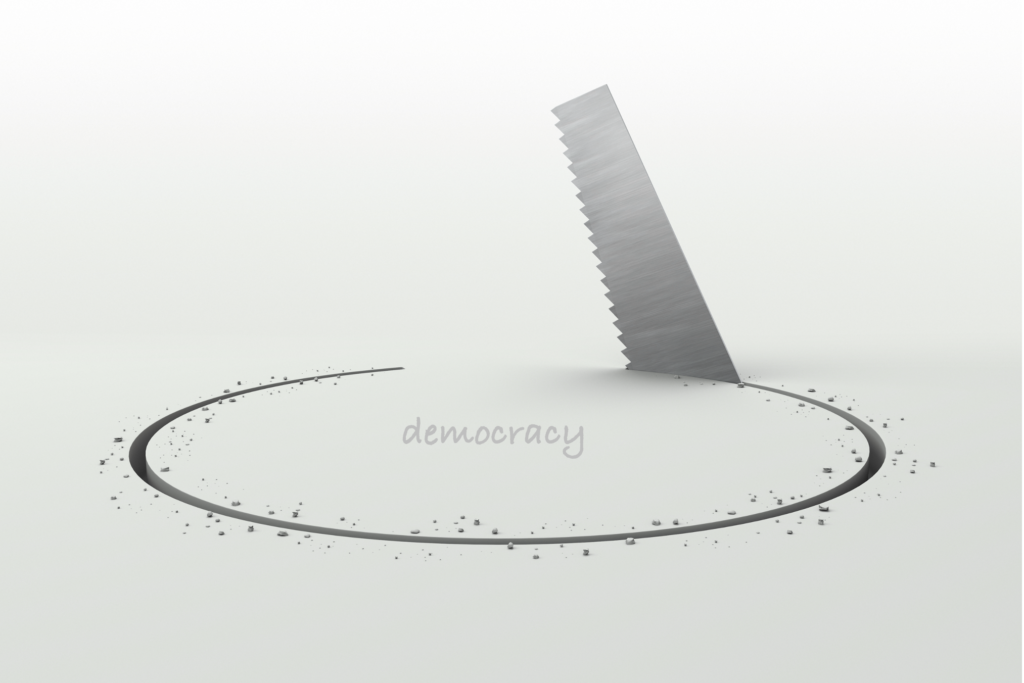

“Tax Day” was earlier this week but the debates, research, and advocacy that determine our taxes and how they are used take place every day of the year, some of which we recently highlighted here. Missouri lawmakers, for example, finished the day-to-day work of their legislative session (including enacting an Earned Income Tax Credit (EITC) and online sales tax fix) but did not finish the job of implementing the people’s election-day choice to expand Medicaid, so they will likely be back this summer for a special session. Meanwhile some lawmakers in Arizona and Iowa worked behind closed doors to avoid the light of day and finalize tax cut deals that will sap billions in funding from public priorities in their states. But brighter days could be ahead soon in Maine and Massachusetts, where leaders continue to push day-in and day-out for progressive enhancements to their tax codes.

Major State Tax Proposals and Developments

- Gov. Doug Ducey and Republican legislators in ARIZONA have reached a budget deal that includes implementing a 2.5 percent flat tax that would cost the state $1.5 billion a year. Roughly 53 percent of the tax cuts would go to the top 1 percent, while those in the bottom 80 percent would receive only 8 percent of the cut. As we noted here last week, the deal reflects a troubling nationwide trend and directly subverts the will of voters to tax rich households for education funding improvements. – MARCO GUZMAN

- IOWA lawmakers and Gov. Kim Reynolds have reached a deal on tax cuts and an end their overdue legislative session. The deal reduces funding for shared priorities by an estimated $1 billion over 8 years and could jeopardize the state’s federal Covid-19 relief aid. The tax changes include some helpful progressive elements, such as increasing standard deductions and eliminating the state’s deduction for federal income taxes, but these were needlessly combined with expensive benefits to high-income households such as cutting the top income tax rate and gradually eliminating the inheritance tax. The state will also stop reimbursing local jurisdictions for a state-imposed property tax cut from 2013, but will take over funding and administration of mental health services, which are currently handled at the county level and funded by local property taxes. – DYLAN GRUNDMAN O’NEILL.

