On May 23, 2018, the IRS and Treasury Department announced that they “intend to propose regulations addressing the federal income tax treatment of certain payments made by taxpayers for which taxpayers receive a credit against their state and local taxes.”

They made the announcement in response to new “workaround tax credits” enacted in New York and elsewhere that help taxpayers bypass the $10,000 cap on federal deductions for state and local tax (SALT) payments enacted late last year. But a review of tax advice being offered around the country reveals that several existing state tax credits for donations to private K-12 school voucher funds are being exploited in much the same way: to generate questionable charitable deductions and avoid the federal SALT deduction cap. The pervasiveness of this advice strongly suggests that the IRS and Treasury must address these private school credits, and other high-percentage charitable tax credits, in their upcoming regulations.

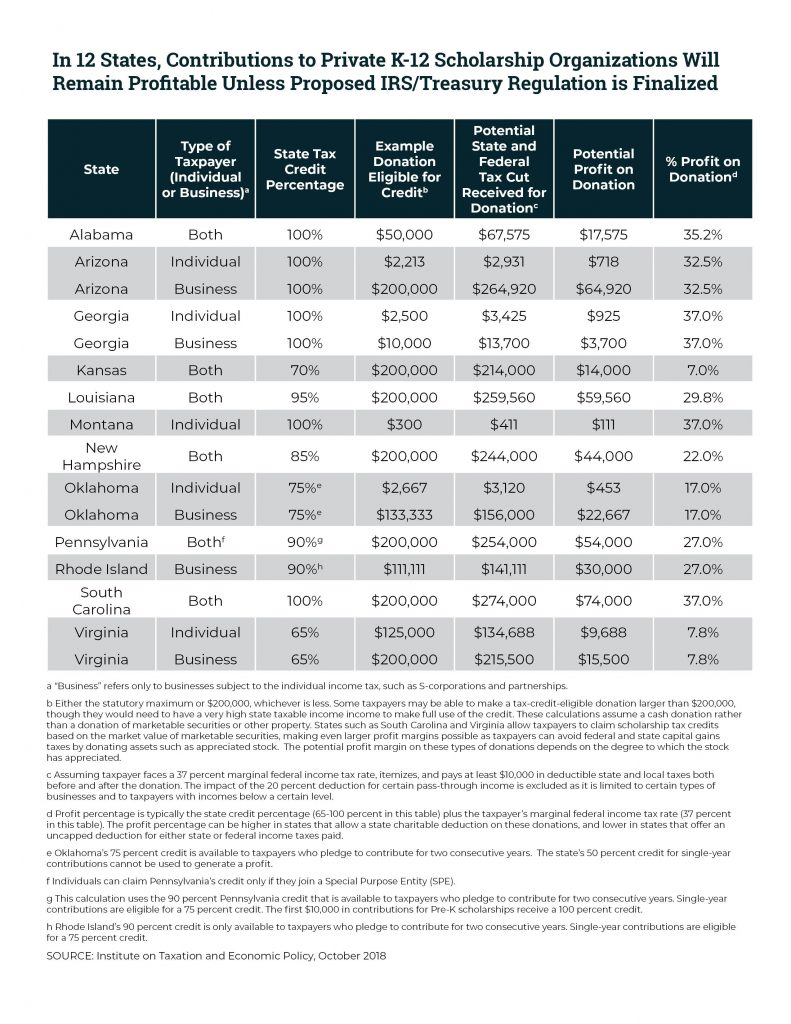

ITEP explained the mechanics of the new workaround credits and similar, preexisting charitable tax credits in a recent report. It concluded that overhauling the federal income tax treatment of new state tax credits, but not preexisting credits, would be unfair, arbitrary, and ineffective.

As catalogued below, tax accountants, financial advisors, private schools, and other organizations are advertising tax credits for donating to private K-12 voucher funds as ways to “sidestep,” “bypass,” “circumvent,” or “mitigate” the impact of the federal SALT deduction cap. In Alabama, Arizona, Georgia, Louisiana, and Pennsylvania, these tax credits are being publicly marketed to potential donors as ways to “convert” or “exchange” capped SALT deductions for uncapped and more lucrative charitable deductions. Typically, so-called “donors” who act on this advice will be financially better off after donating than before. In other words, these tax credits are being used by taxpayers to generate federal charitable deductions for behavior that meets virtually nobody’s definition of genuine charity.

