Corporate Taxes

Live Nation Entertainment Says Trump Tax Law Drove its 2025 Federal Income Tax Bill to Zero

February 20, 2026 • By Matthew Gardner

The company paid zero federal income tax in 2025 despite reporting $145 million of U.S. profits.

Trump Administration Provides Biggest Illegal Tax Cuts Yet for Billion-Dollar Corporations

February 20, 2026 • By Amy Hanauer

The Treasury Department is unilaterally cutting corporate taxes with regulations that ignore the statute they claim to implement, disregarding the separation of powers between the branches of government that has defined how America works for more than two centuries.

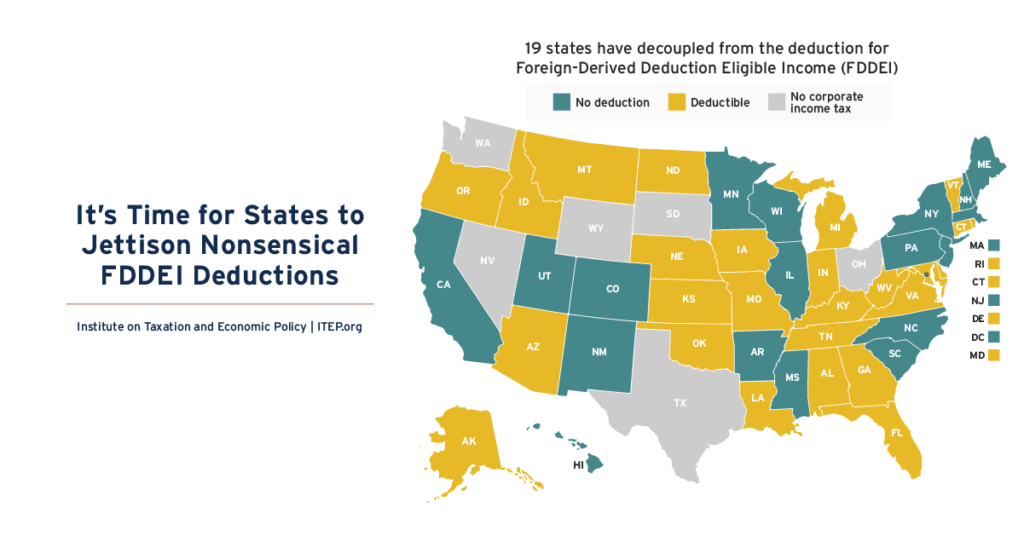

It’s Time for States to Jettison Nonsensical FDDEI Deductions

February 19, 2026 • By Carl Davis

States often link their tax laws to the federal code in significant ways. Many of these links are justified and can simplify tax administration for both taxpayers and state officials. But in other cases, something can get lost in translation, and states end up copying federal provisions that just don’t make sense at the state […]

Palantir Pays Zero Federal Income Tax Despite Explosive Growth, Largely Due to Trump Tax Law

February 17, 2026 • By Matthew Gardner

Palantir reported $1.5 billion of U.S. income but paid exactly zero federal income tax in 2025. Despite explosive growth, tax breaks from the Trump tax law helped Palantir avoid paying even a dime of federal income tax on its earnings.

Michigan Ballot Proposal Would Boost Public Education While Creating a Fairer Tax System

February 17, 2026 • By Miles Trinidad, Matthew Gardner

A new proposal in Michigan would create a 5-percentage point surcharge on top earners with taxable incomes over $1 million for joint filers and $500,000 for single filers. This would raise about $1.7 billion a year, which would be used for public education priorities.

NCTI is an Important Part of the Federal Corporate Tax. States Should Adopt It Too.

February 12, 2026 • By Carl Davis

Including NCTI in state corporate tax law is an effective way to neutralize much of the tax avoidance that occurs when multinational companies artificially shift their profits into overseas tax havens.

State Rundown 2/11: This Valentine’s Day, Conscious Decoupling Is Our Love Language

February 11, 2026 • By ITEP Staff

While some may be excited for a romantic Valentine’s Day this weekend, many state lawmakers are breaking up and decoupling from recent federal tax changes that are poised to leave states with revenue shortfalls – much like a bad date who forgets their wallet and asks you to pick up the tab.

Trump Undermined the Constitution to Give Corporations a $10 Billion Tax Cut

February 10, 2026 • By Matthew Gardner

This unilateral corporate tax cut from the Trump administration will cost $10 billion over a decade unless it is reversed.

What Did 2025 State Tax Changes Mean for Racial and Economic Equity?

February 9, 2026 • By Brakeyshia Samms

The results are a mixed bag, with some states enacting promising policies that will improve tax equity and others going in the opposite direction.

