State Reports

Alaska lawmakers are facing an unprecedented fiscal crisis. The state is more dependent than any other on oil tax and royalty revenues but declines in oil prices and production levels have sapped much of the vitality of these revenue sources. One way of diversifying the state’s revenue stream and narrowing the yawning gap between state revenues and expenses would be to reinstitute a statewide personal income tax. Alaska previously levied such a tax until 1980. This report contains ITEP’s analysis of the distributional impact and revenue potential of a variety of flat-rate income tax options for Alaska, based on draft…

The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis

April 17, 2019 • By Aidan Davis, Meg Wiehe

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce…

U.S.: Who Pays? 6th Edition

October 25, 2018 • By ITEP Staff

Low Tax for Whom? Texas is a “Low Tax State” Overall, But Not for Families Living in Poverty

October 17, 2018 • By ITEP Staff

Texas’s tax system has vastly different impacts on taxpayers at different income levels. For instance, the lowest-income 20 percent of Texans contribute 13 percent of their income in state and local taxes — considerably more than any other income group in the state. For low-income families, Texas is far from being a low tax state; in fact, it is tied with Arizona as the sixth highest-tax state in the country for low-income families.

Low Tax for Whom? Washington is a “Low Tax State” Overall, But Not for Families Living in Poverty

October 17, 2018 • By ITEP Staff

Washington’s tax system has vastly different impacts on taxpayers at different income levels. For instance, the lowest-income 20 percent of Washingtonians contribute 17.8 percent of their income in state and local taxes — considerably more than any other income group in the state. For low-income families, Washington is far from being a low tax state; in fact, it is the highest-tax state in the country for low-income families.

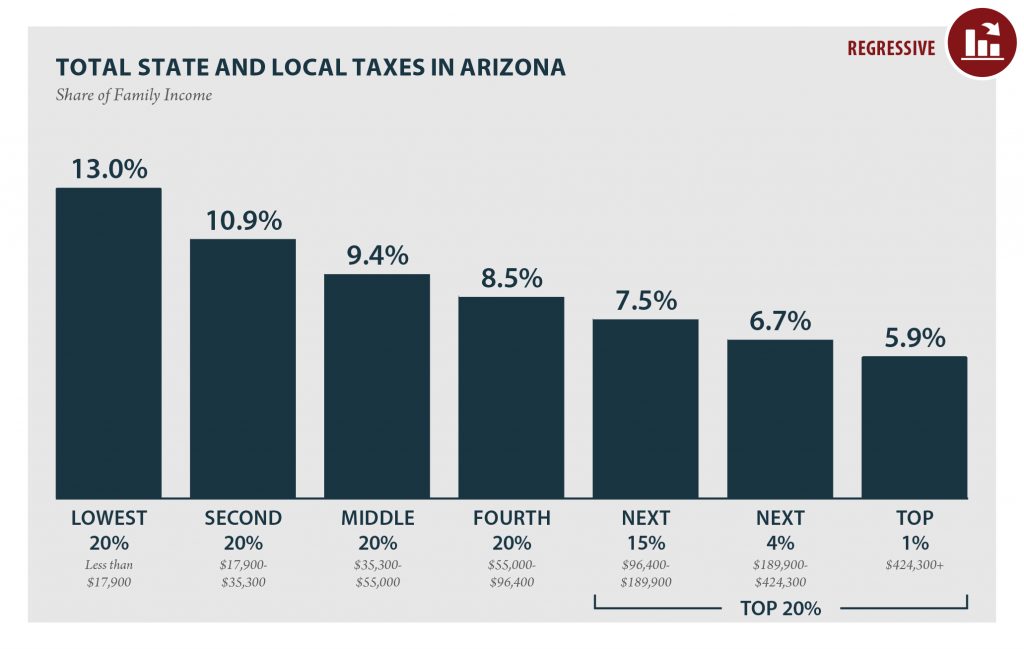

Low Tax for Whom? Arizona is a “Low Tax State” Overall, But Not for Families Living in Poverty

October 17, 2018 • By ITEP Staff

Arizona’s tax system has vastly different impacts on taxpayers at different income levels. For instance, the lowest-income 20 percent of Arizonans contribute 13 percent of their income in state and local taxes — considerably more than any other income group in the state. For low-income families, Arizona is far from being a low tax state; in fact, it is tied with Texas as the sixth highest-tax state in the country for low-income families.

Low Tax for Whom? Indiana is a “Low Tax State” Overall, But Not for Families Living in Poverty

October 17, 2018 • By ITEP Staff

Indiana’s tax system has vastly different impacts on taxpayers at different income levels. For instance, the lowest-income 20 percent of Hoosiers contribute 12.8 percent of their income in state and local taxes — considerably more than any other income group in the state. For low-income families, Indiana is far from being a low tax state; in fact, it is the eighth highest-tax state in the country for low-income families.

