Trump-GOP Tax Law

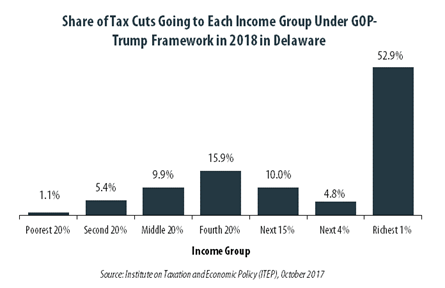

GOP-Trump Tax Framework Would Provide Richest One Percent in Delaware with 52.9 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Delaware equally. The richest one percent of Delaware residents would receive 52.9 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $497,100 next year. The framework would provide them an average tax cut of $49,370 in 2018, which would increase their income by an average of 2.7 percent.

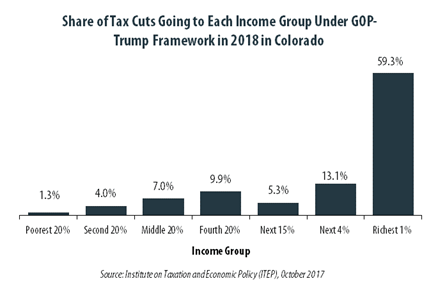

GOP-Trump Tax Framework Would Provide Richest One Percent in Colorado with 59.3 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Colorado equally. The richest one percent of Colorado residents would receive 59.3 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $637,800 next year. The framework would provide them an average tax cut of $86,480 in 2018, which would increase their income by an average of 4.7 percent.

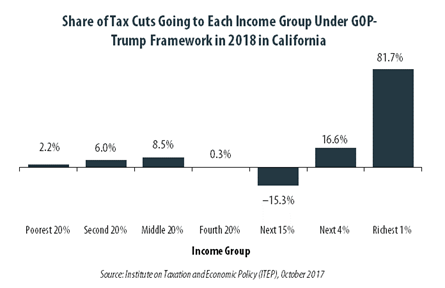

GOP-Trump Tax Framework Would Provide Richest One Percent in California with 81.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in California equally. The richest one percent of California residents would receive 81.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $864,900 next year. The framework would provide them an average tax cut of $90,160 in 2018, which would increase their income by an average of 3.3 percent.

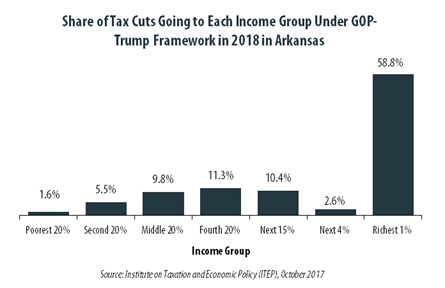

GOP-Trump Tax Framework Would Provide Richest One Percent in Arkansas with 58.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Arkansas equally. The richest one percent of Arkansas residents would receive 58.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $490,000 next year. The framework would provide them an average tax cut of $51,370 in 2018, which would increase their income by an average of 3.8 percent.

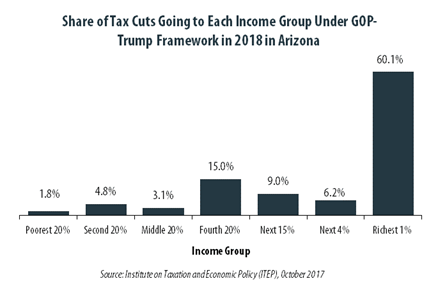

GOP-Trump Tax Framework Would Provide Richest One Percent in Arizona with 60.1 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Arizona equally. The richest one percent of Arizona residents would receive 60.1 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $470,200 next year. The framework would provide them an average tax cut of $59,210 in 2018, which would increase their income by an average of 4.4 percent.

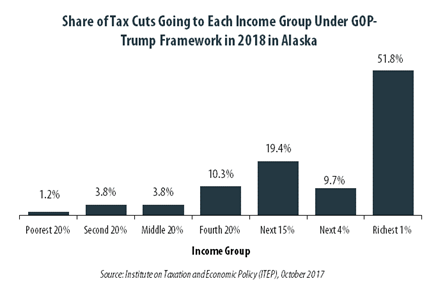

GOP-Trump Tax Framework Would Provide Richest One Percent in Alaska with 51.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Alaska equally. The richest one percent of Alaska residents would receive 51.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $615,800 next year. The framework would provide them an average tax cut of $77,880 in 2018, which would increase their income by an average of 5.5 percent.

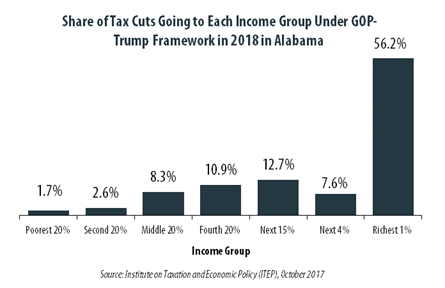

GOP-Trump Tax Framework Would Provide Richest One Percent in Alabama with 56.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Alabama equally. The richest one percent of Alabama residents would receive 56.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $501,800 next year. The framework would provide them an average tax cut of $49,830 in 2018, which would increase their income by an average of 3.5 percent.

