The Census Bureau released data in September showing that the share of Americans living in poverty remains high. In 2013, the national poverty rate was 14.5 percent, a slight drop from last years’ rate of 15 percent and the first decline since 2006.1 However, the poverty rate remains 2.0 percentage points higher than it was in 2007, before the Great Recession, indicating that recent economic gains have not yet reached all households and that there is much room for improvement. The 2013 measure translates to more than 46.7 million – more than 1 in 7 – Americans living in poverty. Most state poverty rates held steady; three states experienced an increase in the number or share of residents living in poverty, while only two states saw a decline.2

The Census Bureau released data in September showing that the share of Americans living in poverty remains high. In 2013, the national poverty rate was 14.5 percent, a slight drop from last years’ rate of 15 percent and the first decline since 2006.1 However, the poverty rate remains 2.0 percentage points higher than it was in 2007, before the Great Recession, indicating that recent economic gains have not yet reached all households and that there is much room for improvement. The 2013 measure translates to more than 46.7 million – more than 1 in 7 – Americans living in poverty. Most state poverty rates held steady; three states experienced an increase in the number or share of residents living in poverty, while only two states saw a decline.2

Astonishingly, tax policies in virtually every state make this problem worse rather than better. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers. Despite the unlevel playing field states create for their poorest residents through existing policies, many state policymakers have recently proposed (and in some cases enacted) tax increases on the poor under the guise of “tax reform,” often to finance tax cuts for their wealthiest residents and profitable corporations.

State and local tax systems typically make things harder for families living in poverty. A 2013 ITEP report, Who Pays? A Distributional Analysis of the Tax Systems in All 50 States, found that the poorest twenty percent of Americans paid on average 11.1 percent of their incomes in state and local taxes. Middle-income taxpayers didn’t fare much better, paying an average of 9.4 percent of their incomes toward those taxes.

But when it comes to the wealthiest one percent, ITEP found they paid an average of just 5.6 percent of their incomes in state and local taxes.

The fact is that nearly every state and local tax system takes a much greater share of income from middle- and low-income families than from the wealthy. This “soak the poor” strategy pushes low-income families further into poverty and increases the likelihood that they will need to rely on safety net programs. From a state budgeting perspective, this strategy also doesn’t yield much revenue compared to modest taxes on the rich.

There is a better approach. Just as state and local tax policies can push individuals and families further into poverty, there are tax policy tools available that can help them move out of poverty. In most states, a true remedy for state tax unfairness would require comprehensive tax reform. Short of this, lawmakers should use their states’ tax systems as a means of providing affordable, effective and targeted assistance to people living in or close to poverty in their states.

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2014, and offers recommendations that every state should consider to help families rise out of poverty. States can jump-start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

STATE TAX STRATEGIES FOR REDUCING POVERTY

Refundable Earned Income Tax Credits

The federal Earned Income Tax Credit (EITC) is widely recognized as an effective anti-poverty strategy. It was introduced in 1975 to provide targeted tax reductions to low-income workers and also to reward work and increase incomes.

The federal EITC is administered through the personal income tax. To encourage greater participation in the workforce, the EITC is based on earned income, such as salaries and wages. For example, for each dollar earned up to $13,650in 2014, families with three children will receive a tax credit equal to 45 percent of those earnings, up to a maximum credit of $6,143. Because the credit is designed to provide tax relief to the working poor, there are income limits that restrict eligibility for the credit. Families continue to be eligible for the maximum credit until income reaches $17,830 (or $23,260 for married-couple families). Above this income level, the value of the credit is gradually reduced to zero and is unavailable when family income exceeds the maximum eligibility level. The credit is entirely unavailable to families with three or more children earning more than $46,997 if the head of household is single and $52,427 if married. For taxpayers without children, the credit is less generous: the maximum credit is $496 and singles earning more than $14,590 (or $20,020 for married couples without children) are ineligible.