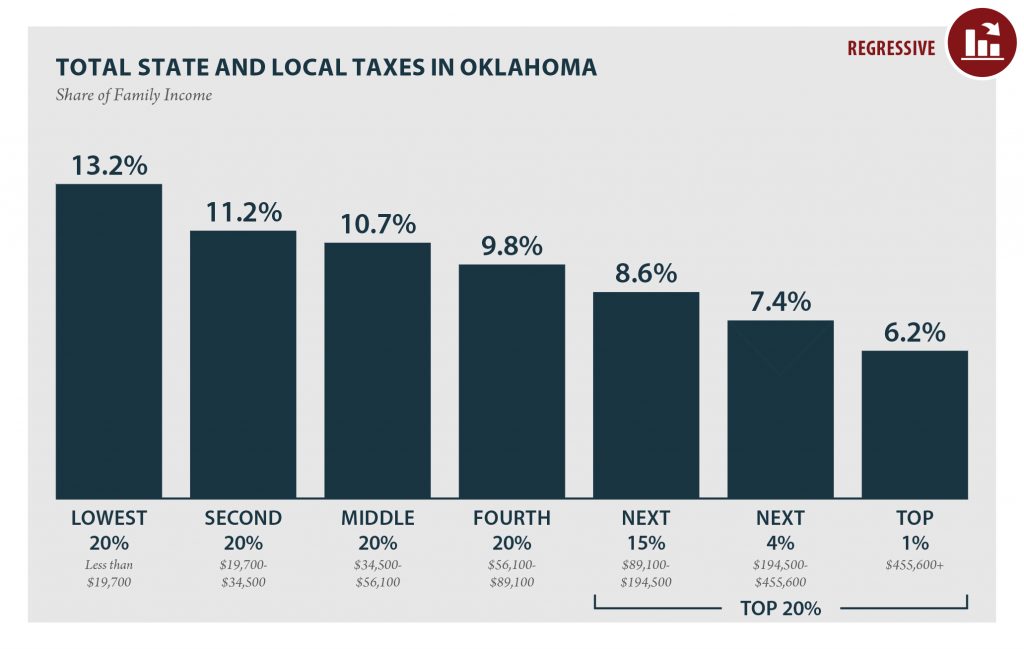

Low Tax for Whom? Oklahoma is a “Low Tax State” Overall, But Not for Families Living in Poverty

October 17, 2018 • By ITEP Staff

Oklahoma’s tax system has vastly different impacts on taxpayers at different income levels. For instance, the lowest-income 20 percent of Oklahomans contribute 13.2 percent of their income in state and local taxes — considerably more than any other income group in the state. For low-income families, Oklahoma is far from being a low tax state; in fact, it is the fifth highest-tax state in the country for low-income families.

