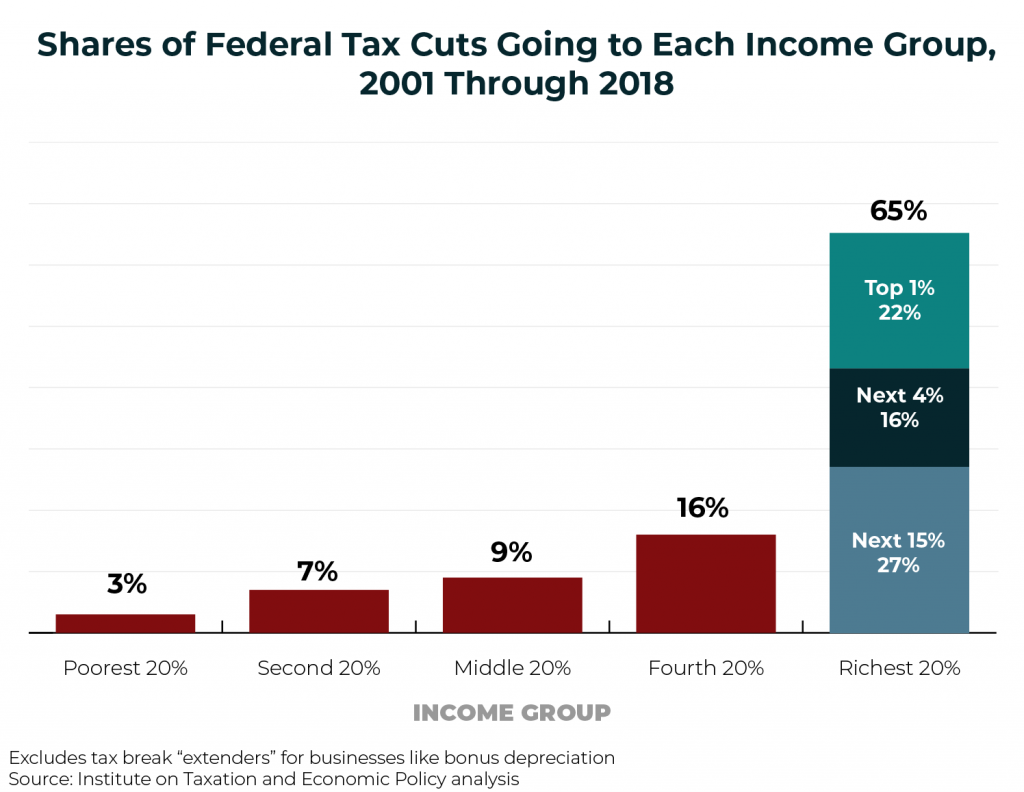

The nation’s tax policies and their role in economic inequality are front and center during this election cycle. For those interested in how the nation can move toward a fairer tax system and/or more detailed information about progressive tax policy ideas, ITEP created this quick guide.

For highlights on candidates’ plans, visit How Democratic Presidential Candidates Would Raise Revenue.

Raising Revenue

The nation’s tax code is the only way to raise federal revenue to adequately fund the nation’s shared priorities. As political candidates discuss their ideas for our tax system, it’s critical to keep in mind that currently, the United States is one of the least taxed developed nations. Raising revenue should be a public policy priority.

Further reading:

