Although the weather is beginning to cool down in parts of the country, the same cannot be said for many state economies, which are still running hot. That, however, doesn’t mean that the good times are guaranteed to last, and states should consider that when making changes to their tax laws. Unfortunately, states like Arizona and Missouri (among others) have already made big changes with benefits that will primarily flow to the already wealthy. Blunt policy tools like harsh, deep tax cuts—like the ones currently being proposed in North Dakota and debated in Colorado—are rarely the best answer, especially when considering how the wealthy are oftentimes best positioned to “weather” things like the increasingly likely recession, while the long-term effects upend the ability to support strong, thriving communities.

Major State Tax Proposals and Developments

- The 2.5 percent flat tax recently approved in ARIZONA will go into effect in 2023, a year ahead of schedule. The plan, which primarily benefits the wealthy, was originally scheduled to be phased in over multiple years but collections have exceeded the statutory thresholds required to implement the tax. – MARCO GUZMAN

- A $1 billion tax cut package was signed by MISSOURI Gov. Mike Parson. The centerpiece of the package is a bill that will reduce the top income tax rate from 5.3 to 4.9 percent in 2023 and includes triggers to further reduce the top rate to 4.5 percent. The plan disproportionately benefits wealthy Missourians over lower-income and elderly households while doing nothing to benefit the state economy and simultaneously jeopardizing the state’s ability to fund priorities like education once these temporary surpluses disappear. – NEVA BUTKUS

State Roundup

- ALABAMA Gov. Kay Ivey announced plans to distribute tax rebates but has yet to reveal details.

- CALIFORNIA Gov. Gavin Newsom is proposing a windfall tax on oil companies that continue to rake in profits and raise prices out of proportion with oil costs. This is a stark contrast to the misguided gas tax holidays that many states have tried this year.

- On Monday, GEORGIA Gov. Brian Kemp extended the suspension of gas taxes through November 11th. As a reminder, state gas tax holidays do not meaningfully benefit consumers.

- NEW JERSEY Gov. Phil Murphy signed legislation that allows parents to take advantage of the state’s new child tax credit when they file taxes for the current year rather than waiting until 2024.

- In OKLAHOMA, legislators ended their most recent special session without acting on Gov. Stitt’s repeated calls for repealing the grocery sales tax. Senate President Pro Tempore Greg Treat is planning work on tax reform during the 2023 legislative session.

- RHODE ISLAND residents will start receiving checks from the state’s new Child Tax Credit as early as this week. The credit amounts to $250 per child, up to $750 total, for two-parent families with up to $200,000 in income and single parent families with incomes up to $100,000.

- The WEST VIRGINIA Association of Counties has come out against Amendment 2, which would authorize the legislature to reduce or eliminate tangible personal property taxes.

What We’re Reading

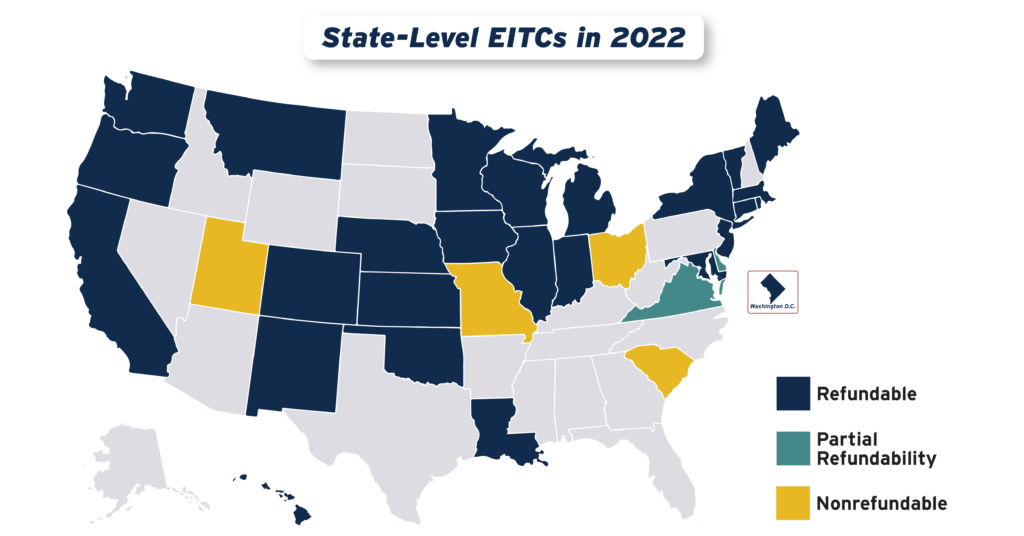

- Farhad Manjoo’s opinion piece in the New York Times discusses how the expanded Child Tax Credit and universal basic income programs can transform the lives of low-income families. Two recent ITEP briefs discuss recent momentum around refundable credits (CTCs and EITCs), and recommendations for policy design of these credits in the states.

- The Institute for Policy Studies has a new report out arguing that Trust policy in many states is enabling billionaires to avoid and evade taxes through what amount to on-shore tax havens.

- Stateline explores how unpaid property taxes can sometimes mean not just losing one’s home, but all the equity built up in that home as well.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Aidan Davis at [email protected]. Click here to sign up to receive the Rundown via email.