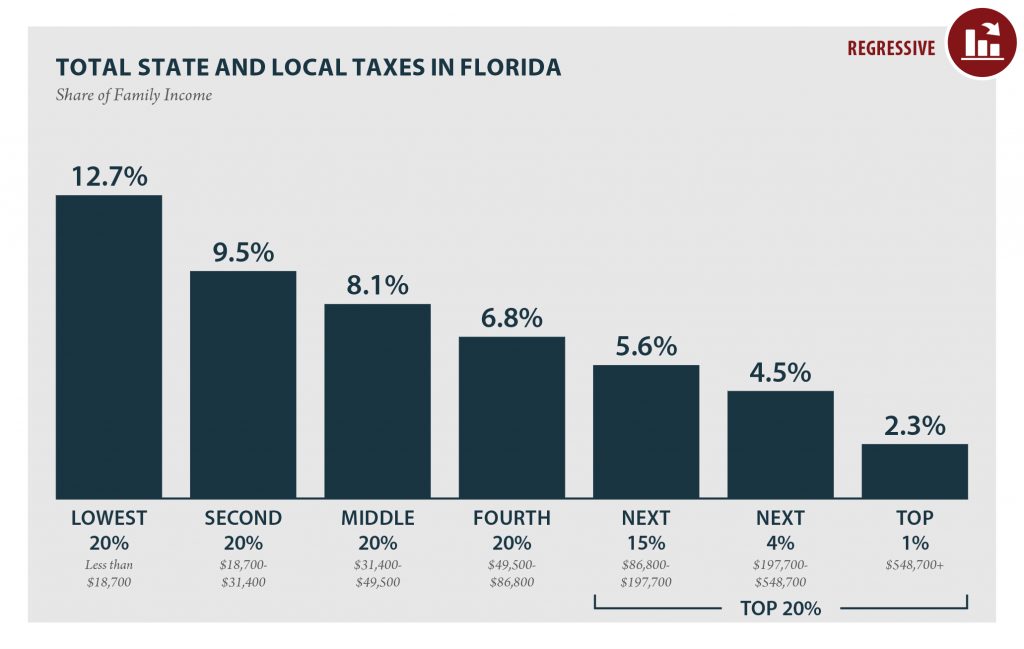

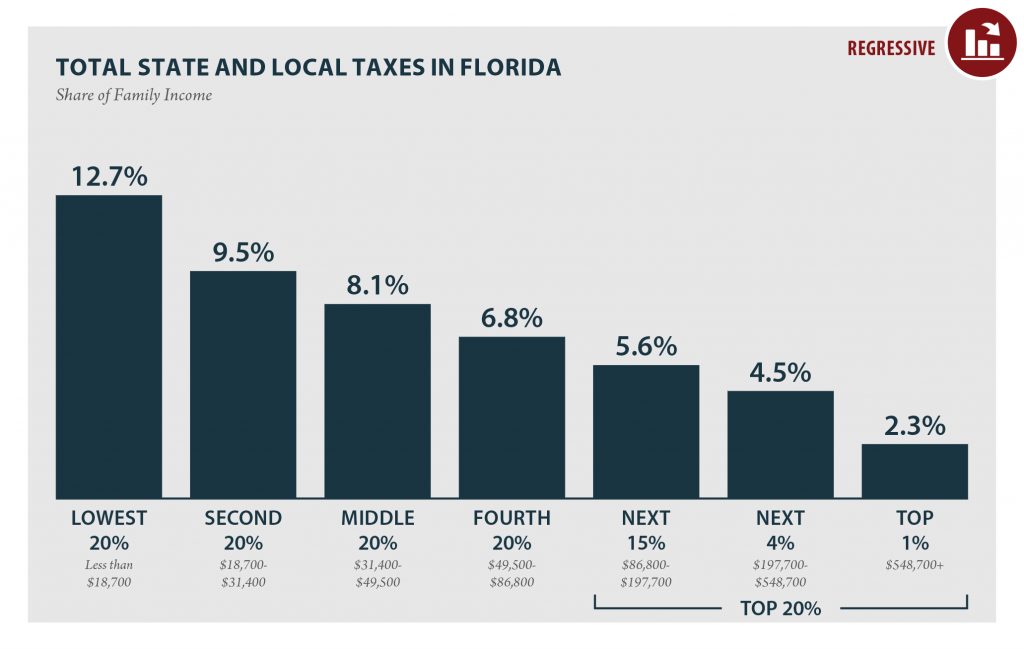

Low Tax for Whom? Florida is a “Low Tax State” Overall, But Not for Families Living in Poverty

October 17, 2018 • By ITEP Staff

Florida’s tax system has vastly different impacts on taxpayers at different income levels. For instance, the lowest-income 20 percent of Floridians contribute 12.7 percent of their income in state and local taxes — considerably more than any other income group in the state. For low-income families, Florida is far from being a low tax state; in fact, it is the ninth highest-tax state in the country for low-income families.

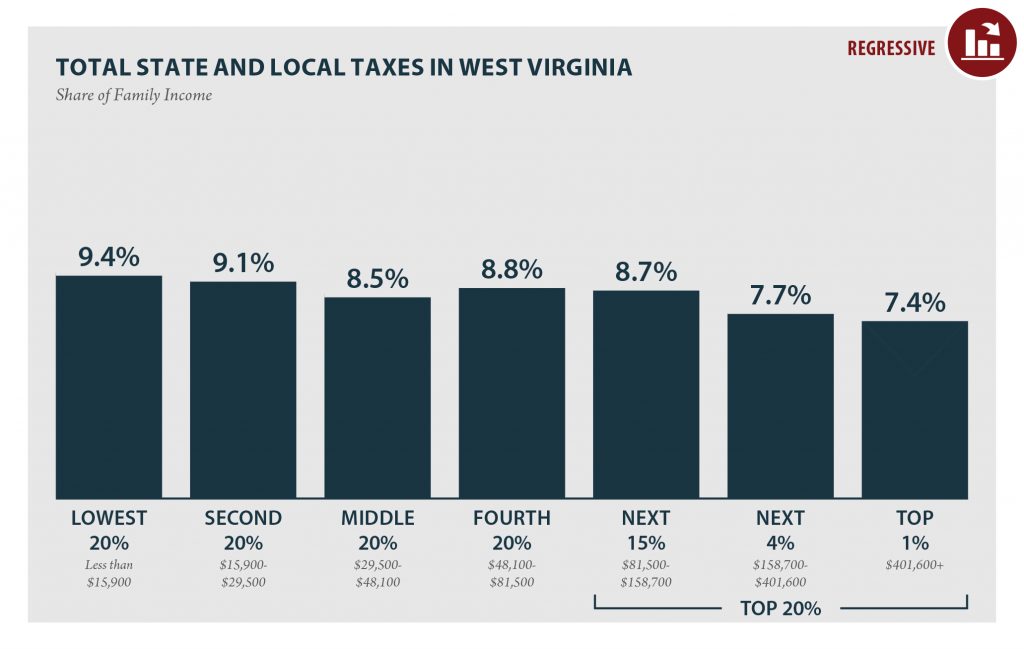

West Virginia: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, which measures the impact of each state’s tax system on income inequality, West Virginia has the 37th most unfair state and local tax system in the country. Incomes are more unequal in West Virginia after state and local taxes are collected than before.

