Vouchers

Despite wintry conditions across much of the country, that hasn’t stopped state lawmakers from debating major tax policy changes.

Megabill Takes Cap Off Unprecedented Private School Voucher Tax Credit, Potentially Raising Cost by Tens of Billions Relative to Earlier Version

July 2, 2025 • By Carl Davis

It is clear that this tax credit has the potential to come with an enormous cost if private school groups are successful in convincing their supporters to participate. In these times of very high debt and deficits, this is reason for all of us to be uneasy.

The ‘Big, Beautiful’ Bill Creates a $5 Billion Tax Shelter for Private School Donors

June 9, 2025 • By Amy Hanauer

On May 22, Congress passed the House reconciliation bill or “One Big Beautiful Bill Act” by a one-vote margin. The bill’s dozens of destructive tax provisions would supercharge inequality and force devastating cuts to health and food aid that have been bedrocks of the American safety net since the 1960s.

Five Issues for States to Watch in the Federal Tax Debate

June 3, 2025 • By Dylan Grundman O'Neill, Kamolika Das, Marco Guzman, Miles Trinidad, Neva Butkus

This post covers five particularly notable provisions for states: increasing deductions for state and local taxes (SALT) paid, allowing more generous tax write-offs for businesses, offering new avenues for capital gains tax avoidance to people contributing to private school voucher funds, carving tips and overtime out of the tax base, and re-upping Opportunity Zone tax breaks for wealthy investors.

House Tax Bill Enlists the Wealthy to Spread Private School Vouchers

May 15, 2025 • By Carl Davis

The House tax plan cuts charitable giving tax incentives for donors to most nonprofit groups while roughly tripling the incentive available to donors to groups that fund private K-12 school vouchers. The bill would also allow private school voucher donors to avoid capital gains tax on their gifts of corporate stock, creating a profitable tax shelter for wealthy people who agree to help funnel public funds into private schools. The bill would reduce federal tax revenue by $23.2 billion over the next 10 years as currently drafted, or by $67 billion over the next 10 years if it is extended…

Shelter Skelter: How the Educational Choice for Children Act Would Use Tax Avoidance to Fuel School Privatization

March 18, 2025 • By Carl Davis

The Educational Choice for Children Act of 2025 would ostensibly provide a tax break on charitable donations to organizations that give out private K-12 school vouchers. Most of the so-called “contributions,” however, would be made by wealthy people solely for the tax savings, as those savings would typically be larger than their contributions.

A Revenue Impact Analysis of the Educational Choice for Children Act of 2025

March 18, 2025 • By Carl Davis

The Educational Choice for Children Act of 2025 would provide donors to nonprofit groups that distribute private K-12 school vouchers with a dollar-for-dollar federal tax credit in exchange for their contributions. In total, the ECCA would reduce federal and state tax revenues by $10.6 billion in 2026 and by $136.3 billion over the next 10 years. Federal tax revenues would decline by $134 billion over 10 years while state revenues would decline by $2.3 billion.

Voucher Boondoggle: House Advances Plan to Give the Wealthy $1.20 for Every $1 They Steer to Private K-12 Schools

September 12, 2024 • By Carl Davis

The U.S. House Ways & Means Committee has advanced a new school voucher bill. H.R. 9462—the Educational Choice for Children Act of 2024—would create an unprecedented tax incentive designed to fund private, mostly religious, K-12 schools.

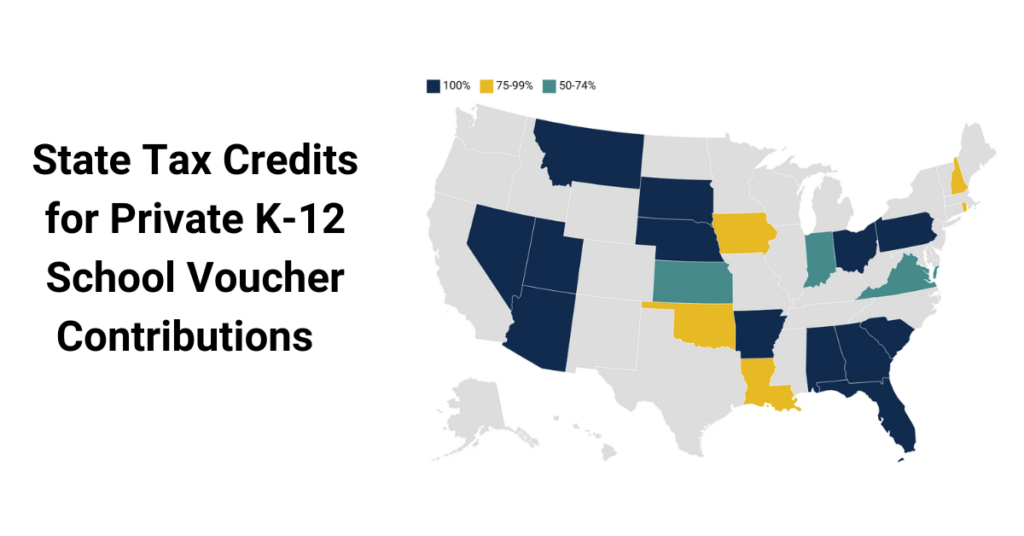

Does Your State Offer Tax Credits for Private K-12 School Voucher Contributions?

August 15, 2023 • By Carl Davis

Twenty-one states provide public support to private and religious K-12 schools through school voucher tax credits.

Illinois Voucher Tax Credits Don’t ‘Invest in Kids,’ They Invest in Inequality

June 12, 2023 • By Carl Davis

By allowing their school privatization tax credit to expire at the end of the year, Illinois lawmakers can take a meaningful step toward better tax and education policy, and a clear show of support for our nation’s public education system.

Letter to IRS on Section 1001 Regulation in 2023-2024 Priority Guidance Plan

June 9, 2023 • By ITEP Staff

Read as PDF Re: Recommendation for Inclusion of Section 1001 Regulation in 2023-2024 Priority Guidance Plan To Whom It May Concern, We are writing to respectfully urge that the IRS return to the work it left unfinished in 2019 when it issued final regulations on “Contributions in Exchange for State or Local Tax Credits” (RIN: […]

Wealthy families are overwhelmingly the ones using school voucher tax credits to opt out of paying for public education and other public services and to redirect their tax dollars to private and religious institutions instead. Most of these credits are being claimed by families with incomes over $200,000.