Vermont

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. But another third of states lost ground, continuing a trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable.

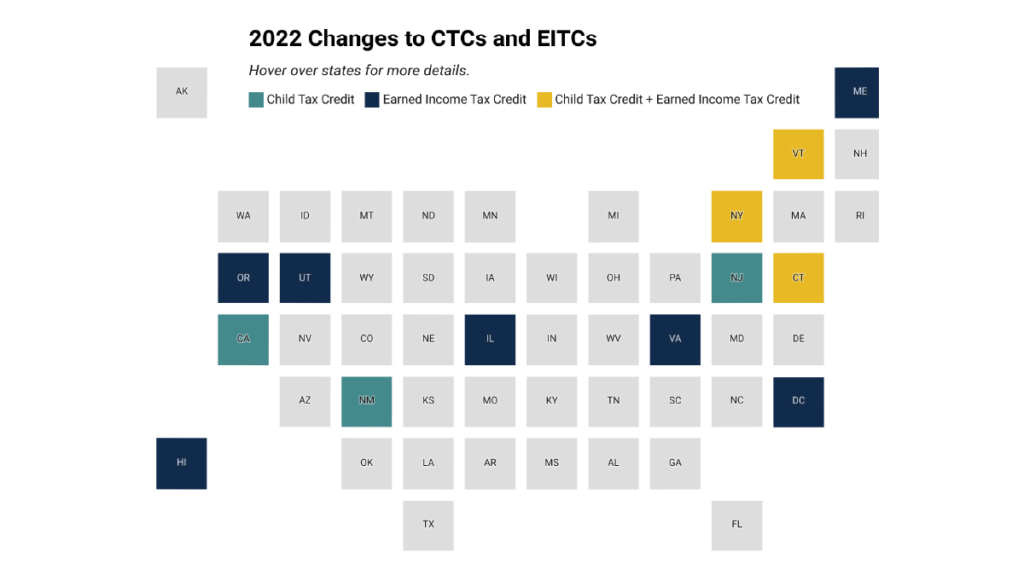

State lawmakers continue to make groundbreaking progress on state tax credits, with 17 states creating or enhancing Child Tax Credits or Earned Income Tax Credits so far this year. These policies have the potential to boost family economic security and dramatically reduce the number of children living below the poverty line.

Summer is here and many states nearing the end of their legislative sessions. Temperatures are rising in more ways than one in some state legislatures while others seem to be cooling off.

As the sweet days of summer pass, the scent of jasmine isn't the only thing blowing through the minds of state lawmakers, as tax policy discussions remain at the forefront...

This past week, in statehouses around the country, tax policy decisions are moving fast as budgets were signed and budget plans were released and passed...

Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Circuit breaker credits are the most effective tool available to promote property tax affordability. These policies prevent a property tax “overload” by crediting back property taxes that go beyond a certain share of income. Circuit breakers intervene to ensure that property taxes do not swallow up an unreasonable portion of qualifying households’ budgets.