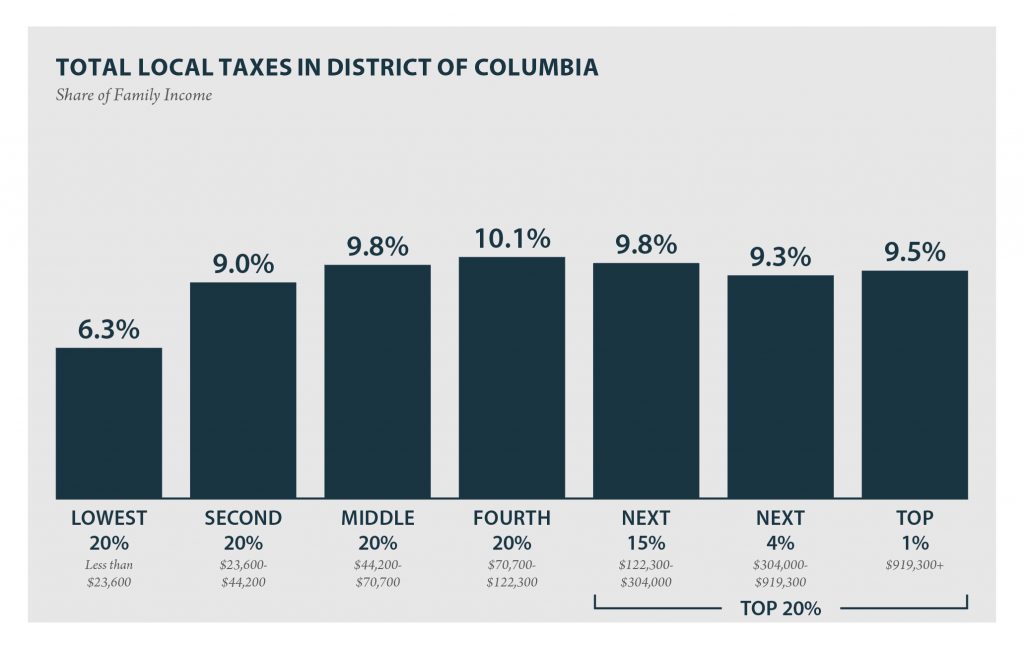

District of Columbia: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, the District of Columbia’s local tax system does not worsen income inequality and ranks 50th on the index. The large income gap between lower- and middle-income taxpayers, as compared to the wealthy, is somewhat narrower after state and local taxes than before.

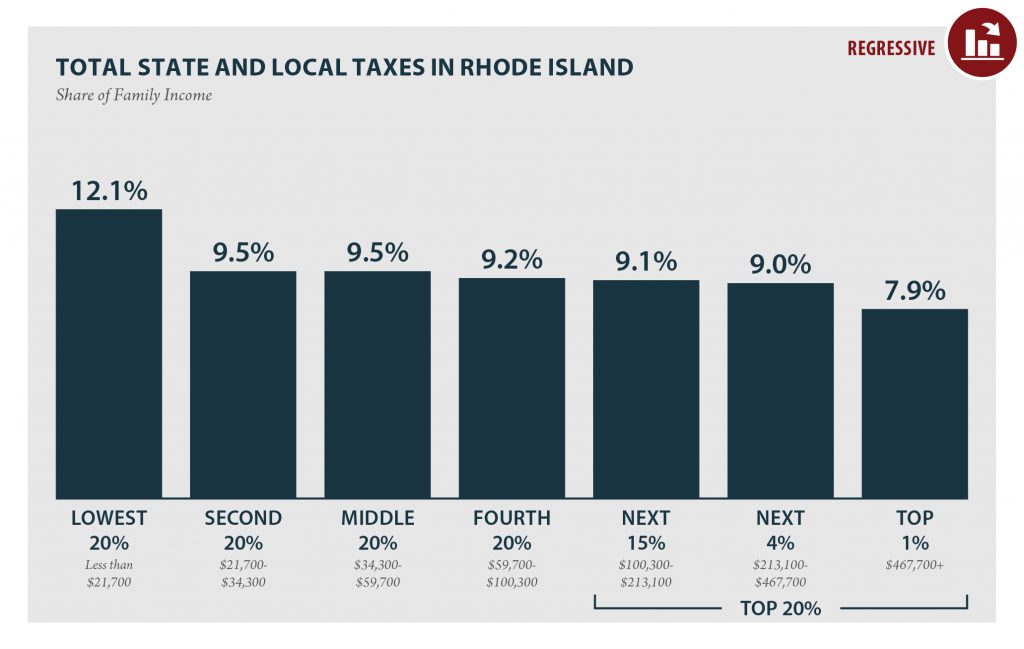

Rhode Island: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, which measures the impact of each state’s tax system on income inequality, Rhode Island has the 32nd most unfair state and local tax system in the country. Incomes are more unequal in Rhode Island after state and local taxes are collected than before.

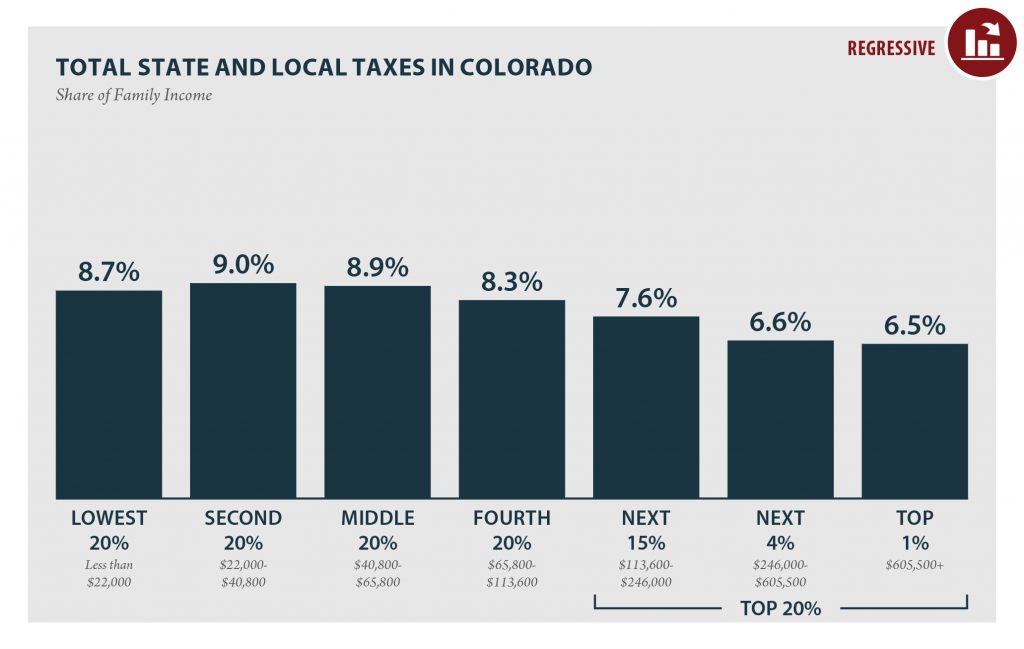

Colorado: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

COLORADO Read as PDF COLORADO STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $22,000 $22,000 to $40,800 $40,800 to $65,800 $65,800 to $113,600 $113,600 to $246,000 $246,000 to $605,500 over $605,500 […]