The following list identifies instances in which tax accountants and others have publicly described private school voucher tax credits as SALT cap workarounds or otherwise profitable tax shelters. It also summarizes similar tax advice related to a hospital donation credit in Georgia. This list focuses on the boldest and most specific examples and omits numerous instances in which firms simply noted that donations can, or may, qualify for both a state tax credit and a federal charitable deduction.

It is important to note that the tax shelter being advertised in these states is more broadly available than the following list might suggest. ITEP research revealed that school voucher tax credits in Kansas, Montana, New Hampshire, Oklahoma, Rhode Island, South Carolina, and Virginia can also be exploited as profitable tax shelters. It is all but guaranteed that tax accountants and financial advisors in these states are offering similar advice to their clients behind closed doors.

Click on a state’s name to find a catalogue of publicly available tax advice related to SALT cap avoidance.

“for federal taxes, the donation is treated as a charitable contribution, therefore sidestepping the $10,000 limitation on state and local income taxes.”

-

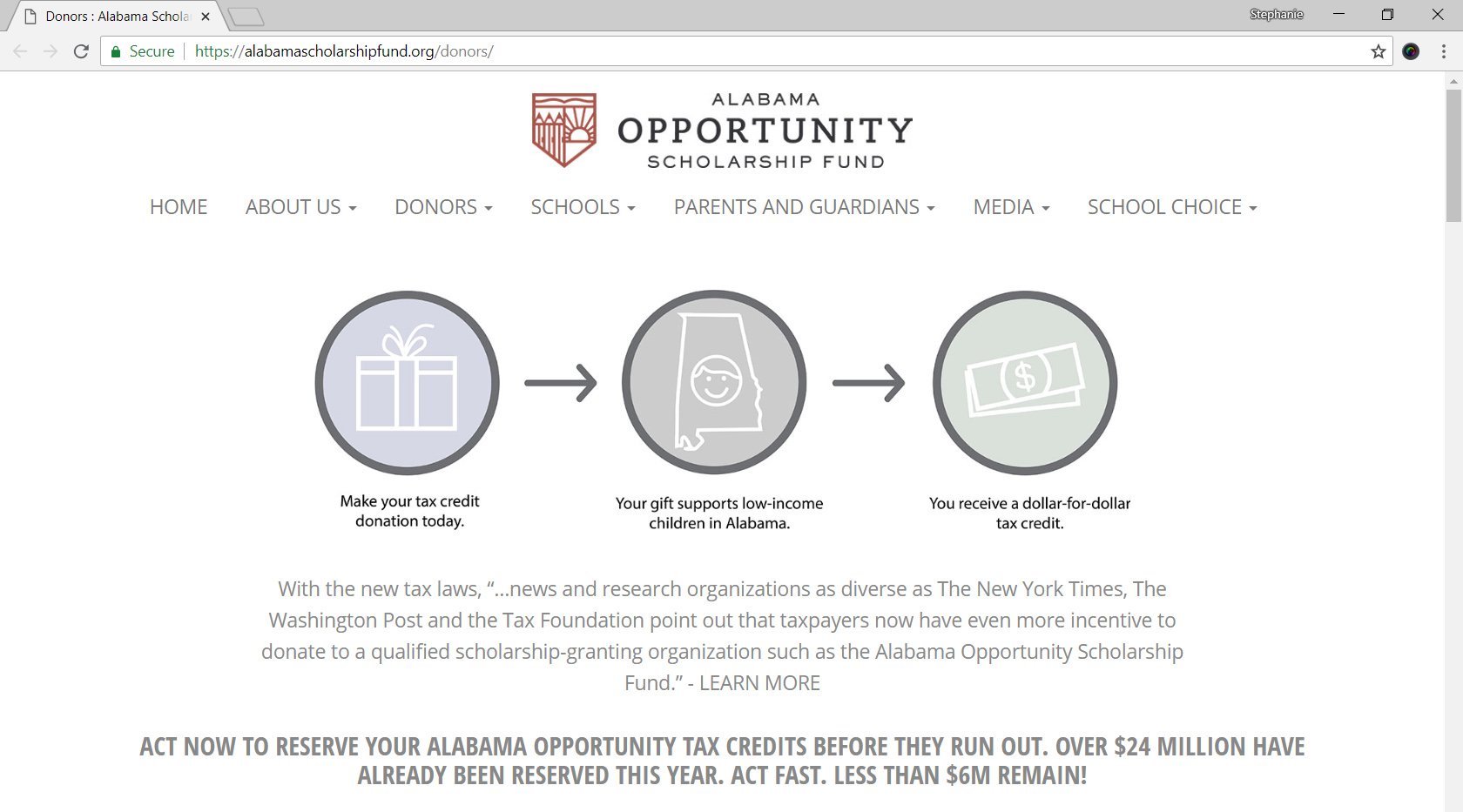

Alabama Opportunity Scholarship Fund Donors Page The Alabama Opportunity Scholarship Fund, one of the state’s largest organizations accepting tax credit voucher donations, explains on its “Donors” page that “with the new tax laws … taxpayers now have even more incentive to donate.” It also hosted a webinar with various tax professionals who walked through an example scenario in which a taxpayer could receive more in state and federal tax benefits than they ever donated in the first place. One of those professionals later explained to a journalist in Alabama that the “the new limitations on the SALT deduction were certainly a driving force” behind the record-breaking pace of credit claims in the state.

- An article written for, and promoted by, the Medical Association of the State of Alabama advises the association’s members (high-income physicians) that donating to the state’s private school voucher program is “an opportunity to preserve your state tax deduction.”

- An accounting firm in Alabama (Dent Moses) suggests that “Alabama taxpayers who expect to itemize deductions in 2018 but will exceed the limit for state and local taxes might want to consider an alternative in order to receive a deduction for the anticipated amount over $10,000.” Specifically, by donating to the state’s voucher tax credit program, the firm notes that “for federal taxes, the donation is treated as a charitable contribution, therefore sidestepping the $10,000 limitation on state and local income taxes.” In light of this tax shelter opportunity, it accurately predicted that “Alabama taxpayers will act quickly and the cap will be reached in record time.”

