Massachusetts

Download PDF

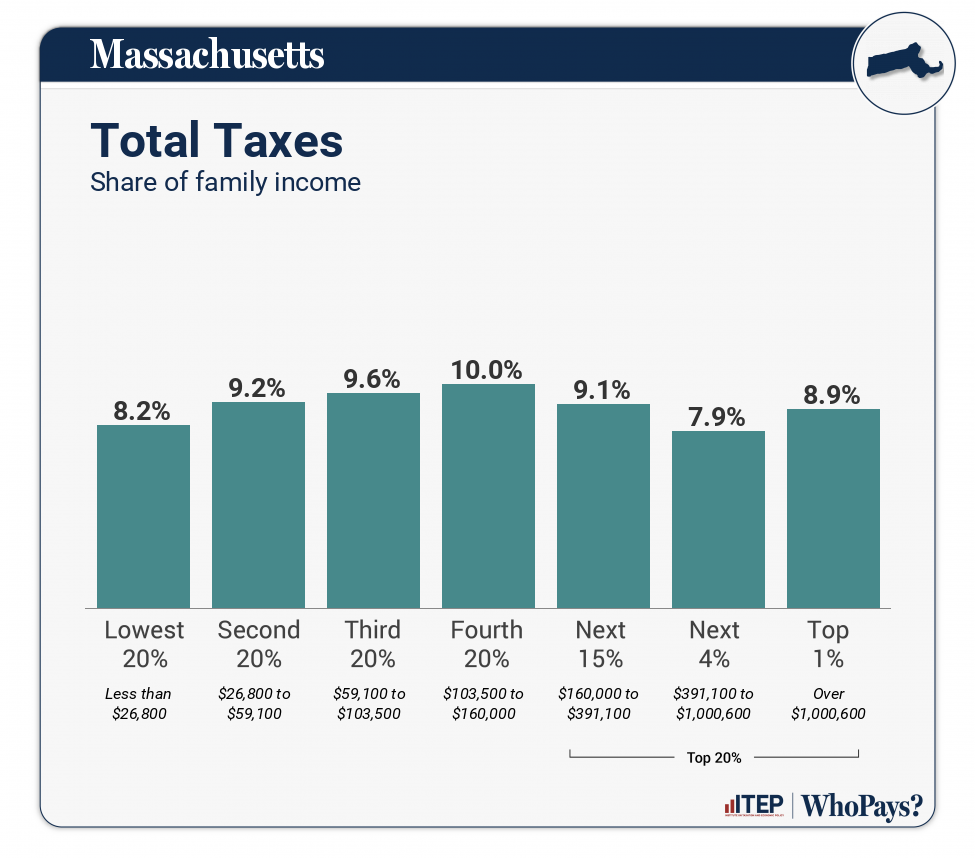

State and local tax shares of family income

| Top 20% | |||||||

| Income Group | Lowest 20% | Second 20% | Middle 20% | Fourth 20% | Next 15% | Next 4% | Top 1% |

| Income Range | Less than $26,800 | $26,800 to $59,100 | $59,100 to $103,500 | $103,500 to $160,000 | $160,000 to $391,100 | $391,100 to $1,000,600 | Over $1,000,600 |

| Average Income in Group | $14,900 | $41,900 | $79,200 | $131,400 | $240,900 | $586,100 | $3,464,700 |

