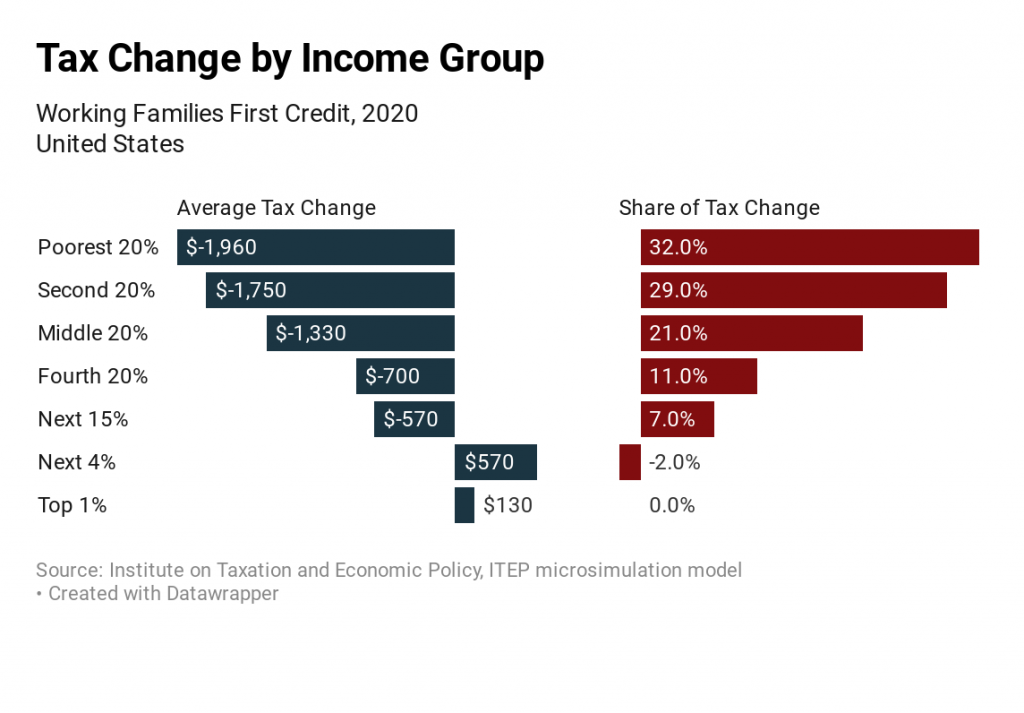

The Working Families First Credit proposal would increase the CTC from $2,000 to $3,000 and remove the limits on refundability that prevent many lower-income families from receiving the entire credit. It would also lower the income level at which the credit begins to phase out from $400,000 to $200,000 for married couples (from $200,000 to $150,000 for single parents) and this change is the reason the top 5 percent would receive a tax increase on average. The proposal would also expand the EITC by increasing the rate at which earnings are credited and it would provide a larger increase for childless workers.

RELATED BLOG POST: Julián Castro Provides the Latest Proposal to Expand Refundable Tax Credits

Lead Sponsor/Proponent |

General Explanation |

Share Going to Bottom 60% |

Share Going to Richest 20% |

Total Cost CY 2020 |

| Julián Castro | Expand the CTC to be fully refundable, expand the EITC |

82% | 5% | $195.3 billion |

State Impact National Impact Who Benefits?