| FIRST STEPS TAKEN TO EXPAND THE EITC FOR CHILDLESS WORKERS

Washington, DC’s expansion of the EITC for childless workers, implemented as part of a larger tax reform package in 2014, is a model for other states seeking to alleviate poverty for this often overlooked population. In May, the DC Council voted to follow the recommendations of a nonpartisan tax commission and expanded the DC EITC for households without children in three ways. First, they increased the maximum credit by allowing childless workers to claim 100% of their federal EITC (rather than 40%). Second, they increased the phase-out range making the maximum credit available to more taxpayers. And, the increased the income eligibility for the credit in a way that more childless workers will benefit from DC’s credit than the federal version . The DC Fiscal Policy Institute estimates that “A worker earning $18,000 would go from owing $533 in income taxes to receiving a refund of $102, almost entirely as a result of the expanded EITC.” The changes will become law on January 1, 2015. |

The Census Bureau estimated almost three million children were lifted out of poverty in 2012 thanks to the federal EITC.

Twenty-five states and the District of Columbia (DC) offer state Earned Income Tax Credits based on the federal EITC. Calculating a state EITC as a percentage of the federal credit makes the credit easier for state taxpayers to claim (since they have already calculated the amount of their federal credit) and easier for state tax administrators to monitor. However, states vary dramatically in the generosity of their credits. The credit provided by the District of Columbia amounts to 40 percent of the federal credit, while seven states will have credits worth less than 10 percent of the federal credit in 2014. In 2013, North Carolina became the first state to allow their EITC.

Refundability is especially important in ensuring that deserving families get the full benefit of the state EITC. Refundable credits do not depend on the amount of income taxes paid: if the credit amount exceeds your income tax liability, the excess amount is given as a refund. Thus, refundable credits are useful in offsetting the regressive nature of sales and property taxes, and can provide a much needed income boost to help families pay for basic necessities. In 2014, all but five states (Delaware, Ohio, Maine, Rhode Island and Virginia), the EITC is fully refundable (Rhode Island will convert to a fully refundable 10 percent EITC in 2015).

State EITCs generate bipartisan support because they are easily administered and relatively inexpensive. However, EITCs are most generous to families with children. Policymakers should be aware that the EITC does little to benefit seniors and low-income individuals without children because it was designed to specifically help families with children. There are other tax provisions offered by states, like enhanced personal exemptions or standard deductions, that are available to elderly taxpayers. The EITC itself can also be modified to reach otherwise excluded groups. For example, policymakers in Washington, DC recently enhanced the district’s EITC for childless workers (see text box on page X for more about DC’s EITC expansion). In his most recent budget, President Obama proposed a similar policy at the federal level, and there are now multiple bills pending in Congress to implement such a change. These recent developments reinforce the importance of linking state EITC eligibility rules to the federal program, so that any federal expansions are immediately passed on to the states.

For more information on the impact a new or enhanced state EITC see ITEP’s report, Improving Tax Fairness with a State Earned Income Tax Credit, which includes data on an array of EITC options in all 50 states and DC.

| NOT ALL EITC EXPANSIONS ARE CREATED EQUAL

This year, Ohio Gov. John Kasich signed his most recent tax cut bill at a food bank touting tax cuts for low-income taxpayers. Yet, the $400 million tax cut package the Governor championed actually did very little to help families who rely on services provided by food banks. Included in the bill were across the board income tax rate reductions and an increase in the state’s “pass through” business income deduction. An ITEP analysis of the bill found that the top 1 percent of Ohioans will get a tax cut for the year averaging $1,846, while the poorest fifth of Ohioans will see just a $4 reduction. Presumably what prompted the Governor to sign the legislation at a food bank was the provision in the bill that expanded the state’s limited and non-refundable EITC from 5 to 10 percent of the federal credit. Ohio is just one of four states that offers a non-refundable EITC, meaning that it can only reduce income tax liability and not be put toward offsetting regressive sales, excise and property taxes. Because of Ohio’s very limited EITC, the expansion isn’t very meaningful for low income families. In fact, only 3 percent of Ohio’s poorest workers will actually benefit. Advocates should be aware that sometimes simply expanding low income tax credits isn’t enough to help working families get out of poverty. |