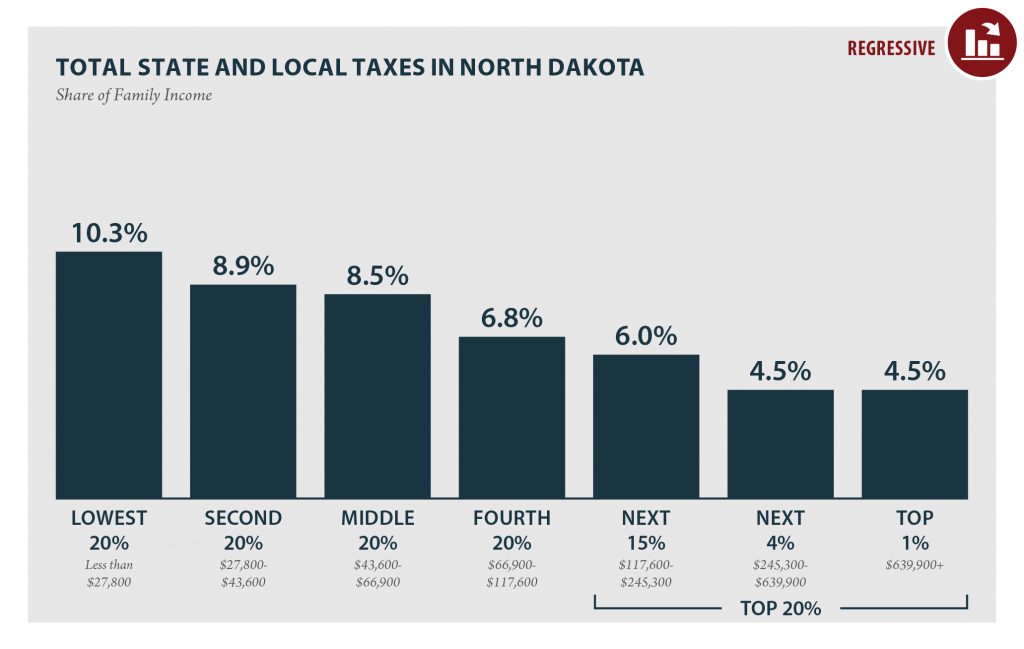

North Dakota: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

NORTH DAKOTA Read as PDF NORTH DAKOTA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $27,800 $27,800 to $43,600 $43,600 to $66,900 $66,900 to $117,600 $117,600 to $245,300 $245,300 to $639,900 […]

District of Columbia: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

DISTRICT OF COLUMBIA Read as PDF DISTRICT OF COLUMBIA LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 5% Top 1% Income Range Less than $23,600 $23,600 to $44,200 $44,200 to $70,700 $70,700 to $122,300 $122,300 to $304,000 $304,000 to $919,300 […]

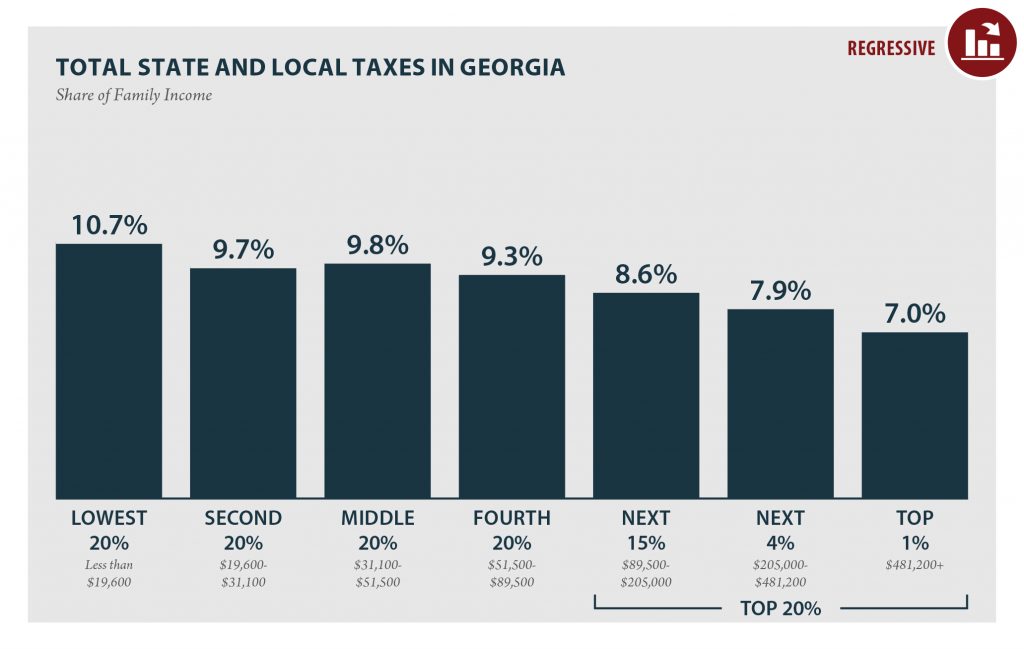

Georgia: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

GEORGIA Read as PDF GEORGIA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,600 $19,600 to $31,100 $31,100 to $51,500 $51,500 to $89,500 $89,500 to $205,000 $205,000 to $481,200 over $481,200 […]

