The Institute on Taxation and Economic Policy

What's New

State Rundown 2/25: Sausage-Making Season Is Upon Us

February 25, 2026 • By ITEP Staff

National Sausage Month isn’t until October, but now is the time of year when state lawmakers are really diving into their sausage-making processes, as separate legislative houses and oftentimes political parties send competing bills, budgets, and visions back and forth to grind out their differences.

Pioneer Institute Criticizes ITEP For Not Writing the Paper They Would Have Written

February 25, 2026 • By Eli Byerly-Duke

Voters, lawmakers, researchers, and advocates frequently disagree about ideal tax policy. But the facts here speak for themselves.

Yum! Brands’ Recipe for Tax Avoidance: Trump Tax Cuts with a Dash of Malta

February 24, 2026 • By Matthew Gardner

the fast-food multinational that owns KFC, Taco Bell, and Pizza Hut reported this week that it made $1 billion of pretax profits in the U.S. last year—and didn’t pay a dime of federal income taxes on those profits.

State-by-State Estimates of the First Year of Trump’s Tax Policies: All But the Richest Americans Face Higher Taxes

February 23, 2026 • By Steve Wamhoff, Michael Ettlinger

As a result of the tax policies approved by President Trump and the Republican majority in Congress, all but the richest Americans are paying higher taxes on average in 2026 than they did last year.

Despite a Supreme Court Victory for Middle-Class Americans, Trump’s Disastrous Tariff Policies Are Not Over

February 20, 2026 • By Steve Wamhoff

Today the Supreme Court made the right decision in striking down most of the tariffs President Trump has put into motion during his second term.

ITEP in the News

St. Louis Magazine: How St. Louis County's Senior Tax Freeze Takes from the Young to Give to the Old

Christian Science Monitor: More Red States Eye the No-Income-Tax Model. Will It Work?

New York Times: Opinion | The Donald Trump 1 Percent Fan Club

New York Times: In Washington State, Democrats Consider Breaking a Taboo: Taxing the Rich

Audio: ITEP's Kamolika Das on the Need for States to Raise Revenue in the Wake of 2025 Trump Tax Law

ITEP Work in Action

D.C Fiscal Policy Institute: DC Can Raise $121 Million or More with a Simple Tax on Proceeds from Wealth

Governor Newsom Launches New State Investment and Philanthropic Collaboration To Continue Supporting Families Under Federal Assault

Video: ITEP's Brakeyshia Samms Talks About Race and the Tax Code on Colorado Fiscal Institute Podcast

Policy Matters Ohio: The Great Ohio Tax Shift, 2026

Massachusetts Budget & Policy Center: Testimony Regarding an Act To Manage Federal Tax Changes in Massachusetts

Across the States

Tax Watch

State Tax Watch 2026

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

Get weekly updates by signing up for our State Rundown newsletter.

Learn more about state taxes across the country, read Who Pays?

State Rundown & On the Map

On the Map

State Rundown 2/25: Sausage-Making Season Is Upon Us

National Sausage Month isn’t until October, but now is the time of year when state lawmakers are really diving into their sausage-making processes, as separate…

