New Mexico

New Mexico Voices for Children: New Analysis: Lowest-Income Taxpayers in NM Pay 1.8 Times the Tax Rate Paid by the Richest New Mexicans

October 17, 2018

“Taxes are the way we accomplish great things for our state – build our schools and infrastructure, provide health care and public safety, and more,” said James Jimenez, executive director of New Mexico Voices for Children, which partnered with ITEP on the report release. “These systems and services underpin our economy and improve our quality of life. We all need to do our part to support them, but our current state tax system ensures that those who can afford to pay the most actually pay the least.”

Public News Service: Report: NM Tax Overhaul Would Benefit Kids, Families

October 17, 2018

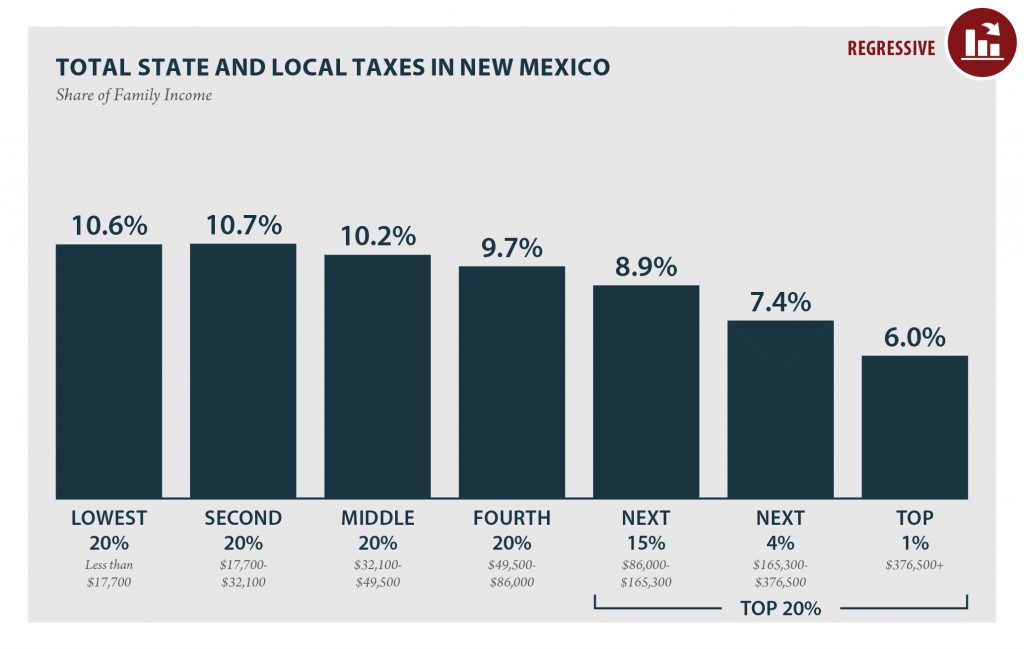

Regressive tax systems hurt children and families, according to a new report from the Institute on Taxation and Economic Policy - and by that standard, it says New Mexico has the 19th-worst tax system in the United States. The study showed that as a share of their income, the lowest-income New Mexicans are paying state and local tax rates almost double those of the state's wealthiest residents.

New Mexico: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

NEW MEXICO Read as PDF NEW MEXICO STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $17,700 $17,700 to $32,100 $32,100 to $49,500 $49,500 to $86,000 $86,000 to $165,300 $165,300 to $376,500 […]

Tax Cuts 2.0 – New Mexico

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Reducing the Cost of Child Care Through State Tax Codes in 2018

September 17, 2018 • By Aidan Davis

Families in poverty contribute over 30 percent of their income to child care compared to about 6 percent for families at or above 200 percent of poverty. Most families with children need one or more incomes to make ends meet which means child care expenses are an increasingly unavoidable and unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.

