A tax system cannot be described as fair unless it is progressive, but that’s not the only reason why states should tax upper-income people at higher rates than those with lower incomes.

Progressive state tax codes raise more revenue for public services, improve the government’s relationship with residents, reduce poverty, and advance racial equity.

A fair tax system asks people to contribute to the cost of government services based on their ability to pay. Fairness is, of course, in the eye of the beholder. Yet almost anyone would agree that the best-off families should pay a higher tax rate than low- and middle-income families. State and local taxes pay for schools, safe neighborhoods, clean water and air, public transportation, and other things that make for a better community and enhance quality of life. Communities cannot afford these services, absent punishingly high levels of taxation on the poor and working class, unless taxes take ability to pay into account.

What Is Tax Progressivity?

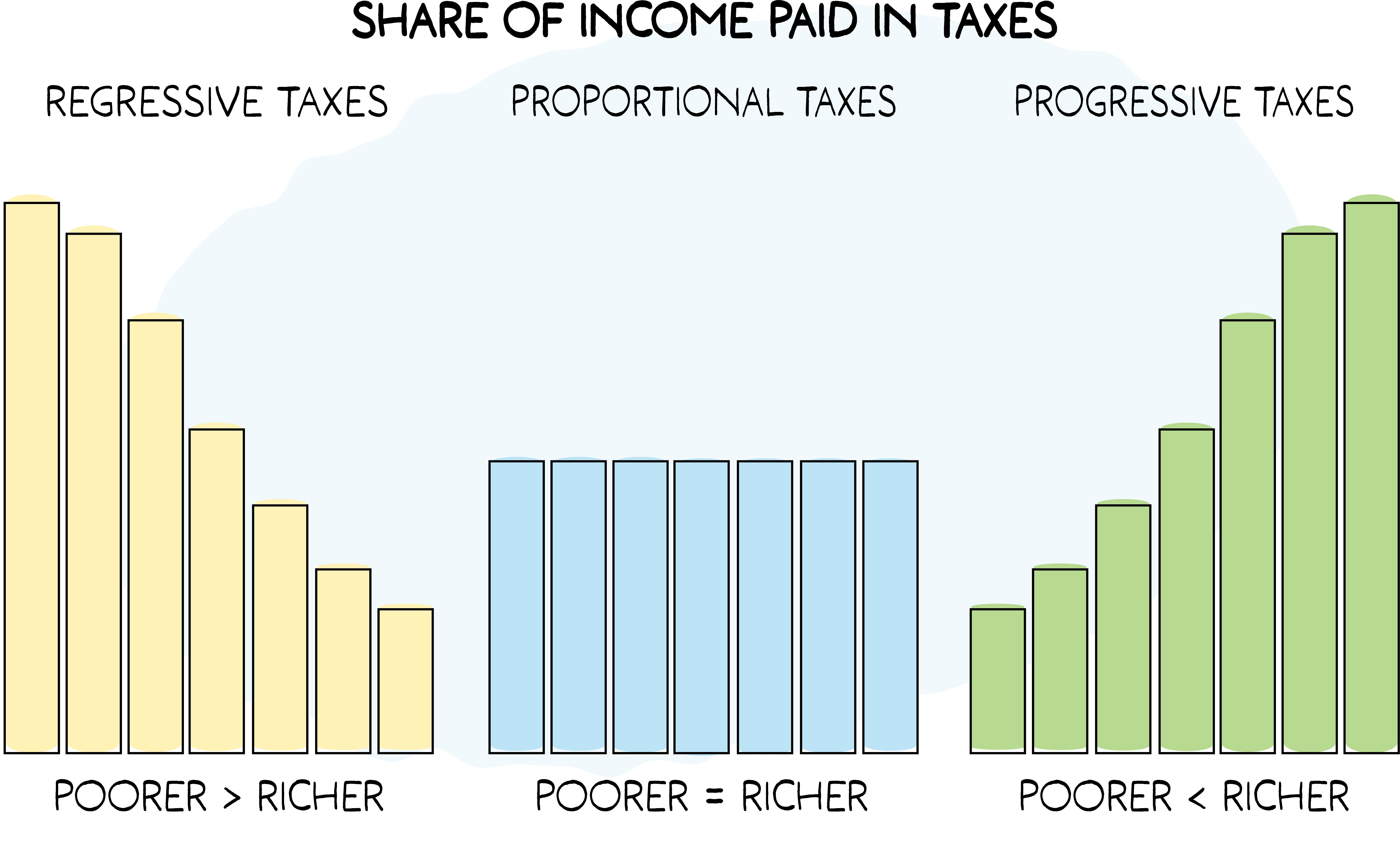

In discussing tax fairness, we use the terms regressive, proportional, and progressive. As the chart below illustrates:

- A regressive tax makes middle- and low-income families pay a larger share of their incomes in taxes than the rich.

