North Carolina

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…

Tuesday’s elections shook up statehouses, governors’ offices, and tax laws in many states, and in this week’s Rundown we bring you the top 3 election state tax policy stories to emerge. First, voters in Kansas and other states sent a message that regressive tax cuts and supply-side economics have not succeeded and are not welcome among their state fiscal policies. Meanwhile, residents of many other states, including most notably Illinois, voted for representatives who reflect their preference for equitable, sustainable policies to improve their state economies through smart public investments and improve the lives of all residents through progressive tax structures. Lastly, while some states missed…

Washington Post: In blow to liberal efforts, voters across the country reject tax increases. (California is the exception.)

November 7, 2018

North Carolina voters, for instance, approved a change to their state constitution bringing down the maximum allowable tax rate from 10 percent to 7 percent. That will effectively only spare the rich from higher taxes, because no tax increases in that neighborhood are on the table for the middle class, but the average voter may […]

Governing: Voters Lower Cap on Income Tax in North Carolina

November 6, 2018

Still, many worry that locking down North Carolina’s income tax rates will hamstring future policymakers’ ability to raise revenue. North Carolina is one of a handful of states that has prioritized tax cuts over restoring education funding since the recession ended in 2009. It also is among states that saw teacher protests this spring over […]

In this special edition of the Rundown we bring you a voters’ guide to help make sense of tax-related ballot questions that will go before voters in many states in November. Interests in Arizona, Florida, North Carolina, Oregon, and Washington state have placed process-related questions on those states’ ballots in attempts to make it even harder to raise revenue or improve progressivity of their state and/or local tax codes. In response to underfunded schools and teacher strikes around the nation, Colorado voters will have a chance to raise revenue for their schools and improve their upside-down tax system at the…

NC Policy Watch: North Carolina’s Tax Code Isn’t Helping the State’s Growing Inequality

October 22, 2018

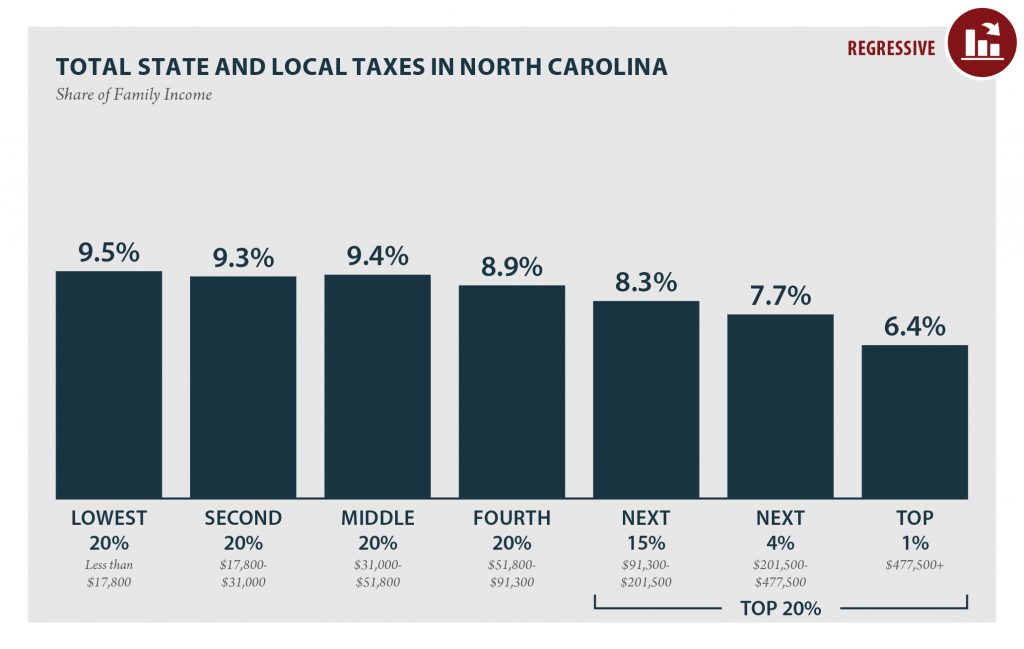

Despite claims by the architects of North Carolina’s failed tax-cut experiment, policy choices since 2013 have not ensured that middle and low-income taxpayers are paying lower shares of their income in state and local taxes. Instead the richest taxpayers—whose average income is more than $1 million—continue to pay 33 percent less in state and local taxes as a share of their income than taxpayers who have averages incomes annually of $11,000, a threshold that aligns with deep poverty.