- An accounting firm with offices in Alabama (Carr Riggs & Ingram) describes the state’s voucher tax credit as an “opportunity to convert a state tax deduction (now limited to $10,000) into a charitable deduction (which is not limited).” It also walks through a detailed example in which a high-income taxpayer receives $27,400 in state and federal tax cuts in return for donating just $20,000.

- An Alabama accounting firm (Pearce, Bevill, Leesburg, Moore) is advertising the credit as “one way to mitigate the impact of this adverse tax change,” meaning the federal SALT cap.

- An accounting firm in Alabama (Jamison Money Farmer) says that making a private school voucher donation is “the best strategy” and “moves your federal deduction from a state taxes deduction (which are now limited to $10,000 annually – that’s income and property taxes) to a charitable deduction.”

- A financial advisor in Alabama (Stewart Welch, founder of The Welch Group) writes that the voucher tax credit is “a way to avoid losing” a portion of the taxpayer’s SALT deduction. He goes on to elaborate that “you are basically converting a State of Alabama income tax deduction (limited to $10,000) to a charitable deduction (which has no limit under the new tax law).”

“The really big news is with the new federal tax plan, our S corporations now have an opportunity to even save at the federal level for 2018.”

– Institute for Better Education Executive Director Kimberly Kirschner

-

Institute for Better Education Executive Director Kimberly Kirschner on Tuscon’s CBS affiliate KOLD-TV The director of an Arizona group (the Institute for Better Education) that accepts tax credit voucher donations appeared on Tucson’s CBS affiliate, KOLD-TV, to explain that “The really big news is with the new federal tax plan, our S corporations now have an opportunity to even save at the federal level for 2018.” She then offered an explanation of how the state’s tax credit allows taxpayers to circumvent the federal SALT cap before concluding that “if you’re a CPA with S-corporate clients, or have an S-corporation yourself, you need to contact us.” The online version of that segment has received more than 20,000 views. On its website, the organization also calls this tax avoidance technique an “amazing opportunity” wherein “Shareholders will be taking their Individual State tax liability out of the SALT deduction and putting it into the Charitable Contribution deduction resulting in a HUGE savings in Federal taxes owed and a dollar-for-dollar tax credit on your State taxes.”

