Washington

Washington Post: White House advisers privately float minimum tax on corporations amid blowback over 2017 GOP law

February 20, 2020

Opponents of the tax law such as presidential candidate Sen. Bernie Sanders (I-Vt.) have assailed the GOP and multibillion-dollar corporations for allegedly paying $0 in federal taxes under the new law. Ninety-one companies on the Fortune 500 paid $0 in federal corporate taxes in 2018, more than double the amount in previous years, according to […]

State Rundown 2/20: Property Taxes and School Finance Take Center Stage

February 20, 2020 • By ITEP Staff

Property taxes and education funding are a major focus in state fiscal debates this week. California voters will soon vote on borrowing billions of dollars to fill just part of the funding hole created in large part by 1978’s anti-property-tax Proposition 13. Nebraska lawmakers are debating major school finance changes that some fear will create similar long-term fiscal issues. And Idaho and South Dakota leaders are looking to avoid that fate by reducing property taxes in ways that will target the families who most need the help. Meanwhile, Arkansas, Nevada, and New Hampshire are taking close looks at their transportation…

State Rundown 2/13: What’s Trendy in State Tax Debates This Year

February 13, 2020 • By ITEP Staff

We wrote earlier this week about Trends We’re Watching in 2020, and this week’s Rundown includes news on several of those trends. Maine lawmakers are considering a refundable credit for caregivers. Efforts to tax high-income households made news in Maryland, Oregon, and Washington. Grocery taxes are receiving scrutiny in Alabama, Idaho, and Tennessee. Tax cuts or shifts are being discussed in Arizona, Nebraska, and West Virginia. And Arizona, Maryland, and Nevada continue to seek funding solutions for K-12 education as Alaska and Virginia do the same for transportation infrastructure.

ITEP Testimony In Support of H.B. 222 Income Tax Rates – Capital Gains Income & H.B. 256 Maryland Estate Tax – Unified Credit

February 12, 2020 • By Kamolika Das

Read as PDF Testimony of Kamolika Das, State Policy Analyst, Institute on Taxation and Economic Policy Submitted to: Ways and Means Committee, Maryland General Assembly Thank you for this opportunity to submit testimony. My name is Kamolika Das, and I represent the Institute on Taxation and Economic Policy (ITEP), a non-profit, non-partisan research organization that […]

Washington Is Finally Having the Right Conversation about Taxes

February 4, 2020 • By Amy Hanauer

Presidential candidates and some elected officials are finally talking about bold tax policy ideas that would increase taxes and raise revenue. This is a dramatic shift from when a radical, right-wing narrative dominated the public debate. Republicans redefined “fiscal responsibility” as fewer taxes and less government, peddled supply-side economic theories, and denied the clear evidence that tax cuts were adding to our nation’s deficits.

State Rundown 1/30: Flip-Flops and Steady Marches in State Tax Debates

January 30, 2020 • By ITEP Staff

State tax and budget debates can turn on a dime sometimes, as in Utah this past week, where lawmakers unanimously repealed a tax package they had just approved in a special session last month. Delaware lawmakers are hoping to avoid the similarly abrupt end to their last effort to improve their Earned Income Tax Credit (EITC) by crafting a bill that Gov. John Carney will have no reason to unexpectedly veto as he did two years ago. But at other times, these debates just can’t change fast enough, as in New Hampshire and Virginia, where leaders are searching for revenue to address long-standing transportation needs, and in Hawaii, Nebraska, and North Carolina, where education funding issues remain painfully unresolved.

Washington Post: Va. Governor Proposes Gas Tax Increase

January 27, 2020

Virginia would join 31 states that have raised or reformed their gas tax in the last decade, according to the Institute on Taxation and Economic Policy. Read more

The Washington Spectator: Tax Policy Options for the Next Administration

January 26, 2020

Bernie Sanders has proposed taxing estates worth more than $3.5 million. The Institute on Taxation and Economic Policy estimates that this would raise more than $30 billion a year. Another reform would generate a good deal more revenue—ending the so-called “step-up” provision of capital gains. When heirs receive an asset, they don’t owe taxes on […]

State tax and budget debates have arrived in a big way, with proposals from every part of the country and everywhere on the spectrum from good to bad tax policy. Just look to ARIZONA for a microcosm of nationwide debates, where education advocates have a plan to raise progressive taxes for school needs, Gov. Doug […]

