Income Taxes

Maryland Gov. Wes Moore’s Tax Plan Boosts Revenue, Increases Fairness

January 30, 2025 • By Miles Trinidad, Nick Johnson

Maryland’s Gov. Wes Moore put forward a tax reform plan that would make the tax system fairer, simpler, and better able to meet the state’s needs. The proposed changes to the income tax ask more of those at the top and provide an average tax cut for those earning less.

Maryland’s Tax Reform Likely Won’t Cause Millionaire Migration

January 30, 2025 • By Nick Johnson

The moment Gov. Wes Moore announced his proposal to reform Maryland’s tax system, in part, by raising income tax rates on high-income households, opponents began predicting that wealthy people would respond by leaving. Experience from other states says that’s not the case.

Congress Could — But Won’t — Pass a Tax Package That Pays for Itself

January 17, 2025 • By Joe Hughes

If Republican lawmakers were serious about deficit-neutral tax reform, they would focus on increasing taxes for the ultra-wealthy and large corporations. The absence of such proposals in their plan reveals their true priority: delivering enormous tax cuts to the wealthiest Americans while average working families receive crumbs.

Trump’s Plan to Extend His 2017 Tax Provisions: Updated National and State-by-State Estimates

January 8, 2025 • By Steve Wamhoff

Trump’s plan to make most of the temporary provisions of his 2017 tax law permanent would disproportionately benefit the richest Americans. This includes all major provisions except the $10,000 cap on deductions for state and local taxes (SALT) paid.

While most states have a graduated rate income tax, some state lawmakers have recently become enamored with the idea of moving toward flat rate taxes instead. What’s the difference? And are states well served by the transition? In short: A flat tax is one where each taxpayer pays the same percentage of their income whereas […]

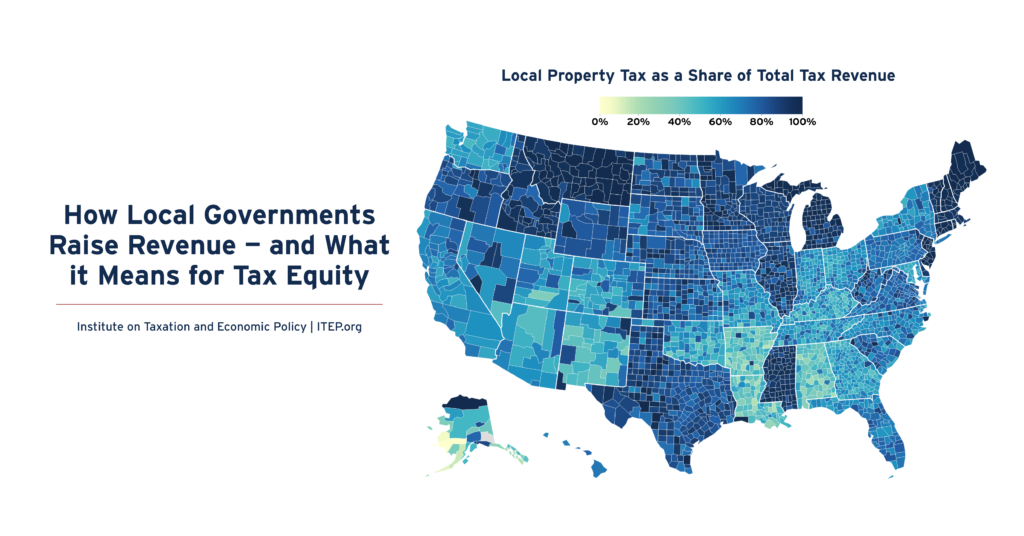

How Local Governments Raise Revenue — and What it Means for Tax Equity

December 5, 2024 • By Galen Hendricks, Rita Jefferson

Local taxes are key to thriving communities. One in seven tax dollars in the U.S.—about $886 billion annually—is levied by local governments in support of education, infrastructure, public health, and other priorities. Three fourths of this funding comes from property taxes, 18 percent comes from sales and excise taxes, and six percent comes from income taxes.

Louisiana Gov. Jeff Landry called the legislature back to the capitol the day after the national election to take up his plan to overhaul the state’s tax system during a 20-day special session. Our analysis shows the tax overhaul would worsen the inequity already rampant in Louisiana’s tax system while potentially shortchanging essential services for families across the state.

Average Louisianans Will Pay for Gov. Landry’s Tax Break for the Rich

November 26, 2024 • By Neva Butkus

Tax cuts for the wealthy and corporations will not make Louisiana more competitive. Rather, they will blow a hole in the state budget while asking low- and middle-income working families to make up the difference. Gov. Landry and the Louisiana legislature would make much better use of their time looking for ways to make Louisiana’s tax structure fairer and more capable of adequately funding important priorities.

