Virginia

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. But another third of states lost ground, continuing a trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable.

Mountain State Spotlight: Tax Cuts, Low-Balled Estimates and Volatile Revenues: Inside West Virginia’s $1.8 Billion Budget Surplus

July 1, 2023

Gov. Jim Justice has used the state’s budget surplus as proof of his business skills as he runs for the U.S. Senate. But the surplus is built on unpredictable revenue streams and will likely be temporary. Read more.

State Rundown 6/28: Movement on Refundable Credits Remains Hot Topic in 2023

June 28, 2023 • By ITEP Staff

The trend of state lawmakers taking big steps on important tax credits like the Child Tax Credit and Earned Income Tax Credit is coming out in full force this week...

Illinois Voucher Tax Credits Don’t ‘Invest in Kids,’ They Invest in Inequality

June 12, 2023 • By Carl Davis

By allowing their school privatization tax credit to expire at the end of the year, Illinois lawmakers can take a meaningful step toward better tax and education policy, and a clear show of support for our nation’s public education system.

Letter to IRS on Section 1001 Regulation in 2023-2024 Priority Guidance Plan

June 9, 2023 • By ITEP Staff

Read as PDF Re: Recommendation for Inclusion of Section 1001 Regulation in 2023-2024 Priority Guidance Plan To Whom It May Concern, We are writing to respectfully urge that the IRS return to the work it left unfinished in 2019 when it issued final regulations on “Contributions in Exchange for State or Local Tax Credits” (RIN: […]

The Commonwealth Institute: Cutting Top Personal Income Tax Boosts the Wealthy, Excludes People with Lower Incomes

June 6, 2023

With no budget compromise yet from the Virginia General Assembly, $1 billion in untargeted tax cuts that mostly benefit the wealthy and profitable corporations are still on the table. Read more.

This op-ed was originally published by Route Fifty and co-written by ITEP State Director Aidan Davis and Center on Budget and Policy Priorities Senior Advisor for State Tax Policy Wesley Tharpe. There’s a troubling trend in state capitols across the country: Some lawmakers are pushing big, permanent tax cuts that primarily benefit the wealthy and […]

Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Circuit breaker credits are the most effective tool available to promote property tax affordability. These policies prevent a property tax “overload” by crediting back property taxes that go beyond a certain share of income. Circuit breakers intervene to ensure that property taxes do not swallow up an unreasonable portion of qualifying households’ budgets.

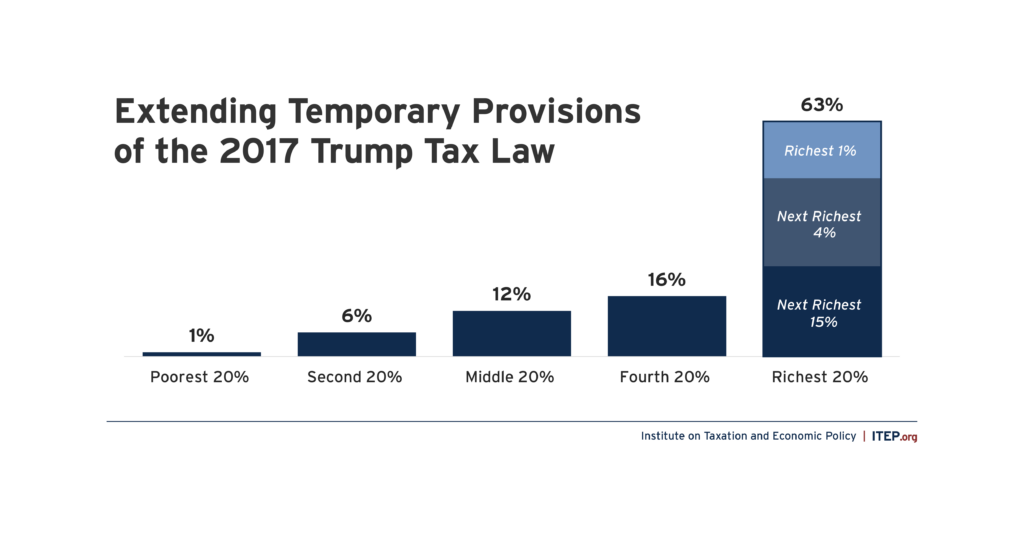

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

Minnesota’s House, Senate and Governor’s office have each proposed their own vision as to how the state should maximize its $17.5 billion surplus and raise new revenue, and these tax plans make one thing clear: Minnesota lawmakers are serious about using tax policy to advance tax equity and improve the lives of Minnesotans.

The Lever: Joe Manchin’s Tax Hike On The Working Class

April 25, 2023

Despite representing one of America’s poorest states, West Virginia Sen. Joe Manchin (D) decided in 2021 to kill legislation to extend expanded child and antipoverty tax credits that were helping the working class. The expiration of the expanded tax credits resulted in more than three million kids being thrown into poverty. New data shows it also resulted in a massive regressive tax increase […]

Deep Public Investment Changes Lives, Yet Too Many States Continue to Seek Tax Cuts

April 12, 2023 • By Aidan Davis

When state budgets are strong, lawmakers should put those revenues toward building a stronger and more inclusive society for the long haul. Yet, many state lawmakers have made clear that their top priority is repeatedly cutting taxes for the wealthy.