Dallas Morning News: Trump slashed corporate tax rates to 21%, but many companies paid far less than that

January 13, 2020

Here’s another reason to complain: Many companies aren’t paying even the lower rate. In 2018, the first year under the new law, 379 profitable companies in the Fortune 500 paid an average effective rate of 11.3%, according to a study by the Institute on Taxation and Economic Policy, a progressive think tank in Washington. Read […]

State Rundown 1/8: States Need Clear Tax and Budget Policy Vision in 2020

January 8, 2020 • By ITEP Staff

Happy New Year readers! The Rundown is back to our usual weekly schedule as state legislative sessions and governors’ budgets and State of the State Addresses begin in earnest. Here’s to clear-eyed 20-20 vision guiding state tax and budget decisions in 2020! So far this year, the harm of Colorado’s TABOR policy and Alaska’s lack of an income tax are coming into focus in big ways. Utah advocates are hoping the benefit of hindsight will help convince voters to overturn a recently enacted tax overhaul. Lawmakers in states including Iowa, Maryland, and Virginia can clearly see a need for revenues,…

Public News Service: Will WA Lawmakers Tackle Tax Fairness in 2020?

January 3, 2020

How can Washington state create a more just society in 2020? Two experts say the state should tax its way toward that goal. The Institute on Taxation and Economic Policy ranks Washington last in the nation in terms of tax-system fairness, with low-income residents shouldering the biggest tax burden as a portion of their income. Katie Baird, […]

Washington Post: The Finance 202: Conservative Economists Say Trump’s Promises About His Tax Cuts Did Not Come True

December 19, 2019

A new report by the left-leaning Institute on Taxation and Economic Policy found 91 corporations in the Fortune 500 paid no federal taxes last year. And about 400 of the largest firms paid an average tax rate of 11 percent, half the burden prescribed by the tax law. Read more

Washington Post: House Narrowly Passes Bill That Would Restore SALT Tax Benefits to Higher-income Americans

December 19, 2019

“This mostly benefits rich people,” Steve Wamhoff, a tax analyst at the Institute on Taxation and Economic Policy (ITEP), a left-leaning think tank, said of repealing the SALT cap. “There’s a disconnect here: Many Democrats understand we have to raise more money to make the tax code more progressive,” Wamhoff said. “But this proposal, taken […]

State Rundown 12/18: Utah’s Tax Fight Wraps Up As Other States’ Ramp Up

December 18, 2019 • By ITEP Staff

With the new year and many state legislative sessions just around the corner, most state tax and budget debates are just getting started. Arkansas will be among the states working to improve their roads and other infrastructure. Massachusetts will have to deal with revenue losses due to a misguided tax-cut trigger put in place in prior years. Maryland and South Dakota will be two of many states facing teacher pay shortages and other education funding needs. And debates over the legalization and taxation of cannabis will likely continue in California, Kentucky, New Jersey, and beyond. Utah lawmakers, on the other…

Washington Examiner: Amazon, Netflix, and Starbucks Paid $0 in 2018 Federal Income Taxes

December 16, 2019

A new study by the Institute on Taxation and Economic Policy found that many of America’s largest corporations paid $0 in federal income taxes under the first year of President Trump’s tax law in 2018. Notable corporations in the study included Amazon, Netflix, Starbucks, Delta, Halliburton, and General Motors. Read more

Washington Post: Corporations Paid 11.3 Percent Tax Rate Last Year, in Steep Drop Under President Trump’s Law

December 16, 2019

About 400 of America’s largest corporations paid an average federal tax rate of about 11 percent on their profits last year, roughly half the official rate established under President Trump’s 2017 tax law, according to a report released Monday. The 2017 tax law lowered the U.S. corporate tax rate from 35 percent to 21 percent, […]

Washington Post: A New Report Hands Democrats a Major Weapon Against Trump

December 16, 2019

There is probably no more glaring example of President Trump’s massive betrayal of the economic populist nationalism that infused his campaign than the 2017 tax law. It isn’t just that he signed a massive tax cut that showered most of its benefits on the very highest earners after vowing to take on financial elites. It’s […]

