Kentucky

Some states have improved tax equity by raising new revenue from the well-off and creating or expanding refundable tax credits for low- and moderate-income families in recent years. Others, however, have gone the opposite direction, pushing through deep and damaging tax cuts that disproportionately help the rich. Many of these negative developments are quantified in […]

As many of you may know, we love taxes, along with the many great things they provide for our communities...

State Rundown 1/26: Wealth Taxes Drawing Interest Early in Legislative Sessions

January 26, 2024 • By ITEP Staff

Bills are moving and state legislative sessions are picking up across the country, giving elected officials the opportunity to consider two distinct paths when it comes to tax policy...

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

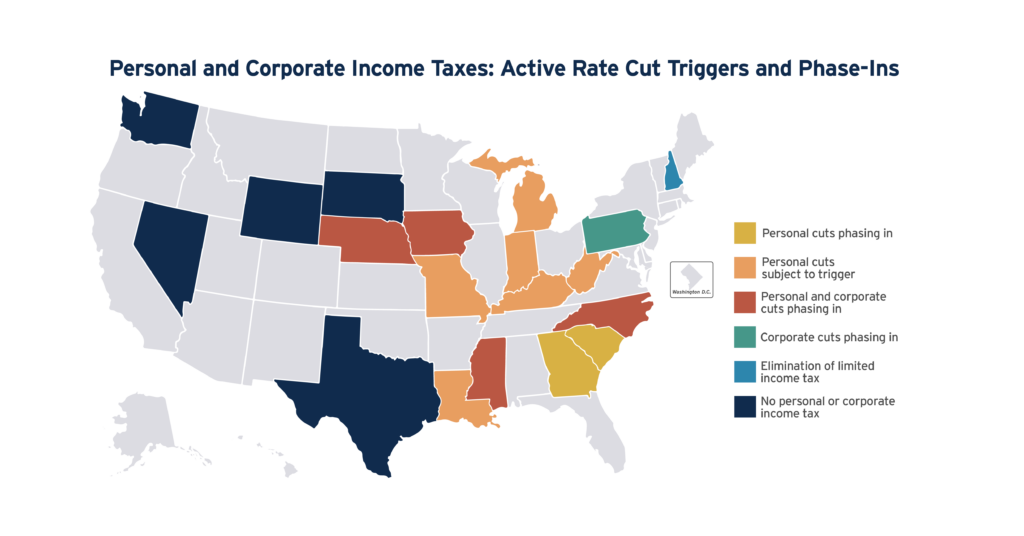

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

Tax policy themes have begun to crop up in states as governors give their yearly addresses and legislators lay out their plans for the 2024 legislative season...

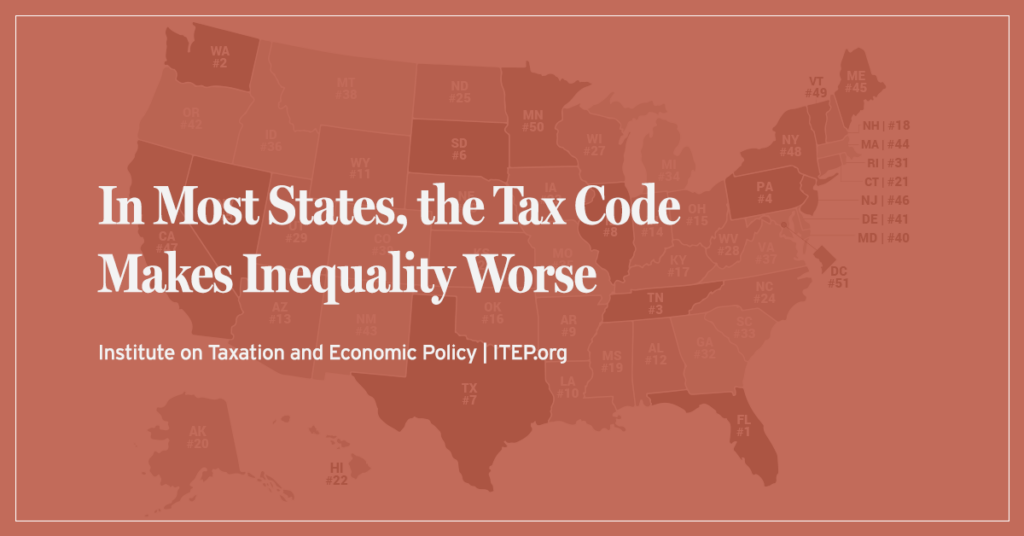

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. Yet a few states have made strides to buck that trend and have tax codes that are somewhat progressive and therefore do not worsen inequality.

Tax Systems in 44 States Exacerbate Inequality, In-Depth ‘Who Pays?’ Study Finds

January 9, 2024 • By ITEP Staff

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. That’s according to the latest edition of the Institute on Taxation and Economic Policy’s Who Pays?, the only distributional analysis of tax systems in all 50 states and the District of Columbia.

Kentucky: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Kentucky Download PDF All figures and charts show 2024 tax law in Kentucky, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.6 percent) state and local tax revenue collected in Kentucky. These figures depict Kentucky’s flat personal income tax rate of 4 percent. […]

Even as revenue collections slow in many states, some are starting the push for 2024 tax cuts early. For instance, policymakers in Georgia and Utah are already making the case for deeper income tax cuts. Meanwhile, Arizona lawmakers are now facing a significant deficit, the consequence of their recent top-heavy tax cuts. There is another […]

Hidden in Plain Sight: Race and Tax Policy in 2023 State Legislative Sessions

November 21, 2023 • By Brakeyshia Samms

Race was front and center in a lot of state policy debates this year, from battles over what’s being taught in schools to disagreements over new voting laws. Less visible, but also extremely important, were the racial implications of tax policy changes. What states accomplished this year – both good and bad – will acutely affect people and families of color.