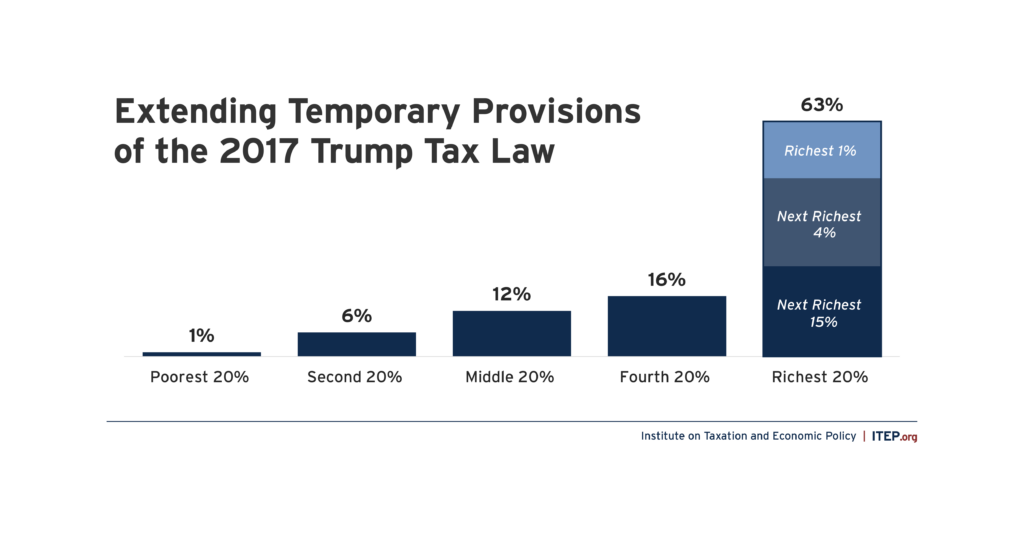

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

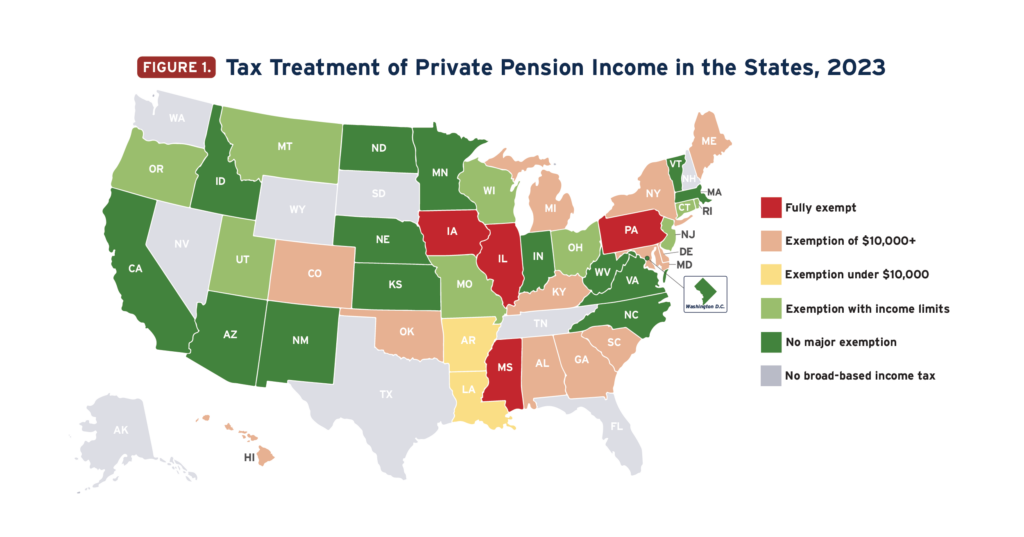

States Prioritize Old Over Young in Push for Larger Senior Tax Subsidies

March 23, 2023 • By Carl Davis, Eli Byerly-Duke

Under a well-designed income tax based on ability to pay, it is simply not necessary to offer special tax subsidies to older adults but not younger families. At the end of the day, your income tax bill should depend on what you can afford to pay, not the year you were born. It’s really as simple as that.

Costly and Poorly Targeted Senior Tax Subsidies Widen Economic, Racial, and Generational Inequalities

March 22, 2023 • By ITEP Staff

Contact: Jon Whiten – [email protected] Costly and Poorly Targeted Senior Tax Subsidies Widen Economic, Racial, and Generational Inequalities State lawmakers should focus on improving overall tax fairness, not creating special carveouts based on age Lawmakers in several states are currently considering tax subsidies for senior citizens, even though these breaks are costly and poorly targeted. […]

The word “tax” appears 97 times and counting in one recent summary of governors’ addresses to state legislators so far this year. The policy visions that governors are bringing, however, vary enormously. While there's good reason to worry about tax cuts for wealthy families and the flattening or elimination of income taxes, there are at least five great tax ideas coming directly out of governors’ offices this year.

