Supply-Side Economics

The Immediate Economic Impact of the Tax Cuts and Jobs Act Could be Even Less Than Expected

July 11, 2018 • By Richard Phillips

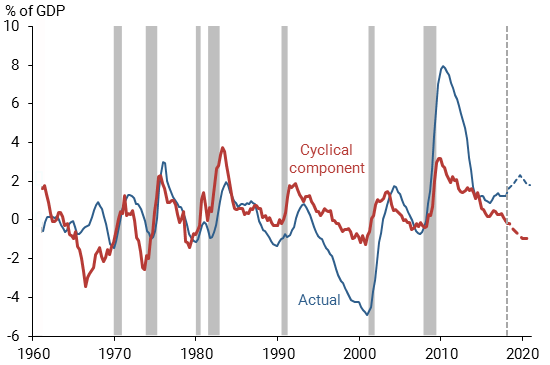

Now, new research from the Federal Reserve Bank of San Francisco finds that the Tax Cuts and Jobs Act may not be so much of a stimulus after all. In other words, lawmakers have left themselves with few options should the country face an economic recession, and the country may not receive a substantive economic benefit in the short term.

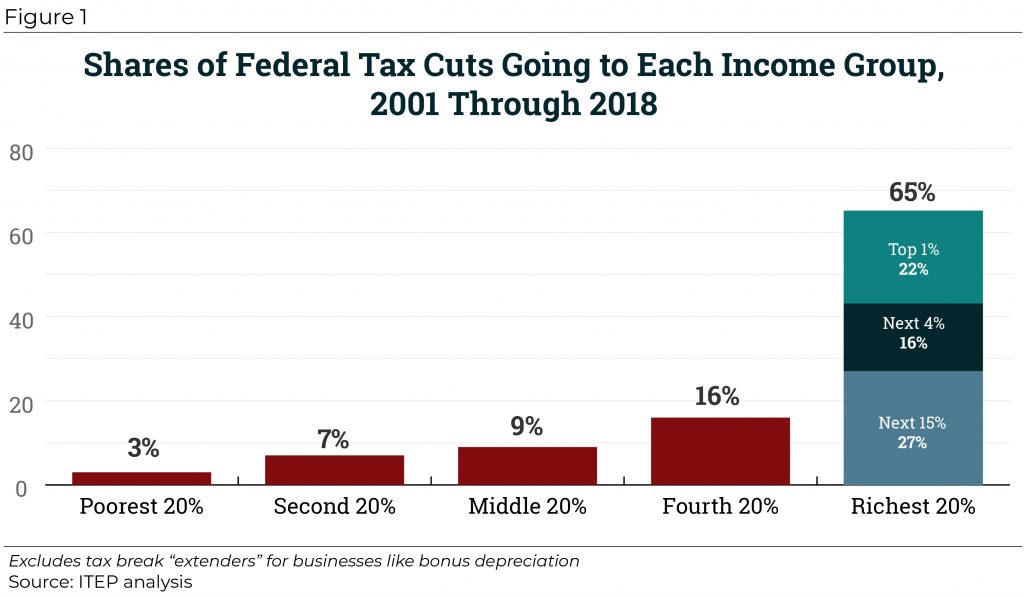

Since 2000, tax cuts have reduced federal revenue by trillions of dollars and disproportionately benefited well-off households. From 2001 through 2018, significant federal tax changes have reduced revenue by $5.1 trillion, with nearly two-thirds of that flowing to the richest fifth of Americans.

Rigging the System and Poor Shaming (Rightly) Are Incompatible Political Strategies

June 27, 2018 • By Jenice Robinson

The absurdity of blaming poor and moderate-income people for their circumstances is close to running its course as an effective political tool, particularly as some elected officials more boldly assert their intent to cater to the whims of the wealthy. Take last year’s GOP-led drive to eliminate the Affordable Care Act (ACA), for example. House […]

Gov. Sam Brownback’s tax experiment in Kansas was a failure. His radical tax cuts for the rich eventually had to be partly paid for through tax hikes on low- and middle-income families and also failed to deliver on promises of economic growth. Meanwhile, the tax cuts decimated the state’s budget, diminished its credit rating, and compromised its ability to meet the state’s constitutional standard of adequacy for public education.

In recent months, the Tax Foundation has used its Taxes and Growth Model (TAG Model) to estimate the impact that a variety of tax policy changes would have on the nation's economy--including tax plans proposed by current presidential candidates. The Tax Foundation describes the underlying "logic" of its TAG Model as being rooted in the assumption that "taxes have a major impact on economic growth." More specifically, the TAG Model has concluded that proposals to lower taxes for high-income individuals and businesses would dramatically grow the economy, and that proposals to raise taxes would significantly slow economic growth.