Arizona: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

ARIZONA Read as PDF ARIZONA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $17,900 $17,900 to $35,300 $35,300 to $55,000 $55,000 to $96,400 $96,400 to $189,900 $189,900 to $424,300 over $424,300 […]

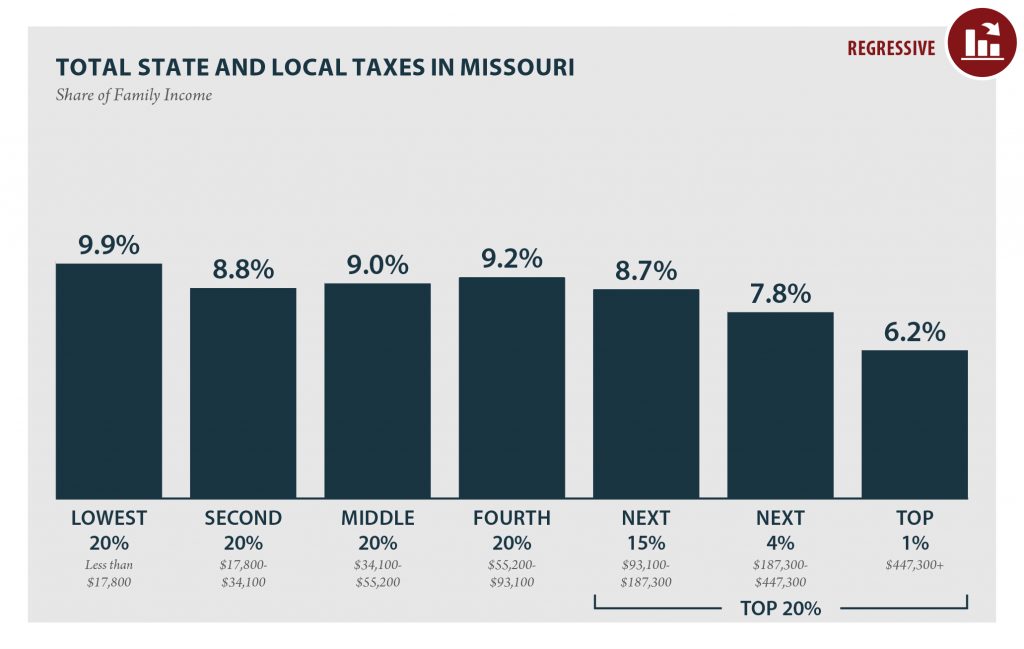

Missouri: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

MISSOURI Read as PDF MISSOURI STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $17,800 $17,800 to $34,100 $34,100 to $55,200 $55,200 to $93,100 $93,100 to $187,300 $187,300 to $447,300 over $447,300 […]

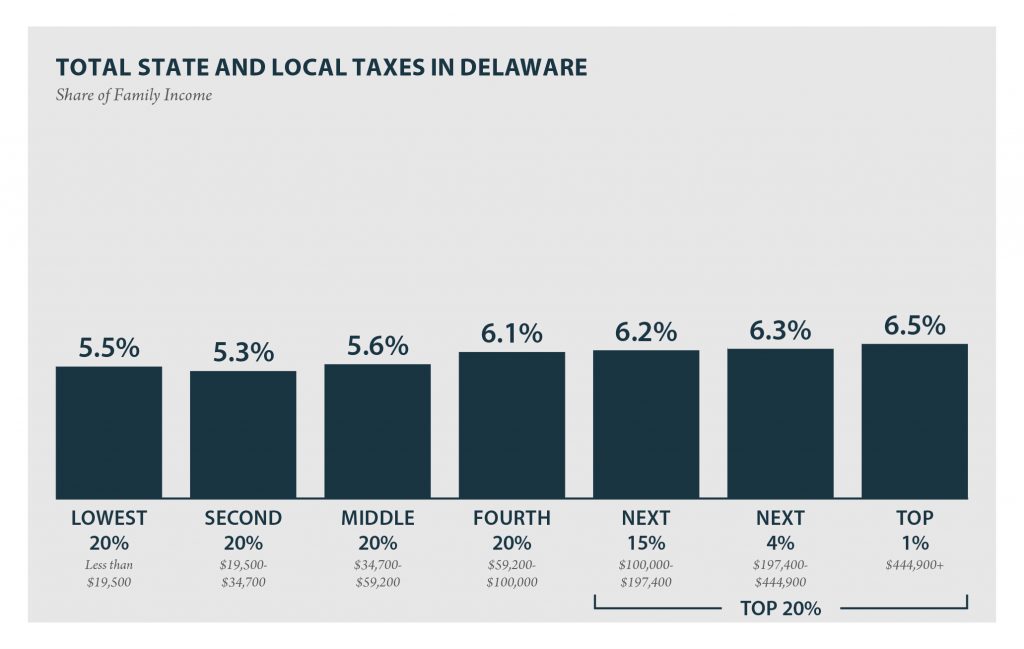

Delaware: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

DELAWARE Read as PDF DELAWARE STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,500 $19,500 to $34,700 $34,700 to $59,200 $59,200 to $100,000 $100,000 to $197,400 $197,400 to $444,900 over $444,900 […]

