There’s a lot at stake in this election cycle: the nation and our economy are reeling from the effects of the coronavirus pandemic, and states remain in limbo as they weigh deep budget cuts and rush to address projected revenue shortfalls.

If early-voting data is any indication, voters across the country see the 2020 election as potentially one of the most consequential in recent history. A moment as important as this is why ITEP has decided to endorse several measures that voters will find on their ballots, including the ones in Arizona, Illinois, and California. The states below are fortunate to have sound tax policy options included on their November ballots that could help raise much-needed revenue to fund vital public services while also addressing longstanding adequacy and equity issues in their tax codes:

- A “yes” vote on Arizona’s Proposition 208 would enact a 3.5 percent surcharge on high-income earners in the state—single filers earning more than $250,000 and joint filers earning over $500,000. The surcharge would raise an additional $827 million to $940 million annually, which will be dedicated to much-needed spending on education, including teacher salaries and training and retention programs. In recent years, Arizona lawmakers have prioritized corporate income tax cuts and targeted public education spending for reductions to help balance the budget. According to the Arizona Center for Economic Progress, since 2009, teacher salaries have decreased 3.5 percent per year, and state funding for public education has dropped almost 2.5 percent per year. I saw this firsthand as a college student at Arizona State University in 2009—the early years of the Great Recession. Spending decreased while my fellow classmates and I saw tuition costs increase. Some students were forced to go back home because the out-of-state tuition was too costly and others—myself included—saw our tuition liabilities ballooning bigger and bigger.

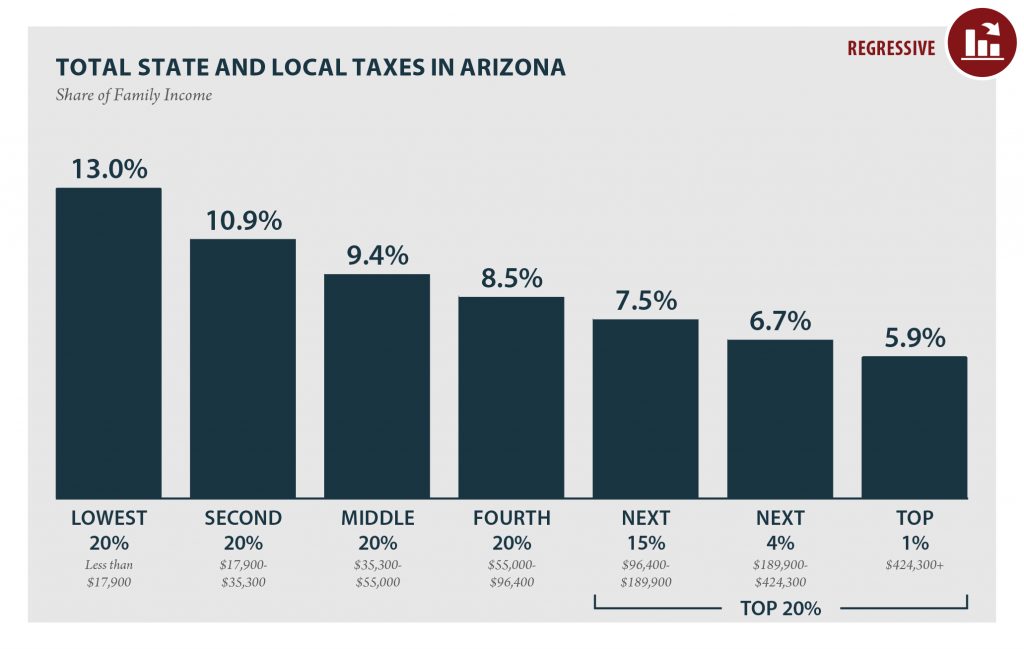

By asking the wealthiest taxpayers in the state to contribute just 3.5 cents more for every dollar above the new thresholds, Proposition 208 would also improve tax fairness in Arizona which currently has the 11th most regressive state and local tax system in the country according to our Who Pays? report.

