A Chart Book on the U.S. Tax System

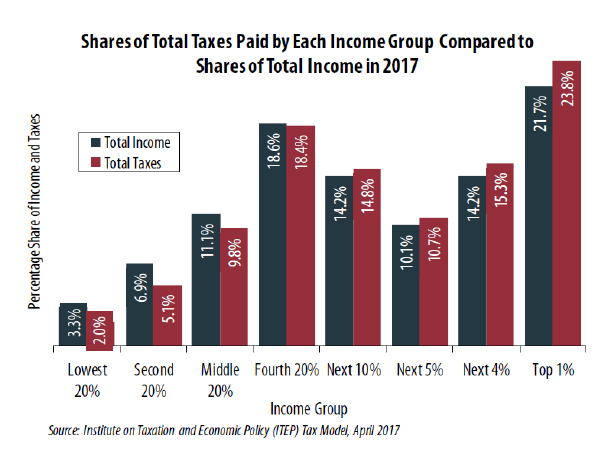

1. Virtually all Americans, including the poorest Americans, are paying some type of tax.

- A comprehensive ITEP analysis shows that the total share of taxes (federal, state, and local) that will be paid by Americans across the economic spectrum in 2017 is roughly equal to their total share of income.

- Although the federal income tax is progressive, state and local tax systems are highly regressive. In fact, an ITEP analysis found that on average the bottom 20 percent of taxpayers pay twice as much in state and local taxes as a percentage of their income than those in the top 1 percent.

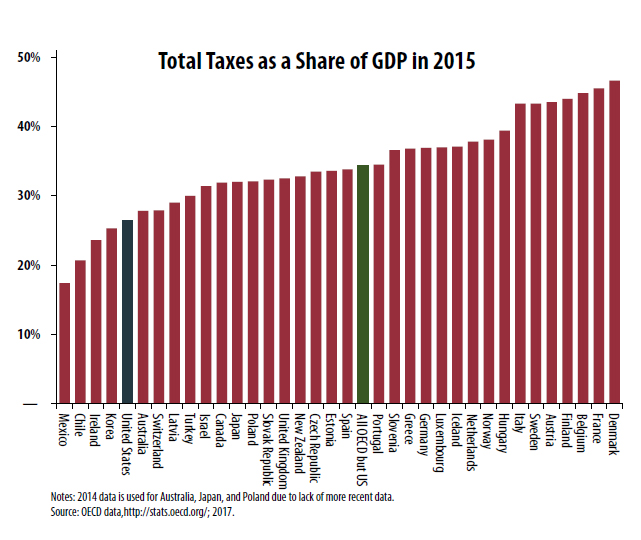

2. Taxes in the United States are well below those of most developed nations.

- Taxes accounted for 26.4 percent of the nation’s GDP in 2015, well below the OECD average and lower than all but four other OECD member nations. The countries collecting more in taxes as a share of their economy than the U.S. include many of our most prominent trade partners and competitors, such as France, Germany, the United Kingdom and Canada.

- S. corporate tax collections are below the OECD average as a share of GDP.

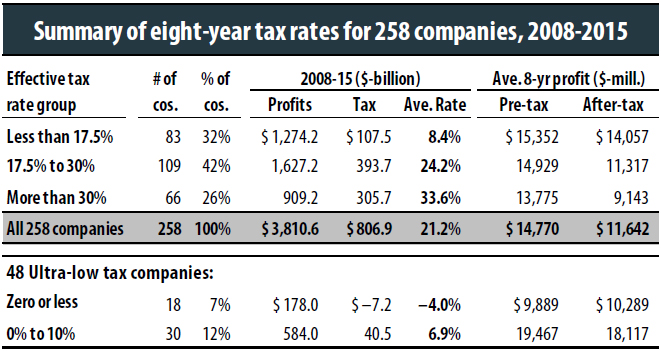

3. The U.S. statutory corporate income tax rate is 35 percent, but overall profitable companies pay a rate closer to 20 percent.

- ITEP’s comprehensive 2017 study of consistently profitable Fortune 500 corporations found that between 2008 and 2015, they paid 21.2 percent of their profits in federal income taxes — far lower than the official 35 percent statutory rate. 100 of these companies enjoyed at least one year in which their federal income tax was zero or less, meaning they received a refund.

- This group includes major companies such as GE, Constellation Brands, and Netflix. They span a wide array of industries and rely on a diverse set of tax breaks to achieve these low rates. Manufacturing tax deductions, executive stock option tax breaks, accelerated depreciation and the research tax credit are among the loopholes that enable effective corporate tax rates that are lower than effective tax rates paid by many middle-income families.