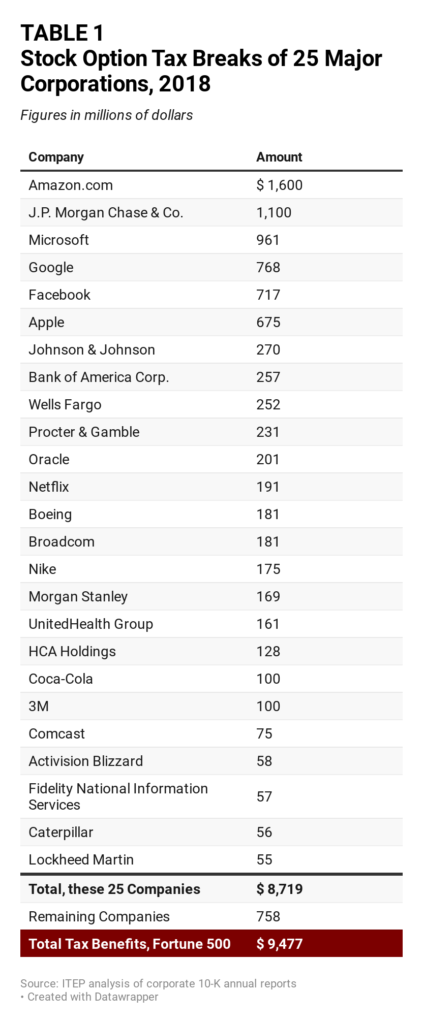

How Congress Can Stop Corporations from Using Stock Options to Dodge Taxes

December 10, 2019 • By ITEP Staff

The stock option rules in effect today create a problem because they allow corporations to report a much larger expense for this compensation to the IRS than they report to investors. The result is that corporations can report larger profits to investors but smaller profits to the IRS, undermining the fundamental fairness of the tax system.

The News Tribune: Washington State Leaders Must Tax the Way to a Just Society

December 7, 2019

The inequalities in our state’s tax code are well known, and have gained us the ignoble designation of “the most unfair state and local tax system in the country.” This medal of dishonor from the Institute on Taxation and Economic Policy is based on ITEP’s assessment of how fairly the tax burden is spread among […]

The New York Times: How FedEx Cut Its Tax Bill to $0

November 17, 2019

“Something like $1.5 billion in future taxes that they had promised to pay, just vanished,” said Matthew Gardner, an analyst at the liberal Institute on Taxation and Economic Policy in Washington. “The obvious question is whether you can draw any line, any connection between the tax breaks they’re getting, ostensibly designed to encourage capital expenditures, and what […]

Washington Post: Pete Buttigieg Proposes Free College for Americans Earning Under $100,000 in his New Economic Plan

November 8, 2019

Democratic candidate Julián Castro, the former secretary of housing and urban development in the Obama administration, has also proposed expanding the EITC. Castro would go further and also make the child tax credit fully refundable, another benefit to lower-income families that Buttigieg did not include in his plan. Sens. Kamala D. Harris (D-Calif.) and Cory […]

The Washington Post: Pete Buttigieg Proposes Free College for Americans Earning Under $100,000 in His New Economic Plan

November 8, 2019

Democratic candidate Julián Castro, the former secretary for housing and urban development in the Obama administration, has also proposed expanding the EITC. Castro would go even further and also make the child tax credit fully refundable, another benefit to lower-income families that Buttigieg did not include in his plan. Sens. Kamala D. Harris (D-Calif.) and […]

State Rundown 11/6: State Voters Show Readiness to Fix Broken Tax Codes

November 6, 2019 • By ITEP Staff

Many of yesterday’s Election Day votes came down to questions of whether or not to improve on upside-down and often inadequate state and local tax systems. The status quo was maintained in Colorado, where voters failed to approve a proposition to allow the state to invest tax revenue in education and other needs, and in Texas, where a constitutional amendment was approved to prohibit the state from creating an income tax. But voters supported important reforms in other states by approving needed funding for schools in Idaho, opting to legalize and tax recreational cannabis in California. And for more on…

Benefits of a Financial Transaction Tax

October 28, 2019 • By Jessica Schieder, Lorena Roque, Steve Wamhoff

A financial transaction tax (FTT) has the potential to curb inequality, reduce market inefficiencies, and raise hundreds of billions of dollars in revenue over the next decade. Presidential candidates have proposed using an FTT to fund expanding Medicare, education, child care, and investments in children’s health. Any of these public investments would be progressive, narrowing resource gaps between the most vulnerable families and the most fortunate.