Florida

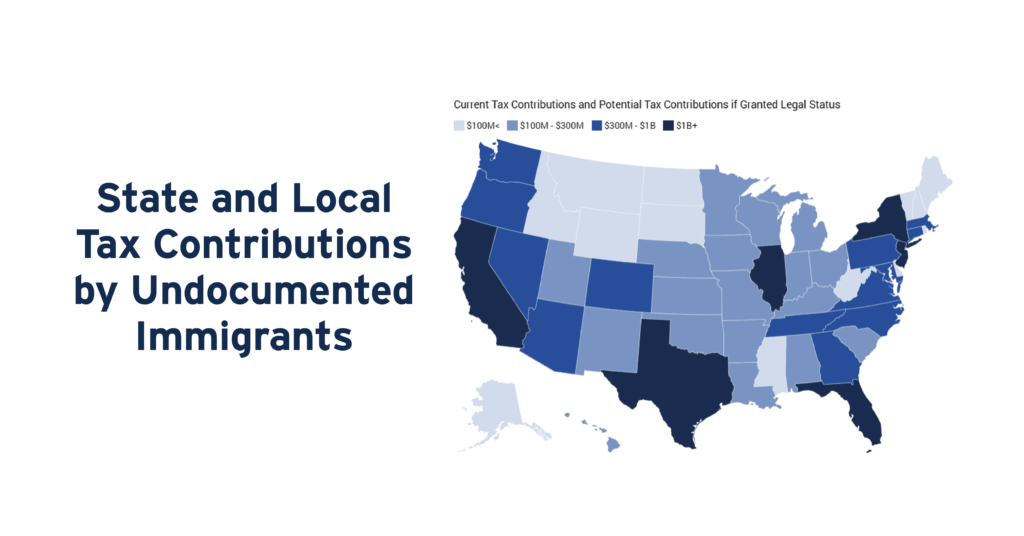

Undocumented immigrants pay taxes that help fund public infrastructure, institutions, and services in every U.S. state. Nearly 39 percent of the total tax dollars paid by undocumented immigrants in 2022 ($37.3 billion) went to state and local governments.

USA Today: Report: Targeted for Deportation by Trump, Undocumented Immigrants Pay Billions in Taxes

August 1, 2024

Florida is among a half-dozen states which each collect more than $1 billion in taxes from undocumented immigrants – a flow of public money likely to disappear under Republican presidential candidate Donald Trump’s mass deportation plan, a new report shows.

Florida Policy Institute: Florida Should Welcome Immigrants

August 1, 2024

New research confirms that immigrants without a documented status still contribute economically, despite most not being eligible for any public services or benefits. Many immigrants without a documented status pay taxes — primarily via sales and excise taxes on purchases.[1] The Institute on Taxation and Economic Policy’s (ITEP’s) latest report details the state and local taxes immigrants without a documented status contribute throughout the United States. Nationwide, ITEP finds that for every 1 million undocumented immigrant residents, revenue for public services increases by $8.9 billion.

Study: Undocumented Immigrants Contribute Nearly $100 Billion in Taxes a Year

July 30, 2024 • By ITEP Staff

Contact: Jon Whiten ([email protected]) Immigration policies have taken center stage in public debates this year, but much of the conversation has been driven by emotion, not data. A new in-depth study from the Institute on Taxation and Economic Policy aims to help change that by quantifying how much undocumented immigrants pay in taxes – both […]

Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Providing access to work authorization for undocumented immigrants would increase their tax contributions both because their wages would rise and because their rates of tax compliance would increase.

Major tax cuts were largely rejected this year, but states continue to chip away at income taxes. And while property tax cuts were a hot topic across the country, many states failed to deliver effective solutions to affordability issues.

Improving Refundable Tax Credits by Making Them Immigrant-Inclusive

July 17, 2024 • By Emma Sifre, Marco Guzman

Undocumented immigrants who work and pay taxes but don't have a valid Social Security number for either themselves or their children are excluded from federal EITC and CTC benefits. Fortunately, several states have stepped in to ensure undocumented immigrants are not left behind by the gaps in the federal EITC and CTC. State lawmakers should continue to ensure that immigrants who are otherwise eligible for these tax credits receive them.

States Should Enact, Expand Mansion Taxes to Advance Fairness and Shared Prosperity

June 26, 2024 • By Carl Davis, Erika Frankel

The report was produced in partnership with the Center on Budget and Policy Priorities and co-authored by CBPP’s Deputy Director of State Policy Research Samantha Waxman.[1] Click here to use our State Mansion Tax Estimator A historically large share of the nation’s wealth is concentrated in the hands of a few, a reality glaring in […]

Marcus Rojas

June 24, 2024 • By ITEP Staff

As a Communications Associate, Marcus helps prepare various digital content and translate complex tax policies into effective messaging for a wide range of audiences. He joined the communications team as an intern during his senior year at the University of Florida until his role became a permanent position. During his college tenure, Marcus published news […]

States Should Opt Into IRS Direct File as the Program is Made Permanent

May 30, 2024 • By Jon Whiten

While there is plenty of room to expand Direct File at the federal level, states can take matters into their own hands and bring this benefit to their residents by opting into the program.

