Rhode Island

America Used to Have a Wealth Tax: The Forgotten History of the General Property Tax

November 2, 2023 • By Carl Davis, Eli Byerly-Duke

Over time, broad wealth taxes were whittled away to become the narrower property taxes we have today. These selective wealth taxes apply to the kinds of wealth that make up a large share of middle-class families’ net worth (like homes and cars), but usually exempt most of the net worth of the wealthy (like business equity, bonds, and pooled investment funds).The rationale for this pared-back approach to wealth taxation has grown weaker in recent decades as inequality has worsened, the share of wealth held outside of real estate has increased, and the tools needed to administer a broad wealth tax…

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.

Summer is here and many states nearing the end of their legislative sessions. Temperatures are rising in more ways than one in some state legislatures while others seem to be cooling off.

Across the country, the marathon budget season has held pace, with a steady stream of bills continuing to cross the finish line...

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

This week, a bill out of Arkansas that would cut the top personal income tax rate and the corporate income tax rate found its way to the governor’s desk...

State Rundown 1/19: ITEP Provides a Roadmap for Equitable Tax Goals in 2023

January 19, 2023 • By ITEP Staff

State legislatures are buzzing as leaders and lawmakers jockey to advance their 2023 goals...

The new year often brings with it new goals and a desire to take on complex problems with a fresh perspective. Unfortunately, that doesn’t always apply to state lawmakers when considering tax policy...

The Economic Progress Institute: Rhode Island Standard of Need

November 18, 2022

With scenic beaches, culinary and arts communities, higher education institutions, and a vibrant celebration of culture, Rhode Island can be a wonderful place to live and to raise a family. Yet many Rhode Islanders work at jobs with wages that pay too little to meet even the most basic living costs. They experience multiple barriers […]

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

Although the weather is beginning to cool down in parts of the country, the same cannot be said for many state economies, which are still running hot. That, however, doesn’t mean that the good times are guaranteed to last...

ITEP Policy Briefs: More and More States Are Helping Low-Income Families with New and Expanded Tax Credits

September 15, 2022 • By ITEP Staff

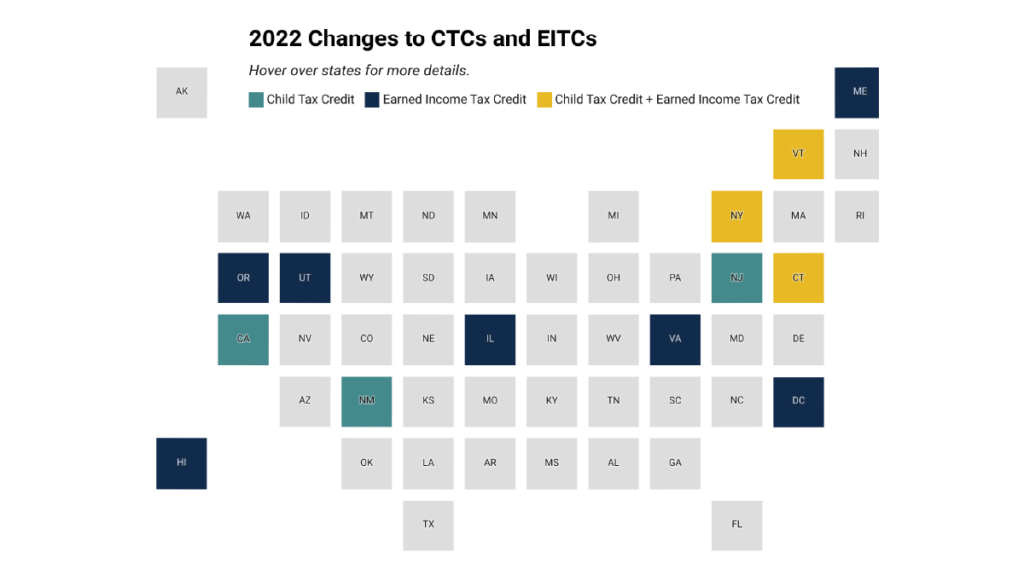

13 states plus D.C. created or expanded state CTCs or EITCs this year, helping create more equitable state tax systems WASHINGTON, D.C.: In 2022’s state legislative sessions, lawmakers across the country advanced tax policies that will bolster the economic security of millions of low- and moderate-income working families through new and enhanced Child Tax Credits […]

More States are Boosting Economic Security with Child Tax Credits in 2022

September 15, 2022 • By Aidan Davis

After years of being limited in reach, there is increasing momentum at the state level to adopt and expand Child Tax Credits. Today ten states are lifting the household incomes of families with children through yearly multi-million-dollar investments in the form of targeted, and usually refundable, CTCs.

Census Data Shows Need to Make 2021 Child Tax Credit Expansion Permanent

September 14, 2022 • By Joe Hughes

The Child Tax Credit expansion led to a 46 percent decline in childhood poverty. That it could be accomplished during the largest economic disruption in most of our lifetimes underscores a basic fact: thoughtful, decisive government action to combat poverty works.

State Rundown 8/10: States Still Talking Taxes as IRA Dominates Headlines

August 10, 2022 • By ITEP Staff

While federal tax policy has dominated the headlines with the Senate’s recent approval of the Inflation Reduction Act, lawmakers in statehouses across the country...

Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs

July 22, 2022 • By Neva Butkus

State legislatures across the country made investments in their future, centering children, families, and workers by enacting and expanding state Earned Income Tax Credits (EITCs), Child Tax Credits (CTCs), and other refundable credits this session. In total, seven states either expanded or created CTCs this session. Connecticut, New Mexico, New Jersey, Rhode Island and Vermont […]

With inflation dominating headlines both nationally and locally, state lawmakers around the U.S. are searching for ways to put their revenues to good use, and not surprisingly, some options are better than others...

State Rundown 6/8: Tax Policy Features Prominently During Budget and Primary Season

June 8, 2022 • By ITEP Staff

As voters head to the polls to weigh in on their state’s primary elections and legislators convene to hash out budget deals, tax policy remains atop the agenda...

Excess Profits Tax Proposals Meet the Moment, But Lawmakers Should Keep Their Eye on Fundamentally Fixing Our Corporate Tax

March 25, 2022 • By Steve Wamhoff

New corporate tax proposals address the current situation, but ultimately leaders in Washington must fix federal law to tax all corporate profits and stop the tax dodging that is rampant today.

ITEP is happy to announce the launch of our new State Tax Watch page, where you can find out about the most up-to-date tax proposals and permanent legislative changes happening across the country...

Several state legislatures are continuing to push ahead this year with significant tax cut packages that are regressive and would dramatically reduce revenues and leave states in a bad position should they experience another unexpected economic shock...

While record state revenue surpluses have led to big pushes in red states to make unnecessary permanent income and corporate tax cuts, Democrats are also getting in on the tax-cut mania...

State Rundown 1/26: States Offering Preview of Tax Themes and Trends for 2022

January 26, 2022 • By ITEP Staff

Governors and legislators are beginning to settle on and advance tax bills that could drastically shape the future of their states and several trends and themes are beginning to emerge...

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.