Christian Science Monitor: A New Candidate Class: Schoolteachers Running For Office

October 22, 2018

North Carolina, one of six states where teachers held strikes before school let out last spring, “is an example of how lawmakers have prioritized tax cuts for corporations and the wealthy over public services,” says Meg Wiehe, deputy director of the Washington, DC-based Institute on Taxation and Economic Policy, and a North Carolina resident. “The big tax-cutting spree started here in 2013, and they’ve continued cutting.”

NC Policy Watch: Low-income Tax Payers in NC Pay More of Their Income in State and Local Taxes Each Year Than the Richest Taxpayers

October 17, 2018

Sales taxes play a critical role in the regressive and consequently inequitable nature of the North Carolina tax system. Like most other states, North Carolina relies on sales and excise taxes (30.7% of the 2018-2019 approved budget) as a primary mechanism to raise revenue. However, in North Carolina, sales and excise taxes are the most regressive taxes when compared to income and property taxes. The lowest 20% of North Carolina workers pay 6.1 percent in sales taxes as a percentage of their income while the top 1 percent pays less than 1 percent in sales taxes as a percentage of…

North Carolina: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

NORTH CAROLINA Read as PDF NORTH CAROLINA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $17,800 $17,800 to $31,000 $31,000 to $51,800 $51,800 to $91,300 $91,300 to $201,500 $201,500 to $477,500 […]

Truthout: North Carolina Ballot Initiative Would Enshrine Tax Cuts for the Rich

October 16, 2018

“Since 2012, when Republicans took full control of the legislature and governorship for the first time in modern history, they’ve been on a tax cutting rampage,” said Meg Wiehe, a North Carolina native and deputy director of the Institute on Taxation and Economic Policy. “The state will be about $3.6 billion shorter in revenue than it would have been otherwise, which is a pretty significant difference in a state with a general fund of just around $21 billion.”

TalkPoverty: North Carolina Legislators Want to Add Tax Breaks for the Rich to the State Constitution

October 11, 2018

“Since 2012, when Republicans took full control of the legislature and governorship for the first time in modern history, they’ve been on a tax cutting rampage,” said Meg Wiehe, a North Carolina native and deputy director of the Institute on Taxation and Economic Policy. “The state will be about $3.6 billion shorter in revenue than it would have been otherwise, which is a pretty significant difference in a state with a general fund of just around $21 billion.”

BTC Report: Income tax rate cap amendment is costly for taxpayers, communities

September 28, 2018

Imposing an arbitrary income tax cap in the North Carolina Constitution could fundamentally compromise our state’s ability to fund our schools, roads, and public health, as well as raise the cost of borrowing. This could all happen even as the tax load shifts even further onto middle- and low-income taxpayers and the state’s highest income taxpayers — the top 1 percent — continue to benefit from recent tax changes since 2013.

Tax Cuts 2.0 – North Carolina

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

The Rundown is back after a few-week hiatus, with lots of state fiscal news and quality research to share! Maine lawmakers found agreement on a response to the federal tax-cut bill, states continue to sort out how they’ll collect online sales taxes in the wake of the Wayfair decision, and policymakers in several states have been working on summer tax studies and other preparations for 2019 legislative sessions. Meanwhile, work on ballot measures and candidate tax plans to go before voters in November has been even more active, particularly in Arizona, California, Florida, Hawaii, and Missouri. Our “What We’re Reading” section has lots of great research and reading on inequalities, cities turning…

State Tax Codes as Poverty Fighting Tools: 2018 Update on Four Key Policies in All 50 States

September 17, 2018 • By Aidan Davis, Misha Hill

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2018, and offers recommendations that every state should consider to help families rise out of poverty. States can jumpstart their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

WRAL: Meg Wiehe: Capping North Carolina’s top income tax rate isn’t good for our communities

September 4, 2018

ITEP Deputy Director Meg Wiehe writes for WRAL.com that it would be unwise to constitutionally cap the North Carolina state income tax rate, pointing out that school funding in the state is already down and faltering revenues in other states have led to teacher pay crises and strikes.