Consumers’ growing interest in online shopping and “gig economy” services like Uber and Airbnb has forced states and localities to revisit their sales taxes, for instance. Meanwhile new evidence on the dangers and causes of obesity has led to rising interest in soda taxes, but the soda industry is fighting back. Carbon taxes are being discussed as a tool for combatting climate change. And changing attitudes toward cannabis use have spurred some states to move away from outright prohibition in favor of legalization, regulation and taxation.

Although most state legislatures are out of session during the summer, the pursuit of better fiscal policy has no "off-season." Here at ITEP, we've been revamping the State Rundown to bring you your favorite summary of state budget and tax news in the new-and-improved format you see here. Meanwhile, leaders in Massachusetts and New Jersey have been hard at work in recent weeks and are already looking ahead their next round of budget and tax debates. Lawmakers in many states are using their summer break to prepare for next year's discussions over how to implement online sales tax legislation. And…

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2018 • By Dylan Grundman O'Neill

An updated version of this brief for 2019 is available here. Read this report in PDF. Overview Sales taxes are an important revenue source, composing close to half of all state tax revenues.[1] But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and […]

With many state fiscal years beginning July 1, most states that will make decisions this year about federal tax conformity have now done so, so it is now time for an update on how well state policymakers have kept to, or veered from, the path we charted out earlier this year. Most states that have enacted laws in response to the federal changes have adhered to some but not all of the principles we laid out, with a few responding rather prudently and a handful charting a much more treacherous course of unfair, unsustainable policy based on unfounded promises of…

This week, lawmakers in Louisiana, Pennsylvania, Rhode Island, Vermont, and the District of Columbia wrapped up their budgets in time for the new fiscal year that starts July first in most states, with some of these resolutions coming after contentious debates and repeated special sessions. New Jersey's debate is not yet finished as leaders clash over spending priorities and the taxes on millionaires and corporations needed to fund them. Meanwhile, signature drives to put tax-related questions on fall ballots are heating up in several other states. And our "What We're Reading" section includes helpful resources on implications of the Supreme…

New Tax Subsidy for Private K-12 Tuition in Massachusetts Creates a Host of Problems

May 9, 2018 • By Carl Davis

Last year’s federal tax cut bill changed 529 college savings accounts in a major way, expanding them so that they can be used as tax shelters by higher-income families who choose to send their children to private K-12 schools. This controversial change was added in the Senate by the slimmest of margins—requiring a tie-breaking vote […]

Trends We’re Watching in 2018, Part 5: 21st Century Consumption Taxes

April 20, 2018 • By Misha Hill

We're highlighting the progress of a few newer trends in consumption taxation. This includes using the tax code to discourage consumption of everything from plastic bags to carbon and collecting revenue from emerging industries like ride sharing services and legalized cannabis sales.

New Mexico Voices for Children: Celebrate Democracy- It’s Tax Day!

April 17, 2018

While it’s easy to tick off a list of the things we enjoy that are paid for out of our taxes, paying taxes is really a moral duty that we all participate in. It is a contract that we honor collectively because it’s the way we invest in our communities. In fact, some research shows that Americans […]

State Rundown 4/13: Teacher Strikes, Special Sessions, Federal Cuts Haunting States

April 13, 2018 • By ITEP Staff

This Friday the 13th is a spooky one for many state lawmakers, as past bad fiscal decisions have been coming back to haunt them in the form of teacher strikes and walk-outs in Arizona, Kentucky, and Oklahoma. Meanwhile, policymakers in Maryland, Nebraska, New Jersey, Oregon, and Utah all attempted to exorcise negative consequences of the federal tax-cut bill from their tax codes. And our What We're Reading section includes yet another stake to the heart of the millionaire tax-flight myth and other good reads.

The U.S. Supreme Court is scheduled to consider a case next week (South Dakota v. Wayfair, Inc.) that has the potential to significantly improve states and localities’ ability to enforce their sales tax laws on Internet purchases.

