Hawaii

State Rundown 2/27: Temperatures and Tax Fights Continue to Polarize

February 27, 2019 • By ITEP Staff

As another polar vortex heads for large swaths of the country, state tax debates this week were highly polarized in another way. Lawmakers and advocates in MICHIGAN, OHIO, OREGON, UTAH, and elsewhere fought to enact or improve state Earned Income Tax Credits to give a boost to low- and middle-income working families. But the opposite extreme was heavily represented as well, as others pushed for regressive tax cuts for wealthy individuals and corporations, including in KANSAS, NEBRASKA, NORTH DAKOTA, OHIO, UTAH, and WEST VIRGINIA. Even our “What We’re Reading” section has informative reading on how education funding policy continues to…

State tax policy can be a contentious topic, but one issue on which lawmakers largely agree is that higher gas tax rates are necessary to keep our nation’s infrastructure operating safely and efficiently. Lawmakers in 27 states have approved gas tax increases since 2013.

Hawai’i Public Radio: Corporate Tax Loophole Costs Hawaii $38 Million Annually

February 20, 2019

Hawaii lawmakers are missing out on millions in potential tax revenue. That is the conclusion of a report from the Institute on Taxation and Economic Policy. The ITEP found that a loophole in Hawaii’s tax code allows multinational corporations to avoid paying state corporate income taxes, resulting in a loss of $38 million in revenue annually. Read […]

Trends We’re Watching in 2019: Consumption Taxes: the Good, Bad and the Ugly

February 7, 2019 • By ITEP Staff

Consumption taxes are a significant source of state and local revenue, and we expect that lawmakers will continue to adjust state consumption tax levies to adapt to budget needs and a changing economy.

Trends We’re Watching in 2019: The Use of Targeted Tax Breaks to Help Address Poverty and Inequality

February 7, 2019 • By Aidan Davis

Continuing to build upon the momentum of previous years, states are taking steps to create and improve targeted tax breaks meant to lift their most in-need state residents up and out of poverty. Most notably, a range of states are exploring ways to restore, enhance or create state Earned Income Tax Credits (EITC). EITCs are an effective tool to help struggling families with low wages make ends meet and provide necessities for their children. The policy, designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, allows struggling families to move toward meaningful economic…

State Rundown 1/31: Governors and Teachers Dominate Headlines, Much More in Fine Print

January 31, 2019 • By ITEP Staff

Gubernatorial addresses and the prospect of teacher strikes continued to take center stage in state fiscal news this week, as governors of Connecticut, Maryland, and Utah gave speeches that all included significant tax proposals. Meanwhile, teachers walked out in Virginia, and many other states debated school funding increases to avoid similar results. State policymakers have many other debates on their hands as well, including what to do with online sales tax revenue, how to cut property taxes without undermining schools, whether and how to legalize and tax cannabis, and whether to update gas taxes for infrastructure investments.

State Rundown 1/24: States Reflect on MLK’s Dream and Teacher Uprisings

January 24, 2019 • By ITEP Staff

This week, as Americans in every state celebrated Martin Luther King Jr. Day and reflected on his dream of peaceful protest and racial and economic justice, many eyes were on the teachers’ strike pressing for parts of this dream amid the “curvaceous slopes of California.” Governors and lawmakers in many states—including Arizona, Georgia, Indiana, Louisiana, Nevada, New Mexico, South Carolina, and Wisconsin—discussed ways to raise pay for teachers and/or enhance education investments generally.

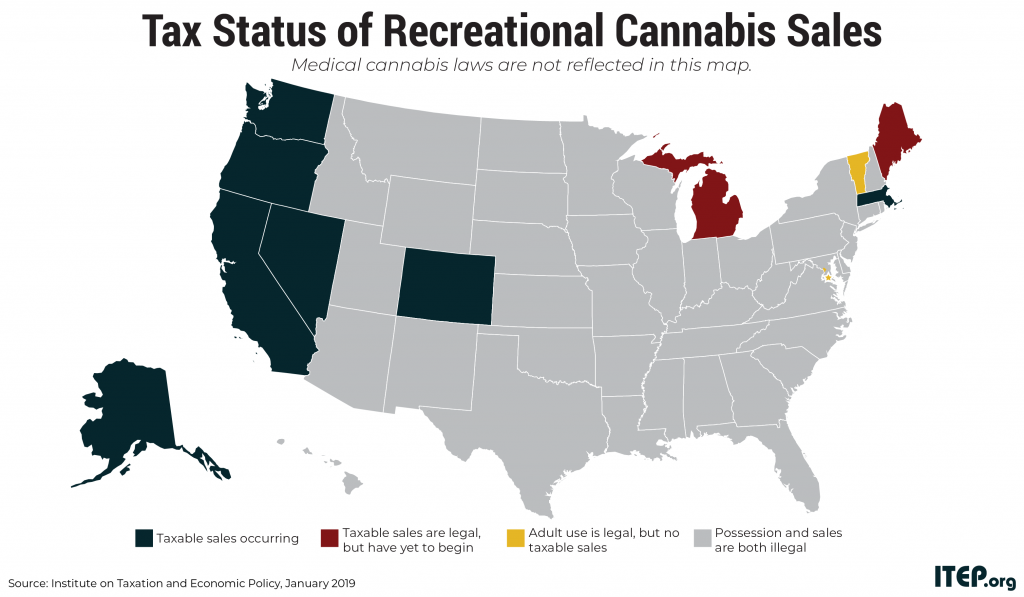

Cannabis Tax Debates are Ramping Up; Here’s What We’ve Learned from Five Years of Cannabis Taxation Thus Far