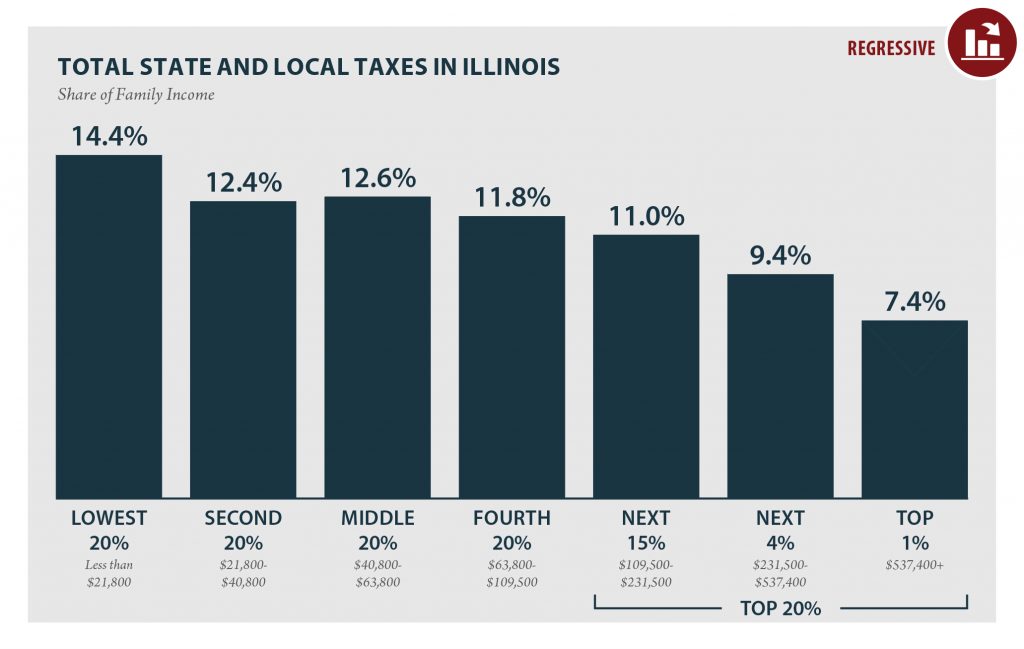

Illinois: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

ILLINOIS Read as PDF ILLINOIS STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $21,800 $21,800 to $40,800 $40,800 to $63,800 $63,800 to $109,500 $109,500 to $231,500 $231,500 to $537,400 over $537,400 […]

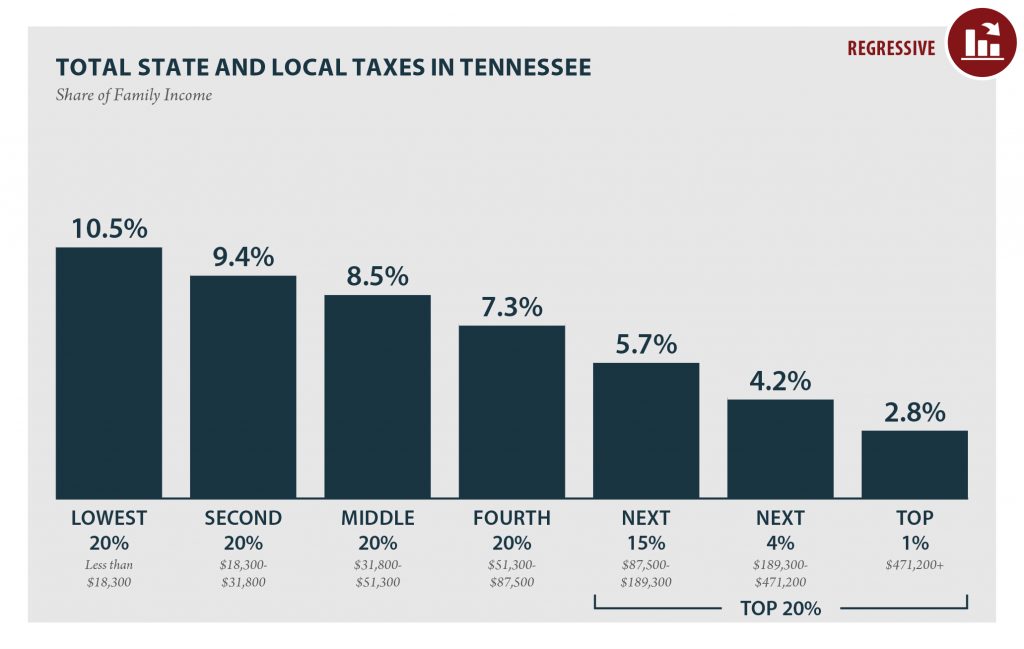

Tennessee: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

TENNESSEE Read as PDF TENNESSEE STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $18,300 $18,300 to $31,800 $31,800 to $51,300 $51,300 to $87,500 $87,500 to $189,300 $189,300 to $471,200 over $471,200 […]