The great women’s philosopher, Pat Benatar, once said “love is a battlefield,” and there’s no greater test of our love for state tax policy than following the ups and downs of state legislative sessions...

State Lawmakers Should Break the 2023 Tax Cut Fever Before It’s Too Late

January 18, 2023 • By Miles Trinidad

Despite mixed economic signals for 2023, including a possible recession, many state lawmakers plan to use temporary budget surpluses to forge ahead with permanent, regressive tax cuts that would disproportionately benefit the wealthy at the expense of low- and middle-income households. These cuts would put state finances in a precarious position and further erode public investments in education, transportation and health, all of which are crucial for creating inclusive, vibrant communities where everyone, not just the rich, can achieve economic security and thrive. In the event of an economic downturn, these results would be accelerated and amplified.

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

ITEP Policy Briefs: More and More States Are Helping Low-Income Families with New and Expanded Tax Credits

September 15, 2022 • By ITEP Staff

13 states plus D.C. created or expanded state CTCs or EITCs this year, helping create more equitable state tax systems WASHINGTON, D.C.: In 2022’s state legislative sessions, lawmakers across the country advanced tax policies that will bolster the economic security of millions of low- and moderate-income working families through new and enhanced Child Tax Credits […]

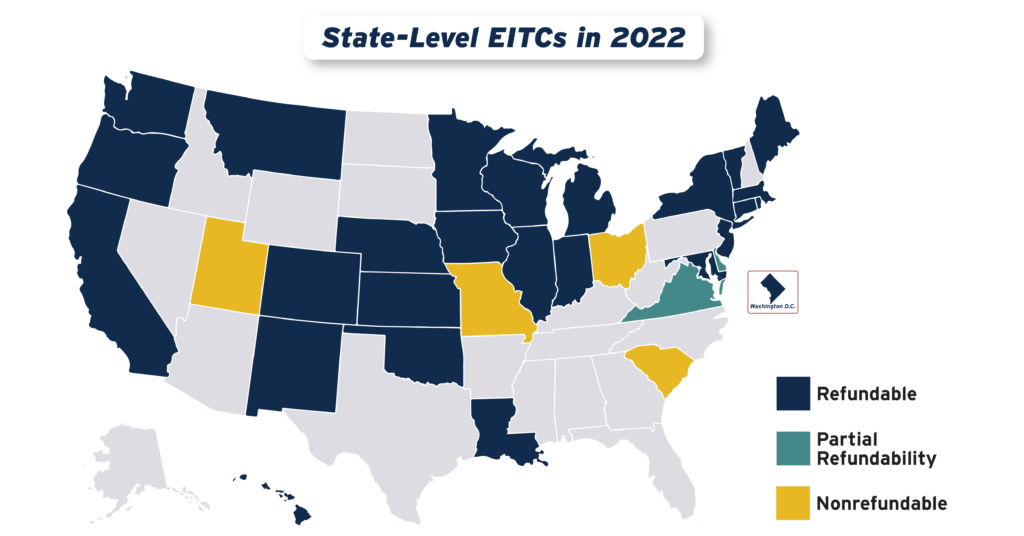

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2022

September 15, 2022 • By Aidan Davis

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.

More States are Boosting Economic Security with Child Tax Credits in 2022

September 15, 2022 • By Aidan Davis

After years of being limited in reach, there is increasing momentum at the state level to adopt and expand Child Tax Credits. Today ten states are lifting the household incomes of families with children through yearly multi-million-dollar investments in the form of targeted, and usually refundable, CTCs.

Census Data Shows Need to Make 2021 Child Tax Credit Expansion Permanent

September 14, 2022 • By Joe Hughes

The Child Tax Credit expansion led to a 46 percent decline in childhood poverty. That it could be accomplished during the largest economic disruption in most of our lifetimes underscores a basic fact: thoughtful, decisive government action to combat poverty works.

Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs

July 22, 2022 • By Neva Butkus

State legislatures across the country made investments in their future, centering children, families, and workers by enacting and expanding state Earned Income Tax Credits (EITCs), Child Tax Credits (CTCs), and other refundable credits this session. In total, seven states either expanded or created CTCs this session. Connecticut, New Mexico, New Jersey, Rhode Island and Vermont […]

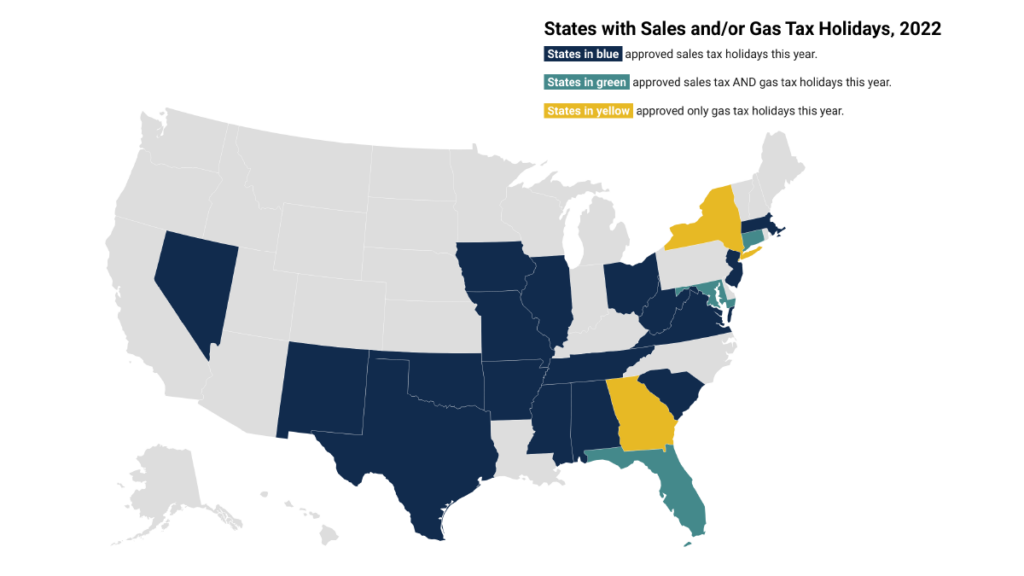

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 20, 2022 • By Marco Guzman

Lawmakers in many states have enacted “sales tax holidays” (20 states will hold them in 2022) to temporarily suspend the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—particularly as lawmakers have sought to apply the concept as a substitute for more meaningful, permanent reform or arbitrarily reward people with specific hobbies or in certain professions. This policy brief looks at sales tax holidays as a tax reduction device.

With inflation dominating headlines both nationally and locally, state lawmakers around the U.S. are searching for ways to put their revenues to good use, and not surprisingly, some options are better than others...

State Rundown 6/8: Tax Policy Features Prominently During Budget and Primary Season

June 8, 2022 • By ITEP Staff

As voters head to the polls to weigh in on their state’s primary elections and legislators convene to hash out budget deals, tax policy remains atop the agenda...

While the temperature ticks up outside, the temperature in state legislatures around the country has fallen slightly. But with several states still dealing with ongoing tax and budget issues, this summer could be a hot one...

State Rundown 5/11: Mid-Year Special Elections and Primary Season Kicks Off with Taxes in the Spotlight

May 11, 2022 • By ITEP Staff

As 2022 inches closer to its midpoint, important tax policy decisions are being put in the hands of voters, as special elections and the primary season begin...

Last week we highlighted how several states were pushing through regressive tax cuts as their legislative sessions are coming to a close. Well, this week many of those same states took further actions on those bills and it’s safe to say we’re even less impressed than before...

Excess Profits Tax Proposals Meet the Moment, But Lawmakers Should Keep Their Eye on Fundamentally Fixing Our Corporate Tax

March 25, 2022 • By Steve Wamhoff

New corporate tax proposals address the current situation, but ultimately leaders in Washington must fix federal law to tax all corporate profits and stop the tax dodging that is rampant today.