WRAL: Capping North Carolina’s Top Tax Rate Isn’t Good for Our Communities

September 4, 2018

Following is an excerpt from an op-ed written by ITEP deputy director Meg Wiehe: Earlier this year, teachers across the country staged walkouts or full-on strikes to protest low wages and lack of investment in education. North Carolina public school teachers and their allies participated too, calling for better pay and more overall school spending […]

State Rundown 8/8: States Setting Rules for Upcoming Tax Decisions

August 8, 2018 • By ITEP Staff

August is often a season for states to define the parameters of tax debates to come, and that is true this week in several states: a tax task force in Arkansas is nearing its final recommendations; residents of Missouri, Montana, and North Carolina await results of court challenges that will decide whether tax measures will show up on their ballots this fall; and Michigan and South Dakota are taking different approaches to making sure they’re ready to collect online sales taxes next year.

The Fight for Education Funding: State Revenue Needs and Responses in 2018

July 24, 2018 • By Aidan Davis

States’ need for revenue and increased investment in key public services is not unique to this legislative session. But the extent of disinvestment—particularly in education—has been a driving force behind policy discussion and state legislative action this year. In many cases ill-advised tax cuts coupled with persistent school funding cuts led states to this common fate, initiating a powerful and growing trend. Here’s how lawmakers in a handful of state responded:

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2018 • By Dylan Grundman O'Neill

An updated version of this brief for 2019 is available here. Read this report in PDF. Overview Sales taxes are an important revenue source, composing close to half of all state tax revenues.[1] But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and […]

New Jersey avoided a second consecutive shutdown and proved that even against staunch opposition, progressive solutions to states' fiscal issues are attainable, and Arizona voters will likely have a chance to solve their education funding crisis in a similar way. Budget and tax debates remain to be resolved, however, in Maine and Massachusetts. Meanwhile, voters are gaining a clearer picture of what questions they will be asked on ballots this fall as signature drives conclude in several states.

Washington Post: At State Level, GOP Renews Push to Require ‘supermajorities’ for Tax Hikes, Imperiling Progressive Agenda

July 9, 2018

In three additional states — Florida, Oregon and North Carolina — conservative lawmakers and business groups are currently advancing similar measures, said Meg Wiehe, a tax analyst at the Institute on Taxation and Economic Policy, a left-leaning think tank. Read more

This week, lawmakers in Louisiana, Pennsylvania, Rhode Island, Vermont, and the District of Columbia wrapped up their budgets in time for the new fiscal year that starts July first in most states, with some of these resolutions coming after contentious debates and repeated special sessions. New Jersey's debate is not yet finished as leaders clash over spending priorities and the taxes on millionaires and corporations needed to fund them. Meanwhile, signature drives to put tax-related questions on fall ballots are heating up in several other states. And our "What We're Reading" section includes helpful resources on implications of the Supreme…

The U.S. Supreme Court made big news this morning by allowing states to collect taxes due on internet purchases, which will help put main-street and online retailers on an even playing field while also improving state and local revenues and the long-term viability of the sales tax as a revenue source. Many states remain focused on more local issues, however, as Louisiana's third special session of the year kicked off, Massachusetts won a living wage battle while losing an opportunity to put a popular millionaires tax proposal before voters, and major fiscal debates continue in Maine, New Jersey, and Vermont.

State Rundown 6/13: Budget Crunch Time Sets in as State Fiscal Years Come to Close

June 13, 2018 • By ITEP Staff

With many state fiscal years ending June 30th, budget negotiations were completed recently in California, Illinois, Michigan, and North Carolina. New Jersey remains a state to watch as a government shutdown looms but leaders continue to disagree about a proposed millionaires tax, corporate taxes, and school funding. In other states looking to wealthy individuals and large corporations for needed revenues, Arizona's teacher pay crisis could be solved with a tax on its highest-income residents and a similar proposal in Massachusetts is polling well, but Seattle's new "head tax" could be on the chopping block.