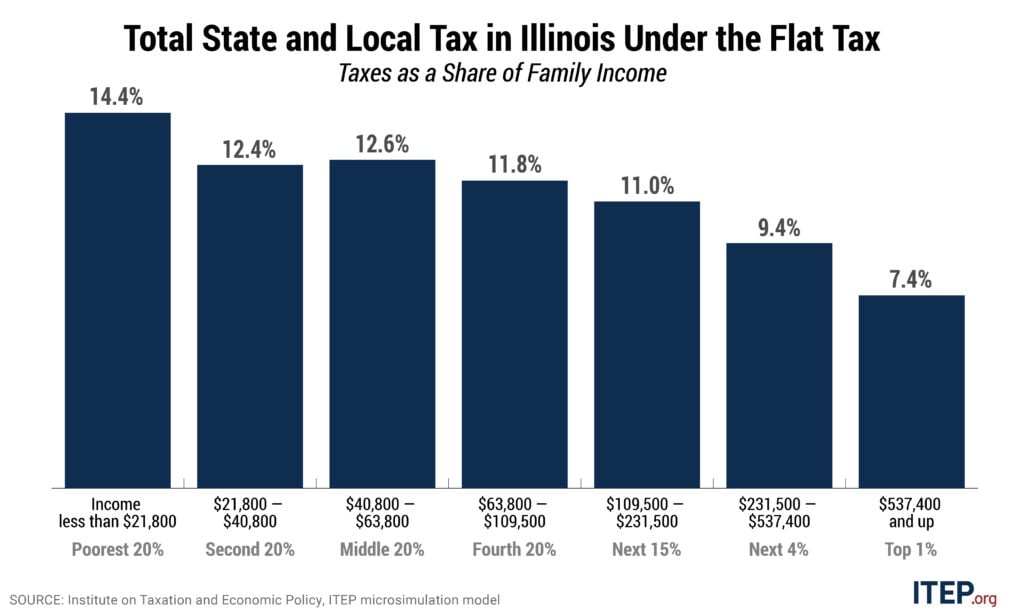

- A “yes” vote on the Illinois Fair Tax (listed on the ballot as the Illinois Allow for a Graduated Income Tax Amendment) would dramatically reshape the state’s lopsided income tax structure for the better by amending the constitution to allow for a graduated income tax structure in place of the current 4.95 percent flat tax rate. The legislature proactively approved a graduated structure in 2019 that will go into place if the measure passes in November. Under the Fair Tax, 97 percent of taxpayers with income tax liability would receive a tax cut and only the wealthiest 3 percent would pay more.According to ITEP’s Who Pays? report, Illinois has the 8th most regressive tax system in the country. Illinoisans making less than $21,800 pay over 14 percent of their income in state and local taxes, while those in the top 1 percent making more than $537,000 pay roughly half that at 7.4 percent. In contrast, the Fair Tax would increase effective tax rates by 2.4 percent for the top 1 percent while cutting taxes for taxpayers whose incomes fall in the bottom 95 percent, improving Illinois’s tax system from the 8th most regressive in the nation to the 20th.

A September ITEP report also found that had the Fair Tax been in place from 1999 to 2019, the richest 3 percent of taxpayers would have contributed on average an additional $27 billion in income taxes.

- A “yes” vote on California’s Proposition 15 would tax certain commercial and industrial property in a more sensible way, promoting fairness and racial justice. As ITEP’s Dylan Grundman O’Neill explains, the amendment requires these properties—valued at $3 million or more—to be taxed based on their market value rather than their purchase price, which is how they are currently assessed. Support for this measure would not only correct an arbitrary method for valuing property that has been in place since 1978 but would also help reverse years of disinvestment in public education and raise an estimated $6.5 to $11.5 billion. Californians have a chance to help local governments raise revenue responsibly instead of on the backs of those most vulnerable to regressive methods like fees and fines, and they should take the opportunity.

Don’t Let Tax Revenue From Cannabis Sales Go Up in Smoke

Four states have the opportunity to legalize and tax the sale of recreational cannabis. Arizona, Montana, New Jersey, and South Dakota would join 33 states and the District of Columbia in allowing adult cannabis use for either recreational or medical purposes. Revenues from the state measures would help fund education, public safety, and public health programs. While the revenue schemes vary in the four states, according to ITEP’s most recent work exploring cannabis taxation, if they followed the same approach as Washington, states they would collectively raise more than $550 million annually in new revenue.

Other Ballot Measures to Keep an Eye On

- Alaskans who support Ballot Measure 1 would impose an alternative gross minimum tax or additional production tax—whichever is greater—for oil production from certain, major oil fields.

- If taxpayers in Arkansas vote “yes” on Arkansas Issue 1 they will be voting to make a temporary 0.5 percent sales tax permanent that will help fund transportation infrastructure.

- Colorado voters have the rare opportunity to repeal the Gallagher Amendment if they vote “yes” on Amendment B. In short, the Gallagher Amendment limits the amount of the tax base that residential property can make up to 45 percent, with nonresidential properties making up the difference. However, since home prices have increased throughout the years, it has forced property tax cuts to maintain balance. Repeal of the amendment would provide additional revenues for local governments and schools and take some pressure off the state.