ITEP's Research Priorities

ITEP Comments and Recommendations on Proposed Section 170 Regulation (REG-112176-18)

October 11, 2018 • By Carl Davis

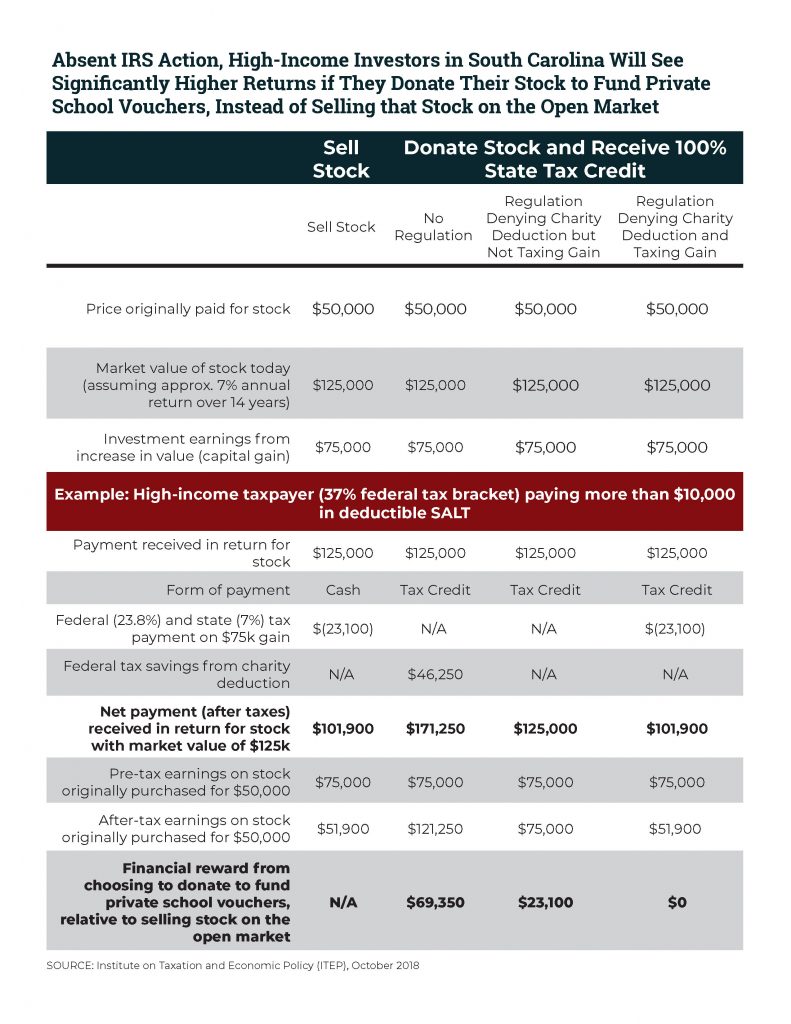

The IRS recently proposed a commonsense improvement to the federal charitable deduction. If finalized, the regulation would prevent not just the newest workarounds to the $10,000 deduction for state and local taxes (SALT), but also a longer-running tax shelter abused by wealthy donors to private K-12 school voucher programs. ITEP has submitted official comments outlining four key recommendations related to the proposed regulation.

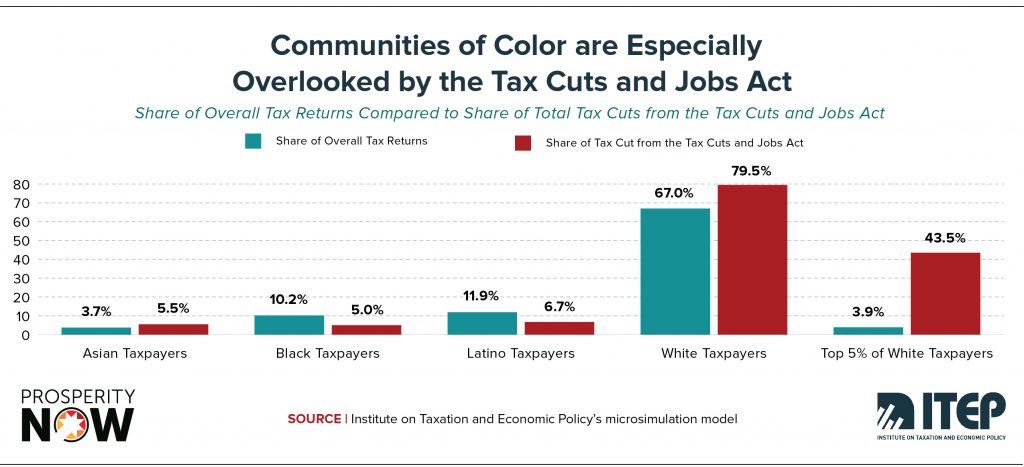

Race, Wealth and Taxes: How the Tax Cuts and Jobs Act Supercharges the Racial Wealth Divide

October 11, 2018 • By Meg Wiehe

A newly released report by Prosperity Now and the Institution on Taxation and Economic Policy, Race, Wealth and Taxes: How the Tax Cuts and Jobs Act Supercharges the Racial Wealth Divide, finds that the TCJA not only adds unnecessary fuel to the growing problem of overall economic inequality, but also supercharges an already massive racial wealth divide to an alarming extent.