- An accounting firm in Arizona (Henry+Horne) says that “All Arizona S Corp shareholders who may be affected by the new $10,000 SALT limit should at least consider having their S Corporation apply for this credit each year. Why? Instead of having a nondeductible state tax payment, you have made a charitable donation instead … The application due date this year is July 1st and the credits will go fast, so you want to act as soon as possible!”

- Pieceful Solutions Schools in Arizona explains that a private school donation results in “a dollar-for-dollar credit/reduction off of their state tax liability. (Net cost is zero.) In addition, if they donate by the end of December, these donations are eligible to be used as a deduction off of federal taxes. They can make money by donating!”

Private School Voucher Credit

“When you donate, you will receive both a Georgia state tax credit AND a federal charitable deduction. You will end with more money than when you started.”

– Pay it Forward Scholarships

- A financial planning firm in Georgia (Minerva Planning Group) discusses the state’s voucher tax credit and a separate credit for donating to rural hospitals, and finds that “the limitation on state and local tax deduction combined with some legislative changes to the programs made them much more attractive.” It concludes that “for taxpayers whose total state and local tax bill is well more than $10,000, participating in these programs can increase your charitable deduction while not reducing the amount you deduct for state and local taxes since the latter is now limited to $10,000.”

- A certified financial planner in Georgia (Brightworth) explains that the state’s voucher tax credit, along with a separate credit for donations to rural hospitals, is a “way to convert a tax payment into a charitable deduction” and that the current structure of the state credit makes it “even more attractive for many attorneys, physicians, dentists and others with an interest in [pass-through] entities.”

- Pay it Forward Scholarships in Georgia states that, “When you donate, you will receive both a Georgia state tax credit AND a federal charitable deduction. You will end with more money than when you started.”

- An accounting firm in Georgia (Windham Brannon) states that “absent any future action taken by the IRS or Congress, donors have the opportunity to exchange nondeductible state income tax payments for deductible charitable contributions on their federal tax returns” using either the state’s private school voucher credit or a separate credit related to donations to rural hospitals. In a separate article, the firm explains that donating under either of those programs allows taxpayer to “retain some, or all of the tax benefits previously received from the remittance of these taxes.” It goes on to explain that by donating “they may be able to minimize the impact of the state and local tax deduction limitations on their federal tax return” and that “taxpayers who continue to itemize and whose state and local tax deduction is limited, will retain an important deduction and reap a monetary benefit by contributing to either program.” The firm began offering this advice in late-2017, before the federal bill was even signed into law.

- In reference to the $10,000 SALT cap, Georgia GOAL Scholarship Program, Inc. explains that “contributing to GOAL will make this less of a ‘sting’ for Georgia taxpayers.” Its “bottom line” conclusion, which it underlines on its website, is that “by contributing to GOAL, taxpayers whose SALT deduction is limited will hang onto at least a portion of the deduction they would otherwise be losing.” It describes the tax shelter as a way to “reap a monetary benefit by contributing to GOAL.” The organization also worked with an accounting firm in Atlanta (Bennett Thrasher) to create several detailed illustrations of how the tax shelter works, including one in which a high-income business owner collects a 37% profit (or “net cash benefit” of $3,700) above and beyond their initial contribution of $10,000. Georgia GOAL is the largest scholarship organization in Georgia, accepting nearly $17 million in donations in 2017.

- A wealth management firm in Georgia (Resource Planning Group) explains that historically, the state’s voucher tax credit has been popular among “a loyal base of high income parents who benefitted from the AMT tax savings.” Under the new federal tax law, however, the credit—along with a separate credit for donating to rural hospitals—is most beneficial to taxpayers who wish to “circumvent the reduced deductibility of SALT taxes … transitioning what would have been a non-deductible state tax deduction for taxpayers at the federal level to a charitable deduction that is not subject to any federal ceiling.” After offering a detailed example in which a taxpayer receives more back in state and federal tax cuts than their initial donation, the firm concludes that: “We anticipate that similar tax credits will launch in Georgia and other states to circumvent the new SALT deduction limits – expanding the benefit of smart tax planning for those who take steps to exploit the credits.”

