This report was produced in partnership with Liberation in a Generation and co-authored by that organization’s Jeremie Greer, Emanuel Nieves, and Solana Rice.

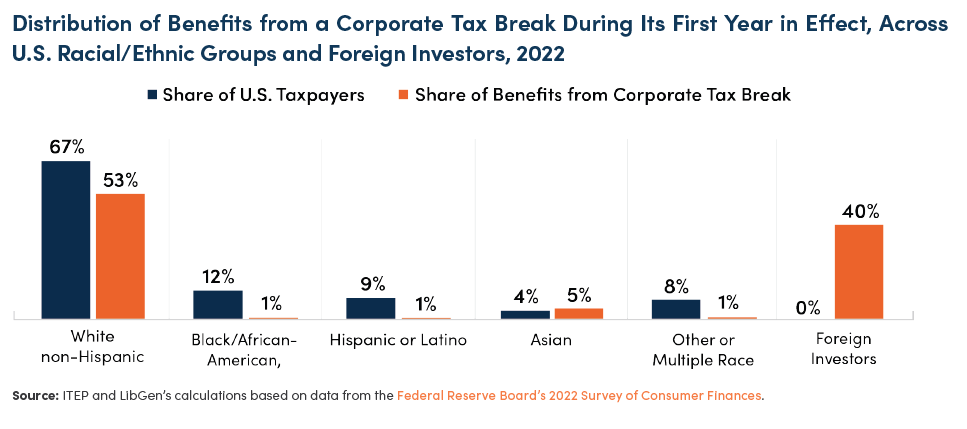

Policies that provide corporate tax breaks and allow corporate tax avoidance exacerbate racial and income disparities in our economy. These policies limit revenue raised that could finance public investments that benefit everyone. They also shift the distribution of income in favor of the owners of corporate assets, who are disproportionately wealthy and white. Finally, corporate tax policies funnel resources to foreign investors who own a large portion of shares in U.S. corporations.

Expanding on recent wealth and income data from the Board of Governors of the Federal Reserve System and methods used by the U.S. Congress’s official revenue estimators to estimate the distribution of corporate tax breaks, this paper explores who benefits from corporate tax breaks and corporate tax avoidance—by income and, for the first time, by race and ethnicity. The analyses reveal that corporate tax breaks and corporate tax avoidance significantly contribute to income and racial inequality and largely benefit foreign investors.

The key findings of this report include the following:

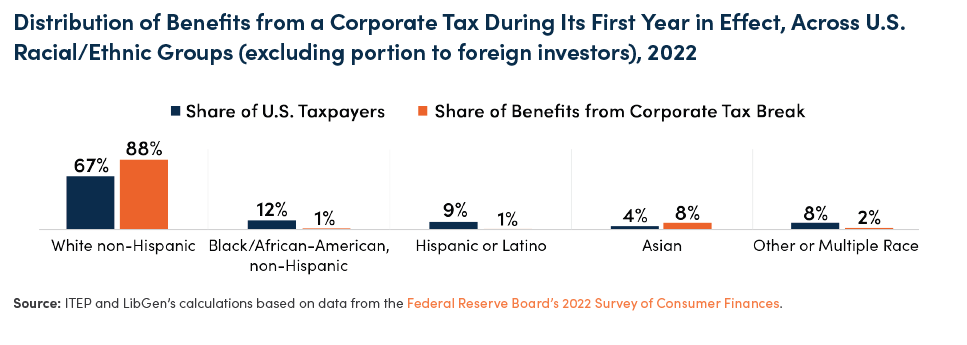

- Corporate tax cuts and corporate tax avoidance worsen racial economic inequality. In the first year that a corporate tax break goes into effect, the 67 percent of U.S. households that are White, receive a disproportionate 88 percent of the benefits that remain in the U.S. In contrast, Black and Hispanic households, comprising 12 percent and 9 percent of U.S. households respectively, each receive only 1 percent of the benefits that remain in the U.S.