January 23, 2019 • By Carl Davis

This year lawmakers in Connecticut, Delaware, Hawaii, Illinois, New Jersey, New York, Rhode Island, and Vermont will all be debating the taxation of recreational cannabis. A new ITEP report reviews the track record of recreational cannabis taxes thus far and offers recommendations for structuring cannabis taxes to achieve stable revenue growth over the long haul.

Maui Now: Report: Hawaii Could Recover $38M Lost to Corporate Tax Loopholes

January 19, 2019

Reforms to end corporate tax loopholes in Hawai‘i could reduce lost tax revenue and bring in an additional $38 million to the state, according to a new report released on Friday by The Institute on Taxation and Economic Policy. The report called “A Simple Fix for a $17 Billion Loophole,” takes a look at complicated […]

State Rundown 1/18: Governors’ Speeches Kick Off State Fiscal Debates

January 18, 2019 • By ITEP Staff

Gubernatorial speeches and budget proposals dominated state fiscal news this week, as governors proposed a wide array of policies including positive reforms such as Earned Income Tax Credit (EITC) enhancements in CALIFORNIA, a capital gains tax on wealthy households in WASHINGTON, and investments in education in several states. Proposals to exempt more retirement income from tax, particularly for veterans, are a common theme so far this year, having been raised in multiple states including MARYLAND, MICHIGAN, and SOUTH CAROLINA. And NEW JERSEY became the fourth state with a $15 minimum hourly wage. Those wishing to better understand and influence important debates about equitable tax policy should mark their…

Who Pays and Why It Matters | MECEP Policy Insights Conference Keynote Address

January 16, 2019 • By Aidan Davis

States have broad discretion in how they secure the resources to fund education, health care, infrastructure, and other priorities important to communities and families. Aidan Davis with the Institute on Taxation and Economic Policy will offer a national perspective on state-level approaches to funding public investments and the implications of those approaches on tax fairness and revenue adequacy, and their economic outcomes. She’ll also provide insight on what’s in store for 2019 among the states.

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…

State Rundown 12/5: Familiar Questions Returning to Fore as 2019 Approaches

December 5, 2018 • By ITEP Staff

State lawmakers are preparing their agendas for 2019 and looking at all sorts of tax and budget policies in the process, raising many familiar questions. Oregon legislators, for example, will try to fill in the blanks in a proposal to boost investments in education that left out detail on how to fund them, while their counterparts in Texas face the inverse problem of a proposed property tax cut that fails to clarify how schools could be protected from cuts. Similar school finance debates will play out in many other states. Alabama, Kansas, and Louisiana will look at gas tax updates,…

Tuesday’s elections shook up statehouses, governors’ offices, and tax laws in many states, and in this week’s Rundown we bring you the top 3 election state tax policy stories to emerge. First, voters in Kansas and other states sent a message that regressive tax cuts and supply-side economics have not succeeded and are not welcome among their state fiscal policies. Meanwhile, residents of many other states, including most notably Illinois, voted for representatives who reflect their preference for equitable, sustainable policies to improve their state economies through smart public investments and improve the lives of all residents through progressive tax structures. Lastly, while some states missed…

In this special edition of the Rundown we bring you a voters’ guide to help make sense of tax-related ballot questions that will go before voters in many states in November. Interests in Arizona, Florida, North Carolina, Oregon, and Washington state have placed process-related questions on those states’ ballots in attempts to make it even harder to raise revenue or improve progressivity of their state and/or local tax codes. In response to underfunded schools and teacher strikes around the nation, Colorado voters will have a chance to raise revenue for their schools and improve their upside-down tax system at the…