‘Financial Exposure’ Showcases Tax Misconduct by Powerful Individuals and Corporations

October 10, 2018 • By Peter Della-Rocca

Elise J. Bean’s Financial Exposure reiterates the point that tax avoidance and tax evasion were endemic to our financial system long before allegations against a sitting president brought them to the forefront of the public consciousness.

NPR: It’s Been 25 Years Since The Federal Gas Tax Went Up

October 5, 2018

Yet over those 25 years, the cost of building and maintaining roads, bridges and transit has shot up, leaving the highway trust fund, which pays the federal portion of highway and transit projects, running on empty. “The whole reason this tax exists is to keep our roads paved and to keep our bridges from falling down,” says Davis. “And to do that effectively, it needs to collect a sustainable amount of revenue over time to cover the cost of paving roads and maintaining bridges, and it can’t do that if it’s just not updated for decades at a time.”

Concerned about Trump-family tax gaming? His law may prompt others to dodge.

October 5, 2018 • By Steve Wamhoff

“The IRS is wildly outgunned,” says Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy, a think tank in Washington. “You can’t keep cutting IRS funding and not expect more things like what The New York Times wrote about the Trumps. That’s bound to happen even more now.”

South Carolina lawmakers have finally passed a federal conformity bill in response to last year’s federal tax-cut legislation. Voters in many states are hearing a lot about tax-related questions they’ll see on the ballot in November, particularly residents of Florida, Montana, and Oregon, where corporate donors and other anti-tax interests are spending major sums to alter policy in their states. And states continue to work on ensuring they can collect online sales taxes and, in some states, online sports betting taxes.

Washington Post: How big developers like Trump benefit from web of tax breaks

October 4, 2018

[Real estate investors] can fall behind on their debts and still face fewer tax penalties for having the debt forgiven than other kinds of investors, according to Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy. Trump took advantage of that, Wamhoff says, when he couldn’t repay debts on his Atlantic City casinos in the 1990s and early 2000s.

Fiscal Times: What Trump’s Family Finances Tell Us About the Tax System

October 3, 2018

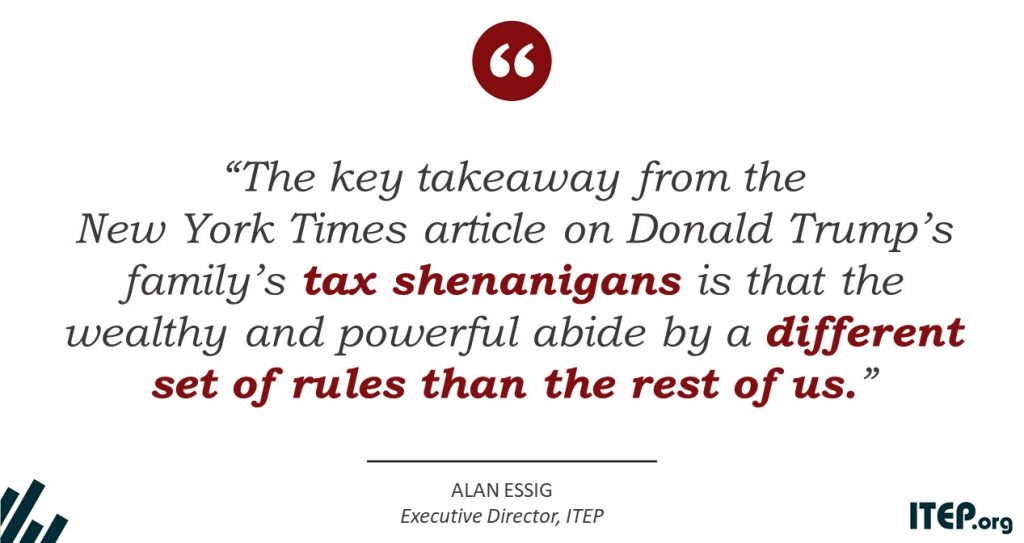

“The key takeaway,” said Alan Essig, director of the liberal Institute on Taxation and Economic Policy, “is that the wealthy and powerful abide by a different set of rules than the rest of us. … During his presidential campaign, President Trump called for closing the types of loopholes that allow some wealthy people to get […]

The New Yorker: The Trump Family’s Tax Dodging Is Symptomatic of a Larger Problem

October 3, 2018

This experience points to an enduring scandal that goes well beyond the Trumps. “The key takeaway from the New York Times article . . . is that the wealthy and powerful abide by a different set of rules than the rest of us,” Alan Essig, the executive director of the Institute on Taxation and Economic Policy, a nonpartisan […]

NYT Expose on Trump Family Tax Avoidance Demonstrates There’s a Different Set of Rules for the Rich and Powerful

October 2, 2018 • By Alan Essig

Following is a statement by Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding an expose in today’s New York Times that reveals Donald Trump’s family engaged in complex schemes to avoid taxes.