Billionaires and businesses have too much power in Washington. Tax revenue is needed to pay for things we all need. If we want economic justice, racial justice and climate justice, we must have tax justice.

The tax proposals from Vice President Kamala Harris would, on average, lead to a tax increase for the richest 1 percent of Americans and a tax cut for all other income groups.

A Distributional Analysis of Donald Trump’s Tax Plan

October 7, 2024 • By Carl Davis, Erika Frankel, Galen Hendricks, Joe Hughes, Matthew Gardner, Michael Ettlinger, Steve Wamhoff

Former President Donald Trump has proposed a wide variety of tax policy changes. Taken together, these proposals would, on average, lead to a tax cut for the richest 5 percent of Americans and a tax increase for all other income groups.

Extending Temporary Provisions of the 2017 Trump Tax Law: Updated National and State-by-State Estimates

September 13, 2024 • By Steve Wamhoff

The TCJA Permanency Act would make permanent the provisions of the Tax Cuts and Jobs Act of 2017 that are set to expire at the end of 2025. The legislation would disproportionately benefit the richest Americans. Below are graphics for each state that show the effects of making TCJA permanent across income groups. See ITEP’s […]

After the dust settles on this year’s election, one of the most pressing issues confronting the next Congress and President will be how to deal with the expiration of the 2017 Trump tax cuts and, more specifically, who will pay for the cost of extending some or all of those cuts. Among the more widely accepted ideas circulating on the right is to raise income taxes on single parents, more than four in five of whom are women and a disproportionate share of whom are people of color.

The IRS has opened its free tax filing service called Direct File to every state for the 2025 tax filing season. Direct File was made possible by President Biden’s Inflation Reduction Act, which provided new resources for the IRS to improve customer service and ensure taxpayers claim the benefits and deductions for which they are […]

The no tax on tips idea isn't a new one, but it's always been abandoned because it's practically impossible to do without creating new avenues for tax avoidance. Despite its embrace by the candidates from both major parties, this policy idea would do little to help the roughly 4 million people who work in tipped occupations while creating a host of problems.

Many cities, counties, and townships across the country are in a difficult, or at least unstable, budgetary position. Localities are responding to these financial pressures in a variety of ways with some charging ahead with enacting innovative reforms like short-term rental and vacancy taxes, and others setting up local tax commissions to study the problem.

Minnesota stands apart from the rest of the country with a moderately progressive tax system that asks slightly more of the rich than of low- and middle-income families. Recent reforms signed by Gov. Tim Walz have contributed to this reality.

Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Providing access to work authorization for undocumented immigrants would increase their tax contributions both because their wages would rise and because their rates of tax compliance would increase.

Major tax cuts were largely rejected this year, but states continue to chip away at income taxes. And while property tax cuts were a hot topic across the country, many states failed to deliver effective solutions to affordability issues.

Reality Interrupts the Fever Dream of Income Tax Elimination in Kentucky

June 27, 2024 • By Eli Byerly-Duke

Keeping the Kentucky income tax on a march to zero would mean tax hikes for working families or widespread cuts to education, health care, and other public services. Reversing course is certainly the wiser course of action.

States Should Opt Into IRS Direct File as the Program is Made Permanent

May 30, 2024 • By Jon Whiten

While there is plenty of room to expand Direct File at the federal level, states can take matters into their own hands and bring this benefit to their residents by opting into the program.

There are a variety of factors that affect teacher pay. But one often overlooked factor is progressive tax policies that allow states to raise and provide the funding educators and their students deserve.

Iowa Flat Tax Shows Why Such Policies Are a Problem Everywhere

May 9, 2024 • By Eli Byerly-Duke

As Iowa lawmakers change the state’s graduated personal income tax to a single flat rate, they are designing a state tax code where the rich will pay a lower rate overall than families with modest means.

Key Findings For families of modest means, California is not a high-tax state. California taxes are close to the national average for families in the bottom 80 percent of the income scale. For the bottom 40 percent of families, California taxes are lower than states like Florida and Texas. The highest earners usually pay higher […]

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

April 11, 2024 • By ITEP Staff

State and local tax codes can do a lot to reduce inequality. But they add to the nation’s growing income inequality problem when they capture a greater share of income from low- or moderate-income taxpayers. These regressive tax codes also result in higher tax rates on communities of color, further worsening racial income and wealth divides.