Florida: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

FLORIDA Read as PDF FLORIDA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $18,700 $18,700 to $31,400 $31,400 to $49,500 $49,500 to $86,800 $86,800 to $197,700 $197,700 to $548,700 over $548,700 […]

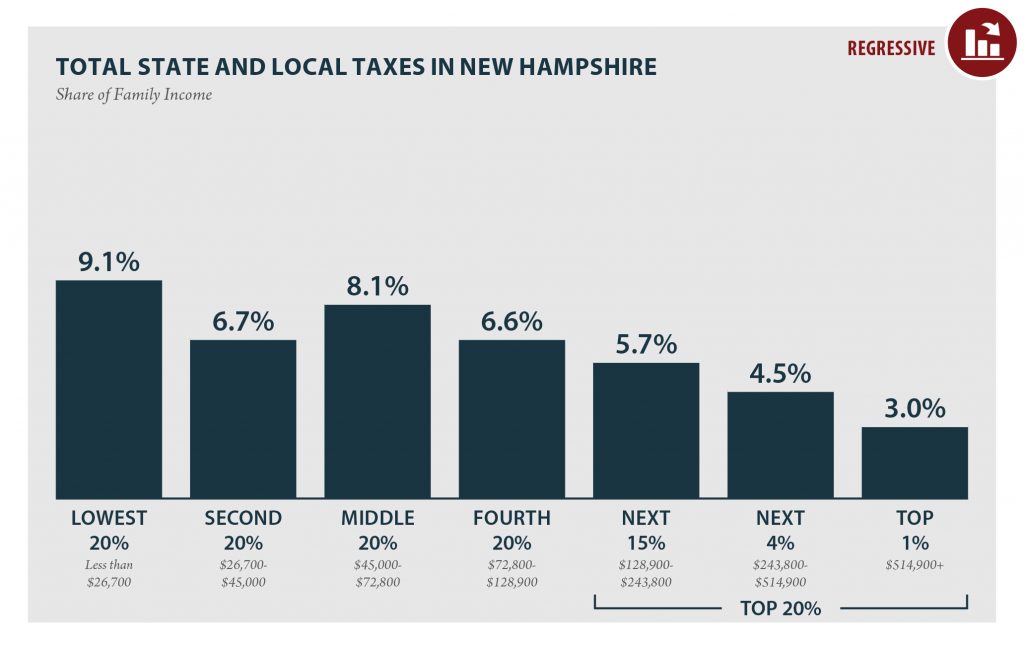

New Hampshire: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, New Hampshire has the 16th most unfair state and local tax system in the country. Incomes are more unequal in New Hampshire after state and local taxes are collected than before.

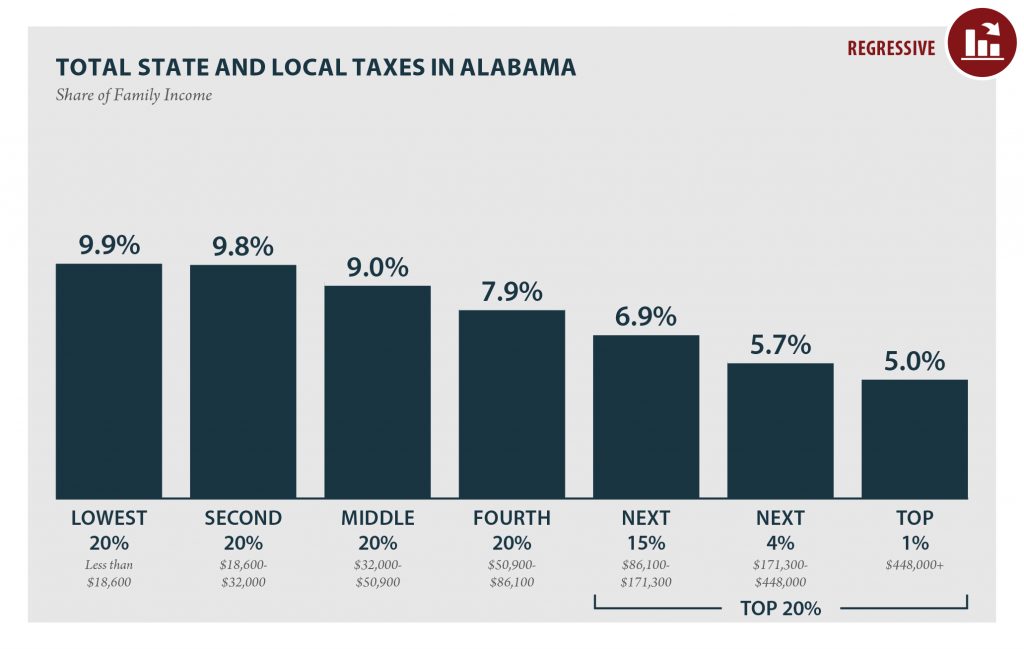

Alabama: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

ALABAMA Read as PDF ALABAMA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $18,600 $18,600 – $32,000 $32,000 – $50,900 $50,900 – $86,100 $86,100 – $171,300 $171,300 – $448,000 More than […]

Oklahoma: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, which measures the impact of each state’s tax system on income inequality, Oklahoma has the 9th most unfair state and local tax system in the country. Incomes are more unequal in Oklahoma after state and local taxes are collected than before.