The Garden Island: Gap Keeps Growing Between Rich, Poor

October 25, 2018

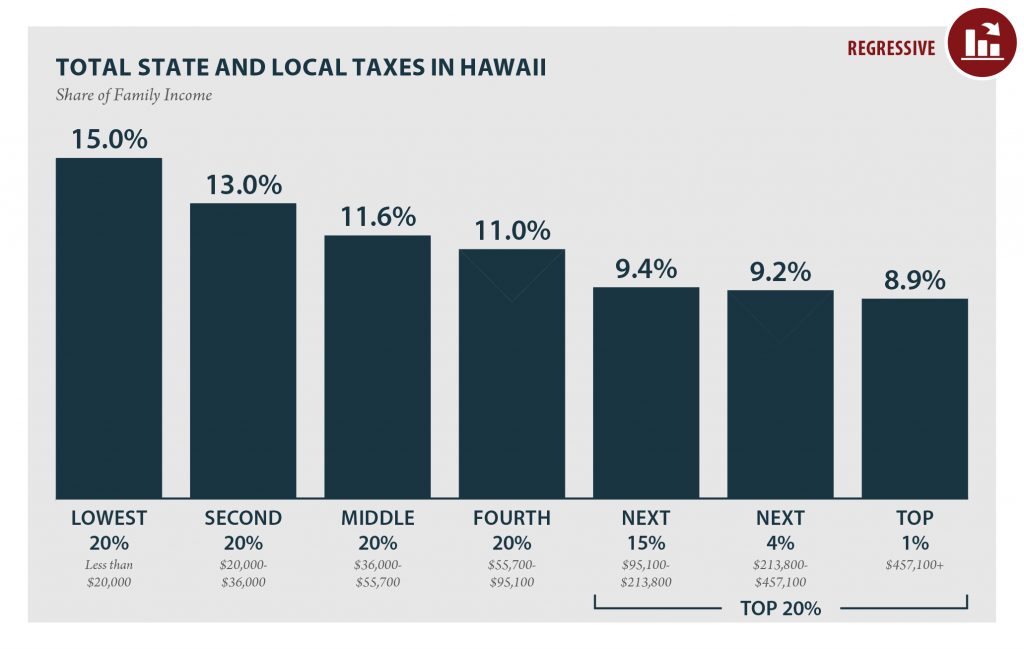

The study finds that those in the bottom fifth of the income spectrum in Hawaii pay 15 percent of their income in state and local taxes, while those in the top 1 percent pay only 8.9 percent, “which exacerbates inequality in our state,” according to a press release about the study.

Hawaii Public Radio: Hawaii Tax System Places Larger Burden on Low Income Residents

October 24, 2018

Low-income residents in Hawaii are paying a higher share of their income in taxes than higher level earners. That is the conclusion of a recent report from the Institute on Taxation and Economic Policy titled Who Pays? The Hawaii tax system is considered highly regressive, due to heavy reliance on the General Excise Tax, or GET. This is despite a progressive, graded state income tax and the lowest property taxes in the nation.

Hawai’i Budget & Policy Center: Hawaii’s Tax System Exacerbates Inequality

October 23, 2018

A new report out from the Institute on Taxation and Economic Policy (ITEP) provides the vital statistics for each state’s tax system. It lays out, in clear and compelling numbers, the sobering message that Hawaiʻi taxes—and those in the United States on average—increase inequality between rich and poor.

Big Island Now: STUDY: Hawai‘i’s Low-Income Taxpayers Carry 2nd Highest Tax Rate

October 17, 2018

The main cause of the heavy tax burden on those making the least in Hawaiʻi is the General Excise Tax (GET). Families in the lowest fifth spend 10.5% of their meager incomes on the GET, while the top 1% spend only 1.2% of their large earnings. In other words, those at the bottom spend 8.75 times more of their income on the GET than do those at the top.

Hawaii: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

HAWAII Read as PDF HAWAII STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $20,000 $20,000 to $36,000 $36,000 to $55,700 $55,700 to $95,100 $95,100 to $213,800 $213,800 to $457,100 over $457,100 […]

South Carolina lawmakers have finally passed a federal conformity bill in response to last year’s federal tax-cut legislation. Voters in many states are hearing a lot about tax-related questions they’ll see on the ballot in November, particularly residents of Florida, Montana, and Oregon, where corporate donors and other anti-tax interests are spending major sums to alter policy in their states. And states continue to work on ensuring they can collect online sales taxes and, in some states, online sports betting taxes.

Tax Cuts 2.0 – Hawaii

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

The Rundown is back after a few-week hiatus, with lots of state fiscal news and quality research to share! Maine lawmakers found agreement on a response to the federal tax-cut bill, states continue to sort out how they’ll collect online sales taxes in the wake of the Wayfair decision, and policymakers in several states have been working on summer tax studies and other preparations for 2019 legislative sessions. Meanwhile, work on ballot measures and candidate tax plans to go before voters in November has been even more active, particularly in Arizona, California, Florida, Hawaii, and Missouri. Our “What We’re Reading” section has lots of great research and reading on inequalities, cities turning…

State Tax Codes as Poverty Fighting Tools: 2018 Update on Four Key Policies in All 50 States

September 17, 2018 • By Aidan Davis, Misha Hill

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2018, and offers recommendations that every state should consider to help families rise out of poverty. States can jumpstart their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

Rewarding Work Through State Earned Income Tax Credits in 2018

September 17, 2018 • By ITEP Staff

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits. The effectiveness of the EITC as an anti-poverty policy can be increased by expanding the credit at…