- MISSOURI lawmakers finalized negotiations to create a state EITC, enforce sales taxes on online purchases, and cut the top income tax rate. They may have to return for a special session, however, as lawmakers and Gov. Mike Parson have violated the will of state voters, and possibly the Missouri Constitution, by not funding voter-approved Medicaid expansion and officially removing it from the state budget. – DYLAN GRUNDMAN O’NEILL

State Roundup

- The ALASKA Senate approved their version of the state budget this week; it includes a $2,300 Permanent Fund dividend.

- Several ARKANSAS gubernatorial candidates have vowed to eliminate the state income tax, which accounts for over a third of the state’s budget. The candidates have not provided details about their respective proposals or discussed strategies to offset the staggering revenue loss.

- The DISTRICT OF COLUMBIA held a hearing yesterday on a controversial bill that would impose a 1.5-cent-per-ounce tax on sugary beverages.

- GEORGIA Gov. Brian Kemp extended the suspension of the state sales tax on diesel and gas for another week following the Colonial Pipeline hack.

- A LOUISIANA bill to legalize and tax the sale of recreational marijuana died on a 47-48 vote; this is the furthest a marijuana legalization bill has ever advanced in the state.

- MAINE lawmakers and advocates continue to push for higher taxes on high-wage earners in the Pine Tree State. The Legislature’s Taxation Committee advanced a bill that would add a 3 percent surcharge on income over $200,000.

- MARYLAND Gov. Larry Hogan signed a bill legalizing sports betting on Tuesday; the industry is expected to generate $35 million a year in state tax revenue.

- Lawmakers and advocates in MASSACHUSETTS are making the case to follow the lead of a handful of other states and expand eligibility for the state’s Earned Income Tax Credit to include taxpayers who file with an individual tax identification number (ITIN). Details on the impact in the Bay State are available here.

- NEBRASKA legislators finalized tax cuts for Social Security and military retirement benefits, at a cost of about $100 million per year once fully phased in. A corporate tax cut bill that would add about $25 million to that cost, and mostly benefit rich households and residents of other states, appears close to passage as well.

- The NEVADA Supreme Court ruled that extending the sunset on a tax increase is tantamount to raising taxes, nullifying a law from 2019 that had extended a $100 million boost to the state’s Modified Business Tax (payroll tax).

- Prospects appear dim for a NEW YORK carbon tax proposal this session, but supporters are pleased with the momentum they built this year and optimistic about enacting the policy in the coming years.

- House Democrats in OKLAHOMA released their budget proposal, which includes eliminating sales tax on groceries.

- SOUTH CAROLINA lawmakers voted not to tax the first $10,200 of unemployment benefits for individuals making less than $150,000 a year.

What We’re Reading

- On Tax Day earlier this week, we summarized key State and Local Lessons from our own research.

- The off the charts blog celebrates states pursuing equity-focused tax policies.

- The TaxProf blog shares highlights from a Joint Economic Committee hearing on Examining the Racial Wealth Gap in the United States (video here), including testimony from leading experts Mehrsa Baradaran (UC-Irvine), Dorothy A. Brown (Emory University), and Darrick Hamilton (The New School).

- A recent report from the Economic Policy Institute lays out in powerful detail how individual and collective bargaining power for workers are crucial to fighting economic inequality.

- Governing reports on Urban Institute data showing tax revenues in 29 states have clawed back to where they were before the Covid-19 pandemic began, noting, however, that this does not mean revenues have kept up with population, inflation, and caseload growth. Route Fifty notes that state Rainy Day Funds are in better shape than many expected early in the pandemic.

- Route Fifty also reports that billions in federal funding will soon be available to help local libraries bridge the digital divide in their communities.

- A progressive coalition in FLORIDA released the “People’s Budget Florida” on Tax Day to call for more equitable tax policy and censure the legislature’s focus on expanding corporate tax breaks.

- NEVADA youth leader Aimee Tram explains in the Nevada Current how raising the state mining tax (which is heading to a public vote) connects to fighting systemic racism in schools.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Meg Wiehe at [email protected]. Click here to sign up to receive the Rundown via email.