- Apogee Scholarship Fund in Atlanta, Georgia states that “in addition to the [state] credit … you are eligible to receive a Federal Charitable Deduction for the amount of your contribution.” While the organization does not walk through SALT cap avoidance scenarios in detail, it explains that “Apogee is well versed in the specifics of how this credit affects most tax scenarios and is happy to offer guidance in how this credit is related to your specific tax situation.”

Rural Hospital Credit

While private K-12 school voucher tax credits are the most common type of preexisting credits now being advertised as SALT cap workarounds, Georgia’s tax credit for donations to rural hospitals is also being advertised in this way. The above advertisements from Brightworth, Windham Brannon, and Resource Planning Group all included descriptions of this tax credit. In addition:

- A certified financial planner and talk radio host in Georgia explains that in return for donating to rural hospitals, “you would receive a dollar-for-dollar tax credit on your Georgia income tax liability. Furthermore, you would be eligible to take an $8,000 charitable deduction on your federal income tax return. For high-income tax payers, this benefit was popular among those who were subject to alternative minimum tax. Going forward, this takes a state income tax deduction that the Tax Cuts and Jobs Act bundled with your property tax and limited to $10,000 and transfers it to a charitable deduction.”

- The Georgia HEART Hospital Program explains that “by contributing to a Georgia HEART RHO, taxpayers can receive a 100% Georgia income tax CREDIT and 100% federal itemized deduction. In the case of Georgia taxpayers who are facing the $10,000 SALT deduction limit, contributing to a rural hospital in this manner can result in significant tax savings.” The organization also worked with an accounting firm in Atlanta (Bennett Thrasher) to create several detailed illustrations of how the tax shelter works, including one in which a high-income taxpayer collects a 37% profit (or “net cash benefit” of $15,502) above and beyond their initial contribution of $41,896.

- An accounting firm in Georgia (Moore Stephens Tiller) describes the $10,000 SALT deduction cap as a reason to claim the state’s hospital donation credit. The firm concludes that “it’s tricky because of the relationship between the SALT deduction and the Georgia HEART credit. We can help you plan for it so your return will be in order next year.”

“It is the dual impact of the state tax credit and federal tax liability reduction that makes this specific charity so unique and so potentially advantageous to taxpayers.”

– Mock & Associates, accounting firm

- An accounting firm in Louisiana (Mock & Associates) took out an advertisement explaining that “It is the dual impact of the state tax credit and federal tax liability reduction that makes this specific charity so unique and so potentially advantageous to taxpayers.”

“Essentially, a taxpayer ‘converts’ their state income tax liability into a charitable deduction and bypasses the $10,000 state tax limitation.”

– Irina Moyseyenko, CPA, MT

- A major accounting firm with offices around the world (EisnerAmper) explains that Pennsylvania’s voucher tax credit “can mitigate the new $10,000 limit on deductibility of personal and real estate taxes on their federal returns.” It elaborates that “the tax benefits may provide individuals with a vehicle to turn a non-deductible tax into a deductible contribution.”

- A Pennsylvania accounting firm (Drucker & Scaccetti) refers to the state’s voucher tax credit as a tool for “bypassing the $10k state and local tax deduction limitation.”

- The Gwynedd Mercy Academy High School in Pennsylvania explains to prospective donors that, under the new SALT cap, the state’s voucher tax credit can be used such that “participants can effectively turn limited state tax deductions into less limited charitable contribution deductions.”

- An accounting firm in Pennsylvania (Kreischer Miller) discusses the impact of the $10,000 cap on SALT deductions and then notes that “Fortunately, [Pennsylvania] has been a pioneer in the area of creating an alternative structure for the payment of tax liabilities.” It refers to the state’s voucher tax credit as a “safety net” against the SALT cap and concludes that “it is possible that, now more than ever, participation in the EITC program would be a prudent decision.”