2014 EITC Developments in the States

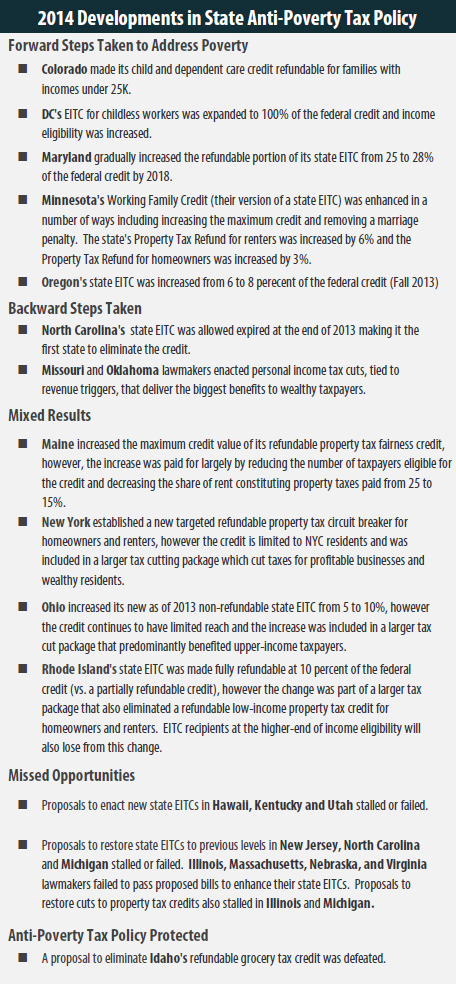

• The DC City Council expanded the District’s EITC for childless workers who will receive 100% of the federal credit starting in 2015. Income eligibility was also increased with childless taxpayers earning up to 200% of poverty receiving some benefit.

• Maryland lawmakers gradually increased the refundable portion of their state EITC from 25 to 28% of the federal credit by 2018.

• Minnesota lawmakers enacted several improvements to Minnesota’s Working Family Credit (WFC), the state’s version of an EITC. The credit for most claimants was increased by raising the percentage of income used to calculate the credit. The bill also removed the existing two-tier calculation for taxpayers with children, allowing the first tier calculation to extend to higher income levels. The improvements in the bill will increase the income level at which the credit begins to phase out for married filers in tax years 2013-2017, reducing the marriage penalty. The maximum credit was also increased.

• North Carolina experienced the biggest defeat to this proven tax policy. Lawmakers also allowed the credit to expire at the end of 2013 despite passing a significant and regressive tax overhaul which increases taxes on low-income families and cuts them for wealthy households and profitable corporations.

• Ohio increased its new as of 2013 non-refundable state EITC from 5 to 10%, however the credit continues to have limited reach and the increase was included in a larger tax cut package that predominantly benefited upper-income taxpayers (see the Ohio text box on page x).

• Oregon lawmakers extended and increased their state EITC from 6 to 8 percent in the fall of 2013.

• Rhode Island’s state EITC was made fully refundable at 10 percent of the federal credit (vs. a partially refundable credit), however the change was part of a larger tax package that also eliminated a refundable low-income property tax credit for homeowners and renters. EITC recipients at the higher-end of income eligibility will also lose from this change.

• Proposals to enact new state EITCs in Hawaii, Kentucky, and Utah advanced but either stalled or failed to win enough lawmaker support.

• Proposals to restore state EITCs to previous levels in New Jersey, North Carolina, and Michigan stalled or failed. Illinois, Massachusetts, Nebraska, and Virginia lawmakers failed to pass proposed bills to enhance their state EITCs.

Recommendation: To help alleviate poverty, lawmakers and advocates in states with EITCs should consider increasing the percentage of the existing credit and making the credits fully refundable. Those in states without a credit should consider introducing a generous and refundable EITC.

| STATES WITH THE GREATEST NEED FOR IMPROVEMENT

Every state could stand to improve its tax policies toward low- and moderate-income families. However, some states have a stronger need to consider the reforms outlined in this report. The chart to the right shows the 15 states with the highest state and local taxes on the poor as a share of income. Washington State, which does not have an income tax, is the highest-tax state in the country for poor people. In fact, when all state and local sales, excise and property taxes are tallied up, Washington’s poor families pay 16.9 percent of their total income in state and local taxes. Compare that to neighboring Idaho and Oregon, where the poor pay 8.2 percent and 8.3 percent, respectively, of their incomes in state and local taxes — far less than in Washington. Illinois, which relies heavily on consumption taxes, ranks second in its taxes on the poor, at 13.8 percent. Florida— a no-income-tax state —taxes its poor families at a rate of 13.3 percent, ranking third in this dubious distinction. |