The Post and Courier: Some Valuable Downtown Charleston Land Now Comes with Tax Breaks

October 2, 2018

“Even if the tax breaks drive some new investment into low-income areas, this does not guarantee that these investments will ultimately benefit low-income families within the opportunity zones,” said the Institute on Taxation and Economic Policy. “In fact, additional investment driven by opportunity zones could have the unintended effect of fueling higher real estate prices […]

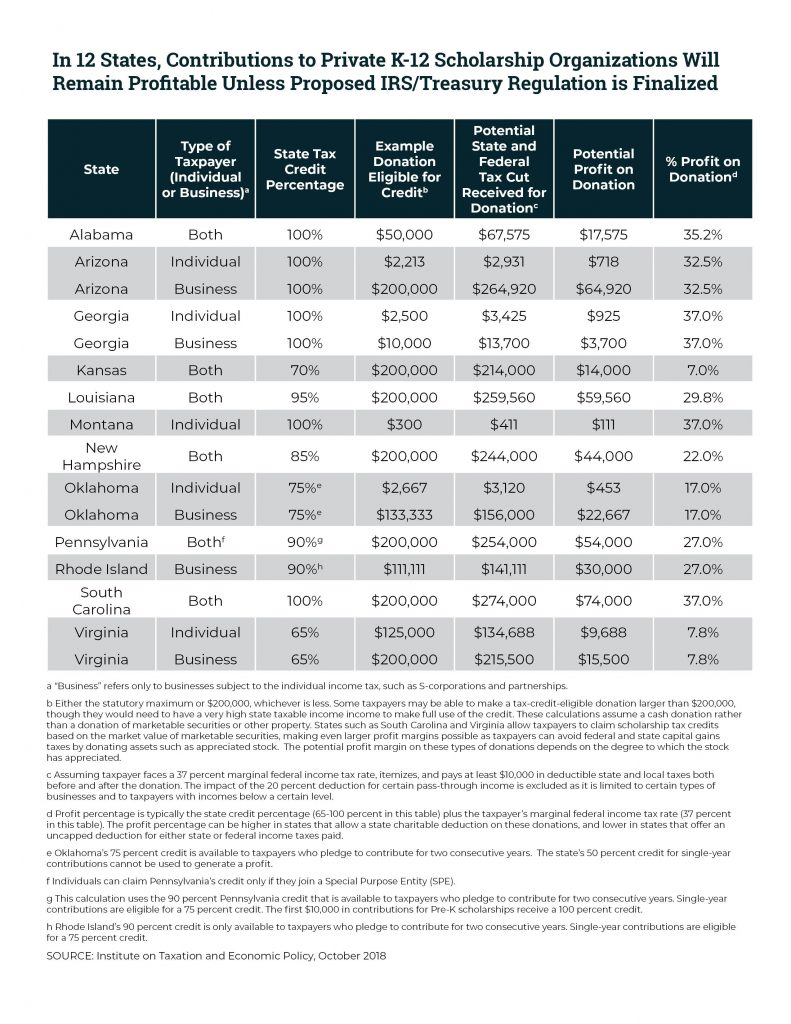

Twelve States Offer Profitable Tax Shelter to Private School Voucher Donors; IRS Proposal Could Fix This

October 2, 2018 • By Carl Davis

A proposed IRS regulation would eliminate a tax shelter for private school donors in twelve states by making a commonsense improvement to the federal tax deduction for charitable gifts. For years, some affluent taxpayers who donate to private K-12 school voucher programs have managed to turn a profit by claiming state tax credits and federal tax deductions that, taken together, are worth more than the amount donated. This practice could soon come to an end under the IRS’s broader goal of ending misuse of the charitable deduction by people seeking to dodge the federal SALT deduction cap.

Politico: Morning Tax

October 1, 2018

Today also marks 25 years since the last federal gas tax increase, which was raised to its current 18.3 cents per gallon in 1993. Plenty of people have talked about hiking the gas tax again over the last quarter-century — even potentially President Donald Trump — without much success, as Republicans have largely opposed the […]