Recent Work

2161 items

State Tax Watch 2026

March 9, 2026 • By ITEP Staff

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

Governor Should Put New Mexico’s Tax Interests First

March 6, 2026 • By Amy Hanauer, Amber Wallin

By decoupling from three misguided federal corporate income tax cuts under the One Big Beautiful Bill, plus taking steps to curb unfair corporate tax avoidance, SB 151 would raise and safeguard more than $120 million annually.

As many state legislative sessions near or cross the halfway point, lawmakers are facing tough choices.

New Income Tax Disclosure Rules Mean Halliburton Can No Longer Conceal Its Offshore Tax Avoidance

March 2, 2026 • By Matthew Gardner

The company’s latest annual report throws the doors wide open once again on Halliburton’s penchant for offshoring its profits to tax havens, thanks to terrific new disclosure rules introduced by an obscure but vital agency, the Financial Accounting Standards Board (FASB).

Cheniere Energy Gets $380 Million Gift from Trump’s Treasury Department

February 26, 2026 • By Matthew Gardner

Cheniere Energy's latest annual financial report shows the company reaped a cool $380 million in tax cuts from a single regulatory change made by the Trump administration last fall.

Nvidia’s Tax Bill Shows It’s Not Just Zero-Tax Corporations That Hurt Our Budget Deficit the Most

February 26, 2026 • By Matthew Gardner

Semiconductor giant Nvidia reported avoiding $6.8 billion in federal income taxes last year. The company did this in a year when it reported greater earnings growth than almost any corporation in history, with U.S. pretax income coming in at an astonishing $123 billion.

National Sausage Month isn’t until October, but now is the time of year when state lawmakers are really diving into their sausage-making processes, as separate legislative houses and oftentimes political parties send competing bills, budgets, and visions back and forth to grind out their differences.

Pioneer Institute Criticizes ITEP For Not Writing the Paper They Would Have Written

February 25, 2026 • By Eli Byerly-Duke

Voters, lawmakers, researchers, and advocates frequently disagree about ideal tax policy. But the facts here speak for themselves.

Yum! Brands’ Recipe for Tax Avoidance: Trump Tax Cuts with a Dash of Malta

February 24, 2026 • By Matthew Gardner

the fast-food multinational that owns KFC, Taco Bell, and Pizza Hut reported this week that it made $1 billion of pretax profits in the U.S. last year—and didn’t pay a dime of federal income taxes on those profits.

State-by-State Estimates of the First Year of Trump’s Tax Policies: All But the Richest Americans Face Higher Taxes

February 23, 2026 • By Steve Wamhoff, Michael Ettlinger

As a result of the tax policies approved by President Trump and the Republican majority in Congress, all but the richest Americans are paying higher taxes on average in 2026 than they did last year.

Despite a Supreme Court Victory for Middle-Class Americans, Trump’s Disastrous Tariff Policies Are Not Over

February 20, 2026 • By Steve Wamhoff

Today the Supreme Court made the right decision in striking down most of the tariffs President Trump has put into motion during his second term.

Live Nation Entertainment Says Trump Tax Law Drove its 2025 Federal Income Tax Bill to Zero

February 20, 2026 • By Matthew Gardner

The company paid zero federal income tax in 2025 despite reporting $145 million of U.S. profits.

Trump Administration Provides Biggest Illegal Tax Cuts Yet for Billion-Dollar Corporations

February 20, 2026 • By Amy Hanauer

The Treasury Department is unilaterally cutting corporate taxes with regulations that ignore the statute they claim to implement, disregarding the separation of powers between the branches of government that has defined how America works for more than two centuries.

Homes in Black neighborhoods are more likely to be over-assessed for tax purposes while being undervalued by private appraisers.

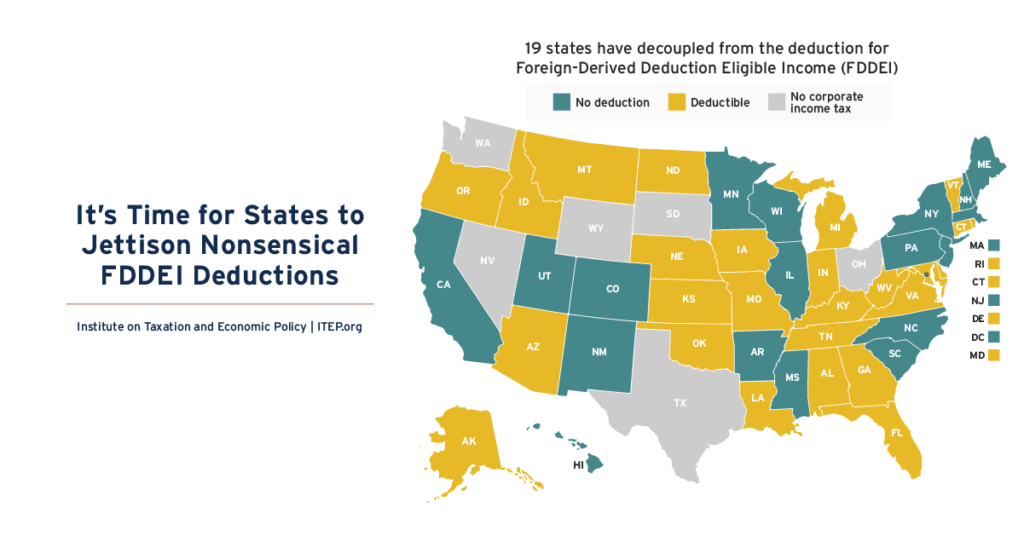

It’s Time for States to Jettison Nonsensical FDDEI Deductions

February 19, 2026 • By Carl Davis

FDDEI deductions should be repealed for policy reasons alone as they do not serve a legitimate purpose at the state level.