Over the past week Washington state saw a major victory for tax fairness after the state Supreme Court held the state’s capital gains tax—passed in 2021—constitutional...

State governments provide a wide array of tax subsidies to their older residents. But too many of these carveouts focus on predominately wealthy and white seniors, all while the cost climbs.

State Rundown 3/9: The Whirlwind 2023 Legislative Session Continues

March 9, 2023 • By ITEP Staff

State 2023 legislative sessions are proving to be eventful ones. With many states eager to make use of their budget surpluses, major tax changes are still being proposed and others signed into law. Michigan residents will soon see an increase to their state Earned Income Tax Credit (from 6 percent to 30 percent) after the […]

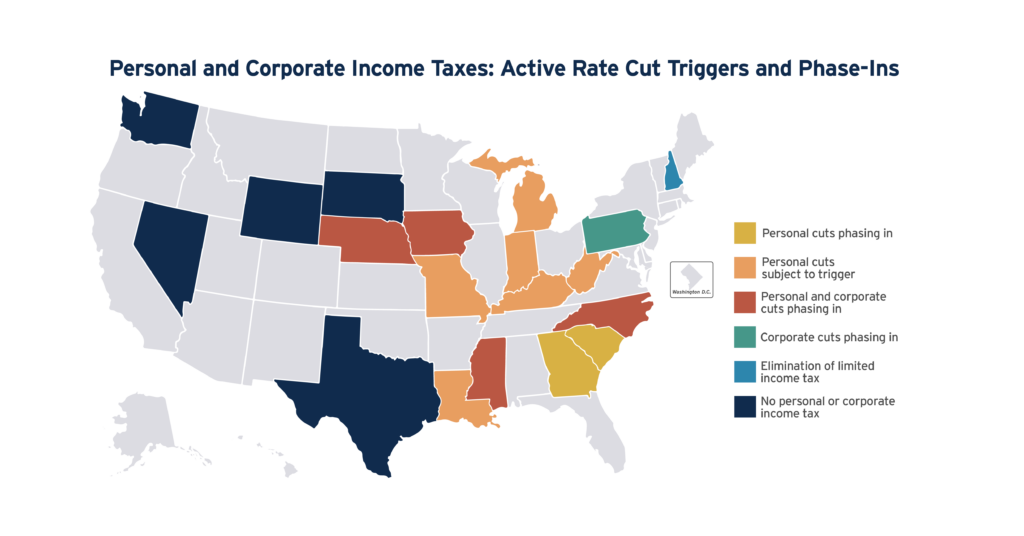

In recent years, lawmakers have been quick to push for phased-in tax cuts or cuts attached to trigger mechanisms. These policy tools push the implementation of tax cuts outside of the current budget window with a predetermined phase-in schedule or a mathematical formula tied to state revenue trends.

Lured by Promises of Financial Gain, Wealthy Families are Flocking to Voucher Tax Shelters and Eroding Public Education in the Process

March 7, 2023 • By ITEP Staff

Contact: Jon Whiten – [email protected] Lawmakers in several states are discussing enacting or expanding school voucher tax credits, which reimburse individuals and businesses for “donations” they make to organizations that give out vouchers for free or reduced tuition at private K-12 schools, as a new brief released today by the Institute on Taxation and Economic […]

Wealthy families are overwhelmingly the ones using school voucher tax credits to opt out of paying for public education and other public services and to redirect their tax dollars to private and religious institutions instead. Most of these credits are being claimed by families with incomes over $200,000.

This week, several big tax proposals took strides on the march toward becoming law...

This week, a fresh bouquet of tax proposals was delivered by state lawmakers, but not all of them have left us with that warm, fuzzy feeling in our stomachs...

The great women’s philosopher, Pat Benatar, once said “love is a battlefield,” and there’s no greater test of our love for state tax policy than following the ups and downs of state legislative sessions...

State Rundown 1/26: Tax Season Brings With it Reminder of EITC’s Impact

January 26, 2023 • By ITEP Staff

Tax season has officially kicked off and with Earned Income Tax Credit (EITC) Awareness Day right around the corner, it serves as another reminder for how important the EITC is...

State Rundown 1/19: ITEP Provides a Roadmap for Equitable Tax Goals in 2023

January 19, 2023 • By ITEP Staff

State legislatures are buzzing as leaders and lawmakers jockey to advance their 2023 goals...

State Lawmakers Should Break the 2023 Tax Cut Fever Before It’s Too Late

January 18, 2023 • By Miles Trinidad

Despite mixed economic signals for 2023, including a possible recession, many state lawmakers plan to use temporary budget surpluses to forge ahead with permanent, regressive tax cuts that would disproportionately benefit the wealthy at the expense of low- and middle-income households. These cuts would put state finances in a precarious position and further erode public investments in education, transportation and health, all of which are crucial for creating inclusive, vibrant communities where everyone, not just the rich, can achieve economic security and thrive. In the event of an economic downturn, these results would be accelerated and amplified.

The Commonwealth Institute: Support Virginia Families Through a Commonwealth Kids Credit

January 17, 2023

True economic prosperity means that families are doing well and have the resources and opportunity to thrive. By coming together, people in Virginia have won an improved Earned Income Tax Credit (EITC), increased minimum wage, and expanded workers rights in recent years — policy wins that lift families up. Yet more must be done to […]