What to Expect if the Supreme Court Allows for Online Sales Tax Collection

April 11, 2018 • By Carl Davis

Online shopping is hardly a new phenomenon. And yet states and localities still lack the authority to require many Internet retailers to collect the sales taxes that their locally based, brick and mortar competitors have been collecting for decades.

Politifact: The Facts Behind Trump’s Jabs at Amazon on Taxes, USPS and Lost Retail Jobs

March 30, 2018

Amazon paid $957 million in income tax in 2017, according to regulatory filings. Amazon paid nothing in federal taxes this year thanks to tax credits and, in large part, Trump’s new tax law. But the Institute on Taxation and Economic Policy found that Amazon is either not collecting local taxes or is charging a lower […]

Fortune: President Trump Claims Amazon Pays “Little or No Taxes.” Here’s Where He’s Wrong

March 30, 2018

Where Trump is correct: Amazon doesn’t collect taxes on behalf of third-party vendors, and it still may not collect some local taxes, giving it an advantage over some traditional retailers, according to the Institute on Taxation and Economic Policy, a think tank. According to an analysis from the ITEP, the gap between the tax rate […]

Bloomberg Law: Trump’s Amazon Tweet Comes at Eventful Time for State-Local Taxes

March 30, 2018

Meanwhile, Amazon may not be paying its share of local sales taxes. A report released March 26 by the left-leaning Institute on Taxation and Economic Policy said Amazon either doesn’t collect and remit local sales tax or is charging a lower sales tax rate than traditional retailers in seven states: Alabama, Alaska, Idaho, Iowa, Mississippi, […]

Dallas Morning News: Texas Was Tougher Than Other States in Dealing with Amazon on Sales Taxes

March 30, 2018

When a Dallas resident or shopper in College Station or Lubbock makes a purchase from Amazon or any other online retailer with a physical presence in Texas such as Wayfair and RH.com, the state gets its 6.25 percent. The cities get their local sales taxes too. In Dallas, that’s an additional 2 percent for a […]

New York Times: As Amazon Steps Up Tax Collections, Some Cities Are Left Out

March 27, 2018

When Amazon agreed last year to begin collecting sales tax in New Mexico, state officials celebrated what they said could be tens of millions of dollars in annual tax revenue. But they aren’t cheering in Albuquerque City Hall. A year after that announcement, New Mexico’s largest city hasn’t seen a dime from Amazon. That’s because […]

Albuquerque Journal: NM cities miss out on Amazon tax payments

March 27, 2018

New Mexico is one of seven states in which Amazon is not collecting local sales taxes, even though the retail giant agreed last year to pay taxes to the state, according to a report released Monday. That’s because New Mexico has tax laws that prevent local collections, said the report by the Institute on Taxation […]

Seattle Times: As Amazon steps up tax collections, some cities are left out

March 27, 2018

Thanks in part to a series of deals with state governments in recent years, Amazon is collecting sales tax in every state that has one. But those deals do not always extend to taxes assessed by local governments. The company still is not collecting sales taxes in dozens of cities, including Philadelphia, Pittsburgh and Cedar […]

Bloomberg BNA: Tax Breaks Plentiful for Second Amazon HQ Even Without Bids

March 27, 2018

Amazon also benefits at the state and local level when it comes to sales tax, according to a report released March 26 by the Institute on Taxation and Economic Policy based in Washington, D.C. In seven states—Alabama, Alaska, Idaho, Iowa, Mississippi, New Mexico, and Pennsylvania—Amazon is either not collecting local taxes or charging a lower […]

Amazon Maintains Sales Tax Advantage over Local Businesses

March 26, 2018 • By ITEP Staff

This report concludes that lack of consistent sales tax collection is contributing to an unlevel playing field for local businesses “because millions of shoppers are able to pay less tax if they choose to buy from out-of-state companies over the Internet rather than at local stores.” It recommends that states explore reforms to bring their sales tax policies into the digital age.