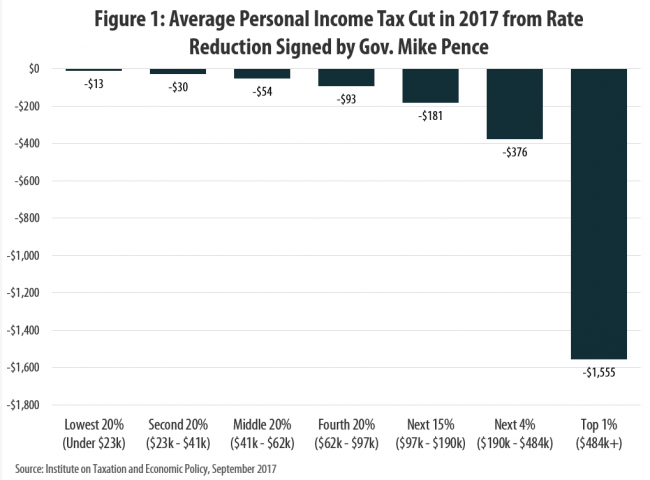

Indiana’s Tax Cuts Under Mike Pence Are Not a Model for the Nation

September 29, 2017 • By Carl Davis

In announcing a new tax cut framework this week in Indianapolis that was negotiated with House and Senate leaders, President Trump claimed that “Indiana is a tremendous example of the prosperity that is unleashed when we cut taxes and set free the dreams of our citizens …. In Indiana, you have seen firsthand that cutting taxes on businesses makes your state more competitive and leads to more jobs and higher paychecks for your workers.”

Fact Sheet: The Consequences of Adopting a Territorial Tax System

September 18, 2017 • By Steve Wamhoff

President Trump and Republican leaders in Congress have proposed a “territorial” tax system, which would allow American corporations to pay no U.S. taxes on most profits they book offshore. This would worsen the already substantial problem of corporate tax avoidance and result in more jobs and investment leaving the U.S. Lawmakers should know some key facts about the territorial approach.

Census Data Reveal Modest Gains for Working People; GOP Tax Overhaul Could Reverse These Gains

September 14, 2017 • By Jenice Robinson

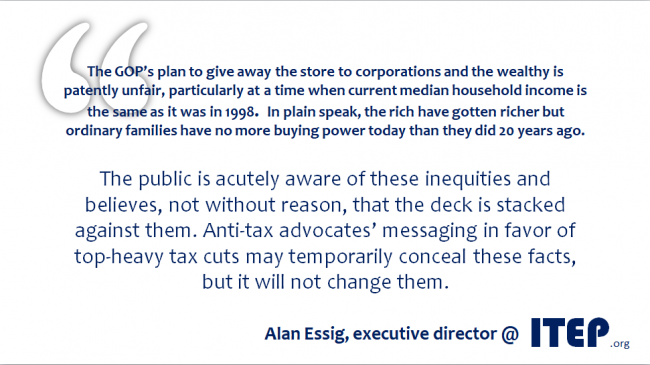

On the surface, census poverty and income data released Tuesday reveal the nation’s economic conditions are improving for working families. The federal poverty rate declined for the second consecutive year and is now on par with the pre-recession rate. For the first time, median household income surpassed the peak it reached in 1999 and is […]

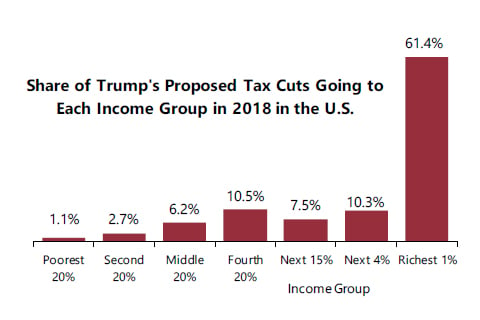

Trump Proposals Would Reduce the Share of Taxes Paid by the Richest 1%, Raise It for Everyone Else

September 13, 2017 • By Steve Wamhoff

The tax proposals released by the Trump Administration in April would reduce the share of total federal, state and local taxes paid by America’s richest 1 percent while increasing the share paid by all other income groups. This clearly indicates that the tax system would be less progressive under the president’s approach.

New ITEP Report: Trump’s Proposed Territorial Tax System Would Increase Corporate Tax Dodging

September 6, 2017 • By Steve Wamhoff

While promoting his ideas for overhauling our tax code today in North Dakota, President Trump said that Congress should adopt a territorial tax system which, he argued, would result in more investment in the United States. You’re not alone if you’re not sure what “territorial” means in this context. It’s a euphemism used by some politicians to describe a proposal that will be wildly unpopular once voters understand what it really means.

