Washington

Sacramento Bee: Child Tax Credits: California’s Winners and Losers in New GOP Congressional Plan

May 13, 2025

But there’s also a sobering feature: The parents of an estimated 910,000 California children would lose the credit because their child has at least one undocumented immigrant parent without a Social Security number, according to an analysis by several research groups including Washington’s Institute on Taxation and Economic Policy.

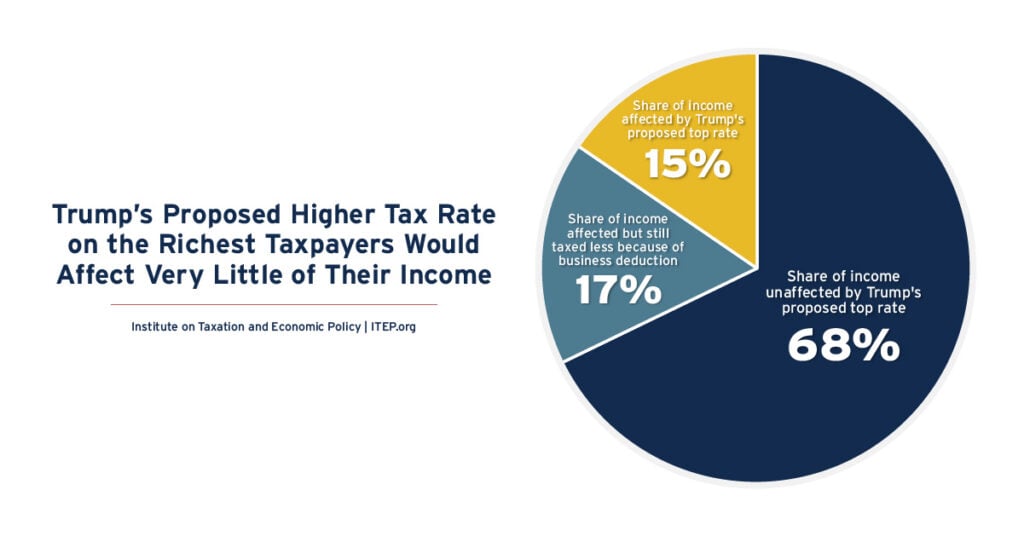

Trump’s Proposed Higher Tax Rate on the Richest Taxpayers Would Affect Very Little of Their Income

May 10, 2025 • By Carl Davis, Steve Wamhoff

President Donald Trump has proposed allowing the top rate to revert from 37 percent to 39.6 percent for taxable income greater than $5 million for married couples and $2.5 million for unmarried taxpayers. But many other special breaks in the tax code would ensure that most income of very well-off people would never be subject to Trump’s 39.6 percent tax rate.

State Rundown 5/7: As Budget Season Heats Up, Tax Proposals Are Getting Serious

May 7, 2025 • By ITEP Staff

With spring in full bloom ,many state lawmakers are reaching tax policy agreements. Out west, lawmakers in North Dakota and Texas have moved major property tax cuts. Meanwhile, in the east and south, Vermont appears likely to pass an expansion to its Child Tax Credit and Earned Income Tax Credit, and South Carolina lawmakers are aiming to make deep, drastic cuts to the state’s income tax.

State Rundown 5/1: State Tax Debates Wrapping Up, and Just Beginning

May 1, 2025 • By ITEP Staff

The rampant uncertainty this year extends far beyond the national economy and federal policy, as many state legislatures are declaring their tax and budget debates finished, and just getting started, sometimes in the same breath.

Equitable (and Less Equitable) Washington State Revenue Raisers

April 24, 2025 • By Dylan Grundman O'Neill

Washington state came into the year with strong tax justice momentum. Lawmakers’ innovative Capital Gains Excise Tax on the state’s highest-income households was upheld by the state and federal Supreme Courts and was overwhelmingly affirmed by voters despite a well-funded repeal effort. The new tax is bringing in much-needed revenue for schools, child care, and […]

State Rundown 4/24: States Push Tax Cuts Despite Fiscal Uncertainty

April 24, 2025 • By ITEP Staff

While some states are preparing for uncertainty – slowing revenue growth, chaos from unpredictable tariffs, cuts to federal programs, etc. – others continue to move forward with plans for deep tax cuts. For instance, Georgia Gov. Brian Kemp signed legislation accelerating the cut to the personal income tax rate, which is currently phasing down. […]

Trump Administration’s Decision to End Direct File is Another Gift to Big Corporations

April 16, 2025 • By ITEP Staff

Contact: Jon Whiten ([email protected]) According to multiple reports, the Trump administration plans to eliminate the IRS Direct File program, a free electronic system for filing tax returns directly to the agency. Statement from ITEP Executive Director Amy Hanauer “The tax preparation industry has for years lobbied to prevent the IRS from providing a tool to […]

State Rundown 4/16: No Vacation from Spring Tax Breaks as Bills Advance

April 16, 2025 • By ITEP Staff

While students and families are enjoying spring break vacations, legislative sessions are still in full swing. And some are poised for a spring tax break season as proposals advance with major implications for the sustainability of state budgets.

Residents and state lawmakers across the country are pushing back against anti-tax measures and are looking for ways to protect revenue and advance proposals that would raise revenue in progressive ways. This comes at a time when federal policy brings significant risks for state tax revenue.

What the Wall Street Journal Editorial Board Got Wrong About Tesla’s Tax Avoidance

April 4, 2025 • By Matthew Gardner

Tesla’s income tax avoidance is still in the news, and that’s a good thing.

