The hottest, stickiest month of the year has left a grimy feeling on several state tax debates, as Idaho lawmakers find themselves unable to fund the state’s priorities after years of cutting taxes, Alaskans express their support for public investments to their governor’s polling office and then watch the governor slash them anyway, New Jersey lawmakers go to bat for ineffective and corrupt business tax subsidies, and residents of North Carolina watch their representatives pursue cheap political points over sound investments and thoughtful policy. Nonetheless, residents and advocates on the other side of these and other debates have fought long and hard for better policy choices, and will undoubtedly continue to do so.

— MEG WIEHE, ITEP Deputy Director, @megwiehe

Major State Tax Proposals and Developments

- NORTH CAROLINA legislators are advancing a politically motivated proposal to send out checks to state residents, regardless of their income or need (and in fact according to an ITEP analysis 1/3 of taxpayers would not receive the check, mostly low- and fixed-income households). NC Budget and Tax Center explains how these refunds would fail to address the state’s upside-down tax code or address other needs such as school construction, recession preparation, and rebuilding from hurricane damage.

- Tax cuts are catching up to lawmakers in IDAHO, who just had to adjust their revenue projections downwards by over $100 million. In addition to government agencies being required to limit their supplemental requests to emergencies only, talk of repealing the state’s grocery tax has been sidelined until 2020. — LISA CHRISTENSEN GEE

- NEW JERSEY Gov. Phil Murphy recently vetoed the legislature’s attempt to temporarily extend the state’s business tax subsidy program, which had been revealed to be inefficient and corrupt. Advocates are calling for major reforms to the program, as is Murphy, whose veto lays out his recommended path forward. Lawmakers may attempt to override the veto. Murphy also vetoed a bill to increase parking fee and fine collections, arguing the legislature should enact his proposed millionaires’ tax instead. — DYLAN GRUNDMAN

State Roundup

- The first 6 cents of ALABAMA’s 10-cent gas tax increase goes into effect on September 1, a needed update (the state’s first since 1992) that will raise about $192 million for transportation infrastructure in the first year and $320 million per year once fully phased in.

- ALASKA Gov. Mike Dunleavy, who just balanced the state’s budget strictly through funding cuts to valued services rather than considering tax increases to reduce those cuts, has now revealed that he did so despite polling from his own office showing overall support among Alaskans for raising taxes to support such shared priorities. Meanwhile, a citizens’ group is organizing now to raise around $1 billion annually through taxes on the oil industry.

- Some in ARIZONA are attempting to pass an initiative that would completely exempt everyone over age 65 from paying property taxes, which would be a very poorly targeted and increasingly expensive policy if adopted.

- A CALIFORNIA lawmaker will have to try again to allow voters to make it easier for local governments to raise taxes or approve bonds for infrastructure projects as her bill to lower the voter approval threshold from two-thirds to 55 percent failed to advance in the Assembly.