Turning Loopholes into Black Holes: Trump’s Territorial Tax Proposal Would Increase Corporate Tax Avoidance

September 6, 2017 • By Matthew Gardner, Steve Wamhoff

The problem of offshore tax avoidance by American corporations could grow much worse under President Donald Trump’s proposal to adopt a “territorial” tax system, which would exempt the offshore profits of American corporations from U.S. taxes. This change would increase the already substantial benefits American corporations obtain when they use accounting gimmicks to make their profits appear to be earned in a foreign country that has no corporate income tax or has one that is extremely low or easy to avoid.

Tax Reform Principles Released by GOP in August Raise More Questions Than They Answer

August 31, 2017 • By Steve Wamhoff

Before Wednesday, you may have forgotten about tax reform given that President Trump’s remarks on the Charlottesville white supremacist rally, as well as the first U.S. solar eclipse since 1979, and Hurricane Harvey, overshadowed most other news. But Republicans on the House Ways and Means Committee, which in theory is the starting place for any tax legislation, certainly tried to get the public to focus on their vision for tax reform. They released a “reason for tax reform” each day in August. Unfortunately, these “reasons” are a combination of ideas that their proposals fail to address and misleading assertions.

Trump (Sort of) Used Our Data on Corporate Tax Avoidance, But He Missed the Point

August 31, 2017 • By Matthew Gardner

On Wednesday, reporters waiting to write about President Trump’s much-ballyhooed tax reform speech in Missouri received a fact sheet from the White House informing them that, “Fortune 500 corporations are holding more than $2.6 trillion in profits offshore to avoid $767 billion in Federal taxes, according to the Institute on Taxation and Economic Policy.”

Sorting Through the Fallacies in Trump’s Missouri Tax Speech

August 30, 2017 • By Steve Wamhoff

President Donald Trump spoke in Springfield, Missouri today about the need for a tax reform that provides “more jobs and higher wages for America” and “tax relief for middle-class families.” But the proposals the Trump administration has released so far would cut taxes for companies moving investment offshore and would provide most tax cuts to the richest one percent of taxpayers.

Inaccuracies Pile Up During Speaker Ryan’s Town Hall Meeting

August 22, 2017 • By Steve Wamhoff

On Monday, House Speaker Paul Ryan participated in a live-broadcast town hall meeting in his district in Wisconsin where he discussed tax reform, among other issues. One could credit Ryan for holding such a meeting, but sadly, anyone wishing to learn about the rationale for Ryan’s ideas on taxes would have been disappointed.

Today, the economic climate is starkly different, but it seems GOP leaders are relying on messaging and luck to push through the biggest tax package since 1986. The White House, Republican leaders and anti-tax advocates all have been toeing the same erroneous line: their plans to cut individual and corporate taxes will benefit middle class families and grow the economy. This is, of course, baloney.

In North Carolina 42.4 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the North Carolina population (0.5 percent) earns more than $1 million annually. But this elite group would receive 42.4 percent of the tax cuts that go to North Carolina residents under the tax proposals from the Trump administration. A much larger group, 50.8 percent of the state, earns less than $45,000, but would receive just 5.9 percent of the tax cuts.

In North Dakota 44.5 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the North Dakota population (0.5 percent) earns more than $1 million annually. But this elite group would receive 44.5 percent of the tax cuts that go to North Dakota residents under the tax proposals from the Trump administration. A much larger group, 42.2 percent of the state, earns less than $45,000, but would receive just 3.9 percent of the tax cuts.

In Nebraska 38.4 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Nebraska population (0.5 percent) earns more than $1 million annually. But this elite group would receive 38.4 percent of the tax cuts that go to Nebraska residents under the tax proposals from the Trump administration. A much larger group, 41.8 percent of the state, earns less than $45,000, but would receive just 5.0 percent of the tax cuts.

In Nevada 51.7 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Nevada population (0.3 percent) earns more than $1 million annually. But this elite group would receive 51.7 percent of the tax cuts that go to Nevada residents under the tax proposals from the Trump administration. A much larger group, 47.5 percent of the state, earns less than $45,000, but would receive just 5.4 percent of the tax cuts.

In New Hampshire 33.5 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the New Hampshire population (0.3 percent) earns more than $1 million annually. But this elite group would receive 33.5 percent of the tax cuts that go to New Hampshire residents under the tax proposals from the Trump administration. A much larger group, 35.1 percent of the state, earns less than $45,000, but would receive just 5.1 percent of the tax cuts.

In New Mexico 35.3 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the New Mexico population (0.3 percent) earns more than $1 million annually. But this elite group would receive 35.3 percent of the tax cuts that go to New Mexico residents under the tax proposals from the Trump administration. A much larger group, 47.5 percent of the state, earns less than $45,000, but would receive just 5.8 percent of the tax cuts.

In Michigan 38.6 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Michigan population (0.2 percent) earns more than $1 million annually. But this elite group would receive 38.6 percent of the tax cuts that go to Michigan residents under the tax proposals from the Trump administration. A much larger group, 43.3 percent of the state, earns less than $45,000, but would receive just 4.2 percent of the tax cuts.