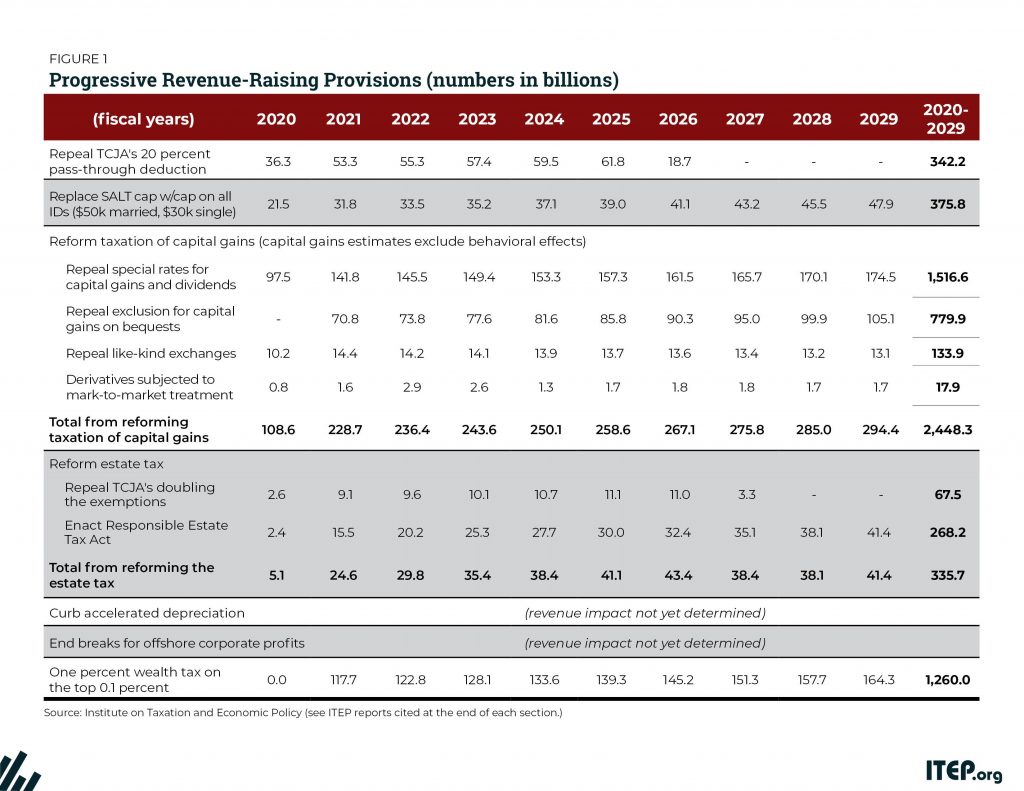

Progressive Revenue-Raising Options

Chart Book: The Case for Progressive Revenue Policies

Wealth Tax

For the past four decades, the nation’s highest-income households have captured an ever-increasing share of the nation’s wealth while most working families have economically stood still. The nation’s tax policies have contributed to this trend. A federal tax directly on extreme wealth could alleviate wealth inequality and raise much-needed revenue.

For the past four decades, the nation’s highest-income households have captured an ever-increasing share of the nation’s wealth while most working families have economically stood still. The nation’s tax policies have contributed to this trend. A federal tax directly on extreme wealth could alleviate wealth inequality and raise much-needed revenue.

Further reading:

The U.S. Needs a Federal Wealth Tax

Wealth Tax Is Supported by Basically Everyone Who Is Not a Politician

VIDEO: The Case for a Federal Wealth Tax

Estate Tax

Federal lawmakers have made it easier for families to accrue dynastic wealth by continually weakening the estate tax. The 2017 Tax Cuts and Jobs Act further diminished the estate tax and now less than one-tenth of 1 percent of estates will owe any tax at all. A more robust estate tax could raise revenue and mitigate wealth inequality.

Further reading:

The Federal Estate Tax: An Important Progressive Revenue Source

Capital Gains Tax

Capital gains (profits investors make by selling assets) and stock dividends are both taxed at lower rates than income earned from work; about 78 percent of this benefit goes to the richest 1 percent of taxpayers. Taxing capital gains and dividends like other types of income would address one cause of growing income inequality and raise revenue.

Capital gains (profits investors make by selling assets) and stock dividends are both taxed at lower rates than income earned from work; about 78 percent of this benefit goes to the richest 1 percent of taxpayers. Taxing capital gains and dividends like other types of income would address one cause of growing income inequality and raise revenue.

Further reading:

Congress Should Reduce, Not Expand, Tax Breaks for Capital Gains

Capital Gains Tax Breaks Are Finally on the Defensive

Corporate Tax Breaks

Before 2017, the statutory federal corporate tax rate was 35 percent but profitable Fortune 500 companies paid an average effective rate of about 21.4 percent. The 2017 tax law dramatically reduced the statutory federal tax rate to 21 percent without closing loopholes that enabled corporate tax avoidance. In 2018, 60 profitable Fortune 500 companies including Amazon paid no federal income tax. Real corporate tax reform would close loopholes and raise revenue.

Before 2017, the statutory federal corporate tax rate was 35 percent but profitable Fortune 500 companies paid an average effective rate of about 21.4 percent. The 2017 tax law dramatically reduced the statutory federal tax rate to 21 percent without closing loopholes that enabled corporate tax avoidance. In 2018, 60 profitable Fortune 500 companies including Amazon paid no federal income tax. Real corporate tax reform would close loopholes and raise revenue.

Further reading:

Corporate Tax Avoidance in the First Year of the Trump Tax Law

Corporate Tax Avoidance Remains Rampant Under New Tax Law

The Failure of Expensing and Other Depreciation Tax Breaks

The New International Corporate Tax Rules: Problems and Solutions

Tax Credits

Just as the tax code has enabled widening wealth inequality, it can be a tool to enhance family economic security. Already, the Earned Income Tax Credit and Child Tax Credit boost after-tax incomes for working families. But these credits leave some people behind. Expanding and strengthening tax credits is one approach to move more individuals and families out of poverty.

Further reading:

Major Federal Tax Credit Proposals