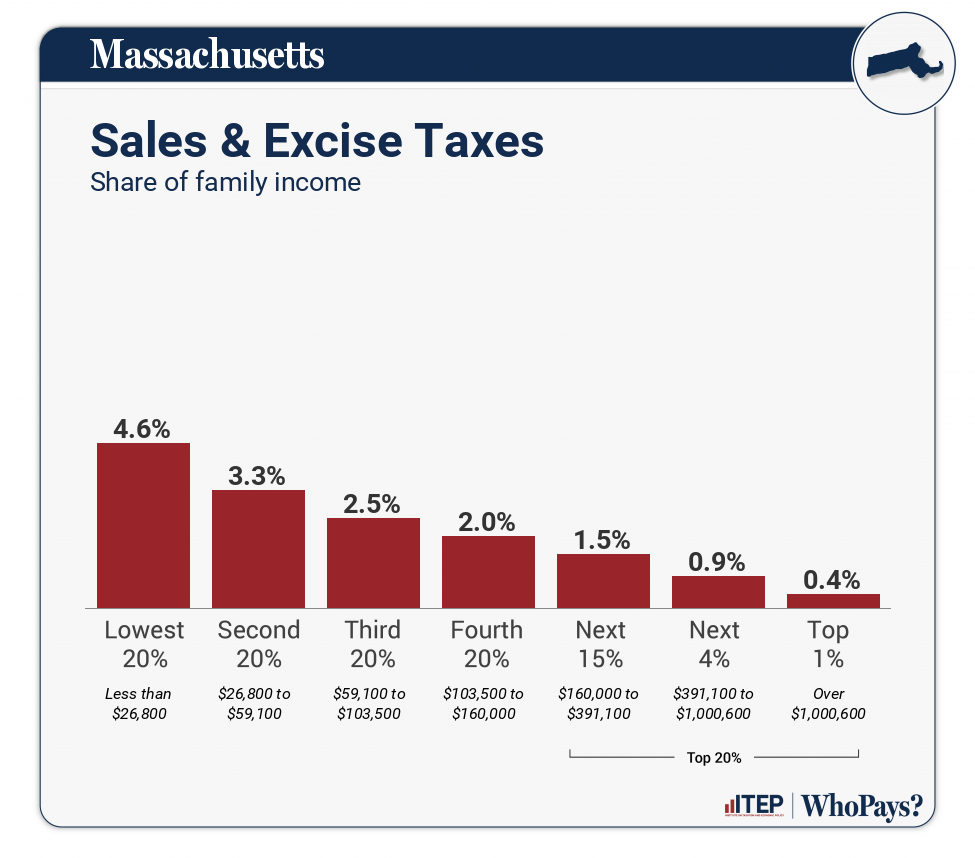

| Sales & Excise Taxes | 4.6% | 3.3% | 2.5% | 2% | 1.5% | 0.9% | 0.4% |

| General Sales–Individuals | 1.8% | 1.7% | 1.4% | 1.1% | 0.8% | 0.4% | 0.1% |

| Other Sales & Excise–Ind | 1.9% | 0.8% | 0.5% | 0.4% | 0.2% | 0.1% | 0% |

| Sales & Excise–Business | 0.8% | 0.7% | 0.6% | 0.5% | 0.4% | 0.3% | 0.3% |

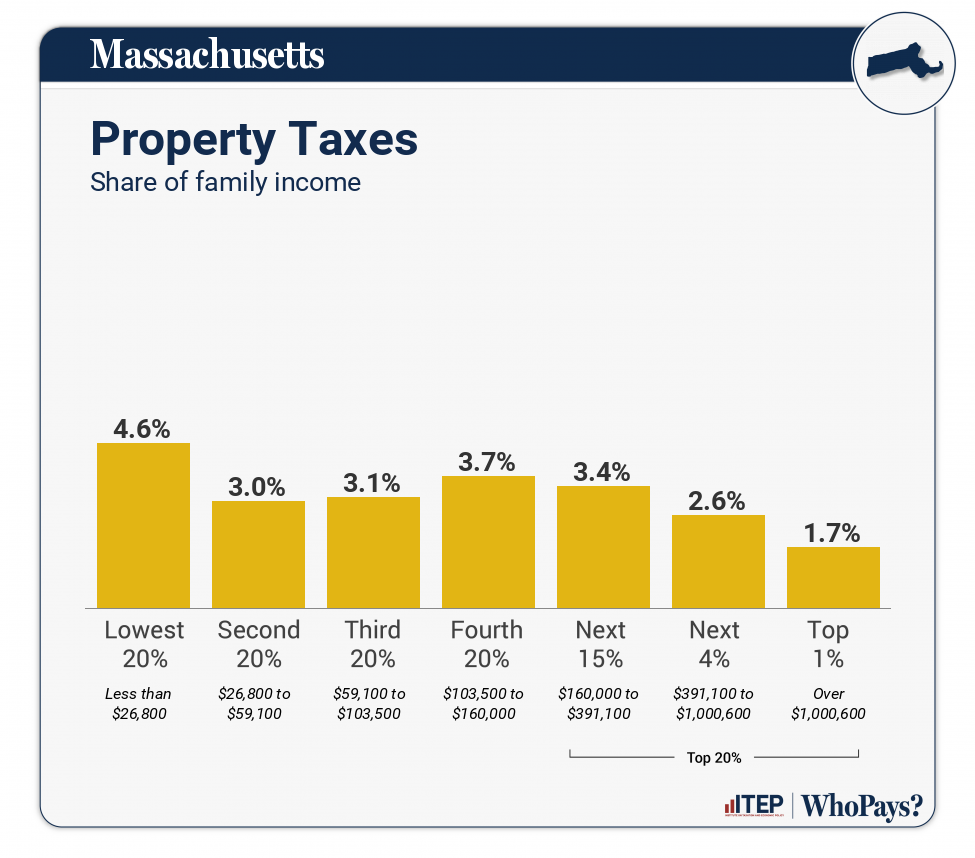

| Property Taxes | 4.6% | 3% | 3.1% | 3.7% | 3.4% | 2.6% | 1.7% |

| Home, Rent, Car–Individuals | 4.2% | 2.6% | 2.7% | 3.3% | 2.9% | 2.1% | 0.5% |

| Other Property Taxes | 0.4% | 0.4% | 0.4% | 0.4% | 0.5% | 0.6% | 1.2% |

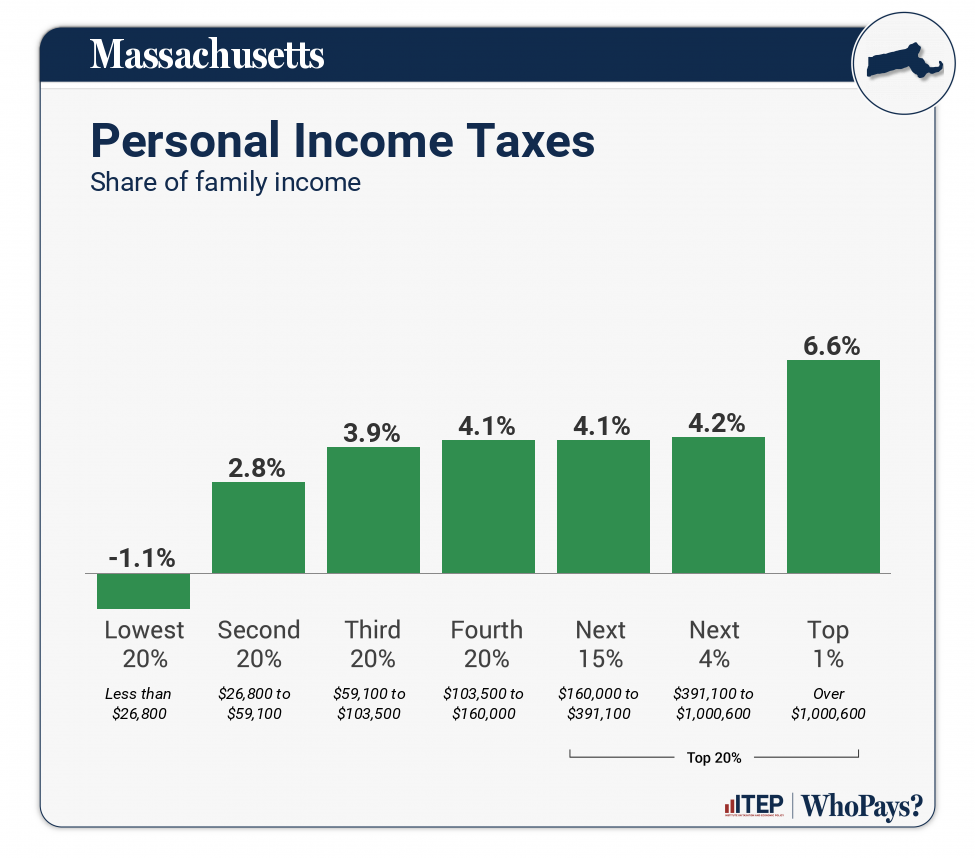

| Income Taxes | -1% | 2.8% | 3.9% | 4.2% | 4.2% | 4.3% | 6.8% |

| Personal Income Taxes | -1.1% | 2.8% | 3.9% | 4.1% | 4.1% | 4.2% | 6.6% |

| Corporate Income Taxes | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% | 0.2% |

| Other Taxes | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% | 0% | 0% |

| TOTAL TAXES | 8.2% | 9.2% | 9.6% | 10% | 9.1% | 7.9% | 8.9% |

| Individual figures may not sum to totals due to rounding. | |||||||

ITEP Tax Inequality Index

Massachusetts has a hybrid system that is progressive through some parts of the income distribution and regressive through other parts. On balance, the overall system tilts slightly regressive under the ITEP’s Tax Inequality Index because of this mix of conflicting distributional patterns. Massachusetts ranks 44th on the Index, meaning that six states and the District of Columbia have more progressive systems. (See Appendix B for state-by-state rankings and the report methodology for additional detail.)

Tax features driving the data in Massachusetts

|

Requires combined reporting for the corporate income tax but excludes profits booked overseas, including in tax haven countries

“No-tax” threshold and low-income credit eliminate income tax liability for poorest taxpayers

Levies higher income tax rate on taxable income over $1 million

Refundable Earned Income Tax Credit (EITC)

Refundable Child Tax Credit (CTC)

Sales tax base excludes groceries

Levies a state estate tax

|

|

|

No property tax “circuit breaker” credit for low-income, non-senior taxpayers

Real estate transfer tax does not include higher rate on high-value sales

Comparatively high reliance on property taxes

|