Four Big Tech Companies Avoid $51 Billion in Taxes in Wake of One Big Beautiful Bill Act

February 6, 2026 • By Matthew Gardner

Four of the corporations whose CEOs flanked President Trump at his 2025 inauguration ceremony have now disclosed that they collectively received $51 billion in federal tax breaks in 2025, much of that likely from the One Big Beautiful Bill Act (OBBBA).

An Anti-Affordability Agenda: Trump’s Advisors Call on States to Raise Taxes on the Working Class and Drastically Cut Taxes for the Rich

January 29, 2026 • By Carl Davis

The Trump administration’s Council of Economic Advisors suggests that states consider drastically raising sales taxes and using those new revenues to pay for repealing taxes on corporate and personal income. Working-class families would face dramatic tax increases while the nation’s wealthiest families would see their state tax bills plummet.

Tesla Reported Zero Federal Income Tax on $5.7 Billion of U.S. Income in 2025

January 29, 2026 • By Matthew Gardner

Tesla enjoyed almost $5.7 billion of U.S. income in 2025 but paid $0 in federal income tax. Over the past three years, the Elon Musk-led company reported $12.5 billion of U.S. income on which its current federal tax was just $48 million.

Intuit Helped Limit Americans’ Tax Filing Options While Raking in Millions in Tax Breaks

January 28, 2026 • By Joe Hughes

As tax filing season begins, families have fewer options than last year, thanks to the heavy lobbying efforts of big tax-preparation corporations like Intuit (the parent company of TurboTax).

Show Me Where We’re Going: Missouri’s Fiscally Irresponsible Path Will Be Paid for by Everyday People

January 8, 2026 • By Logan Liguore

Missouri lawmakers have been pushing regressive and shortsighted tax policies that undermine everyday workers and sabotage the Show-Me State’s ability to raise revenue.

Don’t Be Fooled by Treasury’s Jekyll and Hyde Approach to Tax Enforcement

December 31, 2025 • By Matthew Gardner

While this guidance is sorely needed to clean up the mess created by a hasty Congress, these notices stand in sharp contrast to the deregulatory, anti-tax approach that the Treasury Department has taken.

From Congressional discussions over the so-called "One Big Beautiful Bill Act" to debates on property taxes, ITEP kept busy this year analyzing tax proposals and showing Americans across the country how tax decisions affect them.

10 Reasons Why the U.S. Should Reform Its Corporate Income Tax

December 17, 2025 • By Steve Wamhoff

The U.S. needs a tax code that is more progressive and that raises more revenue than the one we have now. An important way to achieve this is to reform the taxation of business profits. These four key policy reforms would greatly strengthen the corporate tax system: Eliminating or restricting special breaks and loopholes that […]

President Trump Says His Tariffs Aren’t Paid by Americans. Corporations Are Indicating the Opposite.

December 15, 2025 • By Logan Liguore

Corporations have publicly revealed that they are passing the cost of tariffs on to Americans—the opposite of what the executive branch has said is happening.

Tax Haven Data Demonstrate Need for Global Minimum Tax Despite Opposition from Trump Administration

December 10, 2025 • By Steve Wamhoff

American corporations use accounting gimmicks to make profits appear to be earned in tax havens. This widespread problem could be fixed by Congress enacting legislation to implement a minimum tax on corporations that meets the standards of the global minimum tax that other countries have begun to implement.

State governments are rushing to offer billions of dollars in subsidies to data center construction, apparently without understanding their full costs.

Biden Tax Reforms Take a $16 Billion Bite Out of Trump’s Big Tax Giveaway to Meta

October 30, 2025 • By Matthew Gardner

Meta’s earnings setback is entirely attributable to an important tax reform championed by the Biden administration in 2022.

Oil and Gas Companies Are Paying Less Tax to the U.S. than to Foreign Governments

October 30, 2025 • By Matthew Gardner

Since 2017, these companies paid $135 billion in income taxes to foreign governments, but just $29 billion to the U.S.

Why States Shouldn’t Go Along With OBBBA’s Corporate Tax Breaks: A Practical Guide

October 27, 2025 • By Nick Johnson, Michael Mazerov

States should immediately decouple from four costly corporate tax provisions in the new federal tax law.

Well, That Was Fast: Trump Tax Law’s New Corporate Breaks are Already Worsening the Deficit

October 9, 2025 • By ITEP Staff

Corporate income taxes for the fiscal year that ended in September are $77 billion lower than in the previous year, a 15 percent drop.

Coca-Cola To Shareholders: $18 Billion Tax Bill? What $18 Billion Tax Bill?

October 1, 2025 • By Matthew Gardner

If Coca-Cola only pays 3% of the $18 billion tax bill it's facing, then the rest of us will have to pick up the remaining 97%.