- A proportional tax takes the same percentage of income from everyone, regardless of how much or how little they earn.

- A progressive tax is one in which upper-income families pay a larger share of their incomes in tax than do those with lower incomes.

Few people would consider a tax system to be fair if the poorer you are, the more of your income you pay in taxes. But that’s exactly what regressive taxes do. And it turns out that almost every state and local tax system in America is regressive, or upside-down. In contrast, six states plus Washington, D.C. have tax codes that reduce inequality with some strong progressive elements.

ITEP’s landmark Who Pays? study measures overall regressivity in all 50 states plus the District of Columbia. The most recent edition shows that, in the average state, low- and middle-income taxpayers faced a combined state and local tax rate 50 percent to 60 percent higher than the highest-income 1 percent of taxpayers.

Some believe that a proportional, or “flat,” tax structure is fair. They argue that if everyone pays the same share of income in taxes, then everyone is treated equitably. But this view ignores the fact that taking the same share of income from a middle- or low-income family as from a rich family has vastly different consequences. A tax on low- or middle-income families can cut directly into their ability to meet basic needs. The same tax may affect the lifestyle of the wealthiest families very little. Even if one believes that flat taxes are the fairest structure, the vast majority of state and local tax systems are regressive, not flat.

What Problems Does Regressivity Cause?

A basic problem with regressive tax systems is that they seek to raise money from the people who have the least of it. This is illogical at best. The best-off 20 percent of Americans make more than the remaining 80 percent combined. And the wealthiest 1 percent of Americans have an average income 139 times as high as the bottom 20 percent. Soaking the poor in taxes doesn’t yield much revenue compared to modest taxes on the rich. Fair taxes are essential to adequate funding of public services because they tax those who have the most to give.

Many states with regressive tax structures are facing long-term structural budget deficits due to continually imposing higher taxes on people without much money. These states are largely bypassing—that is, by taxing at very low rates—the people whose incomes have grown the fastest: the rich. In the long run, progressive taxes like the income tax are a more dependable source of revenue for state and local governments precisely because they tax the wealthy state residents who have enjoyed the largest income gains in recent decades.

Fair taxes also help the government in its relations with its citizens. The public accepts taxes because it values the services that government provides. When a tax system is unfair, however, it undermines public trust. When states choose to balance their budgets by concentrating tax increases on low- and middle-income families, while giving the best-off families a free pass, this obvious unfairness undermines public support for revenue-raising tax reforms even when they are desperately needed.

A fair tax system is important as a moral imperative. Tax payments can reduce funds available for other things in any family. But for poorer families, it may make it hard to afford food, clothing, a trip to the doctor, or some other necessity. ITEP’s Who Pays? report shows – not surprisingly — that states with lower taxes for wealthy households tend to have higher taxes on poor families.

Reducing poverty through fairer taxes has broad social benefits. Research shows that kids who grow up less poor tend to fare better in school, stay out of trouble, and earn more and pay more taxes as adults. Further, keeping money in low-income communities leaves consumers with greater spending power, boosting local businesses.

Finally, fair taxes help further racial equity. Tax policy is not racially neutral. Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination, uneven systems of public education funding, and racist policies such as redlining and discrimination in lending practices have created extraordinary differences in intergenerational wealth. Taxing poorer people at higher rates than the wealthy tends to widen the racial wealth gap even further.

Related Entries

What Principles Should Guide State and Local Tax Policy?

State and local taxes exist primarily to fund schools, roads, health care, and other services needed for communities to thrive. There are multiple ways to achieve this goal, so it can be helpful to evaluate different options based on a few core principles.

How Do State and Local Tax Systems Affect Racial Justice?

State and local tax codes have the potential to either narrow or widen racial inequality created by historical and current injustices in public policy and in broader society. In general, tax codes that are more progressive across the economic spectrum do more to narrow racial inequality, while regressive tax policies exacerbate it.

Why Does Tax Incidence Matter and How Do We Measure It?

Tax incidence reveals who pays state and local taxes and how those taxes are distributed across the population. It can illuminate how different approaches to tax policy have different impacts on different groups of taxpayers, illuminating in concrete terms the progressivity or regressivity of specific proposals.

Learn More

- Byerly-Duke, Eli, and Dylan Grundman O’Neill (2024). “The Case for More Progressive State and Local Tax Systems, in Charts.” ITEP.

- Cooper, Kerris, and Kitty Stewart (2017). “Does Money Affect Children’s Outcomes? An Update.” Centre for Analysis of Social Exclusion, London School of Economics.

- ITEP (2024). Who Pays? A Distributional Analysis of the Tax Systems in All 50 States. Seventh Edition.