Excise taxes are sales taxes that apply to specific goods (such as gasoline, tobacco, or alcohol) or services (such as hotel and car rentals).

Sometimes it’s appropriate to ask consumers of a particular item to pay an especially high tax for various reasons. But even in those circumstances, many excise taxes are highly regressive.

Like general sales taxes, excise taxes are taxes on consumption that help fund schools, roads, public safety, and other public services. Unlike general sales taxes, excise taxes are often applied on a per-unit basis instead of as a percentage of the purchase price.

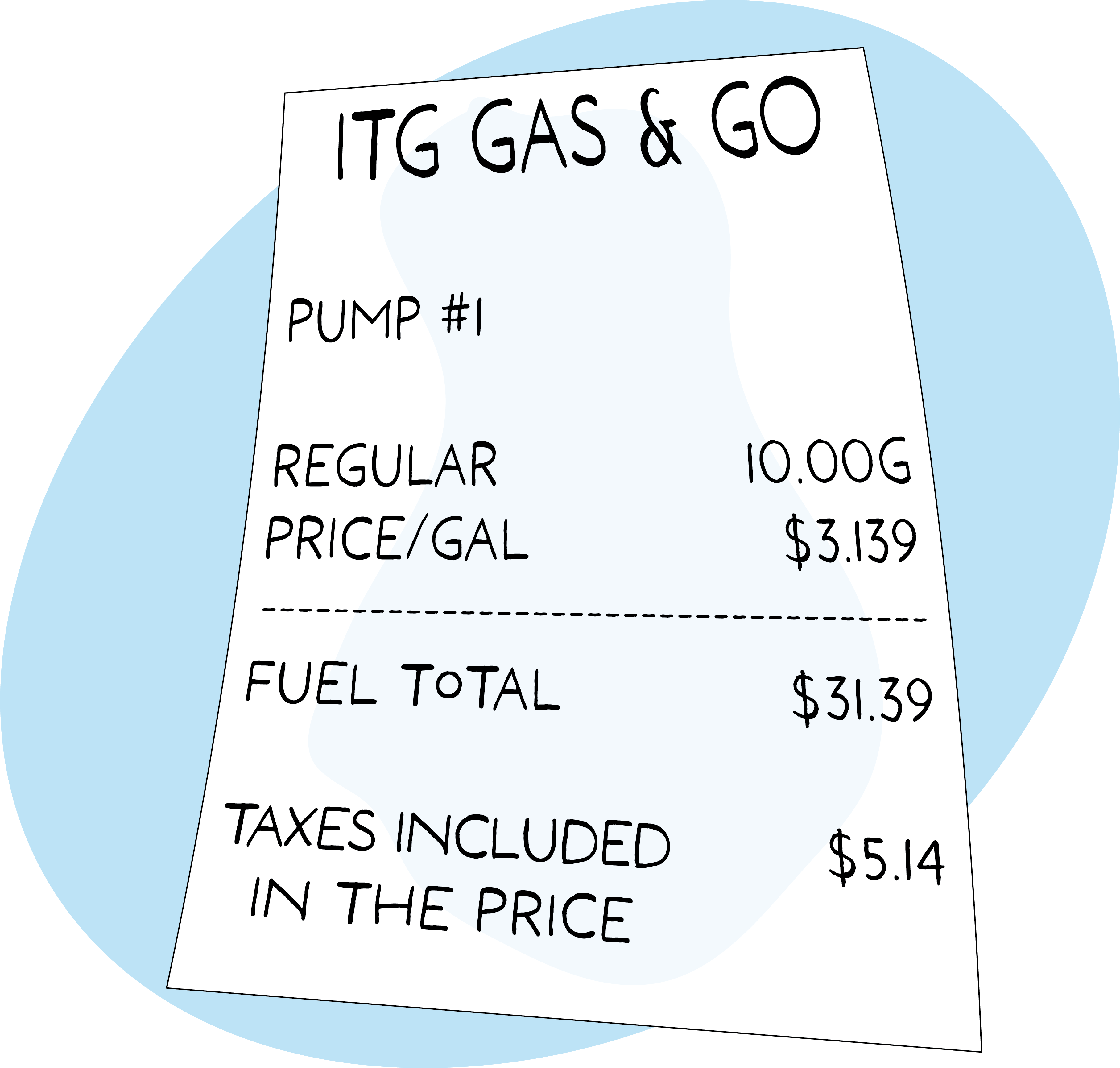

For example, cigarette excise taxes are typically calculated in cents per pack. Gasoline excise taxes are imposed in cents per gallon. Alcohol taxes are also per-gallon, with higher rates for distilled spirits than for beer or wine. These taxes are usually incorporated into the sticker price of an item, rather than being added at the checkout counter. Consumers therefore don’t see the tax, but they usually pay it anyway, in the form of higher prices. For example, roughly 30 to 90 cents of the price of each gallon of gasoline is comprised of federal and state taxes, depending on the state.

Excise taxes often are designed to produce a social benefit if people consume less of what is taxed. These kinds of excise taxes are sometimes referred to as “sin taxes.” For example, tobacco taxes have been shown to reduce rates of cigarette consumption, which in turn saves lives and reduces public health spending, particularly among younger people. Gasoline taxes fall in this category to the extent that they create an incentive for fuel efficiency. States and localities also levy taxes on alcohol, gambling, cannabis, and sometimes sugar-sweetened beverages (e.g. soft drinks) for similar reasons.

Another reason for excise taxes is that revenue can be used to fund related public services, as when gasoline taxes help fund highway construction and maintenance, or tobacco taxes compensate governments for the public health costs of tobacco use.

States and localities also rely on excise taxes to raise money from visitors, via taxes on hotels, restaurants, and rental cars. Since tourists benefit from public services like infrastructure, parks, and public safety, it’s fair for them to pay some of the cost.

Policy Considerations

Excise taxes are typically regressive for some of the same reasons that general sales taxes are regressive: Lower- and middle-income families have tighter budgets and spend a higher percentage of their income on consumer items than wealthier households.