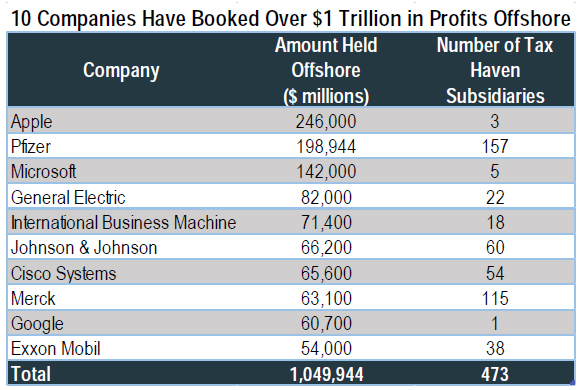

4. U.S. multinational corporations are aggressively shifting their profits into low-rate foreign tax havens.

- An ITEP and U.S. PIRG report shows that at the end of 2016, Fortune 500 corporations disclosed a total of $2.6 trillion in offshore profits, on which these companies may be avoiding as much as $752 billion in U.S. income taxes.

- An analysis of IRS data shows that U.S. multinationals report that almost 60 percent of their subsidiaries’ foreign profits are “earned” in 10 tiny tax haven countries. In fact, these corporations claimed they earned $104 billion in Bermuda in 2012 — a sum that is 18 times bigger than Bermuda’s entire economic output of $6 billion that year.

- A report by U.S. PIRG and ITEP finds that the use of tax haven subsidiaries is now common practice, with 73 percent of Fortune 500 companies disclosing that they have at least one subsidiary in a tax haven jurisdiction and the group as a whole reporting 9,755 tax haven subsidiaries among them.

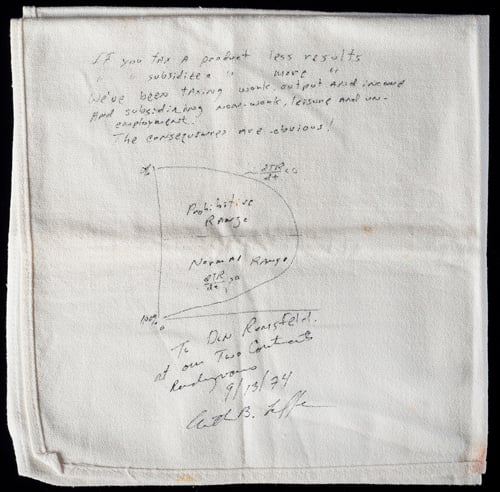

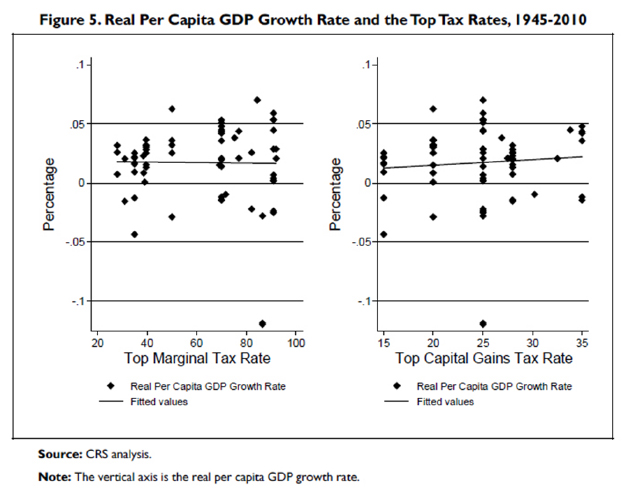

5. Tax cuts for the rich do not help our economy.

- Using data from the past 65 years, the Congressional Research Service (CRS) has found that there is no correlation between top tax rates and economic growth.

- This conclusion holds true at the state level, where research from ITEP and academic economists has shown lowering or eliminating state income taxes has little if any impact on state economies.

- Supply-side economics has been debunked time and again by real world evidence.

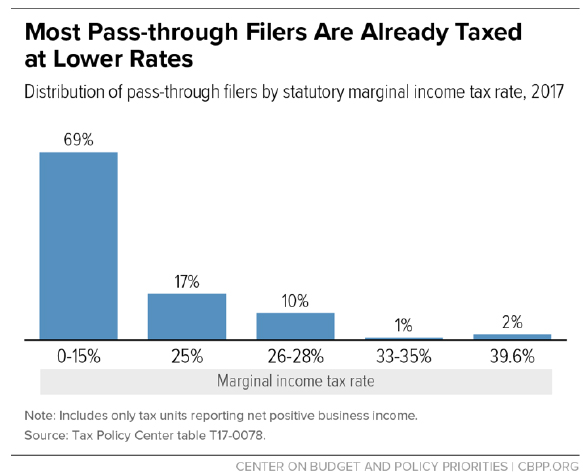

6. Cutting the top tax rate on pass-through businesses would create a huge loophole in the code and provide little help to small businesses.

