Washington

What Did 2025 State Tax Changes Mean for Racial and Economic Equity?

February 9, 2026 • By Brakeyshia Samms

The results are a mixed bag, with some states enacting promising policies that will improve tax equity and others going in the opposite direction.

Testimony: ITEP’s Sarah Austin Urges Washington House Finance Committee to Decouple from Venture Capital Tax Break

January 28, 2026

The prepared testimony below was delivered by ITEP Senior Analyst Sarah Austin to the Washington House Finance Committee on January 27, 2026. For more on the tax break in question, check out our October 2025 brief. Chair Berg, Vice Chair Street, and members of the House Finance Committee, My name is Sarah Austin, I’m a […]

State Rundown 1/22: Cautious Tone Noticeable in Most Statehouses

January 22, 2026 • By ITEP Staff

Most states are adopting a very cautious approach so far this year as legislators begin their sessions and governors make their annual addresses, thanks to ongoing economic uncertainty and federal retrenchment.

States Can Push Back Against Reckless Federal Tax Policy. Here’s How.

January 22, 2026 • By Aidan Davis, Wesley Tharpe

They should take steps to protect and boost their own revenues. And they should take a second look at their own tax cuts.

State Rundown 1/7: New Year, New Opportunities for Progressive Revenue

January 7, 2026 • By ITEP Staff

As we kick off a new year, several states are facing revenue shortfalls. Some lawmakers are approaching the challenge with sustainable and equitable solutions.

Washington Governor’s Office: Governor Ferguson Announces Support for Millionaires’ Tax

January 6, 2026

Washington ranks next to last for fairness and equality in our tax system — meaning those who make the least pay much larger shares of their income than those with the most resources. Washington families whose income is in the bottom 20% pay 13.8% of their total income in taxes, while those whose income is […]

HeraldNet: Editorial: ‘Millionaires’ tax’ can deliver fairness, revenue

January 5, 2026

We should all hope we’d be in the financial position where we’d have to pay Gov. Bob Ferguson’s proposed “millionaires’ tax,” because — as the name implies — it would levy a tax on annual income above $1 million, meaning we’d be doing pretty well. Read more.

State Rundown 12/17: Tax Policy ‘Naughty or Nice’ List Has Late Entrants

December 17, 2025 • By ITEP Staff

With a little over a week left, some states are solidifying their spots on the tax policy “naughty or nice” list.

States are increasingly facing difficult choices as revenues stagnate and deficits come clearer into focus.

State and Local Policymakers Can Resist Austerity Even Amid Historic Federal Retreat

November 6, 2025 • By Kamolika Das

The progressivity of the federal tax code has been waning. State and local policymakers should respond by protecting their revenue bases, promoting equity, and safeguarding vulnerable communities from harmful budget cuts.

The Wealth Proceeds Tax: A Simple Way for States to Tax the Wealthy

October 30, 2025 • By Sarah Austin, Carl Davis

Taxing the proceeds generated by wealth through a new Wealth Proceeds Tax is a simple way for states to raise billions in new revenue and improve the fairness of their tax systems.

Los Angeles Times: Corporate Tax Breaks Are Exploding the Federal Deficit, but Who Gets the Benefits?

October 15, 2025

The question is who stands to gain most from the tax policymaking in Washington — corporations, their shareholders and their executives, most of whom don’t have to worry about whether cutting off Obamacare subsidies will leave them unable to afford healthcare, or the millions of Americans for whom the subsidies can often spell the difference […]

State Rundown 10/1: State and Local Governments Doing the Opposite of Shutting Down

October 1, 2025 • By ITEP Staff

State and local officials are staying very busy by considering a dizzying amount of reversals.

Rep. Steve Cohen: Congressmen Cohen and Beyer and Senator Wyden Introduce the Billionaire Income Tax Act

September 18, 2025

WASHINGTON – Congressmen Steve Cohen (TN-9) and Don Beyer (VA-8) and Senator Ron Wyden of Oregon today introduced bicameral Billionaire Income Tax Act bills in an effort to establish a level of fairness in federal taxation and prevent millionaires and billionaires (and one prospective trillionaire) from avoiding significant liability. The measure would tax wealth gains as […]

State Rundown 9/18: Lawmakers Confront Revenue Loss from Federal Policy Changes

September 18, 2025 • By ITEP Staff

Some states are trying to avoid revenue loss while others are welcoming it and doubling down.

Wall Street Journal: Blue States Hunt for Ways to Wring More Taxes From the Wealthy

August 14, 2025

A growing number of blue cities and states across the country, from Washington state to Rhode Island, are looking at ways to wring more revenue from their richest taxpayers.

Trump’s Tax Law Clobbers State Budgets. Now’s the Time to Prepare.