Certain excise taxes are often particularly regressive. Thanks to the per-unit calculation, the same amount of tax is due whether a customer is purchasing premium alcohol and cigarettes, or much lower-cost versions of these same products. And some items subject to excise tax, like cigarettes and gasoline, are disproportionately purchased by lower- and middle-income households. As a result, excise taxes on average hit low- and middle-income families harder than general sales taxes or any other state and local tax.

Because excise taxes often are denominated in pennies rather than as a percentage of purchase price, they usually do not automatically adjust with inflation. Unless a state repeatedly adjusts the tax upwards, the revenue is likely to fail to keep pace with economic growth and, for “sin taxes,” the effectiveness of the tax in discouraging consumption will decline. This shortcoming can be easily fixed by designing the rate to automatically adjust for inflation over time. States have seen some success, particularly in the context of gasoline taxes, in moving toward this model in recent years.

Revenue sustainability is also a top concern with excise taxes. People today consume less tobacco and generally drive more fuel-efficient cars than in the past. From the perspectives of public health and environmental protection, these declining expenditures are positive, but the consequence is that revenue from these sources is declining. That doesn’t mean states should repeal such taxes. In the context of tobacco taxes in particular, declining smoking rates are a sign that the tax is functioning as intended. But lawmakers should bring a clear-eyed view when evaluating the future revenue trajectory of excise taxes and should avoid overreliance by utilizing other revenue sources as well to fund public priorities.

Related Entries

How Do State and Local Sales Taxes Work?

Sales taxes are the second largest source of revenue for state and local governments. In nearly every state they are an important way we pay for public education, health care, public safety, and other services. But they are also typically the costliest tax for low-income families.

How Do States Tax Cannabis?

A growing number of states are legalizing and taxing cannabis. Cannabis taxes are raising revenue for education, health care, and addressing substance abuse while encouraging consumers to moderate their use. But high cannabis taxes also mean that low-income communities targeted for enforcement now pay a disproportionate share of tax.

Learn More

- Davis, Carl. “Most Americans Live in States with Variable-Rate Gas Taxes.” ITEP, 2019.

- Davis, Carl and Mike Hegeman. “Cannabis Taxes Outraised Alcohol by 20 Percent in States with Legal Sales Last Year.” ITEP, 2022.

- Davis, Carl and Misha Hill. “The Short and Sweet on Taxing Soda.” ITEP, 2016.

- Lopez, German. “The case for raising the alcohol tax.” Vox, 2018.