- The Trump-GOP tax framework includes provisions to give pass-through businesses (businesses that are not required to pay the corporate income tax) a top tax rate of 25 percent, instead of the top rate of 35 percent applied to ordinary income. The reality is that more than 86 percent of pass-through businesses already face marginal income tax rates of 25 percent or less and would not benefit from this proposal.

- A lower pass-through rate might encourage wealthy individuals to disguise earnings as business income. When Kansas implemented a lower rate on pass-through income, the state lost substantially more revenue than expected due to these types of accounting maneuvers by wealthier individuals seeking to avoid taxes.

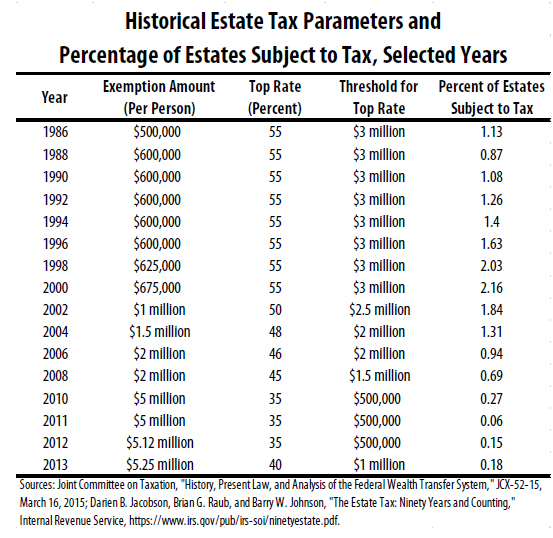

7. The Estate Tax Applies Only to a Small Number of Wealthy Estates

- According to IRS data, only the wealthiest 0.2 percent of estates paid the estate tax in 2015. This means that 99.8 percent of the population does not pay the estate tax.

- For 2017, the first $5.49 million of an estate is exempt from taxation. For married couples, the exemption is $10.98 million. These levels are indexed to inflation.

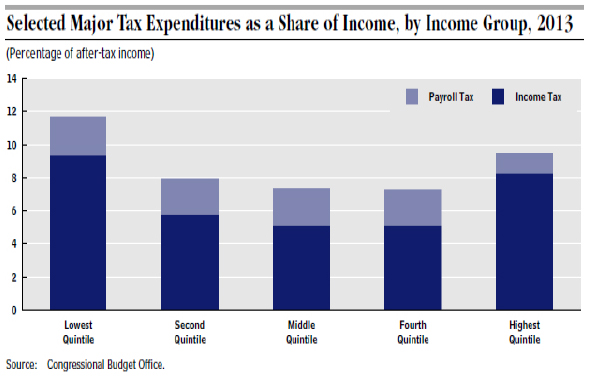

8. The majority of federal tax breaks go to the wealthy.

- The bulk of tax breaks in the federal tax code benefit the wealthy. In fact, a study by the non-partisan Congressional Budget Office (CBO) found that most of the benefits of the major tax expenditures accrue to the top 20 percent of taxpayers, with 16.6 percent of tax breaks going to the top 1 percent.

- One of the most skewed tax breaks in the code is the preferential rate on capital gains and dividends. According to CBO estimates, 68 percent of the benefits go to the top 1 percent of taxpayers.

9. The American public strongly opposes cutting taxes for the wealthy and corporations.

- A recent poll from Politico found that 60 percent of the public believes that corporations pay too little in taxes, while only 14 percent believe they pay too much. Similarly, the same poll found that 61 percent of the public believes that upper income people are paying too little in taxes, while only 14 percent believes that they pay too much.

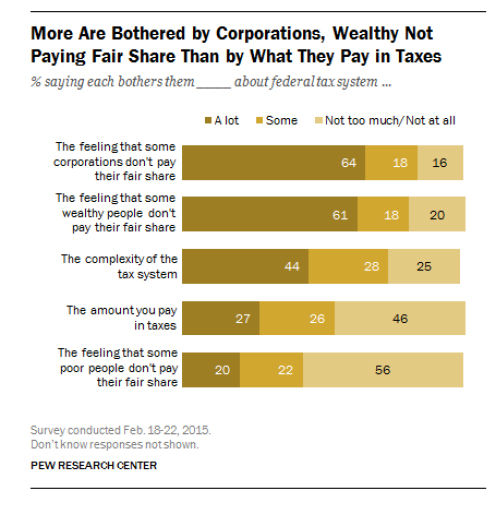

- A Pew Research poll found that 62 percent of Americans are bothered a lot by corporations not paying their fair share in taxes and 60 percent are bothered a lot by the wealthy not paying their fair share. In contrast, only 27 percent of Americans are bothered a lot by how much they have to pay in taxes.