Governing: Are Florida Taxes Low? It Depends on Your Income Level

May 28, 2024

It’s been almost a hundred years since Florida eliminated its personal income tax. Not taxing income contributes to its reputation as a low-tax state and is part of the draw for retirees. But of course Floridians do pay taxes and the state’s system leads to some inequities, according to a new report from a progressive organization.

Yahoo Finance: Jeff Bezos Spent $237 Million On Florida Mansions — Billionaires Flock To ‘Upside Down’ Tax Haven Where Rich Pay Less Than Poor

May 20, 2024

The Sunshine State has become a magnet for billionaires seeking tax relief. Among the latest to join the trend is Amazon founder Jeff Bezos, who has recently expanded his real estate holdings in Miami’s exclusive Billionaire Bunker area. Bezos’ acquisitions include three properties, bringing his total investment in the neighborhood to $237 million.

Forbes: California Is Not Actually a High-Tax State According To New Study

May 17, 2024

Depending on where you fall on the income scale, California may not actually be that high tax of a state. For many in the middle class and below, California may let you keep more of your hard-earned income than many other states, according to a new study, “Who Pays” from the Institute on Taxation and Economic Policy (ITEP). While California has the highest marginal tax rate in the nation at 13.3%, only some households pay this rate on their income. That doesn’t stop so-called low-tax states like Texas and Florida from blasting the tax policy of the Golden State.

There are a variety of factors that affect teacher pay. But one often overlooked factor is progressive tax policies that allow states to raise and provide the funding educators and their students deserve.

Iowa Flat Tax Shows Why Such Policies Are a Problem Everywhere

May 9, 2024 • By Eli Byerly-Duke

As Iowa lawmakers change the state’s graduated personal income tax to a single flat rate, they are designing a state tax code where the rich will pay a lower rate overall than families with modest means.

This week, many states took steps toward enacting tax cuts...

NewsRadio WFLA: Poorest Floridians Taxed at Higher Rate than Richest Californians

April 24, 2024

Florida Policy Institute (FPI) and the Institute for Taxation and Economic Policy (ITEP) released a study today that found California’s tax system is fairer than Florida’s.

Key Findings For families of modest means, California is not a high-tax state. California taxes are close to the national average for families in the bottom 80 percent of the income scale. For the bottom 40 percent of families, California taxes are lower than states like Florida and Texas. The highest earners usually pay higher […]

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

April 11, 2024 • By ITEP Staff

State and local tax codes can do a lot to reduce inequality. But they add to the nation’s growing income inequality problem when they capture a greater share of income from low- or moderate-income taxpayers. These regressive tax codes also result in higher tax rates on communities of color, further worsening racial income and wealth divides.

Congress Should Enhance – Not Diminish – IRS Capability this Tax Season

March 28, 2024 • By Joe Hughes

While funding cuts to the IRS may have been necessary as a political matter to avoid harmful agency shutdowns, they are severely misguided as a policy matter. By all serious accounts, cuts to IRS funding increase the deficit due to uncollected taxes – mostly from big businesses and the very wealthy.

Revenue-Raising Proposals in President Biden’s Fiscal Year 2025 Budget Plan

March 12, 2024 • By Steve Wamhoff

President Biden’s most recent budget plan includes proposals that would raise more than $5 trillion from high-income individuals and corporations over a decade. Like the budget plan he submitted to Congress last year, it would partly reverse the Trump tax cuts for corporations and high-income individuals, clamp down on corporate tax avoidance, and require the wealthiest individuals to pay taxes on their capital gains income just as they are required to for other types of income, among other reforms.

State legislative sessions are in full swing with New Jersey and Oklahoma both particularly active this week...

The ‘Low-Tax’ Lie: States Hyped for Low Taxes Usually Only Low-Tax for the Rich

February 20, 2024 • By Jon Whiten

It’s hard to go a week without seeing a politician or a news article hype up a state as the place that everyone is moving to – or should move to – because of low taxes. However, there’s a big problem with these proclamations: they aren’t true.

As many of you may know, we love taxes, along with the many great things they provide for our communities...

State Rundown 1/26: Wealth Taxes Drawing Interest Early in Legislative Sessions

January 26, 2024 • By ITEP Staff

Bills are moving and state legislative sessions are picking up across the country, giving elected officials the opportunity to consider two distinct paths when it comes to tax policy...