Property Tax Circuit Breaker for Homeowners & Renters

States employ a wide variety of mechanisms to reduce the amount of property taxes that low- and moderate-income families pay, though they vary significantly in effectiveness. A property tax circuit breaker is the only property tax reduction program explicitly designed to reduce the property tax burden on those low-income taxpayers hit hardest by the tax. Its name reflects its design: circuit breakers protect low-income residents from a property tax “overload”, just like electric circuit breakers prevent electricity surges in our homes. When a property tax bill exceeds a certain percentage of a taxpayer’s income, the circuit breaker offsets property taxes in excess of this “overload” level.

In 2014, 17 states and DC offer property tax circuit breaker programs that target tax reductions to low-income families who also owe significant property taxes relative to their incomes. Another 13 states provide property tax credits to some low-income families; however, the credits in those states are only based on income—theses credits cut-off eligibility based on income, but do not include a provision requiring property taxes to exceed a set percentage of income to qualify for the credit.

The most effective and targeted property tax credits are circuit breaker programs made available to all low-income taxpayers, regardless of age, and are also extended to renters. Because it is generally understood that renters pay property taxes indirectly in the form of higher rents, many states now extend their circuit breaker credit to renters as well. The calculation is typically the same as the one used for homeowners, with the exception that renters must assume that their property tax bill is equal to some percentage of their rent. Renters in Maryland for instance, use 15 percent of their rent as their assumed property tax in calculating their circuit breaker credit. For a circuit breaker program to be successful, an effective outreach campaign is necessary.

2014 State Property Tax Circuit Breaker Developments

• Maine lawmakers increased the maximum credit value of its refundable property tax fairness credit, however, the increase was paid for largely by reducing the number of taxpayers eligible for the credit and decreasing the share of rent constituting property taxes paid from 25 to 15%.

• Minnesota lawmakers increased the benefit of the state’s Property Tax Refund for low- and moderate-income homeowners and renters. The renter refund was increased by 6 percent and the homeowners refund was increased by 3 percent.

• New York established a new targeted refundable property tax circuit breaker for homeowners and renters, however the credit is limited to NYC residents and was included in a larger tax cutting package which cut taxes for profitable businesses and wealthy residents.

• Proposals to restore cuts to targeted property tax credits stalled in Illinois and Michigan.

Recommendation: State lawmakers and advocates interested in reducing the property taxes paid by low-income homeowners and renters should consider introducing a robust circuit breaker program. States with circuit breaker programs only available to older adults or homeowners should consider expanding the program to low-income homeowners and renters of all ages.

Targeted Low-Income Tax Credits

Because the Earned Income Tax Credit is targeted to low-income working families with children, it typically offers little or no benefits to older adults and adults without children. Thus, refundable low-income credits are a good complementary policy to state EITCs.

Ten states offer targeted income tax credits to reduce (or zero out) low income families’ personal income tax contributions. For example, Ohio offers a nonrefundable credit that ensures that families with incomes less than $10,000 aren’t subject to the income tax. Kentucky offers a nonrefundable credit based on family size to ensure that families at or below the poverty level aren’t subject to state income taxes. Making these targeted low-income credits refundable would increase their effectiveness for low income families.

Six states offer an income tax credit to help offset the sales and excise taxes that low-income families pay. Some of the credits are specifically intended to offset the impact of sales taxes on groceries. These credits are normally a flat dollar amount for each family member, and are available only to taxpayers with income below a certain threshold. They are usually administered on state income tax forms, and are refundable— meaning that the full credit is given even if it exceeds the amount of income tax a claimant owes.