State Rundown 3/26: Lawmakers Navigate Shortfalls, Potholes, and Pitfalls

March 26, 2025 • By ITEP Staff

State lawmakers around the country are navigating a range of potential hazards this week. Leaders in Maryland and Washington are facing budget holes but are smartly working to get out of them through progressive taxes on those with the most ability to pay. Both North Dakota and Washington state are looking to fill literal potholes […]

Vanity Fair: IRS Prepares to Provide Addresses of Some Undocumented Taxpayers to Immigration Enforcement

March 24, 2025

“It is a complete betrayal of 30 years of the government telling immigrants to file their taxes,” one former IRS official told The Washington Post, who chose anonymity out of fear of retribution. The partnership between the IRS and ICE is one of the latest moves from President Donald Trump’s administration in their unprecedented onslaught against immigrants, especially ones without documentation.

ITEP’s Who Pays? Cited in Washington Bill Creating Financial Intangibles Tax

March 24, 2025

Senate Democratic leaders in Washington state have introduced a series of bills aimed at making the state’s tax code more balanced. In the bill text for a new financial intangibles tax, ITEP’s Who Pays? report is cited: “Washington’s tax system remains the second most regressive in the nation as it asks those with the least […]

March Madness kicks off today and the pressure is on as many states’ legislative sessions are nearing the final buzzer. Some state lawmakers are seemingly competing for the title of most regressive state tax policies while others are looking to lift up best practices for more equitable outcomes. The Mississippi legislature landed on a […]

Shelter Skelter: How the Educational Choice for Children Act Would Use Tax Avoidance to Fuel School Privatization

March 18, 2025 • By Carl Davis

The Educational Choice for Children Act of 2025 would ostensibly provide a tax break on charitable donations to organizations that give out private K-12 school vouchers. Most of the so-called “contributions,” however, would be made by wealthy people solely for the tax savings, as those savings would typically be larger than their contributions.

Washington State Budget & Policy Center: The Truth About Washington’s Revenue Shortfall

March 14, 2025

During the 2025 legislative session, Washington state lawmakers face a budget shortfall that threatens funding for the public programs we all rely on. Read more.

In the face of immense uncertainty around looming federal tax and budget decisions, many of which could threaten state budgets, state lawmakers have an opportunity to show up for their constituents by raising and protecting the revenue needed to fund shared priorities. Lawmakers have a choice: advance tax policies that improve equity and help communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for most families to get ahead.

State Rundown 2/12: State Tax Policy Heats Up as Winter Storms Sweep Much of the Country

February 12, 2025 • By ITEP Staff

Tax policy proposals are a hot topic of conversation across the country. Both North and South Dakota are considering property taxes cuts, while proposed cuts in Florida, Mississippi, and Texas are percolating. Meanwhile, fiscal conditions are tight in states like Alaska, Tennessee, Oklahoma, and West Virginia. None are on the cusp of passing new revenue, but years of recent tax cuts and inflation have caught up to states and many lawmakers have revenue gaps to close.

New York Times: What Mass Deportations Would Do to New York City’s Economy

January 31, 2025

That number comes not from a left-leaning human rights group intent on fostering sympathy for people who crossed the border illegally, but rather from the wonky Institute on Taxation and Economic Policy, a nonpartisan Washington think tank. The organization’s research also tells us that nationally, more than a third of the tax dollars paid by undocumented immigrants go toward payroll taxes, which are aimed at backing entitlement programs that these workers are not entitled to access.

More details on this year’s batch of major tax proposals are emerging from statehouses - and some revenue cuts look like they could be steep. A governor-backed and House-passed plan in Mississippi would phase out the personal income tax, while a recent tax cut proposal out of Idaho is anchored by a $253 million dollar income tax cut.

It’s a new year, and state legislatures across the country are resolved to write new tax policy. Tax debates are heating up nearly everywhere in the early days of 2025, but states’ fiscal situations vary dramatically. New York is considering expanding the state’s Child Tax Credit following Gov. Hochul’s proposed expansion. On the other side […]

Gov. Jay Inslee: Gov. Inslee Releases Future-Focused Budget Proposal

December 18, 2024

Today, Gov. Jay Inslee released a balanced budget proposal that protects progress on the programs and services that working families and businesses depend on — public safety, education, early learning, housing and behavioral health. Read more.

As Congress negotiates a bill for federal funding during the lame-duck session, lawmakers would be wise to remember that stripping funds from the IRS costs more than it saves. On the table in the appropriations bill is a $20 billion recission of funds to the nation’s tax administration. While this may look like a spending cut, it will increase deficits by $46 billion due to a drop in the agency’s capacity to enforce taxes on wealthy individuals owed under existing federal law.

State Rundown 11/20: Some Budgets and Tax Proposals Fail to Defy Gravity, Fall Short

November 20, 2024 • By ITEP Staff

This week, there are high-profile budget and tax debates at both the state and local levels. The Louisiana legislature continues to debate Gov. Jeff Landry’s deeply regressive tax package in a special session focused on replacing corporate and personal income tax revenue with additional sales taxes, but some efforts to find offsets for the cuts […]

Salon: “No Mistake on Who They’re Serving”: Republicans Eye Medicaid, SNAP Cuts to Pay for Trump Tax Plan.

November 19, 2024

President-elect Donald Trump and his advisers are eyeing major cuts to federal safety net programs like Medicaid and food stamps to balance the cost of their massive tax agenda, The Washington Post reported Monday.