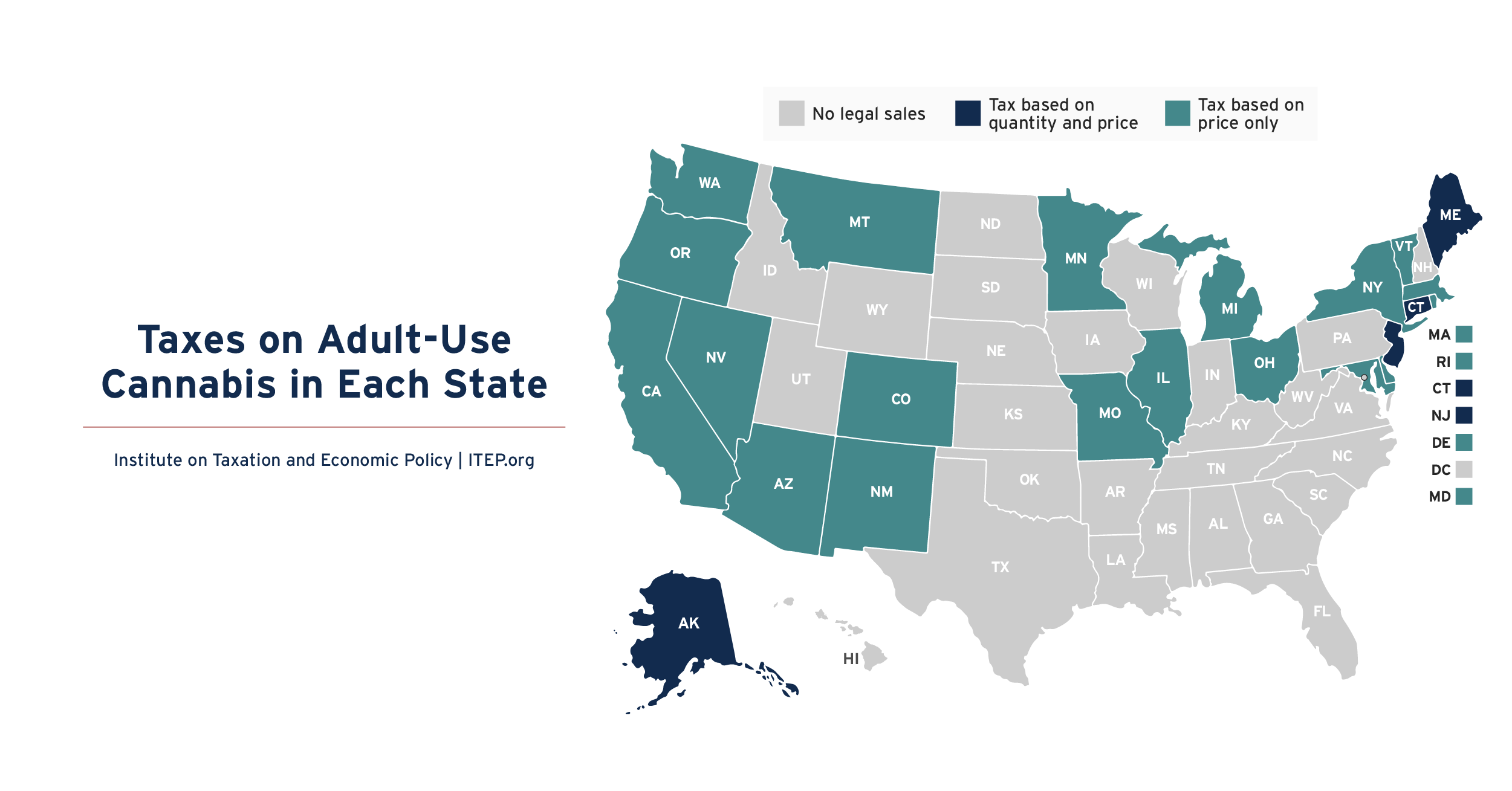

Taxes on Adult-Use Cannabis in Each State

Twenty-three states have legalized the sale of cannabis for general adult use. Every state allowing legal sales applies an excise tax to cannabis based on…

State & Local Tax Policy

Pioneer Institute Criticizes ITEP For Not Writing the Paper They Would Have Written

February 25, 2026 • By Eli Byerly-Duke

Property Tax Reforms Can Bring Racial Justice

February 19, 2026 • By Brakeyshia Samms

It’s Time for States to Jettison Nonsensical FDDEI Deductions

February 19, 2026 • By Carl Davis

Michigan Ballot Proposal Would Boost Public Education While Creating a Fairer Tax System

February 17, 2026 • By Matthew Gardner, Miles Trinidad