Refundability is crucial because it allows low-income credits to be used by taxpayers who have little or no income tax liability but pay a substantial amount of their income in sales taxes. For example, Idaho offers a refundable credit for each Idahoan and their dependents to offset grocery taxes even if taxpayers aren’t subject to the income tax. Kansas lawmakers eliminated their state’s refundable grocery tax credit in 2012 but enacted a new, less-effective nonrefundable credit in 2013.

| IMPORTANCE OF REFUNDABILITY

The hallmark of a truly effective low-income credit is that it is refundable. This means that if the amount of the credit exceeds the amount of personal income tax you would otherwise owe, you actually get money back. Refundability is a vital feature in low-income credits because for most fixed-income families, sales and property taxes take a much bigger bite out of their wallets than the personal income tax does. Refundable credits on income tax forms are the most cost-effective mechanism for partially offsetting the effects of regressive consumption taxes on low-income families. |

2014 State Low-Income Tax Credit Developments

There were no significant changes made to state low-income tax credits in 2014. A proposal to enact a nonrefundable tax credit fully eliminating personal income taxes for families living in poverty (and cutting them in half for those between 100 and 125 percent of poverty) failed to pass the Hawaii legislature. A bill that would have eliminated Idaho’s refundable grocery tax credit to pay for corporate and personal income rate reductions also failed.

Recommendation: State lawmakers and advocates committed to making sure taxes don’t push families further into poverty should create refundable, targeted low income credits especially to help offset regressive sales and excise taxes. In states where these credits already exist, lawmakers should act to enhance them, such as by making them refundable.

Child-Related Tax Credits

Child Tax Credits: Federal income tax law allows taxpayers to claim a $1,000 income tax credit for each dependent child under 17 years of age. The credit amount is gradually phased out for high income families. A portion of the child tax credit is refundable for low-income families.

Four states currently offer a much smaller version of the child tax credit for qualifying families (Colorado will join this list contingent on Congress passing a law to allow states to force out-of-state online retailers to collect and remit sales taxes). These per-child credits are an important anti-poverty strategy, especially if they are refundable and limited by income. The credits are offered beyond the extra dependent exemptions or exemption credits that most states offer families. For example, New York offers a $100 refundable child tax credit for qualifying families.

Child and Dependent Care Credits: Low and middle-income working parents increasingly spend a significant portion of their income on child care. The federal government allows a nonrefundable income tax credit to help offset child care expenses. In 2014, single working parents (and two-earner married couples) with children less than 12 years of age can claim a credit to partially offset up to $6,000 of child care expenses; low-income taxpayers can receive a credit of up to 35 percent of these expenses. The credit percentage gradually falls for higher-income taxpayers. This “sliding scale” approach helps to target tax relief somewhat more effectively to low-income taxpayers, but making the credit refundable would help those parents and children most in need.

The majority of the 23 states (including DC) that offer a credit for child care expenses model their state credit on the federal credit. For example, Georgia allows taxpayers to take 30 percent of their federal child and dependent care credit as their Georgia nonrefundable child care credit. Nebraska takes a slightly different approach, offering both a refundable and a nonrefundable credit depending on a family’s income. The Nebraska refundable child care credit is calculated as 100 percent of the federal credit for low income filers. Higher earners can claim a nonrefundable credit equal to 25 percent of the federal credit. This approach targets the benefits of the Nebraska credit much more efficiently to low- and middle-income parents than does the federal credit. Policymakers should note that these credits do nothing to support families without children or seniors who live in poverty.

2014 Child-Related Tax Credit Developments

• Colorado lawmakers made the state’s child and dependent care credit refundable for families with incomes under $25,000.

• North Carolina’s Child Tax credit will increase to $125 per child for families with incomes under $40,000 (included in 2013 tax legislation).

Recommendation: State lawmakers and advocates who want to help low-income families with children should consider increasing the value of existing child credits, making them refundable, or introducing a new refundable per child credit. Lawmakers and advocates interested in targeting child and dependent care credits to help families most in need would do well to make their credits refundable and make the credit available only to families with limited incomes.

| STATES PRAISED AS “LOW-TAX” STATES ARE OFTEN HIGH TAX STATES FOR FAMILIES LIVING IN POVERTY

Annual state and local data from the Census Bureau is often used to rank states as “low” or “high” tax states based on taxes collected as a share of state personal income. But focusing on a state’s overall tax revenues overlooks the fact that taxpayers experience tax systems very differently. In particular, the poorest 20 percent of taxpayers pay a greater share of their income in state and local taxes than any other income group in all but 10 states (including DC). And, in every state, low- and moderate-income taxpayers pay more as a share of income than the wealthiest top 1 percent of taxpayers. No income-tax states like Washington, Texas and Florida do, in fact, have average to low taxes overall. But, can they also be considered “low-tax” states for poor families? Far from it. In fact, these states’ disproportionate reliance on sales and excise taxes make their taxes among the highest in the entire nation on low-income families. The bottom line is that many so-called “low-tax” states are high-tax states for the poor, and most do not offer a good deal to middle-income families either. Only the wealthy in such states pay relatively little. |

