax Law Erases Economic, Racial Progress in the Tax Code

October 6, 2025 • By Brakeyshia Samms

President Trump’s massive tax-and-spending bill continues the administration’s assault on racial and economic justice by prioritizing tax breaks for the top 1% while neglecting the economic well-being of poor and working families of all races, especially people of color.

Quite Some BS: Expanded ‘QSBS’ Giveaway in Trump Tax Law Threatens State Revenues and Enriches the Wealthy

October 2, 2025 • By Sarah Austin, Nick Johnson

States should decouple from the federal Qualified Small Business Stock (QSBS) exemption.

Coca-Cola To Shareholders: $18 Billion Tax Bill? What $18 Billion Tax Bill?

October 1, 2025 • By Matthew Gardner

If Coca-Cola only pays 3% of the $18 billion tax bill it's facing, then the rest of us will have to pick up the remaining 97%.

State Rundown 10/1: State and Local Governments Doing the Opposite of Shutting Down

October 1, 2025 • By ITEP Staff

State and local officials are staying very busy by considering a dizzying amount of reversals.

Leaving Billions on the Table: Trump-Induced Brain Drain Leaves the IRS Struggling to Prevent Corporate Tax Avoidance

September 25, 2025 • By Matthew Gardner

The IRS's capacity to prevent big multinational corporations from avoiding income taxes is facing a generational crisis.

State Rundown 9/18: Lawmakers Confront Revenue Loss from Federal Policy Changes

September 18, 2025 • By ITEP Staff

Some states are trying to avoid revenue loss while others are welcoming it and doubling down.

Child Poverty Remains Unacceptably High, New Federal Changes Unlikely to Move Needle

September 16, 2025 • By Neva Butkus

By not extending the 2021 temporary Child Tax Credit expansion, federal lawmakers have allowed the number of children and families in poverty to increase and remain unnecessarily high.

IRS Enforcement Boost Was Supposed to Last 10 Years. Congress Killed It in Under Three.

September 16, 2025 • By Sarah C. G. Christopherson

The IRS was set to overhaul how it audits the ultra-rich. Now most of that funding is gone.

What currently stands in the way of better corporate tax transparency.