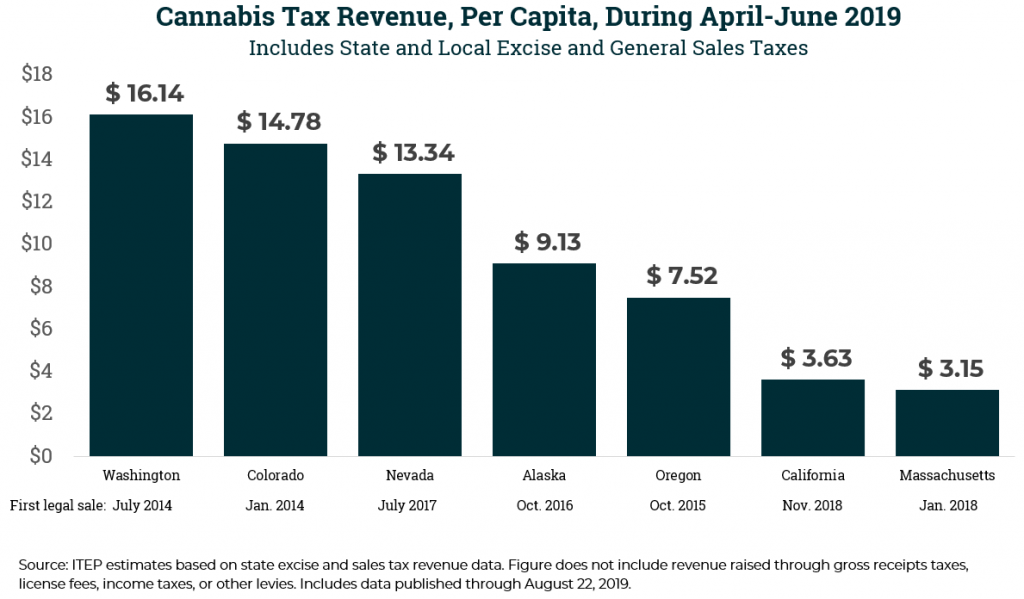

- CALIFORNIA’s cannabis revenue performance has been a hot topic issue this past week. Here’s ITEP’s take on what’s behind the numbers.

- COLORADO is courting an undisclosed bioscience company, hoping to lure the company to create a campus in Boulder with $25 million in tax incentives.

- Word on the street is that Chicago Mayor Lori Lightfoot will be seeking authority from the ILLINOIS state legislature later this fall to tax high-end professional services and levy a higher transfer tax on properties over $1 million rather than increase the city’s property tax levy.

- A MICHIGAN senator is back with a proposal to eliminate the state’s income tax, a proposal that he has also sponsored previously while a representative.

- MISSOURI’s Department of Revenue is so backlogged they have yet to review or pay tax refunds for around 20,000 Missourians who filed their income taxes before tax day in April, costing the state hundreds of thousands of dollars in interest.

- NEVADA becomes the latest state to experiment with replacing or supplementing gas taxes and other transportation revenues with a “miles traveled” tax. A pilot program to collect data to help inform whether the state will move in this direction is beginning this fall.

- OKLAHOMA Gov. Kevin Stitt told business leaders recently that he’s interested in exploring options that would allow local governments to raise more money for schools—such as raising property taxes–without it impacting the amount of funding localities are receiving from the state’s funding formula.

- A PENNSYLVANIA lawmaker is proposing that the state tax retirement income and levy its sales tax on food and clothing in order to eliminate school property taxes.

- The Sturgis Motorcycle Rally, held every year in SOUTH DAKOTA, raised an estimated $1.3 million this year in tourism taxes and sales taxes on temporary vendors.

- Talk of tax reform in UTAH has seemingly tempered as the vision of what might be accomplished has shifted from more substantial reforms of the sales tax to proposals such as taxing groceries at the full general sales tax rate. Recent polls indicate a lack of general voter support for other efforts such as overhauling the tax system and even lower support for removing the constitutional mandate that earmarks income tax revenue for education.

- VIRGINIA’s new additional regional gas tax enacted this year to fund improvements to Interstate 81 is getting push-back from counties that are in the region but not directly in the path of the highway.

- Tacoma, WASHINGTON, is looking at a gun and ammunition tax similar to one already in effect in Seattle.

What We’re Reading

- Binyamin Applebaum writes in the New York Times that we made a major mistake by relying so much on economists and orthodox economics to set our policy course and, in many ways, be our moral compass as well. “Why,” he asks, did we ever “listen to the people who thought we needed ‘more millionaires and more bankrupts?’.”

- Governing has a major new report out on local governments turning increasingly to punitive and regressive fines and fees to finance their activities, largely because state-imposed policies and funding cuts give them no choice.

- Amid concerns that the country is plunging into a national recession, Stateline explains how state-level recessions are different beasts, and that some states may already be in recession.

- Stateline also covers trends in states regulating and taxing electronic cigarettes and other vaping products.

- The Center on Budget and Policy Priorities (CBPP) writes in a blog and full report that states can and should adopt inclusive policies toward immigrants. Such policies can promote racial equity, fairness in pay, more educated workforces, and generate revenue for shared priorities.

- CBPP also reports that state investments in school facilities and equipment have declined and represent another area where improved policy can yield many positive results.

- Governing covers a recent trend of states considering an old but seldom implemented idea of “land value taxes” rather than traditional property taxes.

- The Denver Post explores if COLORADO is missing out by not having a permanent mineral trust fund?

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Meg Wiehe at [email protected]. Click here to sign up to receive the Rundown via email.