IMPLEMENTATION: A VITAL STEP

Offering the tax policies described in this report is a necessary step to helping lift families out of poverty, but simply offering these credits is not sufficient. In order to ensure that as many eligible families benefit from these anti-poverty policies as possible, lawmakers should consider how to make the credits more accessible. A simple design, such as linking a credit to an already established credit (as is the case with state EITCs) is a good place to start. Allowing taxpayers to claim credits on their personal income tax forms (as opposed to filling out a separate form or application at a different time of the year) also increases the likelihood that eligible taxpayers will take advantage of the credits.

Furthermore, policymakers, advocacy groups, and the media must work together to ensure that an effective outreach program is established and adequately funded so that taxpayers are informed about these credits. Outreach programs should be frequently evaluated to improve the effective reach of the tax credits offered.

| WHICH STATES GET IT (CLOSE TO) RIGHT?

The most noticeable features of the least regressive tax states are a highly progressive income tax including targeted tax credits and a lesser reliance on sales and excise taxes. For example: • Vermont’s tax system is among the least regressive in the nation because it has a highly progressive income tax and low sales and excise taxes. Vermont’s tax system is also made more fair by the size of the state’s refundable Earned Income Tax Credit (EITC)— 32 percent of the federal credit— and a generous property tax circuit breaker credit. • Delaware’s income tax is not very progressive, but its high reliance on income taxes and low dependence of consumption taxes results in a tax system that is only slightly regressive overall. Similarly, Oregon has a high reliance on income taxes and very low use of consumption taxes. Both states also offer a state EITC. • New York and the District of Columbia each achieve a close-to-flat tax system overall through the use of generous refundable EITC’s and an income tax with relatively high top rates and limits on tax breaks for upper-income taxpayers. A recent tax reform bill in DC lowered the income tax rate for middle-income earners, increased the standard deduction and personal exemption allowed, and expanded the EITC for childless workers. New York also provides a refundable Child Tax Credit based on the federal program, and both states provide property tax circuit breaker credits. It should be noted that even the least regressive states generally fail to meet what most would consider minimal standards of tax fairness. In each of these states, at least some low- or middle-income groups pay more of their income in state and local taxes than the wealthiest families must pay. |

SUMMARY OF RECOMMENDATIONS

• State lawmakers and advocates in states with EITCs should consider increasing the percentage of the existing credit and making the credits fully refundable. Those in states without a credit should consider introducing a generous and refundable EITC.

• State lawmakers and advocates interested in reducing the property taxes paid by low-income homeowners and renters should consider introducing a robust circuit-breaker program. States with circuit breaker programs only available to older adults or homeowners should consider expanding the program to low-income homeowners and renters of all ages.

• State lawmakers and advocates committed to making sure taxes don’t push families further into poverty should create refundable, targeted low-income credits especially to help offset regressive sales and excise taxes. In states where these credits already exist, lawmakers should act to enhance them, such as by making them refundable.

• State lawmakers and advocates who want to help low-income families with children should consider increasing the value of existing child credits, making them refundable, or introducing a new refundable per child credit. Lawmakers and advocates interested in targeting child and dependent care credits to help families most in need would do well to make their credits refundable and make the credit available only to families with limited incomes.

CONCLUSION

American families living in poverty are in crisis, and many state tax systems across the country do too little to offer the assistance low-income families need. In fact, regressive state tax structures can push families deeper into poverty. State lawmakers have a responsibility to ensure that their state’s tax code does not exacerbate this crisis and should consider using the low-income tax credits outlined in this paper as a means of mitigating poverty in their states. Refundable tax credits are effective and time-tested anti-poverty solutions that would also provide additional income to help families pay for food, housing, transportation and other necessities. The reforms discussed in this paper are among the most cost-effective anti-poverty strategies available to state lawmakers.