Kentucky Center for Economic Policy: Local Sales Tax Amendment Could Lead to Wider Inequality Without Better Funding Local Services

November 17, 2023

Under Kentucky’s constitution, there are limits on the types of taxes the General Assembly may authorize local governments to levy, and local sales taxes are not allowed. The 2024 General Assembly may take the first step toward changing that if it considers an amendment to the constitution that would grant the legislature broader authority on […]

States differ dramatically in how much they allow families to make choices about whether and when to have children and how much support they provide when families do. But there is a clear pattern: the states that compel childbirth spend less to help children once they are born.

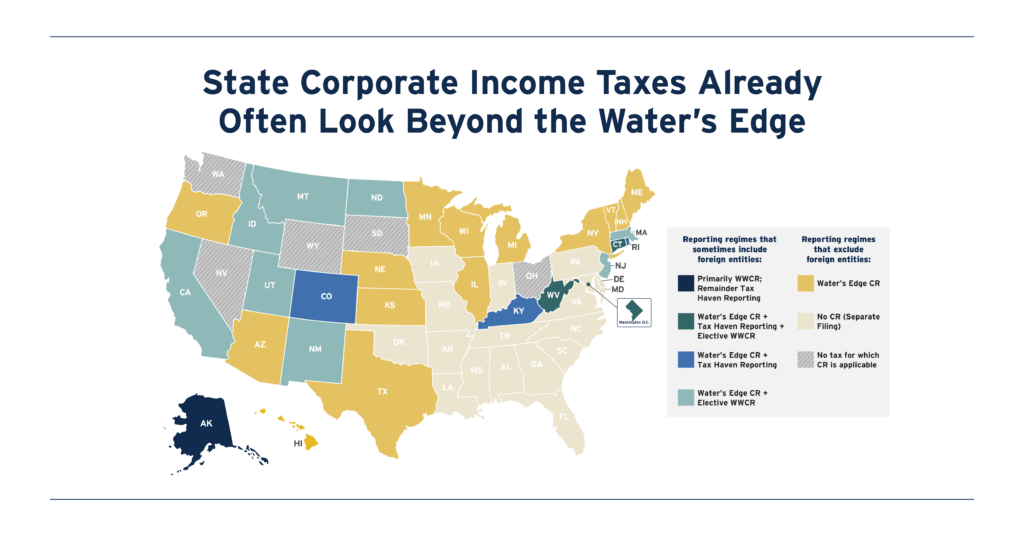

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

America Used to Have a Wealth Tax: The Forgotten History of the General Property Tax

November 2, 2023 • By Carl Davis, Eli Byerly-Duke

Over time, broad wealth taxes were whittled away to become the narrower property taxes we have today. These selective wealth taxes apply to the kinds of wealth that make up a large share of middle-class families’ net worth (like homes and cars), but usually exempt most of the net worth of the wealthy (like business equity, bonds, and pooled investment funds).The rationale for this pared-back approach to wealth taxation has grown weaker in recent decades as inequality has worsened, the share of wealth held outside of real estate has increased, and the tools needed to administer a broad wealth tax…

State Rundown 10/26: Off-Year Ballot Measures and State & Local Tax Policy

October 26, 2023 • By ITEP Staff

November elections are creeping closer and closer and while that typically means a new batch of lawmakers are elected, it also means voters have another chance to help shape state and local tax policy...

We can make modest reforms to better tax those who are taking a larger share of our wealth and income in order to reinforce a major pillar of our promise to Americans.

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. But another third of states lost ground, continuing a trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable.

This op-ed was originally published by Route Fifty and co-written by ITEP State Director Aidan Davis and Center on Budget and Policy Priorities Senior Advisor for State Tax Policy Wesley Tharpe. There’s a troubling trend in state capitols across the country: Some lawmakers are pushing big, permanent tax cuts that primarily benefit the wealthy and […]

States Looking to Make Property Taxes Affordable Should Turn to ‘Circuit Breakers’

May 11, 2023 • By ITEP Staff

Many state legislatures this year have been considering property tax cuts – but too many are ignoring the solution that speaks more directly to questions of property tax affordability than any other policy option: the “circuit breaker."

Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Circuit breaker credits are the most effective tool available to promote property tax affordability. These policies prevent a property tax “overload” by crediting back property taxes that go beyond a certain share of income. Circuit breakers intervene to ensure that property taxes do not swallow up an unreasonable portion of qualifying households’ budgets.

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

Minnesota’s House, Senate and Governor’s office have each proposed their own vision as to how the state should maximize its $17.5 billion surplus and raise new revenue, and these tax plans make one thing clear: Minnesota lawmakers are serious about using tax policy to advance tax equity and improve the lives of Minnesotans.

This week, a bill out of Arkansas that would cut the top personal income tax rate and the corporate income tax rate found its way to the governor’s desk...

State Rundown 3/9: The Whirlwind 2023 Legislative Session Continues

March 9, 2023 • By ITEP Staff

State 2023 legislative sessions are proving to be eventful ones. With many states eager to make use of their budget surpluses, major tax changes are still being proposed and others signed into law. Michigan residents will soon see an increase to their state Earned Income Tax Credit (from 6 percent to 30 percent) after the […]

In recent years, lawmakers have been quick to push for phased-in tax cuts or cuts attached to trigger mechanisms. These policy tools push the implementation of tax cuts outside of the current budget window with a predetermined phase-in schedule or a mathematical formula tied to state revenue trends.