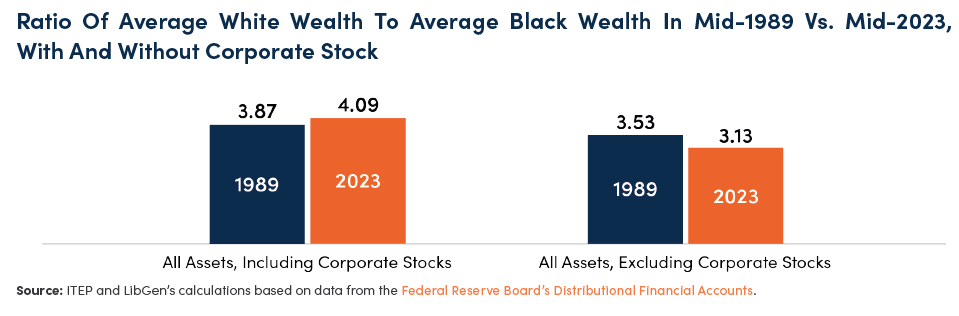

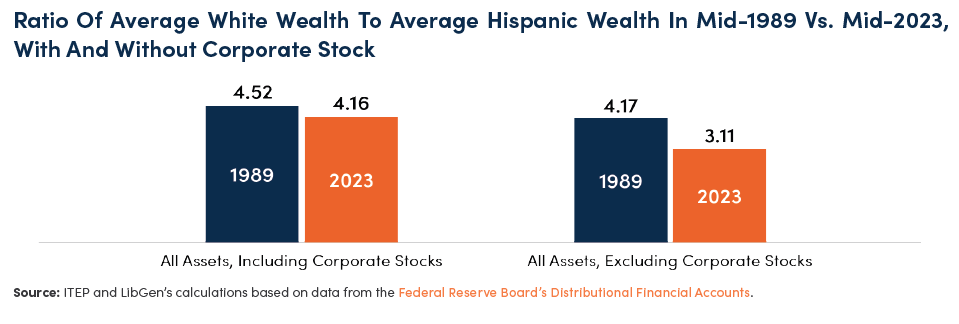

- The ratio of white wealth to Black wealth and the ratio of white wealth to Hispanic wealth, which are both exceedingly high, would be a fourth lower today if not for disparities in ownership of corporate stocks.

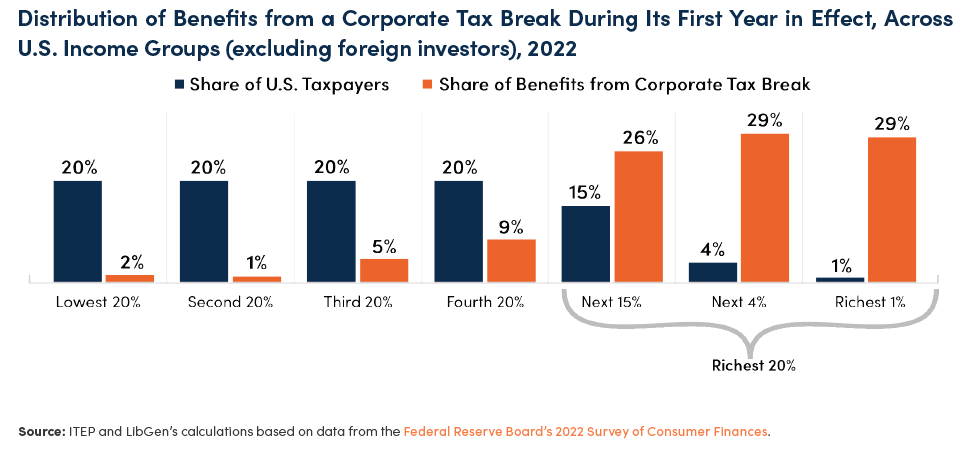

- Corporate tax cuts and corporate tax avoidance worsen income inequality and provide very little benefit to low- and middle-income households. During the first year when a new corporate tax break is in effect, 58 percent of the benefits that remain in the U.S. go to the richest 5 percent of households who disproportionately own corporate stocks.

- Corporate tax cuts and corporate tax avoidance hurt all U.S. households. Because foreign investors own 40 percent of American stocks, U.S. households receive only 60 cents of every dollar in corporate tax reductions during the first year when a new corporate tax break is in effect.

Ultimately, even if we adopt the assumption held by proponents of corporate tax cuts that some benefits eventually go to workers, our conclusions do not change. Reforming the corporate tax code is crucial for reducing racial and economic disparities.