August 13, 2025 • By ITEP Staff

The Trump megabill hands the richest 1% a trillion-dollar windfall while gutting funding for health care, education, and disaster relief — leaving communities to pick up the pieces. State and local leaders must step up, tax the wealthiest fairly, and safeguard the essentials that keep America healthy, educated, and safe.

State Tax Action in 2025: Amid Uncertainty, Tax Cuts and New Revenue

July 28, 2025 • By Aidan Davis, Neva Butkus, Marco Guzman

Federal policy choices on tariffs, taxes, and spending cuts will be deeply felt by all states, which will have less money available to fund key priorities. This year some states raised revenue to ensure that their coffers were well-funded, some proceeded with warranted caution, and many others passed large regressive tax cuts that pile on to the massive tax cuts the wealthiest just received under the federal megabill.

State Rundown 7/8: State Tax Cuts Continue Despite Federal Megabill Passing

July 8, 2025 • By ITEP Staff

The last states are wrapping up legislative sessions, and some are crossing the finish line with major income tax cuts.

New York Times: States Brace for Added Burdens of Trump’s Tax and Spending Law

July 7, 2025

The ink is not even dry on the far-reaching domestic policy law that President Trump signed on Friday, and already state governments are bracing for impact as Washington shifts much of the burden for health care, food assistance and other programs onto them.

Many states are reaching their end-of-June budget deadlines, and major tax policy changes look to have big implications as states are forced, per federal policy, to do more with less.

Washington State Budget & Policy Center: The Economic and Fiscal Impacts of Mass Deportation: What’s at Risk in Washington State

May 22, 2025

In 2022, people who are undocumented paid nearly $1 billion ($997 million) in Washington state and local taxes.2 If 10% of people who are undocumented are deported, it would result in a loss of $100 million per year in state and local tax revenues.

State Rundown 5/21: Big and Not-So Beautiful Tax Cut Bills Abound in States

May 21, 2025 • By ITEP Staff

As a sprawling, regressive tax bill continues to take shape at the federal level, many states are moving forward with major tax cut proposals of their own.

Sacramento Bee: Child Tax Credits: California’s Winners and Losers in New GOP Congressional Plan

May 13, 2025

But there’s also a sobering feature: The parents of an estimated 910,000 California children would lose the credit because their child has at least one undocumented immigrant parent without a Social Security number, according to an analysis by several research groups including Washington’s Institute on Taxation and Economic Policy.

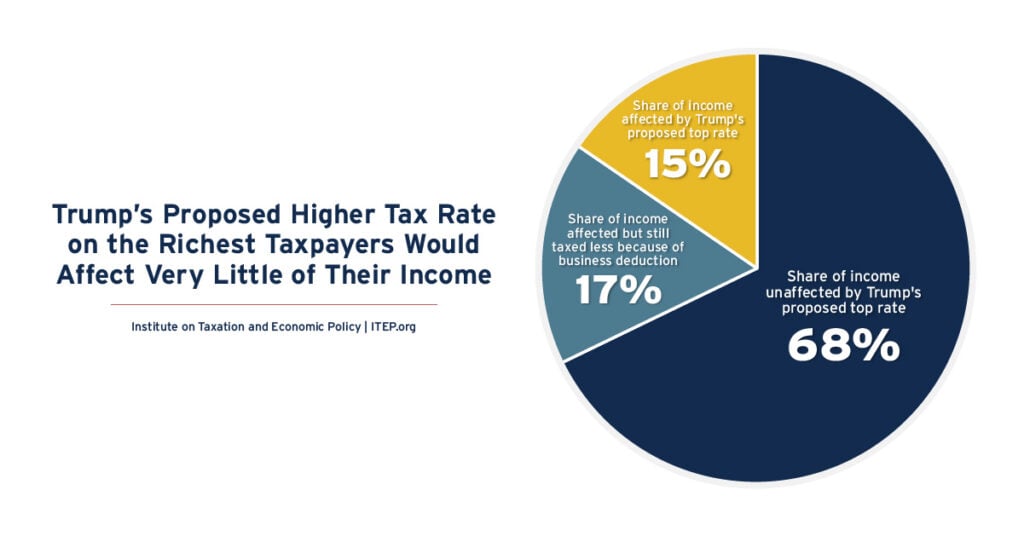

Trump’s Proposed Higher Tax Rate on the Richest Taxpayers Would Affect Very Little of Their Income

May 10, 2025 • By Carl Davis, Steve Wamhoff

President Donald Trump has proposed allowing the top rate to revert from 37 percent to 39.6 percent for taxable income greater than $5 million for married couples and $2.5 million for unmarried taxpayers. But many other special breaks in the tax code would ensure that most income of very well-off people would never be subject to Trump’s 39.6 percent tax rate.